An unexpected surge in consumer spending across Britain, heavily fueled by New Year fitness resolutions and a spike in sports supplement purchases, has delivered a 1.8% boost to January retail sales, defying economic gloom and offering a fascinating parallel to East Africa’s own booming wellness industry.

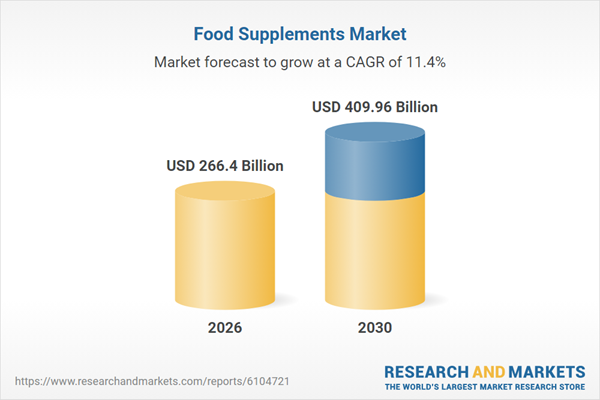

The fitness boom is no longer just a lifestyle choice; it is a profound economic driver. As January rolled in, a wave of health-conscious consumers hit the digital and physical aisles, pushing retail sales significantly higher than the 0.2% predicted by leading economists. This retail phenomenon highlights a fascinating shift in consumer priorities, prioritizing personal health even amid broader financial caution.

This unexpected retail resilience matters now more than ever. It demonstrates that specific sectors—like health, wellness, and targeted luxury—can thrive and prop up national statistics even when the broader macroeconomic picture looks bleak. For markets in East Africa, where the middle class is rapidly expanding its wellness footprint, this is a clear signal of where future domestic spending is heading.

The Anatomy of a Retail Surge

The numbers from the Office for National Statistics (ONS) paint a vivid picture of a consumer base determined to invest in themselves. The 1.8% volume increase is the strongest monthly growth seen since May 2024. Non-store retailing, primarily driven by e-commerce platforms, saw an even more impressive 3.4% leap. This digital pivot was aided by colder weather, keeping shoppers off the high streets and glued to their laptops.

Interestingly, the surge was not isolated to protein powders and vitamins. Online jewelers experienced robust sales, riding the wave of record-breaking global gold and silver prices. The combination of health-driven spending and alternative asset purchasing reveals a bifurcated consumer mindset: spending on immediate physical well-being and long-term tangible wealth.

The Kenyan Context: A Parallel Wellness Boom

While the ONS data is strictly British, the underlying consumer psychology resonates deeply within the East African context. Nairobi has witnessed an explosion of fitness centers, wellness retreats, and a burgeoning market for imported and locally manufactured sports supplements. From the upscale gyms in Kilimani to the expanding fitness culture in local estates, the “New Year, New Me” mantra translates directly into significant economic activity.

Consider the following dynamics shaping the local market:

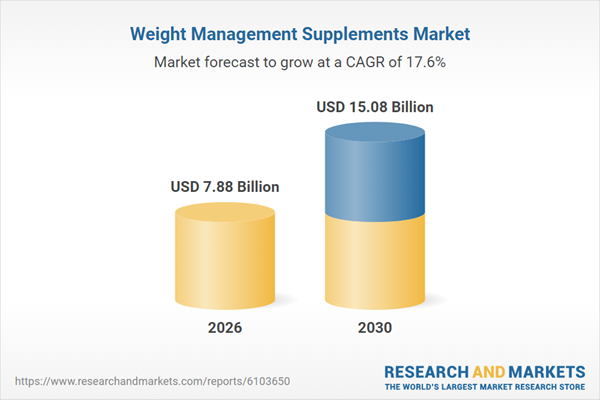

Supplement Importation: A surge in demand for whey protein, creatine, and pre-workout formulas, often priced at a premium in KES due to import duties and currency fluctuations.

Boutique Fitness: The rise of specialized fitness classes that charge premium subscription rates, mirroring the discretionary spending seen in the UK.

Digital Retail: Just as UK consumers shifted online, Kenyan buyers are increasingly relying on e-commerce platforms and Instagram vendors to source their health products.

However, the cost of these health investments remains high. A standard 2kg tub of premium whey protein can cost upwards of KES 12,000, representing a significant portion of disposable income. Yet, the demand remains inelastic, proving that health is increasingly viewed as a non-negotiable expense.

A Temporary Blip or a Sustained Trend?

Despite the celebratory January figures, financial analysts remain cautious. Danni Hewson, head of financial analysis at AJ Bell, noted that the uptick might be a temporary, resolution-fueled anomaly. In the three months leading to January, sales were nearly flat, and underlying weaknesses in the broader jobs market continue to breed consumer caution.

This cautionary tale is highly relevant globally. A sudden spike in discretionary spending does not necessarily indicate long-term economic health. If the fundamental pillars of the economy—wage growth, job security, and inflation control—are not stable, the fitness-fueled retail surge will likely lose its momentum by mid-year.

“The true test of consumer resilience is not the January sprint, but the marathon of the entire fiscal year,” warns a leading retail analyst.