Middle East Fortified Dairy Products Market Summary

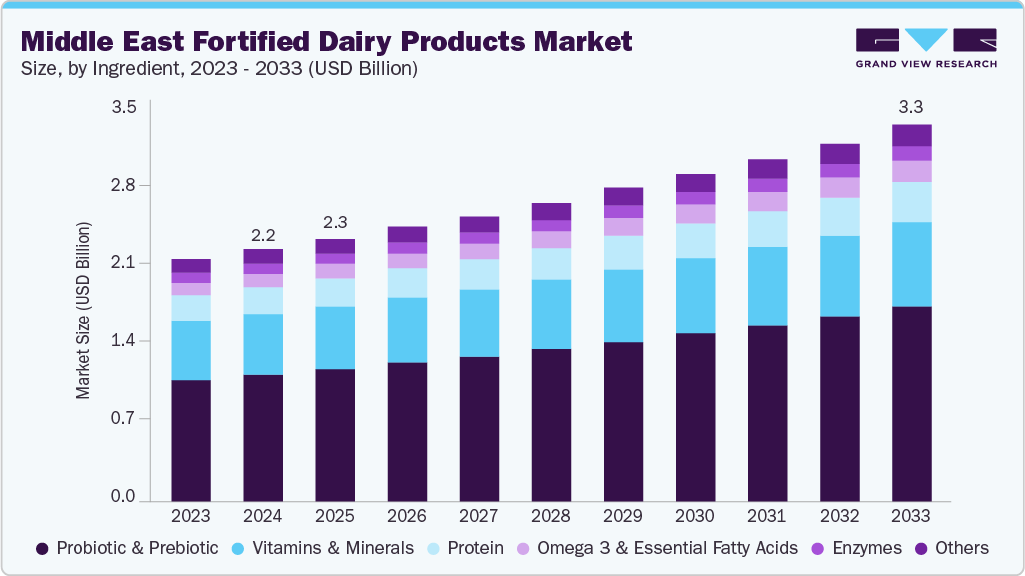

The Middle East fortified dairy products market size was estimated at USD 2.25 billion in 2024 and is projected to reach USD 3.35 billion by 2033, growing at a CAGR of 4.6% from 2025 to 2033. As the region experiences a growing population and expanding urbanization, there is a shift toward more modern, health-conscious diets.

Key Market Trends & Insights

Saudi Arabia dominated the Middle East fortified dairy products market in 2024 with a revenue share of 26.65%.

The fortified dairy products market in the UAE is growing at a CAGR of 5.7% from 2025 to 2033.

By product, the yogurt segment in the Middle East fortified dairy products market accounted for a the largest share of 48.23% in 2024.

By ingredient, the probiotic & prebiotic segment held the largest share of 50.12% in 2024.

By distribution channel, the hypermarket/supermarkets segment dominated the market with a revenue share of 43.52% in 2024.

Market Size & Forecast

2024 Market Size: USD 2.25 Billion

2033 Projected Market Size: USD 3.35 Billion

CAGR (2025-2033): 4.6%

UAE: Fastest growing market in 2024

Furthermore, as individuals become more aware of the importance of immunity and general wellness, there has been a marked rise in the consumption of functional dairy products such as probiotic yogurts, kefir, and fortified milk. The Middle East is also seeing a growing preference for dairy alternatives, driven by increasing lactose intolerance in certain populations, as well as rising interest in plant-based diets. In response to this, fortified plant-based dairy alternatives like almond, soy, and oat milk are gaining traction, as they are fortified with essential nutrients to meet consumer nutritional needs.

Countries such as Saudi Arabia, the UAE, and Qatar are experiencing strong demand for fortified milk, yogurt, and cheese enriched with vitamins A, D, calcium, and probiotics. Government-led health initiatives to combat malnutrition and vitamin D deficiency, especially in the Gulf Cooperation Council (GCC) region, have further accelerated product innovation and mandatory fortification programs. Major dairy players are reformulating traditional dairy lines with added nutrients to cater to health-conscious consumers and parents seeking value-added options for children’s nutrition.

Key market trends include the growing adoption of premium, fortified dairy offerings, particularly lactose-free and protein-rich variants, which target urban and affluent consumers. The region’s young population, increasing disposable incomes, and rapid retail modernization are boosting product accessibility through hypermarkets, pharmacies, and online platforms. Additionally, the rising preference for plant-based fortified alternatives and clean-label formulations is reshaping product portfolios. Strategic collaborations between international brands and regional manufacturers are enhancing product localization and trust, positioning fortified dairy as a mainstream and fast-evolving category within the Middle East’s broader functional foods market.

Consumer Insights for the Middle East Fortified Dairy Products Market

Consumers in the Middle East fortified dairy products market are increasingly prioritizing health, nutrition, and preventive wellness, with purchasing decisions influenced by age, gender, and lifestyle. Women, particularly mothers aged 25-45 years, represent a major consumer group, driving demand for fortified milk, yogurt, and cheese enriched with calcium, vitamin D, and iron to support family nutrition. This segment values trusted brands, convenience, and clean-label formulations free from artificial additives. Meanwhile, young adults (18-30 years) are showing rising interest in fortified dairy products with high protein content, probiotics, and functional claims related to energy, digestion, and fitness. The growing awareness of deficiencies such as vitamin D insufficiency prevalent in the GCC due to limited sun exposure is also prompting higher consumption among both genders.

Male consumers, especially those aged 30-50 years, are gradually becoming more engaged in fortified dairy purchases, mainly in connection with fitness, muscle recovery, and active lifestyle trends. The region’s affluent and urban population prefers premium fortified products and international brands that emphasize scientific validation and quality sourcing. In contrast, older adults (50+ years) are drawn to products fortified with calcium and vitamin D for bone and joint health. Across all demographics, consumers value taste, trust, and nutritional transparency, with digital marketing, influencer endorsements, and in-store promotions shaping brand loyalty.

Product Insights

Yogurt segment held the largest share, accounting for 48.23% of the Middle East fortified dairy products industry in 2024. Fortified yogurt, particularly those enriched with probiotics and prebiotics, supports digestive health by promoting a balanced gut microbiome. In addition, vitamin D and calcium fortification cater to concerns about bone health and osteoporosis prevention, especially among aging populations. Moreover, consumers are moving toward personalized nutrition, choosing foods that cater to their specific dietary needs. Fortified yogurts tailored for gut health, heart health, brain function, and bone health are gaining popularity. To attract younger consumers and expand their appeal, brands are launching innovative flavors, functional ingredients, and exotic superfoods in fortified yogurts. The inclusion of turmeric (for anti-inflammatory benefits), matcha (rich in antioxidants), chia seeds (fiber and omega-3s), and adaptogens (stress-relieving properties) has created a new niche of superfood yogurts that appeal to health-conscious buyers.

Frozen desserts segment is anticipated to grow at a CAGR of 6.1% from 2025 to 2033 in the Middle East fortified dairy products market, driven by rising consumer demand for indulgent yet nutritious treats. Manufacturers are introducing fortified ice creams, frozen yogurts, and dairy-based desserts enriched with probiotics, proteins, and essential vitamins to appeal to health-conscious consumers. The growing youth population, premiumization of dairy desserts, and expansion of modern retail formats are further fueling category growth. Moreover, the increasing popularity of low-fat and lactose-free fortified variants supports sustained demand across urban markets in the region.

Ingredient Insights

Probiotics and prebiotics segment held the largest revenue share of 50.12% in 2024. The inclusion of probiotics and prebiotics in fortified dairy products aligns with increasing consumer demand for gut health-focused nutrition. These ingredients enhance the effectiveness of fortification by improving the bioavailability of essential nutrients such as calcium, vitamin D, and protein. Moreover, the growing interest in functional foods has driven dairy manufacturers to innovate with probiotic yogurts, prebiotic-infused milk, and other gut-friendly dairy options.

Omega 3 & essential fatty acids segment is anticipated to grow at the fastest CAGR of 5.4% during the forecast period. This growth is attributed to the rising consumer awareness of heart health, brain development, and overall wellness benefits associated with Omega-3 enrichment. Dairy producers are increasingly fortifying milk, yogurt, and cheese with these ingredients to cater to health-conscious adults and parents seeking nutrient-rich options for children. In addition, the influence of preventive healthcare trends and the availability of premium, science-backed fortified products are further propelling demand for Omega-3-enhanced dairy offerings across the region.

Distribution Channel Insights

The sale of fortified dairy products through the hypermarkets/supermarkets accounted for a share of over 43.52% in 2024, making it the dominant distribution channel in the Middle East market. These large-format retail outlets offer extensive product visibility, competitive pricing, and a wide assortment of fortified milk, yogurt, and cheese brands, appealing to both mass and premium consumers. The expansion of organized retail chains such as Carrefour, Lulu, and Panda across GCC countries has further strengthened category accessibility. In addition, in-store promotions, attractive packaging, and health-oriented marketing campaigns continue to drive consumer preference for fortified dairy products in modern retail environments.

Sale of fortified dairy products through online channels is anticipated to grow at a CAGR of 6.1% from 2025 to 2033. The surge is driven by increasing internet penetration, rising adoption of e-commerce platforms, and consumer preference for convenient doorstep delivery of fresh and fortified dairy items. Online retailers such as Amazon, Noon, Carrefour Online, and Talabat are expanding their fortified product portfolios, offering discounts, subscription models, and same-day delivery options. Moreover, digital marketing campaigns, health-focused content, and influencer endorsements are enhancing consumer trust and boosting online sales across urban markets.

Country Insights

UAE Fortified Dairy Products Market Trends

The UAE fortified dairy products market is expected to grow at the fastest CAGR of 5.7% from 2025 to 2033, driven by rising health awareness, increasing urbanization, and growing consumer demand for nutrient-enriched food products. The market benefits from strong government initiatives promoting nutritional fortification to combat vitamin D and calcium deficiencies prevalent in the region. Consumers, particularly young professionals and families, are showing a strong preference for fortified milk, yogurt, and functional dairy beverages that support immunity and overall wellness. Moreover, the expansion of modern retail chains and online grocery platforms is further enhancing product accessibility and category growth.

Saudi Arabia Fortified Dairy Products Market Trends

The fortified dairy products market in Saudi Arabia held a revenue share of 26.65% of the Middle East fortified dairy products industry in 2024. The market in Saudi Arabia is primarily driven by the growing awareness of health and nutrition among consumers, especially in the context of a rising prevalence of chronic diseases such as diabetes and obesity. According to the data published in October 2024, diabetes is one of the major health concerns in Saudi Arabia, and 40% of diabetic patients are unaware of their condition. In addition, with the increasing focus on preventive healthcare, fortified dairy products that offer additional benefits such as calcium, vitamin D, and probiotics are gaining popularity. Saudi consumers are particularly interested in dairy products that support bone health, digestive health, and immune function. This demand is further fueled by the country’s young, health-conscious population and a rising awareness about the importance of functional foods.

Key Middle East Fortified Dairy Products Company Insights

Key companies in Middle East fortified dairy products market primarily focus on innovation, ingredient diversity, and health-centric offerings. They are investing in product development, strategic partnerships, and sustainable packaging to cater to evolving consumer preferences, expand their footprint, and strengthen competitiveness across regions.

Key Fortified Dairy Product Companies:

Nestlé S. A

Danone S.A

FrieslandCampina

LACTALIS

The Kraft Heinz Company

General Mills Inc.

Dairy Farmers of America, Inc.

Müller Group

Yili Group

AMUL (GCMMF)

Recent Developments

In June 2025, Al Ain Farms Group (UAE) entered a strategic partnership with Finnish firm Foodiq to deploy a new processing platform enabling clean-label, additive-reduced dairy and hybrid products signalling innovation at the ingredient/manufacturing level tied to value-added dairy.

In January 2025, Mleiha Milk (UAE – Sharjah) announced an expanded product line such as flavored milk, yogurts and small-pack milk that are fortified with “essential vitamins and minerals” and aimed at both children and adults.

In January 2025, Mleiha Milk (UAE – Sharjah) announced expansion of its product line to include flavored milks, yogurts and smaller packs, under its organic/clean-label farm operations aligned with nutrition & premium positioning.

Middle East Fortified Dairy Products Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.34 billion

Revenue Forecast in 2033

USD 3.35 billion

Growth rate

CAGR of 4.6% from 2025 to 2033

Actual data

2021 – 2024

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, ingredient, distribution channel, and region

Country scope

Saudi Arabia; UAE; Qatar

Key companies profiled

Nestlé S. A; Danone S.A; FrieslandCampina; LACTALIS; The Kraft Heinz Company; General Mills Inc.; Dairy Farmers of America, Inc.; Müller Group; Yili Group; AMUL (GCMMF)

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Fortified Dairy Products Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the Middle East fortified dairy products market based on product, ingredient, distribution channel, and country:

Product Outlook (Revenue, USD Billion, 2021 – 2033)

Milk

Whole Milk

Flavored Milk

Others

Yogurt

Regular/Traditional

Greek

Drinkable

Plant-based

Cheese

Butter & Spread

Ice Cream

Frozen Desserts

Others

Ingredient Outlook (Revenue, USD Billion, 2021 – 2033)

Distribution Channel Outlook (Revenue, USD Billion, 2021 – 2033)

Hypermarket/Supermarket

Convenience Stores

Specialty Stores

Online

Others

Regional Outlook (Revenue, USD Billion, 2021 – 2033)

North America

Europe

UK

Germany

Spain

France

Italy

Asia Pacific

China

Japan

India

Australia & New Zealand

Central & South America

Middle East & Africa

South Africa

Saudi Arabia

Frequently Asked Questions About This Report

b. The Middle East fortified dairy products market was estimated at USD 2.25 billion in 2024 and is expected to reach USD 2.34 billion in 2025.

b. The Middle East fortified dairy products market is expected to grow at a compound annual growth rate of 4.6% from 2025 to 2033 to reach USD 13.35 billion by 2033.

b. Based on product type, yogurt dominated the Middle East fortified dairy products market in 2024 with a share of about 48.23%.

b. Key players in the Middle East sports nutrition market are Nestlé S. A; Danone S.A; FrieslandCampina; LACTALIS; The Kraft Heinz Company; General Mills Inc.; Dairy Farmers of America, Inc.; Müller Group; Yili Group; AMUL (GCMMF), among others.

b. Key factors driving Middle East fortified dairy products market growth include rising health consciousness, increasing demand for nutrient-enriched foods, growing incidences of vitamin and mineral deficiencies, expanding young population, government support for nutrition, and wider retail availability.