What’s going on here?

Nestle is eyeing a sale of its mass-market vitamin and supplement brands—including Nature’s Bounty, Osteo Bi-Flex, Puritan’s Pride, and its US private label unit—which together bring in about $1.25 billion in annual sales.

What does this mean?

Nestle snapped up these mainstream supplement brands for $5.75 billion back in 2021, hoping to boost its presence in wellness. But after a stretch of sluggish growth and tighter margins, the company’s new CEO, Philipp Navratil, has launched a review that could lead to a sale. These days, Nestle’s betting on premium, science-driven labels like Solgar as industry focus shifts toward clinically supported products. Research from McKinsey underlines this change, with global buyers and rivals like Danone and Unilever chasing cutting-edge, high-growth brands instead of older mass-market names. It’s a crowded market, and regulation is uncertain—especially in the US, where changing rules keep legacy brands on their toes. Private equity firms will likely circle any deal, but with limited room to cut costs, Nestle might have to accept a lower price than it paid.

Why should I care?

For markets: Investors want innovation, not just name recognition.

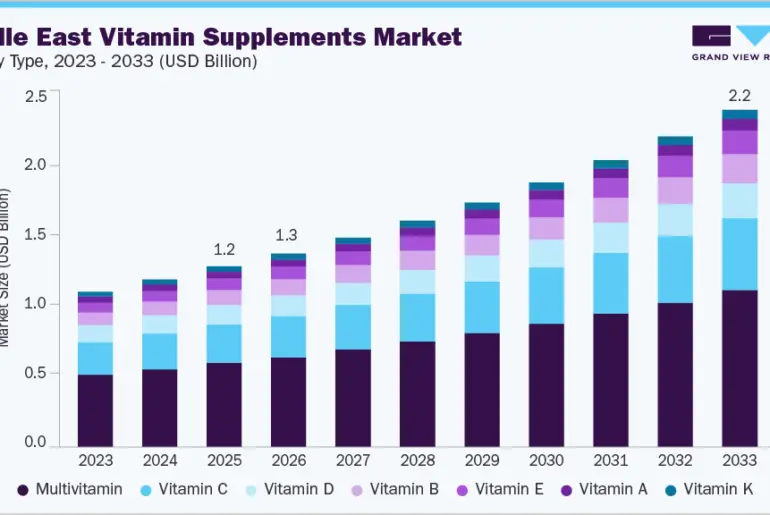

The global supplement market is set for major growth, with sales projected to more than double from $192.7 billion today to $414.5 billion by 2033. But markets are favoring brands with scientific claims and unique offerings, putting pressure on players stuck in the budget lane. If big buyers pass on legacy brands, valuations could drop further, steering more investment toward premium and digitally savvy businesses.

The bigger picture: Science is taking the lead in wellness.

Supplement regulation is becoming stricter, especially in the US, where the bar for safety is rising. With consumers demanding proof that these products work, the industry is tilting toward firms willing to invest in clinical testing and advanced formulas. For Nestle and its competitors, leaning into science may be the only way to stay at the front of the pack.