Nov 24, 2025

IndexBox has just published a new report: GCC – Medicaments Containing Vitamins And Provitamins – Market Analysis, Forecast, Size, Trends And Insights.

The GCC market for medicaments containing vitamins and provitamins is projected to grow steadily, reaching 25,000 tons and $846 million by 2035. Consumption increased to 21,000 tons in 2024, led by Saudi Arabia (9,800 tons) and the United Arab Emirates (7,500 tons), while regional production declined sharply to 1,600 tons. Imports rose to 20,000 tons, dominated by Saudi Arabia and UAE, but exports dropped significantly to 761 tons. The market shows strong consumption growth despite production challenges, with varying price trends across import and export markets.

Key Findings

Market projected to reach 25K tons and $846M by 2035 with steady growthSaudi Arabia and UAE dominate consumption, comprising 91% of total volumeRegional production declined sharply to 1.6K tons while imports surged to 20K tonsUAE leads exports with 97% share despite 32% volume decline in 2024Significant price disparities exist with Qatar paying $52K/ton versus UAE’s $8.6K/ton for importsMarket Forecast

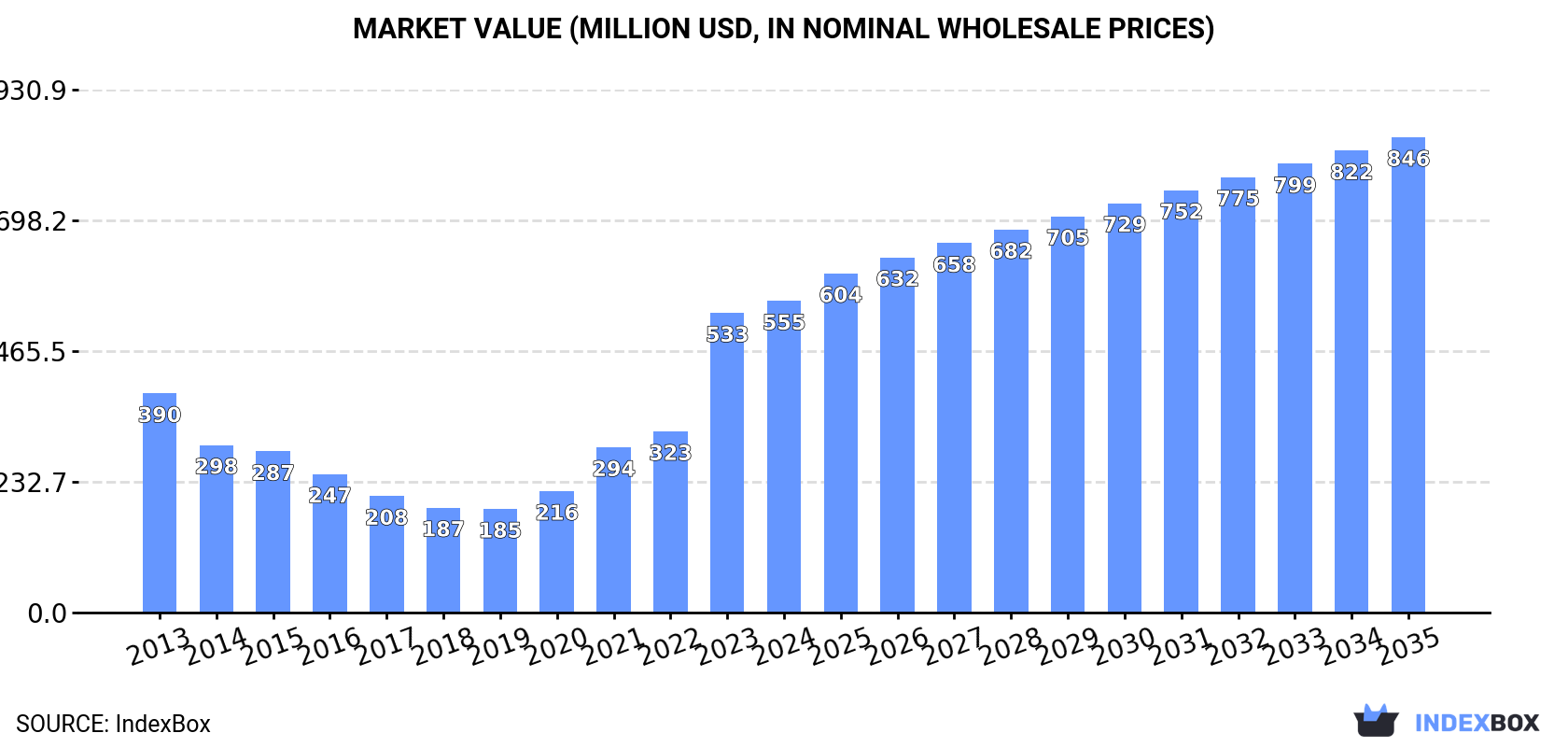

Driven by increasing demand for medicaments containing vitamins and provitamins in GCC, the market is expected to continue an upward consumption trend over the next decade. Market performance is forecast to decelerate, expanding with an anticipated CAGR of +1.9% for the period from 2024 to 2035, which is projected to bring the market volume to 25K tons by the end of 2035.

In value terms, the market is forecast to increase with an anticipated CAGR of +3.9% for the period from 2024 to 2035, which is projected to bring the market value to $846M (in nominal wholesale prices) by the end of 2035.

ConsumptionGCC’s Consumption of Medicaments Containing Vitamins And Provitamins

ConsumptionGCC’s Consumption of Medicaments Containing Vitamins And Provitamins

In 2024, consumption of medicaments containing vitamins and provitamins increased by 3.1% to 21K tons, rising for the sixth year in a row after five years of decline. Overall, consumption enjoyed a resilient increase. Over the period under review, consumption reached the maximum volume in 2024 and is likely to see steady growth in the near future.

The revenue of the medicaments containing vitamins market in GCC was estimated at $555M in 2024, rising by 4% against the previous year. This figure reflects the total revenues of producers and importers (excluding logistics costs, retail marketing costs, and retailers’ margins, which will be included in the final consumer price). In general, consumption showed a noticeable increase. The level of consumption peaked in 2024 and is likely to see steady growth in years to come.

Consumption By Country

The countries with the highest volumes of consumption in 2024 were Saudi Arabia (9.8K tons), the United Arab Emirates (7.5K tons) and Oman (1.4K tons), together comprising 91% of total consumption.

From 2013 to 2024, the most notable rate of growth in terms of consumption, amongst the key consuming countries, was attained by the United Arab Emirates (with a CAGR of +12.5%), while consumption for the other leaders experienced more modest paces of growth.

In value terms, Saudi Arabia ($292M), the United Arab Emirates ($166M) and Qatar ($35M) appeared to be the countries with the highest levels of market value in 2024, with a combined 89% share of the total market.

The United Arab Emirates, with a CAGR of +9.1%, saw the highest rates of growth with regard to market size among the main consuming countries over the period under review, while market for the other leaders experienced more modest paces of growth.

In 2024, the highest levels of medicaments containing vitamins per capita consumption was registered in the United Arab Emirates (728 kg per 1000 persons), followed by Kuwait (270 kg per 1000 persons), Saudi Arabia (266 kg per 1000 persons) and Oman (263 kg per 1000 persons), while the world average per capita consumption of medicaments containing vitamins was estimated at 333 kg per 1000 persons.

From 2013 to 2024, the average annual growth rate of the medicaments containing vitamins per capita consumption in the United Arab Emirates amounted to +11.4%. The remaining consuming countries recorded the following average annual rates of per capita consumption growth: Kuwait (+1.8% per year) and Saudi Arabia (+1.6% per year).

ProductionGCC’s Production of Medicaments Containing Vitamins And Provitamins

Medicaments containing vitamins production reduced rapidly to 1.6K tons in 2024, falling by -25.1% compared with the previous year’s figure. Over the period under review, production continues to indicate a deep reduction. The pace of growth appeared the most rapid in 2023 with an increase of 180% against the previous year. The volume of production peaked at 10K tons in 2013; however, from 2014 to 2024, production failed to regain momentum.

In value terms, medicaments containing vitamins production reduced markedly to $41M in 2024 estimated in export price. Overall, production continues to indicate a abrupt slump. The most prominent rate of growth was recorded in 2023 with an increase of 177%. The level of production peaked at $241M in 2013; however, from 2014 to 2024, production stood at a somewhat lower figure.

Production By Country

The country with the largest volume of medicaments containing vitamins production was Kuwait (1.1K tons), comprising approx. 67% of total volume. Moreover, medicaments containing vitamins production in Kuwait exceeded the figures recorded by the second-largest producer, Oman (515 tons), twofold.

From 2013 to 2024, the average annual growth rate of volume in Kuwait totaled +1.6%.

ImportsGCC’s Imports of Medicaments Containing Vitamins And Provitamins

For the fifth consecutive year, GCC recorded growth in purchases abroad of medicaments containing vitamins and provitamins, which increased by 4.2% to 20K tons in 2024. In general, imports recorded a resilient increase. The most prominent rate of growth was recorded in 2021 with an increase of 84%. The volume of import peaked in 2024 and is likely to continue growth in the immediate term.

In value terms, medicaments containing vitamins imports skyrocketed to $356M in 2024. Over the period under review, imports, however, continue to indicate a relatively flat trend pattern. The pace of growth appeared the most rapid in 2021 with an increase of 43%. The level of import peaked at $389M in 2013; however, from 2014 to 2024, imports remained at a lower figure.

Imports By Country

Saudi Arabia (9.8K tons) and the United Arab Emirates (8.2K tons) prevails in imports structure, together committing 91% of total imports. It was distantly followed by Oman (941 tons), achieving a 4.8% share of total imports. Qatar (675 tons) followed a long way behind the leaders.

From 2013 to 2024, the most notable rate of growth in terms of purchases, amongst the main importing countries, was attained by the United Arab Emirates (with a CAGR of +13.6%), while imports for the other leaders experienced more modest paces of growth.

In value terms, Saudi Arabia ($223M) constitutes the largest market for imported medicaments containing vitamins and provitamins in GCC, comprising 63% of total imports. The second position in the ranking was taken by the United Arab Emirates ($71M), with a 20% share of total imports. It was followed by Qatar, with a 9.9% share.

In Saudi Arabia, medicaments containing vitamins imports remained relatively stable over the period from 2013-2024. The remaining importing countries recorded the following average annual rates of imports growth: the United Arab Emirates (+0.4% per year) and Qatar (-5.2% per year).

Import Prices By Country

The import price in GCC stood at $18,022 per ton in 2024, jumping by 25% against the previous year. In general, the import price, however, saw a abrupt downturn. The level of import peaked at $47,472 per ton in 2019; however, from 2020 to 2024, import prices stood at a somewhat lower figure.

Prices varied noticeably by country of destination: amid the top importers, the country with the highest price was Qatar ($52,173 per ton), while the United Arab Emirates ($8,604 per ton) was amongst the lowest.

From 2013 to 2024, the most notable rate of growth in terms of prices was attained by Saudi Arabia (-1.7%), while the other leaders experienced a decline in the import price figures.

ExportsGCC’s Exports of Medicaments Containing Vitamins And Provitamins

Medicaments containing vitamins exports declined remarkably to 761 tons in 2024, waning by -31.6% compared with the previous year. In general, exports recorded a sharp slump. The most prominent rate of growth was recorded in 2020 when exports increased by 41% against the previous year. The volume of export peaked at 10K tons in 2013; however, from 2014 to 2024, the exports stood at a somewhat lower figure.

In value terms, medicaments containing vitamins exports rose modestly to $20M in 2024. Overall, exports saw a dramatic descent. The growth pace was the most rapid in 2020 with an increase of 35% against the previous year. Over the period under review, the exports attained the maximum at $273M in 2013; however, from 2014 to 2024, the exports failed to regain momentum.

Exports By Country

The United Arab Emirates prevails in exports structure, accounting for 742 tons, which was near 97% of total exports in 2024. Oman (12 tons) held a relatively small share of total exports.

The United Arab Emirates was also the fastest-growing in terms of the medicaments containing vitamins and provitamins exports, with a CAGR of -19.7% from 2013 to 2024. Oman (-29.0%) illustrated a downward trend over the same period. The United Arab Emirates (+18 p.p.) significantly strengthened its position in terms of the total exports, while Oman saw its share reduced by -3.5% from 2013 to 2024, respectively.

In value terms, the United Arab Emirates ($19M) remains the largest medicaments containing vitamins supplier in GCC, comprising 98% of total exports. The second position in the ranking was taken by Oman ($335K), with a 1.7% share of total exports.

In the United Arab Emirates, medicaments containing vitamins exports declined by an average annual rate of -17.5% over the period from 2013-2024.

Export Prices By Country

The export price in GCC stood at $25,831 per ton in 2024, rising by 53% against the previous year. In general, the export price, however, continues to indicate a relatively flat trend pattern. The level of export peaked at $46,752 per ton in 2019; however, from 2020 to 2024, the export prices stood at a somewhat lower figure.

Average prices varied noticeably amongst the major exporting countries. In 2024, amid the top suppliers, the country with the highest price was Oman ($27,258 per ton), while the United Arab Emirates stood at $25,917 per ton.

From 2013 to 2024, the most notable rate of growth in terms of prices was attained by Oman (+5.7%).