The UK market for veterinary dietary supplements is experiencing strong growth as pet owners become increasingly health-conscious and veterinarians emphasize preventive wellness. Rising adoption of premium pet foods, growing awareness about joint health, immunity, digestive support, and the overall humanization of pets continue to fuel demand. Supplements formulated for dogs, cats, and production animals are becoming mainstream, supported by innovations in clean-label ingredients and species-specific nutrition.

The UK market for veterinary dietary supplements is experiencing strong growth as pet owners become increasingly health-conscious and veterinarians emphasize preventive wellness. Rising adoption of premium pet foods, growing awareness about joint health, immunity, digestive support, and the overall humanization of pets continue to fuel demand. Supplements formulated for dogs, cats, and production animals are becoming mainstream, supported by innovations in clean-label ingredients and species-specific nutrition.

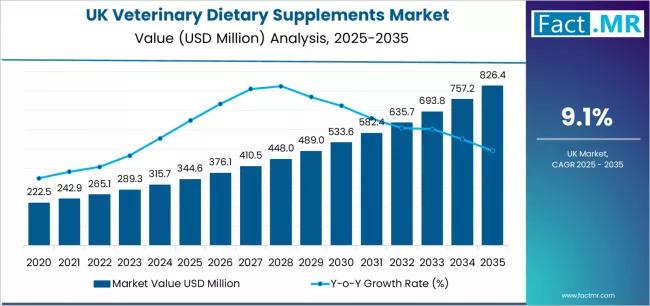

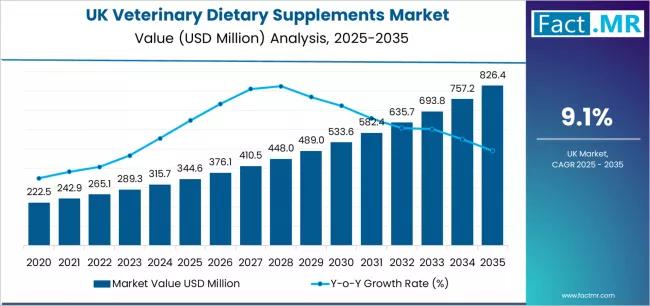

Quick Stats (2025-2035)

2025 Market Value: ~USD 344.6 million

2035 Forecast Market Value: ~USD 826.4 million

Forecast CAGR: ~9.1%

Dominant Animal Type (2025): Companion animals (~65.8% share)

Leading Distribution Channel (2025): Veterinary clinics and hospitals (~42.3% share)

To access the complete data tables and in-depth insights, request a Discount On The Report here: https://www.factmr.com/connectus/sample?flag=S&rep_id=12459

Market Drivers

1. Growing Pet Humanization

UK households increasingly treat pets like family members, investing in long-term health and wellness. This shift boosts demand for supplements supporting joint health, immunity, coat quality, digestion, and cognitive function.

2. Rising Veterinary Recommendations

Veterinarians are prescribing supplements more frequently as part of preventive care. Joint-care formulas, probiotics, multivitamins, and skin-support supplements are especially recommended, increasing trust and market adoption.

3. Aging Pet Population

As pets live longer due to better nutrition and healthcare, conditions such as arthritis, mobility challenges, and digestive issues become more common. This demographic shift increases demand for products designed for senior pets.

4. Growth of E-commerce and Subscription Models

Online pet-health platforms and D2C supplement brands are expanding. Subscription deliveries, custom nutrition profiling, and breed-specific recommendations encourage consistent, repeat purchases.

5. Shift Toward Natural and Clean-Label Products

Pet owners prefer supplements free from artificial additives, GMOs, and fillers. Naturally sourced ingredients, traceable supply chains, plant-based formulations, and sustainability certifications are becoming key differentiators.

Market Segmentation & Insights

By Animal Type

Companion Animals:

Dominates the market due to rising pet ownership and higher spending per pet. Dogs account for the majority of supplement consumption, followed by cats.

Production Animals:

While smaller in the UK compared to companion animals, supplements for poultry, cattle, and swine support immunity, performance, and feed efficiency – contributing steady demand.

By Product Type

Joint & Mobility Supplements

Glucosamine, chondroitin, MSM, and collagen-rich formulations are widely used, especially in older dogs.

Digestive Health & Probiotics

One of the fastest-growing segments as awareness about gut microbiome health increases.

Multivitamins & Minerals

Core products used to address nutritional gaps in both pets and farm animals.

Skin, Coat, and Allergy Supplements

Omega-rich supplements and skin-calming formulations target common pet issues.

Cognitive & Behavioral Health

Emerging category catering to senior pets and pets with anxiety.

By Distribution Channel

Veterinary Clinics & Hospitals

The most trusted channel; clinical-grade formulas sold through vet guidance encourage higher-value purchases.

Pet Retail & Specialty Stores

Strong visibility and wide product options attract mainstream consumers.

E-commerce & Direct-to-Consumer

Fastest-growing channel due to convenience, discounted subscriptions, auto-shipping, and personalized recommendations.

Challenges

Price Sensitivity for Premium Products:

High-quality supplements often carry premium pricing, limiting adoption among some consumer segments.

Lack of Standardization:

Evidence quality varies across brands, and lack of strict regulatory testing may impact buyer confidence.

Supply Chain Limitations:

Sourcing high-grade natural ingredients like marine collagen, herbal extracts, and advanced probiotics can increase costs.

Regulatory Changes in the Veterinary Sector:

Proposed reforms in veterinary medicine could influence dispensing practices and shift buyer behavior.

Opportunities

1. Vet-Backed Clinical Studies

Brands that invest in scientific validation gain strong credibility and secure long-term partnerships with veterinary clinics.

2. Personalized Nutrition Solutions

Microbiome tests, DNA-based pet profiling, and age-specific supplement lines offer strong differentiation.

3. Subscription & Wellness Plans

Bundling supplements with monthly wellness packages ensures recurring revenue for brands and clinics.

4. Sustainability & Ethical Sourcing

Eco-friendly packaging, responsibly sourced ingredients, and traceability attract modern UK consumers.

5. Functional Treats & Chewable Formats

Taste-friendly formats improve adherence and allow cross-selling with everyday pet treats.

Outlook (2025-2035)

The UK veterinary dietary supplements market is expected to more than double by 2035, driven largely by rising pet humanization, increased veterinary influence, and strong uptake of premium and natural formulations. Companies that focus on clinical validation, transparency, personalization, and convenient delivery models will lead the next decade of growth. With expanding digital retail and growing awareness of animal wellness, supplements are set to become a standard part of both preventive and therapeutic pet care in the UK.

Browse Full Report: https://www.factmr.com/report/united-kingdom-veterinary-dietary-supplements-market

Purchase Full Report for Detailed Insights

For access to full forecasts, regional break-outs, product- and application-level analysis, company share details, and emerging trend assessments, you can purchase the complete report: https://www.factmr.com/checkout/12459

Have specific requirements or need assistance on report pricing or have a limited budget? Please contact sales@factmr.com

Related Reports:

Demand and Trend Analysis of Surimi in East Asia: https://www.factmr.com/report/demand-and-trend-analysis-of-surimi-in-east-asia

Demand and Trend Analysis of Surimi in Europe: https://www.factmr.com/report/demand-and-trend-analysis-of-surimi-in-europe

Demand and Trend Analysis of Surimi in Latin America: https://www.factmr.com/report/demand-and-trend-analysis-of-surimi-in-latin-america

Demand and Trend Analysis of Surimi in Middle East & Africa: https://www.factmr.com/report/demand-and-trend-analysis-of-surimi-in-middle-east-and-africa

Contact:

US Sales Office

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583, +353-1-4434-232

Email: sales@factmr.com

About Fact.MR:

Fact.MR is a global market research and consulting firm, trusted by Fortune 500 companies and emerging businesses for reliable insights and strategic intelligence. With a presence across the U.S., UK, India, and Dubai, we deliver data-driven research and tailored consulting solutions across 30+ industries and 1,000+ markets. Backed by deep expertise and advanced analytics, Fact.MR helps organizations uncover opportunities, reduce risks, and make informed decisions for sustainable growth.

This release was published on openPR.