Clean Beauty Packaging Prototypes Market Forecast and Outlook 2026 to 2036

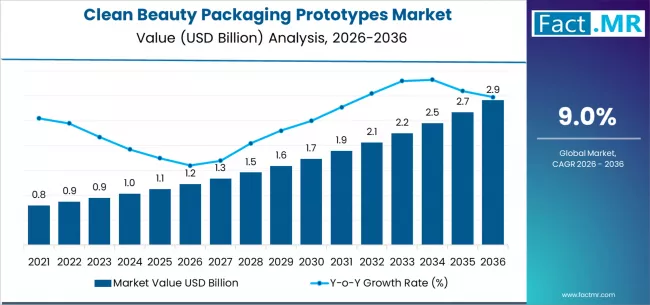

The global clean beauty packaging prototypes market is positioned at the forefront of a transformative shift in cosmetic and personal care branding, projected to expand from USD 1.23 billion in 2026 to USD 2.91 billion by 2036, advancing at a 9.0% CAGR.

Key Takeaways from the Clean Beauty Packaging Prototypes Market

Market Value for 2026: USD 1.23 Billion

Market Value for 2036: USD 2.91 Billion

Forecast CAGR (2026-2036): 9.0%

Leading Prototype Type Segment (2026): Refillable / Reusable Concepts (34%)

Leading Material Type Segment (2026): Glass (Recycled / Lightweight) (30%)

Leading End-Use Product Segment (2026): Skincare Packaging (38%)

Key Growth Countries: India (10.80% CAGR), China (10.20% CAGR), USA (9.60% CAGR), Germany (8.70% CAGR), Japan (8.10% CAGR)

Key Players in the Market: AptarGroup, Inc., Berry Global, Inc., Albéa (Groupe Pochet), HCT Group, Silgan Holdings

This robust growth is propelled by the convergence of the clean beauty movement’s ingredient transparency ethos with urgent consumer and regulatory demands for sustainable packaging solutions. Refillable and reusable concepts lead prototype development with a 34% share, reflecting a strategic pivot from single-use disposal to circular engagement models.

Glass, particularly recycled and lightweight variants, remains the material of choice for 30% of prototypes, prized for its inert quality and premium recyclability. Skincare, as the foundational clean beauty category, drives 38% of end-use demand, where packaging integrity and sustainability directly align with product purity claims.

The market’s trajectory is defined by brands racing to innovate beyond mere material substitution, developing holistic systems that encompass refill mechanics, minimalist design for reduced material use, and end-of-life clarity through compostable or mono-material structures. India (10.80% CAGR) and China (10.20% CAGR) are key growth engines, driven by massive consumer bases rapidly adopting clean beauty principles alongside tightening environmental policies, forcing both domestic brands and global players to localize sustainable packaging development.

Metric

Metric

Value

Market Value (2026)

USD 1.23 Billion

Market Forecast Value (2036)

USD 2.91 Billion

Forecast CAGR (2026-2036)

9.0%

Category

Category

Segments

Prototype Type

Refillable / Reusable Concepts, Minimalist Sustainable Designs, Biodegradable / Compostable Materials, Recycled / PCR Material Prototypes, Others

Material Type

Glass (Recycled / Lightweight), Sustainable Plastics (PCR / Bio-based), Metal & Aluminum, Paperboard & Fiber, Others

End-Use Product

Skincare Packaging, Makeup / Color Cosmetics, Hair Care Packaging, Fragrance Packaging, Others

Region

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, MEA

Segmental Analysis

By Prototype Type, Which Concept is Defining Circular Engagement?

Refillable and reusable concepts hold a leading 34% market share, representing the most direct strategy for waste elimination while fostering ongoing brand loyalty. These prototypes move beyond material innovation to system design, encompassing durable primary containers, convenient refill pouches or cartridges, and streamlined in-store or mail-back logistics. Their dominance underscores a brand commitment to tangible, long-term circularity, addressing the consumer desire to reduce single-use plastic without sacrificing product experience or aesthetic appeal.

By Material Type, Which Offers Purity and Premium Perception?

Glass, especially in recycled and lightweight engineered forms, leads the material segment with a 30% share. Its dominance in clean beauty prototyping is anchored in its inherent qualities: impermeability, which protects sensitive formulations; a premium, inert feel that communicates purity; and a well-established, infinitely recyclable end-of-life pathway. Innovations in lightweighting and strengthening technologies are mitigating its traditional weight and breakage drawbacks, solidifying its role as the benchmark material for skincare serums, oils, and fragrance prototypes.

By End-Use Product, Which Category is the Core Driver?

Skincare packaging constitutes the dominant end-use segment, accounting for 38% of prototype development. Skincare is the heart of the clean beauty movement, where efficacy, ingredient integrity, and preservation are paramount. Packaging prototypes for this category must not only be sustainable but also functionally superior-offering precise dispensing, airtight seals, and UV protection. The high-value, frequent-use nature of skincare products justifies investment in advanced sustainable prototypes, making this category the primary testing ground for new packaging technologies and circular business models.

What are the Drivers, Restraints, and Key Trends of the Clean Beauty Packaging Prototypes Market?

The primary market driver is the powerful consumer demand for brands to demonstrate holistic sustainability, with packaging being the most visible and tangible proof point. Stringent extended producer responsibility regulations and pending bans on certain single-use plastics are compelling brands to invest in compliant alternative prototypes. The clean beauty segment’s premium positioning allows for the cost absorption associated with developing and testing higher-priced sustainable packaging solutions, accelerating innovation cycles.

A significant market restraint is the high cost and technical complexity of developing, testing, and scaling functional prototypes that meet both aesthetic and performance criteria for luxury products. Supply chain challenges in securing consistent, high-quality streams of post-consumer recycled or bio-based materials can hinder scalability. Furthermore, consumer confusion around proper end-of-life disposal for novel materials like compostable plastics can undermine the environmental benefits and lead to greenwashing accusations if not communicated effectively.

Key trends include the rise of digital product passports and QR codes on prototypes to educate consumers on material composition and recycling instructions. There is strong growth in water-soluble and mono-material plastic prototypes that simplify recycling. Brands are increasingly co-developing proprietary refill ecosystems to create customer lock-in. Additionally, the use of augmented reality in prototyping allows for rapid virtual testing of shelf appeal and consumer interaction before physical samples are produced, reducing development waste.

Analysis of the Clean Beauty Packaging Prototypes Market by Key Countries

Country

CAGR (2026-2036)

India

10.80%

China

10.20%

USA

9.60%

Germany

8.70%

Japan

8.10%

How is India’s Burgeoning Clean Beauty Market and Policy Shift Driving Innovation?

India’s leading CAGR of 10.80% is fueled by a surge in domestic clean beauty brands and the rapid consumer adoption of sustainability principles, coupled with a strong governmental push against single-use plastics. The market demands cost-effective yet innovative prototypes that leverage local materials, such as molded fiber from agricultural waste, and refill systems suited to high-density urban retail. Price sensitivity necessitates prototypes that deliver sustainability without a prohibitive premium, driving unique, locally-sourced material innovation.

What is the Impact of China’s Dual Role as Manufacturing Hub and Consumption Giant?

China’s 10.20% growth is driven by its unparalleled packaging manufacturing ecosystem rapidly pivoting to meet global brand demand for sustainable prototypes, while its own massive consumer market increasingly values eco-conscious brands. Chinese packaging engineers are innovating in advanced PCR processing and bio-based plastics to serve both export and domestic needs. The scale and speed of Chinese prototyping capabilities are crucial for global brands seeking to iterate and launch sustainable packaging lines quickly.

Why Does the USA’s Brand-Centric Market and Regulatory Landscape Sustain Demand?

The USA’s 9.60% growth is anchored in its concentration of clean beauty brand headquarters and a consumer base highly responsive to sustainability marketing. A patchwork of state-level packaging regulations creates a complex compliance landscape, driving brands to prototype versatile solutions. The market is characterized by demand for high-design, Instagram-worthy prototypes that communicate sustainability instantly on-shelf and online, with a strong focus on refillable systems for direct-to-consumer models.

How is Germany’s Engineering Rigor and Green Legislation Shaping Prototyping?

Germany’s 8.70% CAGR reflects its strict packaging laws and engineering excellence. German brands and suppliers focus on technically rigorous prototypes with impeccable life-cycle assessment data. The market favors prototypes designed for disassembly and high-value recycling, such as pure aluminum jars or separable multi-material components. Innovation is methodical, with an emphasis on proving long-term durability and true circularity over superficial design trends.

What Role Does Japan’s Minimalist Aesthetic and Precision Manufacturing Play?

Japan’s 8.10% growth occurs within a market that values minimalist design, supreme functionality, and meticulous waste sorting. Prototypes emphasize precise, reduced material use, elegant refill mechanisms, and clear, instructive disposal graphics. Japanese packaging technologists excel in creating lightweight, strong structures and pioneering new applications for paperboard and biopolymers. The demand is for prototypes that achieve sustainability through extreme efficiency and user-friendly design, aligning with cultural values of respect and resourcefulness.

Competitive Landscape of the Clean Beauty Packaging Prototypes Market

The competitive landscape features global packaging conglomerates with dedicated sustainable divisions competing alongside niche design studios specializing in circular innovation. Competition intensifies around proprietary refill technology patents, access to certified advanced recycled material streams, and speed-to-market for bespoke client solutions. Success is increasingly tied to offering end-to-end services-from conceptual design and life-cycle analysis to pilot production and recycling pathway validation-positioning suppliers as strategic sustainability partners rather than mere component manufacturers.

Key Players in the Clean Beauty Packaging Prototypes Market

AptarGroup, Inc.

Berry Global, Inc.

Albéa (Groupe Pochet)

HCT Group

Silgan Holdings

Scope of Report

Items

Values

Quantitative Units

USD Billion

Prototype Type

Refillable / Reusable Concepts, Minimalist Sustainable Designs, Biodegradable / Compostable Materials, Recycled / PCR Material Prototypes, Others

Material Type

Glass (Recycled / Lightweight), Sustainable Plastics (PCR / Bio-based), Metal & Aluminum, Paperboard & Fiber, Others

End-Use Product

Skincare Packaging, Makeup / Color Cosmetics, Hair Care Packaging, Fragrance Packaging, Others

Key Countries

India, China, USA, Germany, Japan

Key Companies

AptarGroup, Inc., Berry Global, Inc., Albéa (Groupe Pochet), HCT Group, Silgan Holdings

Additional Analysis

Life-cycle assessment comparisons of different prototype systems; consumer willingness-to-pay for refillable packaging; compatibility testing of bio-based plastics with complex cosmetic formulations; design for disassembly principles in multi-material packs; scalability analysis of novel material supply chains.

Market by Segments

Prototype Type :

Refillable / Reusable Concepts

Minimalist Sustainable Designs

Biodegradable / Compostable Materials

Recycled / PCR Material Prototypes

Others

Material Type :

Glass (Recycled / Lightweight)

Sustainable Plastics (PCR / Bio-based)

Metal & Aluminum

Paperboard & Fiber

Others

End-Use Product :

Skincare Packaging

Makeup / Color Cosmetics

Hair Care Packaging

Fragrance Packaging

Others

Region :

North America

Latin America

Brazil

Mexico

Argentina

Rest of Latin America

Western Europe

Germany

UK

France

Spain

Italy

Netherlands

BENELUX

Rest of Western Europe

Eastern Europe

Russia

Poland

Czech Republic

Rest of Eastern Europe

East Asia

China

Japan

South Korea

Rest of East Asia

South Asia & Pacific

India

ASEAN

Australia

Rest of South Asia & Pacific

MEA

Saudi Arabia

UAE

Turkiye

Rest of MEA

References

Boz, Z., Korhonen, V., & Koelsch Sand, C. (2023). Consumer considerations for the implementation of sustainable packaging: A review. Journal of Cleaner Production, 252, 119889.

Garcia, J. M., & Robertson, M. L. (2024). The future of plastics recycling: Chemical advances and environmental imperatives. Science, 383(6681), 254-259.

Herbes, C., Beuthner, C., & Ramme, I. (2023). Consumer attitudes towards biobased packaging: A cross-cultural study. Sustainable Production and Consumption, 35, 181-194.

Klein, F., & Emberger-Klein, A. (2024). The clean beauty movement: Drivers, consumer perceptions, and market implications. Journal of Retailing and Consumer Services, 76, 103542.

Magnier, L., & Crie, D. (2023). Communicating packaging eco-friendliness: The role of pictorial and verbal claims. International Journal of Research in Marketing, 40(2), 398-416.

Molina-Besch, K., & Wikström, F. (2024). The environmental impact of packaging in the cosmetics industry: Opportunities for improvement. Packaging Technology and Science, 37(1), 3-18.

Steenis, N. D., & van Herpen, E. (2023). Consumer response to sustainable packaging design: A meta-analysis. Journal of Environmental Psychology, 69, 101411.

Svanes, E., & Oestergaard, S. (2024). Sustainable packaging design: A framework for holistic development. Journal of Industrial Ecology, 28(2), 345-360.

Williams, H., & Wikström, F. (2023). The influence of packaging attributes on consumer food waste behavior. Waste Management, 145, 44-51.

Wyrwa, J., & Barska, A. (2024). Packaging innovations in the sustainable cosmetics market. Sustainability, 16(3), 1296.

![[From Japan] An Unprecedented Skin Beauty Experience Just by Showering. [From Japan] An Unprecedented Skin Beauty Experience Just by Showering.](https://www.vitaminrush.com/wp-content/uploads/2026/01/1768561053_1768335835-770x515.jpg)