China Nutraceuticals Market Summary

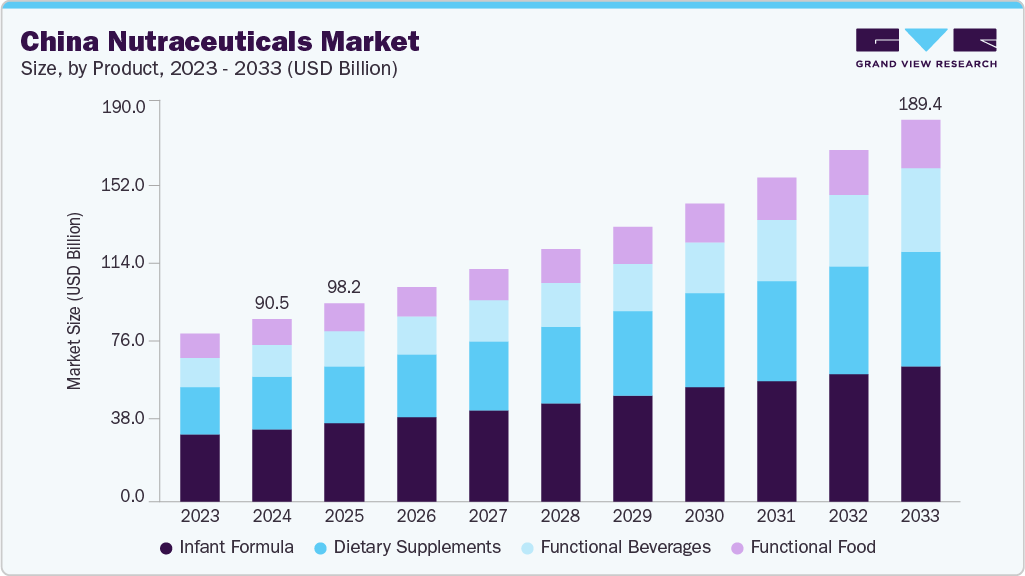

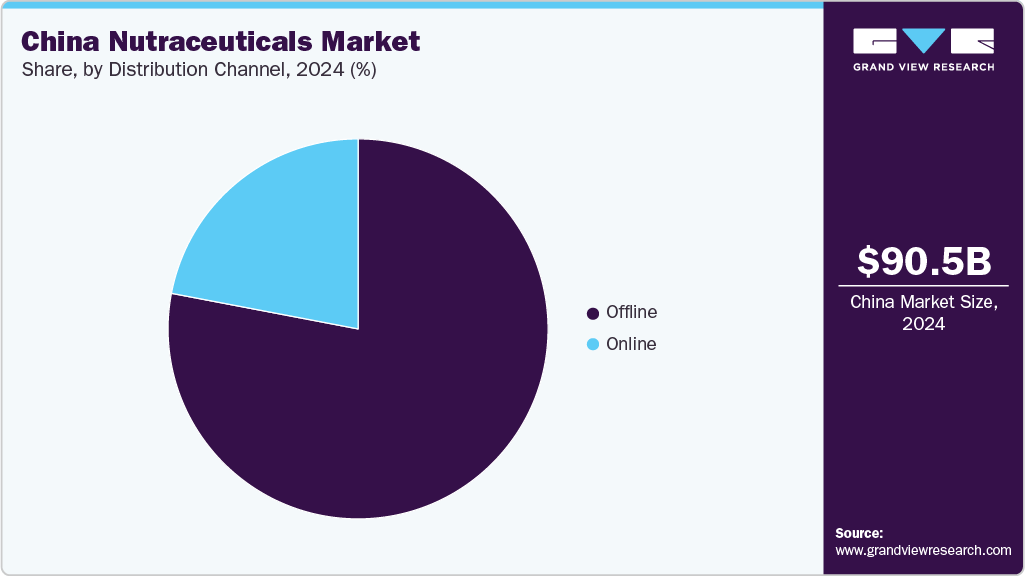

The China nutraceuticals market size was estimated at USD 90.48 billion in 2024 and is projected to reach USD 189.39 billion by 2033, growing at a CAGR of 8.6% from 2025 to 2033. This market is primarily driven by rising consumer health awareness, growing demand for functional foods and dietary supplements, and government support for preventive healthcare.

Key Market Trends & Insights

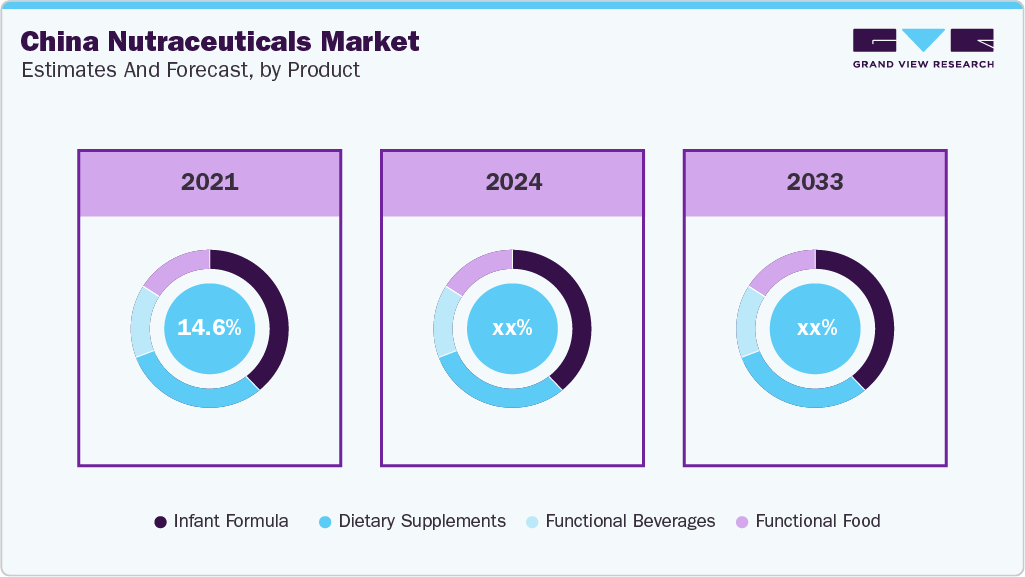

By product, the infant formula segment held the highest market share of 39.9% in 2024.

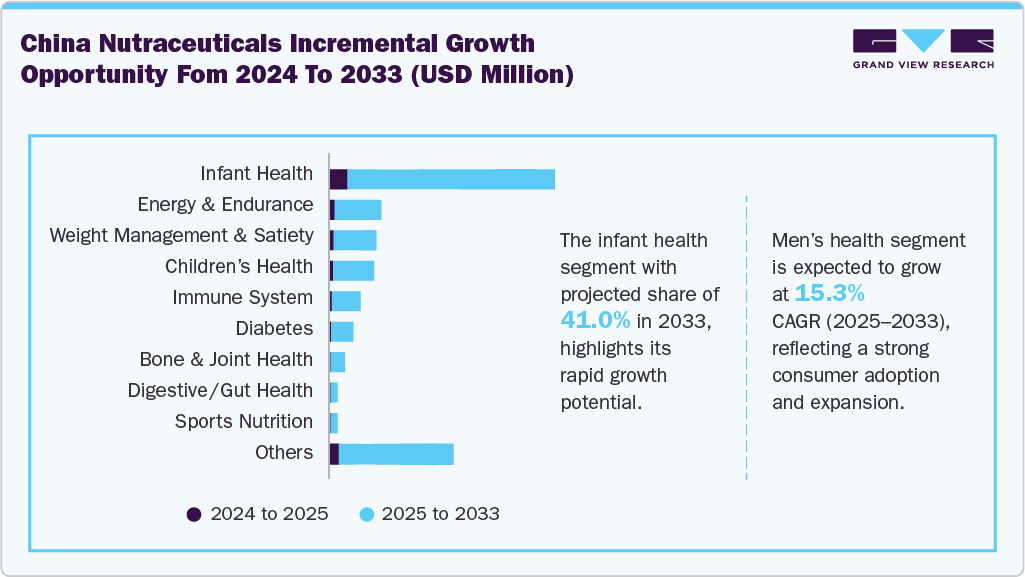

Based on application, the infant health segment held the highest market share in 2024.

By distribution channel, the offline segment held the highest market share in 2024.

Market Size & Forecast

2024 Market Size: USD 90.48 Billion

2033 Projected Market Size: USD 189.39 Billion

CAGR (2025-2033): 8.6%

The integration of traditional Chinese medicine into modern nutraceutical products also contributes to market growth. The growing prevalence of lifestyle-related and chronic diseases such as obesity, diabetes, and hypertension is accelerating the adoption of nutraceuticals as preventive and supportive health solutions. The prevalence of non-communicable diseases in China increased significantly, from 17.0% in 1993 to 34.3% in 2018, with hypertension and diabetes accounting for over half of these cases. Growing health awareness encourages consumers to proactively seek functional foods and dietary supplements to improve overall well-being. In addition, rising disposable income and urbanization influence purchasing behavior toward premium wellness products. The growing use of digital platforms and e-commerce enhances product accessibility and consumer education. Rising demand for clean-label, plant-based, and traditional Chinese medicine-based formulations is prompting manufacturers to innovate, while increasing investments by both domestic and global players are expected to boost market expansion further.

The rising aging population is a significant driver of the Chinese nutraceuticals market, as elderly consumers increasingly seek products that support mobility, bone health, immunity, and cognitive function. According to official data released jointly by the Ministry of Civil Affairs and the China National Committee on Ageing, China’s population aged 60 and above reached nearly 297 million in 2023, estimated at 21.1% of the total population, while individuals aged 65 and above totaled 216.76 million, representing 15.4%. This demographic trend is creating substantial demand for age-specific dietary supplements. In response, manufacturers are developing targeted formulations focused on senior health, thereby further propelling market growth.

Consumer Insights

The consumer trends in China’s nutraceuticals market are significantly driven by the preference of urban consumers from key cities such as Beijing, Shanghai, Wuhan, Shenzhen, and others. In 2023, nearly 65.0% of the population in China lived in urban areas. Significant consumer groups such as working professionals and young adults in China increasingly adopt functional foods and beverages with functional ingredients such as plant-based proteins, vitamins, and other nutrients to address nutrition gaps. In addition, the growing prevalence of chronic health issues such as stroke, Chronic obstructive pulmonary disease, and cardiovascular diseases has resulted in rising expenditure on preventive health and enhanced food products.

Notable changes in Chinese consumers’ shopping preferences also contribute to trends in this market. A growing number of individuals prefer online shopping over frequent visits to pharmacies to purchase regular dosages of supplements. Increasing market penetration of delivery platforms and e-commerce websites will likely stimulate a significant shift towards online supplement distribution in the forecast period.

Product Insights

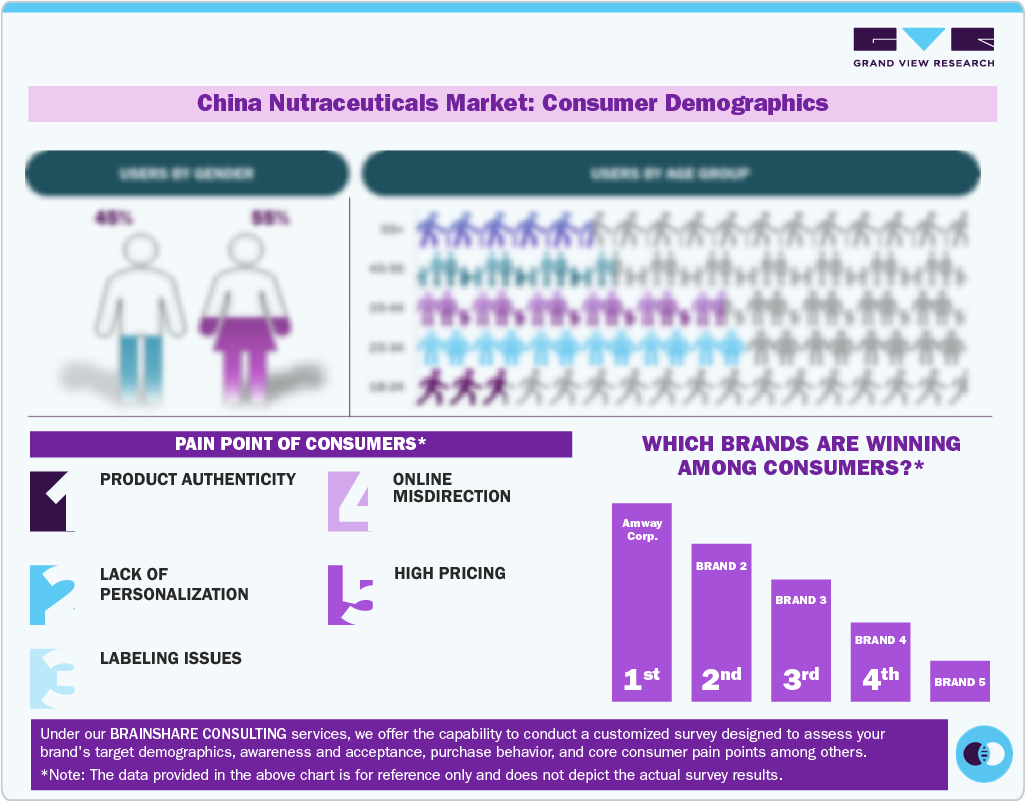

Based on product, the infant formula segment dominated the market with a revenue share of 39.9% in 2024. Growth of this segment is primarily driven by high parental awareness of infant nutrition and growing trust in fortified and premium formula products. The segment benefits from increasing urbanization, higher disposable incomes, and rising female workforce participation, which drive demand for safe, nutritious, and convenient feeding options.

The functional beverages segment is projected to experience the fastest CAGR of 11.6% from 2025 to 2033. The market is driven by increasing demand for convenient, on-the-go health solutions. Consumers, especially millennials and working professionals, are seeking drinks fortified with vitamins, minerals, probiotics, and herbal extracts to support energy, immunity, digestion, and stress management. The rising popularity of fitness, sports, and wellness routines also boosts the consumption of performance-enhancing and recovery beverages.

Furthermore, innovation in flavors, packaging, and sugar-free or plant-based alternatives is helping brands attract a wider health-conscious audience. E-commerce platforms and specialty retail channels are accelerating accessibility and product visibility, further supporting growth.

Application Insights

The infant health segment held the largest revenue share of the China nutraceuticals market in 2024. A strong parental focus on early nutrition, safety, and immunity drives this dominance. The widespread adoption of fortified infant formula and complementary products such as Docosahexaenoic Acid (DHA) supplements, probiotics, and multivitamins reinforces the segment’s growth. Rising household income and urbanization contribute to high expenditure on infant well-being. In addition, the increasing availability of specialized formulas for allergies, gut health, and cognitive development has expanded the product mix. Brands continue to invest in science-backed innovations and regulatory compliance to strengthen consumer trust in infant-targeted nutraceuticals.

The men’s health segment is projected to experience the fastest CAGR from 2025 to 2033. The market is driven by rising awareness of preventive healthcare, fitness, and reproductive wellness. Younger male consumers increasingly incorporate supplements for energy, muscle recovery, prostate function, and stress reduction into their routines. The rise in sedentary lifestyles, high work-related stress, and growing digital health engagement are further driving demand for clean-label, personalized products. According to the World Health Organization (WHO), ischaemic heart disease and chronic obstructive pulmonary disease (COPD) are among the leading causes of death among Chinese men, highlighting the urgent need for preventive health strategies.

Distribution Channel Insights

The offline distribution segment dominated the China nutraceuticals market in 2024. The market is driven by strong consumer trust in pharmacies, hospital-based retail counters, specialty nutrition stores, and traditional Chinese medicine outlets. Brick-and-mortar channels offer personalized consultations, credibility, and product verification factors that are especially important for senior consumers and parents purchasing infant or maternal supplements. Expansions initiated by key market participants in the retail pharmacy industry in China also influence the growth of this segment.

The online segment is anticipated to experience the fastest CAGR of 10.8% from 2025 to 2033. This growth is owing to rapid digitalization, increasing smartphone penetration, and expanding e-commerce infrastructure in China. Platforms such as Tmall, JD Health, and cross-border e-commerce sites have transformed access to global nutraceutical brands, especially among urban millennials and Gen Z consumers. Online channels also enable transparent product comparisons, influencer-driven marketing, and subscription-based purchasing models. The integration of AI-powered health recommendations and livestream sales further accelerates consumer adoption and boosts market growth.

Key China Nutraceuticals Company Insights

Some of the key players in the China nutraceuticals market include Amway Corp., Danone, Yakult Honsha Co., Ltd, and others.

Amway Corp. is a global leader in health and wellness, offering a broad nutrition portfolio under its Nutrilite brand. Its products include foundational supplements, targeted health solutions, personalized nutrition, and sports nutrition.

Key China Nutraceuticals Companies:

Amway Corp.

Danone

Yakult Honsha Co., Ltd.

General Mills Inc.

Nestlé S.A

Recent Developments

In August 2024, Meiji China Co., Ltd. introduced a new Hokkaido-flavored probiotic yogurt to the Chinese market. The product featured premium raw milk strains from Hokkaido.

In November 2023, Danone launched Fortimel, its first product in China’s adult Foods for Special Medical Purposes category, to expand in adult medical nutrition. Designed for patients recovering from surgery or conditions such as cancer and stroke, Fortimel complements Danone’s existing tube-feeding range.

In November 2023, Nestlé announced the launch of its new brand, Wyeth illume, a growing-up milk formula containing Human Milk Oligosaccharides (HMO), for early life nutrition in mainland China, following regulatory approval by China’s National Health Commission.

China Nutraceuticals Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 98.23 billion

Revenue forecast in 2033

USD 189.39 billion

Growth rate

CAGR of 8.6% from 2025 to 2033

Actuals

2021 – 2024

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, and distribution channel

Key companies profiled

Amway Corp.; Danone; Yakult Honsha Co., Ltd.; General Mills Inc.; Nestlé S.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

China Nutraceuticals Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the China nutraceuticals market report based on product, application, and distribution channel:

Product Outlook (Revenue, USD Million, 2021 – 2033)

Dietary Supplements

Tablets

Capsules

Soft Gels

Powders

Gummies

Liquid

Others

Functional Food

Functional Beverages

Energy drink

Sports drink

Others (Functional dairy based beverages, kombucha, kefir, probiotic drinks, and functional water)

Infant Formula

Application Outlook (Revenue, USD Million, 2021 – 2033)

Distribution Channel Outlook (Revenue, USD Million, 2021 – 2033)