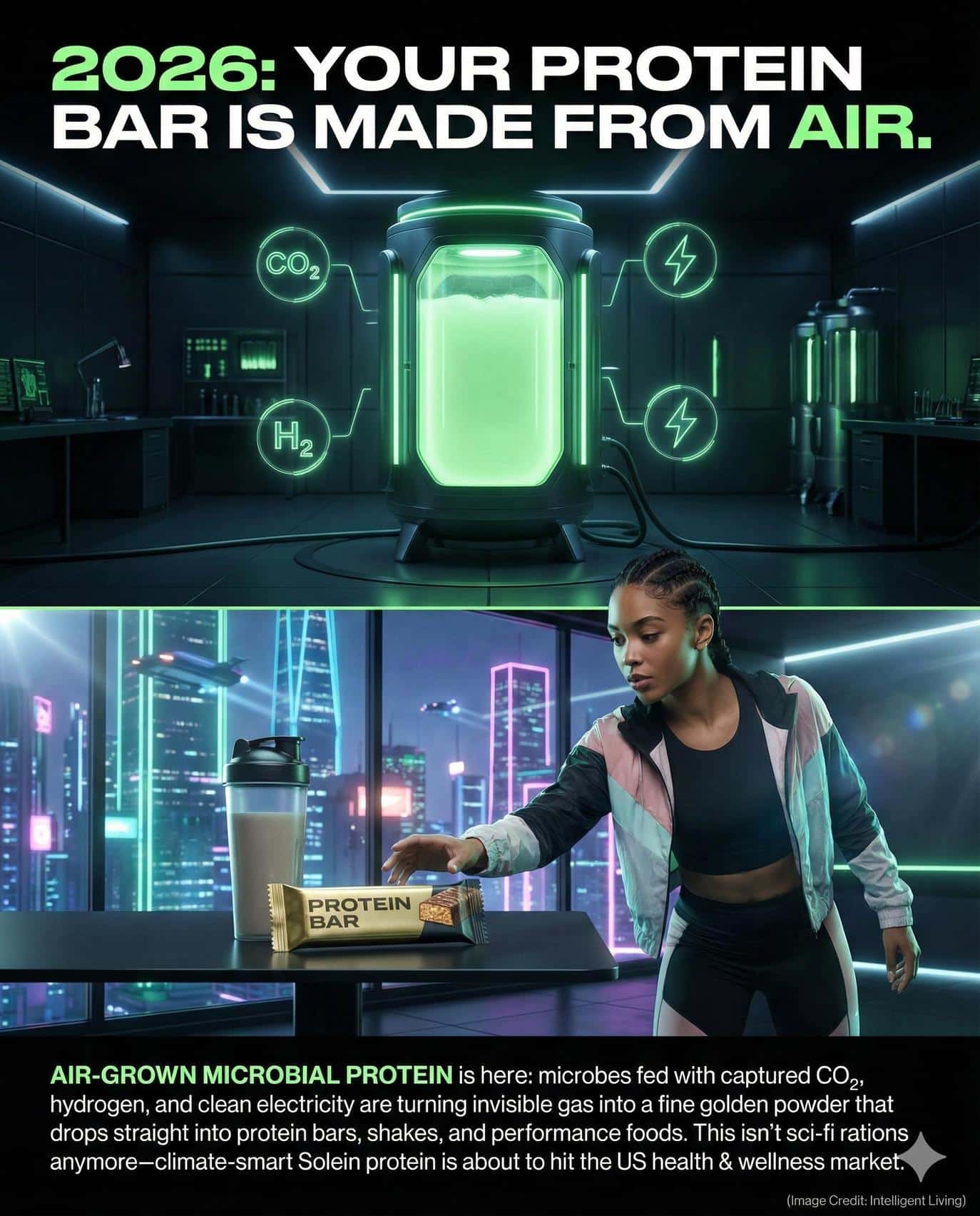

Air-grown protein transitioned from a theoretical concept into a commercial reality in early 2026. Finland-based Solar Foods has transitioned Solein from experimental success to commercial availability, proving that gas fermentation can reliably transform carbon dioxide and renewable electricity into high-quality nutrition. This breakthrough allows the microbial protein market to compete directly with traditional agriculture, offering a viable alternative to land-intensive soy and animal proteins, with recent analysis valuing the sector at roughly $1.33 billion in 2025.

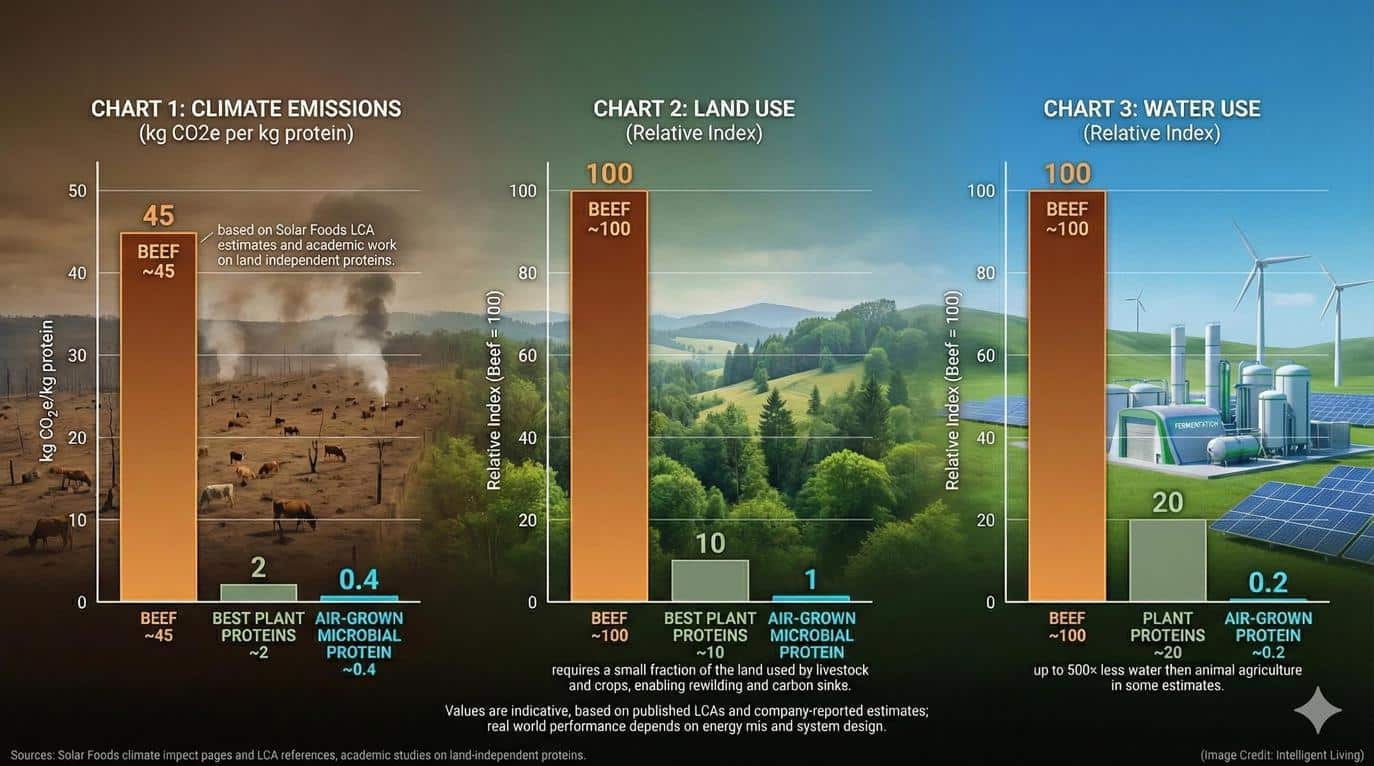

Decoupling nutrition from soil constraints stabilizes food security against the rising frequency of climate-driven crop failures and livestock disruptions. Microbial conversion systems operate with twenty times the efficiency of photosynthesis, turning industrial gases into edible biomass without requiring vast acreages or irrigation.

Nations pursuing food independence can now view energy infrastructure as a primary source of nourishment. Protein sovereignty becomes attainable when bioreactors localized in any geography can generate essential amino acids using only captured emissions and clean power. Solar Foods’ expansion demonstrates that the carbon-to-protein cycle is no longer a niche curiosity but a scalable pillar of the 2026 sustainable economy.

(Credit: Intelligent Living)

(Credit: Intelligent Living)

Sustainable Protein Metrics: 2026 Solar Foods Operational Quick Facts

Solar Foods has released a comprehensive technical update regarding its current operational capacity and 2026 rollout strategy. This data highlights the specific metrics that allow microbial proteins to compete with traditional agriculture on a global scale.

Company: Solar Foods (Finland)

Product: Solein microbe-based protein

Technology: Gas fermentation using CO2, hydrogen, and renewable electricity

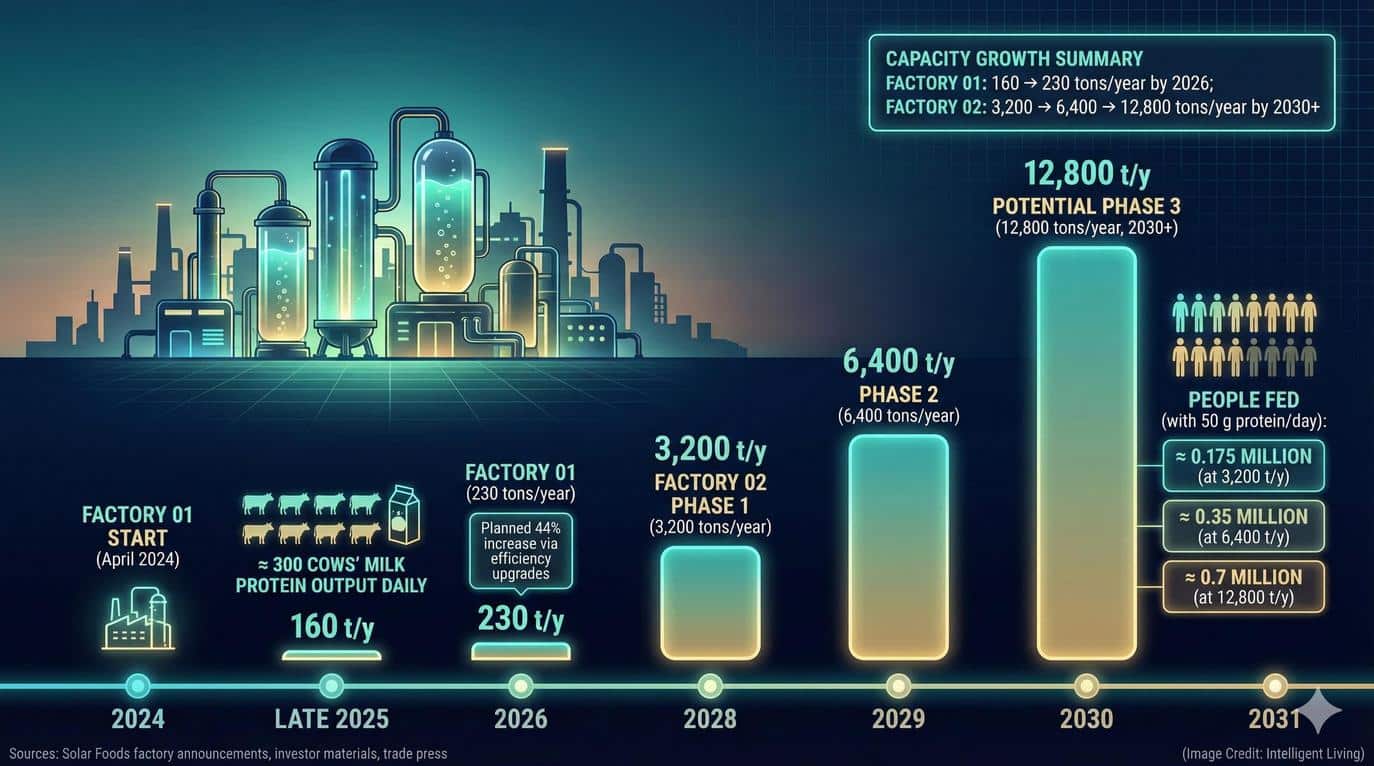

Factory 01: Reached full design capacity of 160 tons per year; expanding to 230 tons in 2026

Factory 02: Planned large-scale facility in Lappeenranta with phased capacity up to 12,800 tons annually

US Market Entry: Fermenta’s Gutsy protein bars and Pothos’ PRVL powders launching in Q1 2026

Regulatory Status: GRAS self-affirmed in the US; FDA and EFSA reviews expected by the end of 2026

Global Availability: Commercially available in Singapore since 2024

Sustainability Impact: 20 times more efficient than photosynthesis, requiring 95% less land than animal protein

These figures demonstrate the immediate scalability of the carbon-to-protein cycle. The following breakdown provides further clarity on how these metrics translate to commercial reality.

(Credit: Intelligent Living)

(Credit: Intelligent Living)

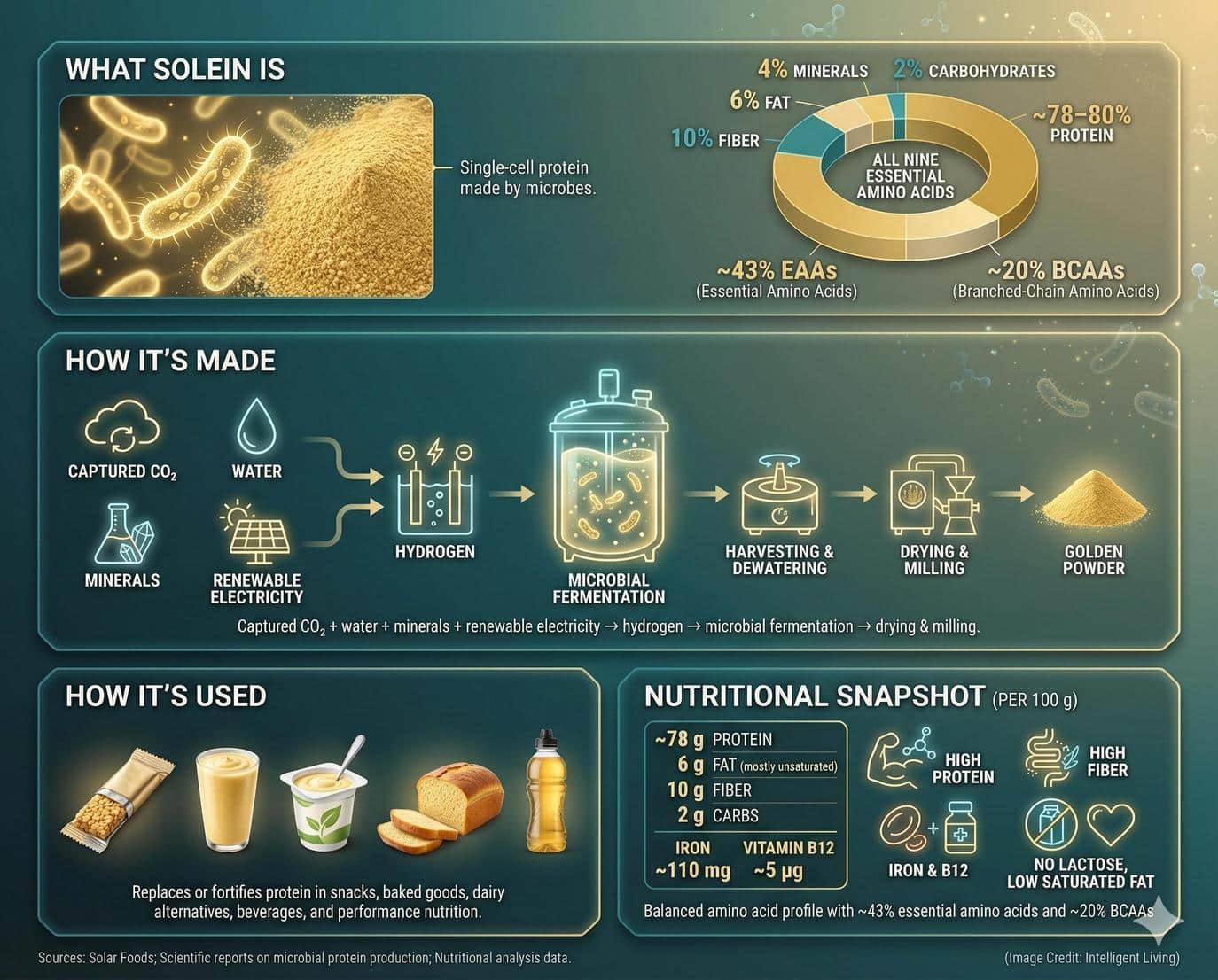

The Science of Solein: Why Decoupled Microbial Protein Is Essential

Solein is a single-cell protein made by feeding microscopic organisms with carbon dioxide, hydrogen, and renewable electricity. Inside Solar Foods’ bioreactors, these microbes convert those simple gases into amino acids, vitamins, and other nutrients.

The resulting golden-yellow powder provides a dense nutritional profile:

Protein content between 65 and 70 percent

Essential dietary fiber and healthy fats

High concentrations of iron

Full spectrum of vitamin B12

Precision Bioreactors: The Mechanics of Air-Grown Nutrition

These nutrients integrate seamlessly into food formulations without affecting taste. This balance of macro- and micronutrients positions Solein as a superior alternative to traditional plant isolates.

Solein functions independently of conventional agriculture, eliminating the historical reliance on fertile soil and livestock. It does not require farmland, livestock, or crop inputs, which means production can take place anywhere electricity is available. The company describes the process as food without fields, a protein source that sidesteps droughts, deforestation, and fertilizer emissions by turning CO2, water, and renewable electricity into edible protein.

For context, traditional photosynthesis converts sunlight into plant biomass with about five percent efficiency. Solein’s microbial conversion system is roughly 20 times more efficient, which could enable meaningful carbon savings if scaled globally. Singapore, the first country to grant novel food approval for Solein in 2022, has already incorporated the ingredient into ice creams, mooncakes, and Sichuan-style dishes, showing that taste and texture can integrate seamlessly into familiar foods.

This independence from soil and weather introduces the idea of protein sovereignty—the ability for nations to secure food supply through energy and bioprocessing rather than land and imports. In a future shaped by climate extremes, Solar Foods’ model demonstrates how energy infrastructure could double as food infrastructure.

(Credit: Intelligent Living)

(Credit: Intelligent Living)

Factory 01 Just Crossed the Line that Matters: Commercial Operating Parameters

Solar Foods’ Factory 01, located in Vantaa near Helsinki, represents a critical turning point for the company and for the broader microbial protein industry. The facility began operations in April 2024 and reached its target production parameters by late 2025, meeting the designed output of 160 tons of Solein per year. According to the company’s latest operational update, Factory 01 now operates continuously with a productivity rate of 1 gram per liter per hour and an energy efficiency ratio (O2/CO2) of 2.7.

From a sustainability perspective, Factory 01 provides empirical proof that air-based protein production is no longer theoretical, and its operational metrics now act as a template for future facilities worldwide that build on Solar Foods’ renewable Solein protein, moving from lab-scale experiments to commercial reality.

Sustainability Proof of Concept: Comparing Solein to Traditional Dairy Yields

Operating at full capacity, Factory 01 produces as much protein as a 300-cow dairy farm while bypassing methane emissions and feed production. The plant’s next milestone involves an efficiency upgrade that will lift annual capacity to 230 tons by the end of 2026. These improvements were validated during pilot operations and are expected to optimize gas flow dynamics and nutrient recycling inside the bioreactors.

The company has also begun using real-time digital monitoring tools to fine-tune bioprocess efficiency, a critical step in preparing for the upcoming Factory 02 expansion. The data from Factory 01 now forms the benchmark dataset for process replication and quality assurance in future plants.

Factory 02 is the Scale Bet, and 2026 is the Decision Year

Solar Foods validated commercial gas fermentation at Factory 01. Now, Factory 02 serves as the ultimate test for economic scalability in Lappeenranta, Finland.

The company has outlined a three-phase construction model designed to minimize financial risk. This pre-engineering roadmap targets first operations in 2028 and establishes a clear path to industrial-scale profitability.

The Phased Expansion Plan

Phase 1: 3,200 tons per year (targeted operational start: 2028)

Phase 2: Expansion to 6,400 tons per year (projected 2029)

Phase 3: Full capacity goal of 12,800 tons per year (anticipated after 2030)

Solar Foods utilizes this multi-stage approach to secure incremental investments and long-term offtake agreements. Solar Foods has already signed letters of intent and memorandums of understanding covering up to 7,650 tons of annual capacity, representing about half of Factory 02’s eventual output. These early commitments are especially relevant to the company’s U.S. entry strategy, which focuses on the health and performance nutrition market.

Investment and Partner Strategy

Factory 02’s construction is projected to require several hundred million euros in total capital expenditures. To reduce financial exposure, Solar Foods plans to partner with companies managing energy supply, CO2 sourcing, and hydrogen infrastructure, creating a distributed investment model. This approach aligns with Finland’s growing ecosystem of clean industrial hydrogen projects.

The company expects to reach its final investment decision (FID) during 2026, following completion of the pre-engineering phase. That timing will depend on securing additional equity and debt financing as well as obtaining regulatory clarity in the European Union and the United States. If successful, the first phase of Factory 02 would represent one of the world’s largest carbon-to-protein production sites.

As Factory 02 moves forward, the learnings from Factory 01 will provide the operational backbone. Real-time analytics, gas-utilization efficiency, and reactor control data from the first facility will be integrated into the engineering model for Factory 02, ensuring that each phase builds on proven metrics rather than projections.

Factory 02 is not only Solar Foods’ growth catalyst but also a bellwether for the entire field of sustainable protein. If the company can demonstrate profitable scalability, it will signal a new era where air-derived nutrition competes directly with soy, whey, and pea proteins on both cost and carbon footprint.

(Credit: Intelligent Living)

(Credit: Intelligent Living)

Targeting North American Athletes: The US Market Entry Strategy for Solein

Solar Foods prioritized practicality and rapid adoption when designing its North American market entry strategy. Instead of immediately targeting mainstream grocery distribution, the company has chosen the health and performance nutrition sector, where consumers are accustomed to powdered supplements and high-protein formulations. This makes adoption faster and reduces regulatory friction because these categories already align with existing GRAS pathways.

The first products to feature Solein in the United States are Fermenta’s Gutsy protein bars and Pothos’ PRVL protein powders, both scheduled for Q1 2026. These products are marketed as animal-free, gluten-free, soy-free, and non-GMO.

This strategy targets athletes, vegetarians, and sustainability-conscious consumers. It taps into the broader functional food trend connecting protein intake and microbiome resilience through fermented nutrients and seaweed-based strategies for precision gut health, making this timing ideal for a clean-label innovation like Solein.

Building Consumer Trust: The Role of Performance Nutrition Partnerships

Solar Foods’ collaboration with performance nutrition brands also provides critical consumer education. Rather than selling Solein directly, the company uses co-branding and ingredient partnerships to build trust and recognition. This mirrors the strategy used by plant-based ingredient companies during their early market phases. Each successful launch adds data to validate Solein’s taste, solubility, and nutritional bioavailability in real consumer products.

If adoption in sports nutrition proves strong, Solar Foods could eventually expand into ready-to-drink shakes and meal replacement segments, where protein differentiation and sustainability credentials carry high value. These early successes will help determine how quickly the company can move from niche supplements to mainstream retail foods.

Culinary Validation: How Singapore Proved Air-Grown Protein Integrates into Real Food

Singapore provided the first full commercial validation for air-grown protein years ahead of the U.S. market debut. Since then, Solein has appeared in diverse foods, including ice cream, mooncakes, and Sichuan-style dishes served in Singapore’s restaurants, offering proof that the protein blends well with both sweet and savory applications.

Solar Foods avoided the niche appeal of fine dining, focusing instead on proving that air-grown ingredients integrate into everyday recipes without compromising flavor. In collaboration with local partners such as Ajinomoto and restaurant innovators like Atlr.72, Solar Foods demonstrated how the ingredient performs under real culinary conditions.

Singapore’s early adoption provides a case study for other regulators and manufacturers worldwide. By validating Solein’s production consistency and safety profile, the city-state effectively provided the blueprint for other markets pursuing novel food frameworks.

This milestone sits alongside other sustainable edible protein innovations made from plastic, captured CO2, and food waste that treat emissions and waste streams as future nutrition and mark some of the first tangible steps toward scaling alternative proteins derived entirely from industrial gases.

(Credit: Intelligent Living)

(Credit: Intelligent Living)

Global Compliance Pathways: Navigating FDA and EFSA Regulatory Reviews

The next major phase for Solar Foods lies in the regulatory domain. The company has already achieved self-affirmed GRAS status in the United States, confirming that Solein meets food safety standards recognized by qualified experts. In September 2025 Solar Foods submitted a formal GRAS notification on Solein to the FDA while projecting EU novel food approval around 2026, and it currently expects a “no questions” letter by the end of 2026, though that timing depends on FDA review speed and any requests for additional data.

European and UK Horizons: Pending Decisions on Novel Food Status

In Europe, the company submitted its dossier for EU Novel Food approval to the European Food Safety Authority (EFSA) and similar bodies in the United Kingdom. Both submissions are currently under review, with provisional decisions also anticipated by late 2026. While projections are optimistic, these approvals remain conditional. Under the Reality-Only Integrity Policy, all such outcomes must be treated as expectations rather than certainties until the official regulatory decisions are published.

Singapore remains the only jurisdiction where Solein is fully authorized for commercial use, making it the company’s most established testing ground. If U.S. and EU regulators follow suit, Solar Foods will gain access to two of the world’s largest nutrition markets, solidifying its global credibility.

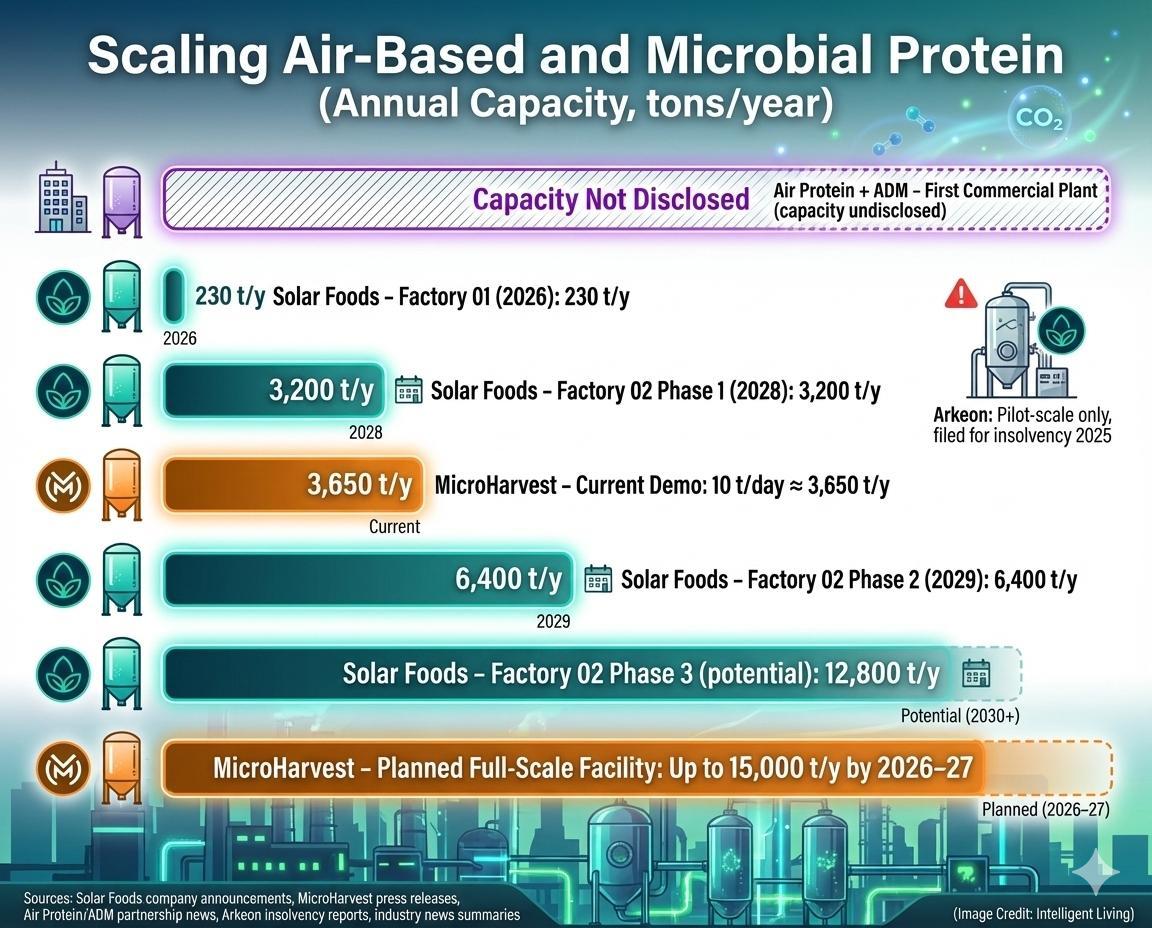

The Competitive Landscape: Evaluating the Global Air-to-Protein Sector

While Solar Foods has maintained steady progress, the wider gas-fermentation sector shows varying levels of commercial maturity:

These examples reveal both the promise and the pressure of scaling microbial protein, echoing work on renewable protein systems where microbes convert CO2 into food, and they show that success depends on efficiency, financing discipline, and transparent lifecycle assessments.

(Credit: Intelligent Living)

(Credit: Intelligent Living)

Future-Proofing Global Nutrition: Why 2026 Marks the Real Turning Point for Solein

Operational data from Factory 01 confirms that air-derived nutrition is ready for global distribution. Solar Foods has successfully bridged the gap between laboratory potential and industrial reality, setting a benchmark for bioreactor efficiency and gas fermentation safety. The upcoming investment decisions for Factory 02 will determine how quickly this technology can displace traditional protein sources in the mainstream market, moving beyond niche supplements into everyday grocery staples.

A carbon-to-protein economy represents a permanent shift toward circular manufacturing where emissions serve as a feedstock. Successful U.S. launches and ongoing European regulatory reviews provide the necessary credibility to rebuild food security through climate-smart agriculture and next-generation protein systems. Establishing alternatives to field-based agriculture provides a necessary safeguard for a global food system under intense environmental strain.

Deep Dive: Essential Facts About Air-Grown Protein and Solar Foods

1. Is Solein protein safe for human consumption?

Solein is fully authorized in Singapore and holds self-affirmed GRAS status in the United States, meeting rigorous safety standards for microbial fermentation.

2. When can US consumers purchase air-made protein products?

Fermenta’s Gutsy bars and Pothos’ PRVL powders are scheduled for a Q1 2026 debut, marking the first commercial availability in North America.

3. Why is microbial protein considered more sustainable than plant-based options?

Microbial systems require 95% less land than animal protein and significantly less water than soy or pea crops because they grow in closed bioreactors.

4. How does gas fermentation contribute to carbon capture?

The process uses captured CO2 as a primary feedstock for microbes, effectively recycling greenhouse gases into edible nutrients when powered by renewable energy.

5. What are the primary nutritional components of Solein powder?

Solein contains roughly 65–70% protein along with essential dietary fiber, healthy fats, iron, and a full spectrum of B vitamins.

6. Where can I learn more about the technology behind Solein?

The core technology combines carbon capture, gas fermentation, and renewable electricity to grow single-cell microbes into a protein-rich biomass, and an increasing number of scientific life cycle assessments now examine how these power-to-food systems compare with conventional crops and livestock.