Introduction: A New Standard for Infant Nutrition

The global Organic Baby Food Market is undergoing a transformative shift as modern parents increasingly demand clean, transparent, and sustainable nutrition for their children. Organic baby food—made without synthetic fertilizers, artificial preservatives, genetically modified organisms (GMOs), or chemical pesticides—has moved from a niche category to a mainstream necessity. Rising awareness of food safety, health outcomes, and environmental sustainability is reshaping consumer behavior worldwide.

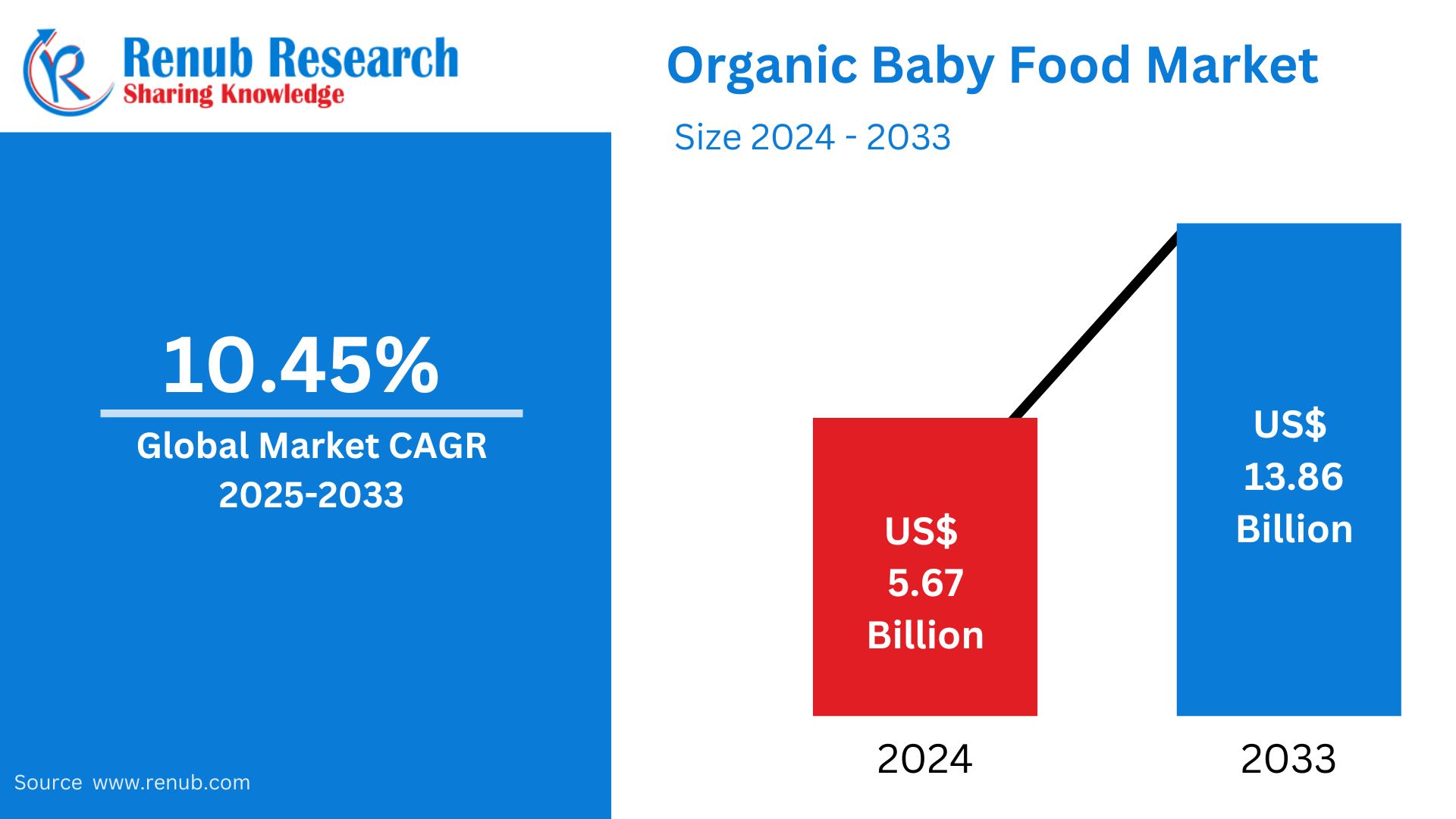

According to Renub Research, the Organic Baby Food industry is projected to grow from US$ 5.67 billion in 2024 to US$ 13.86 billion by 2033, registering a strong compound annual growth rate (CAGR) of 10.45% during 2025–2033. This impressive growth trajectory reflects a fundamental change in how families approach early-life nutrition.

Organic Baby Food Market Overview

The Organic Baby Food Market is witnessing sustained expansion as parents prioritize health, nutrition, and ecological responsibility in infant diets. Growing concerns over the adverse effects of chemical additives, pesticides, and synthetic preservatives have accelerated demand for clean-label, organic alternatives. Products made with natural ingredients, free from GMOs and artificial flavors, are increasingly perceived as safer and more beneficial for infants’ long-term development.

Beyond consumer awareness, the market is being supported by the rapid expansion of organized retail formats, specialty organic stores, and e-commerce platforms. Online availability has enhanced product accessibility, while premium baby food brands are strengthening visibility through targeted digital marketing. At the same time, manufacturers are introducing innovative solutions such as plant-based recipes, fortified formulations, allergen-free variants, and convenient packaging.

Government initiatives encouraging organic farming practices, alongside stricter food safety regulations, further reinforce market credibility. Together, these factors position organic baby food as a cornerstone of the future infant nutrition ecosystem.

Market Size & Forecast (Renub Research)

The Organic Baby Food Market is expected to expand lucratively from US$ 5.67 billion in 2024 to approximately US$ 13.86 billion by 2033, reflecting a CAGR of 10.45% from 2025 to 2033. This growth is being driven by rising birth rates in emerging economies, increased female workforce participation, greater disposable incomes, and a global cultural shift toward preventive healthcare through nutrition.

Historical Trends

Historically, baby food consumption was dominated by conventional packaged products emphasizing affordability and convenience. Over the last decade, however, a rising number of parents have begun questioning ingredient transparency, sourcing practices, and nutritional integrity. Organic baby food brands have responded by offering certified products that prioritize traceability, sustainability, and nutritional completeness.

The introduction of stricter labeling requirements in developed markets, coupled with heightened public discourse around food safety, accelerated the adoption of organic alternatives. What once served a niche audience of health-conscious consumers has now evolved into a global movement redefining infant nutrition standards.

Forecast Analysis

Looking ahead, the market is poised for rapid growth across both developed and developing regions. Asia-Pacific is emerging as a high-potential market due to increasing urbanization, expanding middle-class populations, and greater awareness of organic products. North America and Europe continue to lead in terms of per-capita spending, driven by premium product adoption and well-established certification frameworks.

Future growth will be shaped by innovation in plant-based formulations, functional nutrition (probiotics, omega-3s, iron fortification), and sustainable packaging. As parents become more discerning, companies that emphasize transparency, ethical sourcing, and nutritional science will gain competitive advantage.

Market Share Analysis – Organic Baby Food

The Organic Baby Food Market is moderately consolidated, with multinational food corporations competing alongside specialized organic brands. Large players benefit from global distribution networks and brand recognition, while niche companies leverage authenticity, ingredient transparency, and innovation. Strategic partnerships, acquisitions, and private-label expansion by retailers are intensifying competition.

List of Leading Companies in the Organic Baby Food Market

Abbott Laboratories (USA)

Kraft Heinz (USA)

Danone SA (France)

Kewpie Corporation (Japan)

Hero Group (Switzerland)

Nestlé S.A.

Arla Foods amba

AAK AB

The Hain Celestial Group, Inc.

HiPP GmbH & Co. KG

Bellamy’s Organic

Mead Johnson Nutrition

Sprout Organic Foods, Inc.

Baby Gourmet Foods, Inc.

Once Upon a Farm, LLC

Company Analysis – Abbott Laboratories

Overview

Abbott Laboratories is a diversified global healthcare company with a strong presence in nutrition products. Its infant and pediatric nutrition portfolio includes scientifically formulated, high-quality food products that cater to early childhood development.

Company History and Mission

Founded in 1888, Abbott’s mission centers on improving lives through science-based healthcare solutions. Over the decades, the company has expanded its nutritional offerings to support health at every life stage, including early childhood.

Business Model and Operations

Abbott integrates research, manufacturing, and global distribution to deliver nutrition products through hospitals, pharmacies, government agencies, and retail networks across multiple continents.

Workforce and Leadership

The company employs tens of thousands globally, supported by experienced executive leadership, regional operational management, and a well-structured board that emphasizes innovation, compliance, and sustainability.

Recent Developments & Strategies

Abbott continues investing in product innovation, fortification technologies, and digital health integration while strengthening partnerships with healthcare institutions and research organizations.

Sustainability Analysis

Abbott is expanding renewable energy adoption, optimizing energy-efficient infrastructure, and investing in sustainable packaging materials. Its water conservation programs and waste-reduction initiatives align with global environmental goals.

Product Analysis

Abbott’s organic and pediatric nutrition lines emphasize quality standards, rigorous safety testing, and nutritional benchmarking against international guidelines.

Strategic Assessment – SWOT

Strengths:

Strong scientific expertise, global distribution, trusted healthcare brand.

Weaknesses:

Higher production costs for organic sourcing and regulatory complexity.

Opportunities:

Rising demand for organic infant nutrition in emerging markets.

Threats:

Intense competition from niche organic brands and evolving regulations.

Revenue Analysis

Abbott reported US$ 42.0 billion in revenue in 2023, underscoring its financial strength to invest in product development and market expansion.

SWOT Analysis – The Hain Celestial Group, Inc.

Strength – Strong Portfolio of Natural and Organic Brands

Hain Celestial’s diverse portfolio across food, beverages, and personal care positions it as a leader in health-focused consumer goods. Brands such as Earth’s Best and Celestial Seasonings resonate strongly with health-conscious parents seeking clean-label, non-GMO products. Strategic innovation, ethical sourcing, and wide retail distribution enhance its competitive advantage.

Opportunity – Expansion Through Strategic Acquisitions and Global Market Penetration

The company can accelerate growth through acquisitions of complementary organic brands and deeper penetration into Asia-Pacific and Latin American markets. Localized product development and digital retail partnerships offer strong pathways to sustained international expansion.

SWOT Analysis – Arla Foods amba

Strength – Strong Cooperative Structure and Global Brand Portfolio

Arla’s cooperative model ensures stable milk supplies, consistent quality, and strong farmer engagement. Its globally recognized brands strengthen market reach, while integrated supply chains enhance efficiency and sustainability.

Opportunity – Growing Demand for Sustainable and Plant-Based Dairy Alternatives

With increasing interest in environmentally responsible nutrition, Arla can leverage its innovation capabilities to expand into plant-based infant products and low-carbon dairy alternatives.

SWOT Analysis – AAK AB

Strength – Expertise in Specialty Fats and Customized Solutions

AAK’s leadership in specialty vegetable fats enables it to develop customized, clean-label formulations for infant food manufacturers. Its global production network and R&D capabilities reinforce long-term customer loyalty.

Opportunity – Expansion in Plant-Based and Sustainable Food Markets

The growing plant-based food movement creates opportunities for AAK to supply functional fat ingredients to next-generation organic baby food formulations.

Latest News and Developments

October 2024: Babylife Organics launched the first Regenerative Organic Certified® baby food, emphasizing soil regeneration and sustainable farming practices.

October 2024: Nestlé India announced the expansion of its Cerelac line with “no refined sugar” variants, increasing its organic product range to 21 varieties.

September 2024: Happy Family Organics introduced USDA- and EU-approved organic baby formulas with patented probiotic blends to promote gut health.

September 2024: Bobbie expanded its USDA Organic-certified infant formulas across Whole Foods Market locations in the U.S., reinforcing demand for premium organic nutrition.

Market Share Analysis – Competitive Landscape

Major multinational corporations continue to dominate in scale, while boutique organic brands differentiate through innovation, ingredient purity, and ethical sourcing. Retailers’ private labels and subscription-based delivery models are reshaping how parents access organic baby food. Mergers, partnerships, and investments in R&D remain central strategies for sustaining market leadership.

Outlook: Innovation, Sustainability, and Consumer Trust

The future of the Organic Baby Food Market lies in aligning nutritional science with sustainability and transparency. Companies that integrate regenerative agriculture, biodegradable packaging, and functional nutrition will outperform competitors. As consumer trust becomes increasingly tied to brand values, ethical practices will be as important as product quality.

Final Thoughts

The Organic Baby Food Market is no longer a niche segment—it is a rapidly expanding global industry reshaping how societies think about early-life nutrition. With the market expected to grow from US$ 5.67 billion in 2024 to US$ 13.86 billion by 2033 at a CAGR of 10.45%, the opportunities for innovation, sustainability, and strategic expansion are immense.

As parents worldwide demand cleaner labels, safer ingredients, and environmentally responsible products, companies that prioritize transparency, science-backed nutrition, and ethical sourcing will define the next generation of infant food. The market’s evolution reflects a broader societal commitment: investing in healthier beginnings for children and a more sustainable future for the planet.