Aflac Incorporated recently announced it has been named a Workday Wellness partner for supplemental health solutions, allowing its products and services to integrate with Workday’s AI-powered benefits platform to help employers improve offerings and streamline administration.

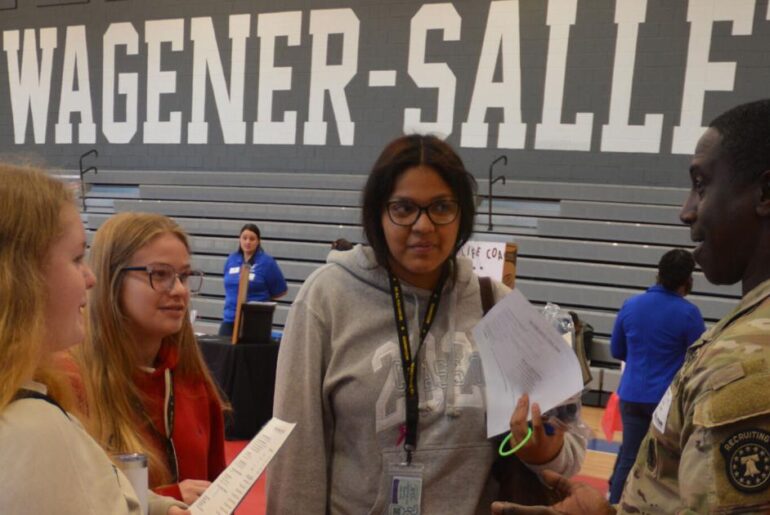

This collaboration directly targets a key pain point highlighted in Aflac’s 2025–2026 Workforces Report, where many employees said they lack sufficient information and understanding about their benefits, potentially leading to underuse of available coverage.

We’ll now examine how integrating Aflac’s supplemental health solutions into Workday’s AI-driven platform could influence the company’s investment narrative.

We’ve found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

To own Aflac, you need to believe in its role as a core supplemental health insurer in Japan and the U.S., with enough product innovation and cost discipline to offset sluggish premium trends and currency exposure. The new Workday Wellness partnership may support near term U.S. growth and efficiency efforts, but it does not fundamentally change the key catalyst of revitalizing earned premium growth or the major risk of pressure on Japanese premiums and margins.

Among recent announcements, the Workday Wellness engagement itself is most relevant here, because it aligns with Aflac’s broader push into digital, AI enabled distribution and administration. If this integration helps employers and employees better understand and use supplemental benefits, it could reinforce Aflac’s wider digital initiatives that aim to improve efficiency and support more resilient U.S. sales over time.

Yet behind this promising technology tie up, investors should also be aware that…

Read the full narrative on Aflac (it’s free!)

Aflac’s narrative projects $18.5 billion revenue and $3.8 billion earnings by 2028. This requires 5.1% yearly revenue growth and a $1.4 billion earnings increase from $2.4 billion today.

Uncover how Aflac’s forecasts yield a $111.31 fair value, in line with its current price.

AFL Earnings & Revenue Growth as at Jan 2026

Four members of the Simply Wall St Community currently see Aflac’s fair value between US$98.64 and US$168.61, underlining how far apart individual views can be. When you set those opinions against pressures like declining net premiums in Japan, it becomes clear why looking at several competing narratives about Aflac’s future is essential before you decide how this stock fits into your portfolio.

Explore 4 other fair value estimates on Aflac – why the stock might be worth 10% less than the current price!

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

A great starting point for your Aflac research is our analysis highlighting 2 key rewards that could impact your investment decision.

Our free Aflac research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Aflac’s overall financial health at a glance.

Our daily scans reveal stocks with breakout potential. Don’t miss this chance:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AFL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com