Peloton Interactive (PTON 5.37%) provides a valuable case study of the wild distortions the COVID-19 pandemic caused in the business world. With people spending more time at home, this company benefited from the perfect tailwind to boost sales of its at-home fitness equipment. As the economy normalized, though, Peloton struggled to navigate a new reality.

The market has lost confidence. The consumer discretionary stock trades an alarming 96% below its peak (as of Jan. 12). Is Peloton a high-risk turnaround or long-term fitness opportunity?

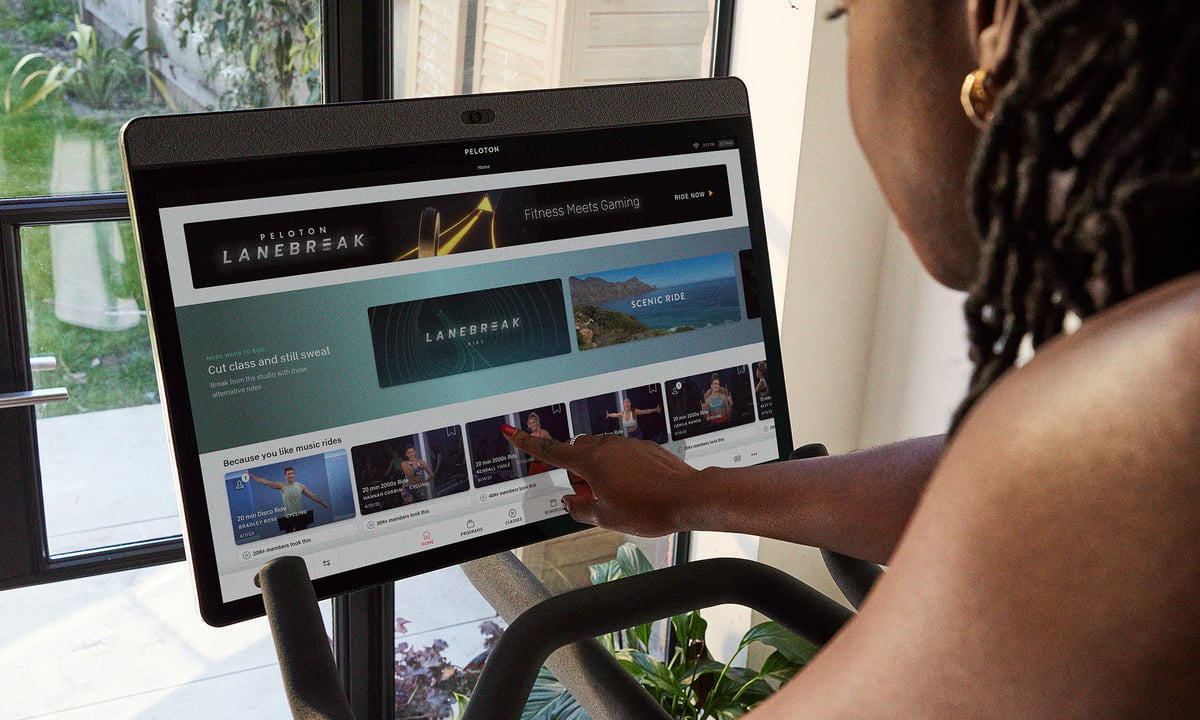

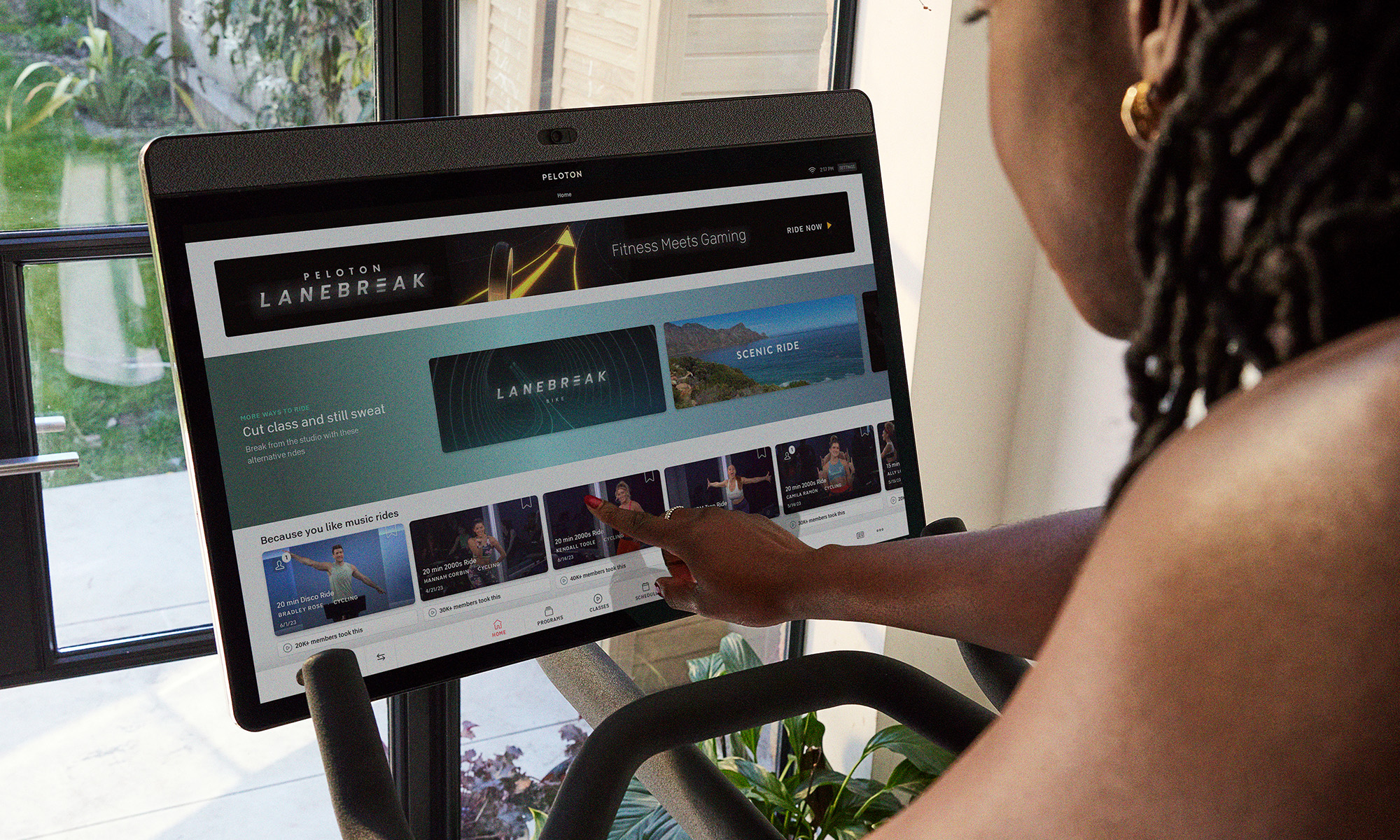

Image source: Peloton.

Cost cuts can only get you so far

Peloton deserves credit for getting its finances in order. It started with Barry McCarthy, who was the CEO from 2022 to 2024. The current CEO, Peter Stern, has continued the right-sizing focus.

During the last two fiscal quarters (Q4 2025 and Q1 2026), Peloton reported positive GAAP net income. This was pleasant news for longtime followers of the company. That’s because Peloton has a history of registering sizable net losses.

Peloton posted a negative gross margin on the sale of its hardware products in fiscal 2022 and fiscal 2023. This part of the business has returned to gross profitability. And it helps that 72% of revenue now comes from high-margin subscriptions.

Operational efficiencies have been driven by workforce reductions, shrinking the physical retail footprint, and cutting product development outlays. But these cost reductions, aimed at achieving $100 million in savings this fiscal year, can only go so far. Eventually, Peloton needs to get back to growth.

This is where it struggles mightily. Connected-fitness subscribers totaled 2.7 million as of Sept. 30, down 6% year over year. And analysts project revenue to decline 0.5% between fiscal 2025 and fiscal 2026.

Today’s Change

(-5.37%) $-0.36

Current Price

$6.34

Key Data Points

Market Cap

$2.6B

Day’s Range

$6.29 – $6.69

52wk Range

$4.63 – $10.25

Volume

304K

Avg Vol

9.4M

Gross Margin

49.14%

Fitness is a risky business

The stock is certainly cheap, as shares trade at a price-to-sales ratio of 1.1 that’s near historically low levels. Some market participants might view Peloton as a long-term opportunity in the fitness industry.

I take a different view. Peloton is a high-risk turnaround story. While the stock could provide short bursts of positive gains, it’s not a smart long-term opportunity. That’s the right perspective to have until subscriber gains resume, if they ever do.

Fitness is a difficult market to find lasting success in. Companies are banking on people to stick to their workout plans. But these consumers always seem to be drawn to the shiny new thing. And in Peloton’s case, it faces immense competition with its subscription apps, as there are unlimited free workout videos and content online. The target market for households that want to spend four-figure sums on exercise equipment is also limited.

Investors are better off avoiding this stock.