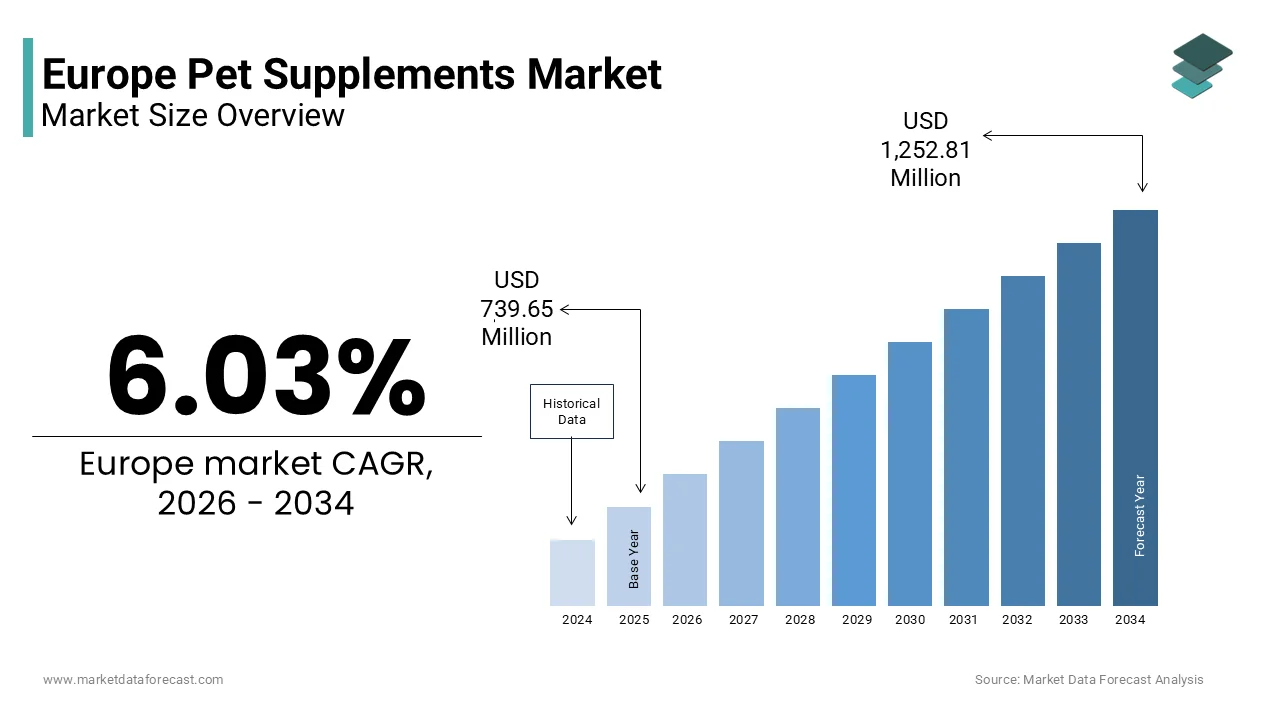

Europe Pet Supplements Market Size

The Europe pet supplements market size was valued at USD 739.65 million in 2025 and is projected to reach USD 1,252.81 million by 2034 from USD 784.25 million in 2026, growing at a CAGR of 6.03%.

Pet supplements are products, available in various forms like chews, powders, or liquids, that are added to a pet’s diet to provide additional nutrients or target specific health conditions beyond what their regular food offers. Unlike veterinary medicinal products, these supplements are regulated as feed additives under Regulation (EC) No 1831/2003 and must demonstrate safety and efficacy without making disease treatment claims. The sector has evolved from basic multivitamins to science backed nutraceuticals featuring ingredients like omega-3 fatty acids, glucosamine, probiotics, and CBD isolates tailored to life-stage and breed-specific needs. According to research, pet ownership in European households has seen significant growth, with dogs and cats firmly established as the most popular companions across the continent. As per sources, a significant number of European practitioners are incorporating evidence-based supplements into preventative health plans for dogs and cats, driven by a growing focus on long-term wellness. This shift reflects a broader humanization trend where pets are increasingly viewed as family members deserving of personalized wellness regimens, which transforms supplements from optional add-ons into integral components of responsible pet ownership across urban and rural communities alike.

MARKET DRIVERS Rising Humanization of Pets and Preventive Care Mindset

The deepening emotional bond between Europeans and their companion animals has catalyzed demand for premium health solutions that mirror human wellness practices and drives the growth of the Europe pet supplements market. According to research, a notable share of pet owners in the EU consider their pets as family members, with a portion willing to invest in advanced nutrition to extend their pets’ healthy lifespan. This sentiment translates into proactive health management, where supplements are used not just to address deficiencies but to prevent age-related decline. Many dog owners are proactively administering mobility supplements to pets early in life, often before visible symptoms appear. Veterinary consultations increasingly involve recommendations for nutraceuticals, highlighting a shift towards preventive care. The adoption of pet insurance encourages early intervention strategies designed to manage long-term health. This trend suggests a growing focus on preventative measures to support joint health in pets. The increasing emphasis on nutrition in veterinary training is erasing the line between medical care and daily supplementation, cementing these products as fundamental to routine pet wellness.

Growing Geriatric Pet Population and Age-Related Health Needs

The region’s aging pet demographic is a powerful structural driver of supplement consumption, particularly for mobility, cognitive, and renal support formulations, which propels the expansion of the Europe pet supplements market. A significant portion of the companion animal population is classified as senior, with this demographic expected to increase as veterinary care advances. Age-related joint issues are prevalent in older canine populations, resulting in the widespread use of nutritional supplements for management. Cognitive dysfunction is observed in senior feline populations, driving interest in supplements aimed at supporting brain health. The aging pet population is changing demand patterns for specialized supplements addressing age-related health conditions. These conditions rarely require pharmaceutical intervention in early stages but respond well to nutritional modulation, making supplements the preferred first-line approach. The aging of Europe’s population has normalized a care-oriented culture within households, where the long-term well-being of both elderly residents and their pets is anticipated and prioritized.

MARKET RESTRAINTS Fragmented Regulatory Framework Across Member States

The approval and labeling of pet supplements remain inconsistently interpreted across national authorities, which creates compliance complexity for manufacturers, and thereby restrains the growth of the Europe pet supplements market. National authorities within the European Union frequently implement varying restrictions on specific animal feed ingredients, such as botanical products and high-dose vitamins, that differ from broader community guidelines. Some member states impose specialized pre-market authorization processes for compound supplements, which can result in extended timelines for product introduction. National regulations regarding hemp-derived ingredients in animal nutrition are inconsistent, with some countries placing complete bans on these products while others allow them. This patchwork of regulations creates disparities in product availability for different categories of feed additives across the European market. This regulatory patchwork forces companies to develop multiple product variants, increasing R&D and packaging. The absence of harmonized health claim guidelines, unlike the EFSA-approved claims for human foods, further limits marketing clarity, leaving consumers confused about efficacy and deterring mainstream retail adoption.

Limited Scientific Validation and Consumer Skepticism

Lack of robust clinical evidence fuels skepticism among veterinarians and informed consumers, which hinders the expansion of the Europe pet supplements market. A recent evaluation of top-selling European joint supplements revealed that a substantial majority lack solid, peer-reviewed evidence proving their absorption or actual effectiveness in the target animal, making it difficult for consumers to identify truly beneficial products. Many products rely on extrapolated human data or in vitro models that do not reflect real-world pet physiology. This evidence gap has prompted caution from professional bodies. The British Small Animal Veterinary Association recommends that veterinarians advise clients to select pet supplements that have been validated by independent, third-party quality assurance programs to ensure product safety and effectiveness. Consequently, trust remains concentrated among a narrow set of science-backed brands, while the broader market struggles with perceptions of being “wellness theater.” Category growth is constrained by lagging consumer confidence, which stems from a lack of mandatory efficacy disclosures and standardized testing, despite high pet ownership rates.

MARKET OPPORTUNITIES Integration of Precision Nutrition Through Genetic and Microbiome Testing

Emerging biotechnologies are enabling personalized pet supplement regimens based on DNA and gut microbiome analysis, which opens doors for new opportunities in the Europe pet supplements market. Companies like Basepaws and Embark now offer at home test kits that analyze genetic predispositions to joint disorders allergies and metabolic conditions, generating tailored supplement recommendations. Research indicates that tailored probiotic blends, which consider gut flora, can lead to more significant improvements in digestive health compared to conventional, standard formulations. In the UK, the startup Nutriscan partners with veterinary clinics to provide metabolomic profiling that guides omega-3 and antioxidant dosing. As genomic literacy rises among pet owners, mirroring trends in human health, demand for bespoke solutions is accelerating. Increased funding and institutional support for research into specialized diets for pets suggest a growing focus on personalized nutrition within the animal health industry. This convergence of diagnostics and nutraceuticals positions Europe to lead in data driven pet wellness, moving beyond one size fits all products toward truly individualized care.

Expansion of Sustainable and Clean Label Formulations

European consumers’ strong preference for natural and eco conscious products is driving innovation in clean label, traceable, and low impact pet supplements, which provides fresh prospects for the Europe pet supplements market. Consumers in European markets are increasingly seeking pet products characterized by transparent ingredient sourcing and minimal processing. The industry is shifting toward alternative ingredients, including marine-based omega-3s derived from algae and amino acids from insect proteins. Packaging solutions are evolving to incorporate sustainable materials, such as those derived from sugarcane bioplastics. Pet supplement brands are reformulating products to remove synthetic preservatives and adopting renewable energy sources for manufacturing processes. Carbon neutrality is becoming a focal point for new product ranges, with emissions managed through initiatives like reforestation. Upcoming regulatory frameworks in Europe are expected to require environmental footprint disclosures, favoring companies already prioritising sustainability. Pet supplement brands can foster loyalty among environmentally aware pet guardians by aligning with Europe’s circular ethos, ensuring that ethics are as compelling as efficacy.

MARKET CHALLENGES Supply Chain Volatility for Key Bioactive Ingredients

Recurring disruptions in the availability and pricing of critical raw materials such as krill oil, green-lipped mussel extract, and specialized probiotic strains due to geopolitical and ecological pressures, which challenge the growth of the Europe pet supplements market. The strict, precautionary management of Antarctic krill harvesting by the Commission for the Conservation of Antarctic Marine Living Resources has created supply limitations amid high demand, contributing to rising prices for krill oil, as noted in discussions surrounding industry sustainability. Similarly, Environmental factors, such as droughts and unusual weather patterns, have caused, at times, significant volatility in the harvest volumes of New Zealand green-lipped mussels, as tracked by the Ministry for Primary Industries, impacting supply stability for this high-demand product. These shortages force formulators to seek alternatives that may lack equivalent clinical backing, risking product consistency and consumer trust. Moreover, stringent European Union regulatory requirements for novel foods and feed, including extensive evaluations by EFSA, often result in extended, multi-year timelines for approving new, sustainable alternatives such as algae-derived DHA. European supplement manufacturers remain exposed to external shocks that jeopardize both product affordability and formulation integrity, highlighting the urgent need for diversified and resilient supply networks.

Veterinary Gatekeeping and Channel Fragmentation

The path to purchase for pet supplements in the region remains heavily influenced by veterinary professionals who control access to high trust recommendations, yet operate within a fragmented retail landscape, which poses a major obstacle for the growth of the Europe pet supplements market. Veterinary professionals frequently favor direct dispensing of supplements within their practices to oversee product quality and monitor patient progress. A notable difference exists between the preference for clinic-based distribution and the growing consumer tendency to purchase supplements through online and specialty retail channels. Regulatory environments in certain regions, such as pharmacy-only mandates, can limit the availability of specific supplement products. Distribution patterns vary by location, with independent retailers holding a significant, yet sometimes technically restricted, role in specific markets. This disconnect between expert endorsement and consumer convenience slows category adoption and enables misinformation from unvetted online sellers. A lack of coordinated education and uniform standards threatens to polarize the market into high-quality, inaccessible options and unproven, widely available alternatives.

REPORT COVERAGE

REPORT METRIC

DETAILS

Market Size Available

2025 to 2034

Base Year

2025

Forecast Period

2026 to 2034

CAGR

6.03%

Segments Covered

By Functional Application, Supplement Type, Pet Type, Form, Distribution Channel, and Region

Various Analyses Covered

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities

Regions Covered

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and the Czech Republic

Market Leaders Profiled

Virbac, Royal Canin, VetPlus, NutraPet Labs, Dechra Veterinary Products, Hill’s Pet Nutrition, Animonda, Pet Naturals of Vermont, Forthglade, and Hill’s Science Diet

SEGMENTAL ANALYSIS By Functional Application Insights

The hips & joints segment held the largest share of 34.7% of the Europe pet supplements market in 2025. The dominance of the hips & joints segment is driven by the high prevalence of osteoarthritis and mobility disorders among aging companion animals, particularly large breed dogs. Radiographic signs of joint degeneration are commonly observed in older dogs. A notable portion of senior dogs experiencing these structural changes also demonstrate physical symptoms. Veterinary consultations for aging dogs frequently include discussions regarding joint support. Addressing joint health is a common aspect of care for geriatric dogs. The widespread use of glucosamine chondroitin and omega-3 fatty acids, backed by decades of clinical research, has normalized daily supplementation as a standard preventive measure. Additionally, rising pet insurance coverage across Northern Europe incentivizes early intervention, as insurers such as Agria and Petplan reimburse supplement costs when prescribed for diagnosed conditions. This convergence of epidemiological need, veterinary endorsement, and financial support solidifies Hips & Joints as the cornerstone of Europe’s functional pet supplement landscape.

The digestive health segment is expected to exhibit a noteworthy CAGR of 11.6% between 2026 and 2034 due to increasing awareness of the gut microbiome’s role in overall pet wellness and the rise of diet-related gastrointestinal sensitivities linked to processed pet foods. Many dogs living in urban environments often experience persistent gastrointestinal problems, such as irregular stool or digestive discomfort, which can be triggered by stress or consuming unsuitable food items. Veterinary practitioners are showing a greater preference for recommending probiotic products that contain a variety of bacterial strains and have verified, tested levels of active cultures. Research indicates that specific combinations of beneficial bacteria, including Lactobacillus and Bifidobacterium, can help decrease the frequency of digestive issues in dogs over an extended period. Industry groups have introduced certification programs for microbiome-focused supplements, which aim to increase consumer confidence in product quality. Greater access to genomic and metabolomic tools is boosting demand for customized gut health, fueling regional innovation.

By Supplement Type Insights

The glucosamine segment led the Europe pet supplements market by capturing a 38.6% share in 2025. The leading position of the glucosamine segment is attributed to its entrenched status as the gold standard ingredient for managing osteoarthritis and supporting cartilage integrity in dogs and cats. Veterinary mobility protocols across the EU frequently incorporate glucosamine-based formulations due to their recognized safety profile and synergistic effects with other compounds. Daily administration of glucosamine for older dogs is a common practice among pet owners, often initiated during routine wellness check-ups. The ingredient’s regulatory acceptance under EU feed additive regulations, specifically as a nutritional supplement rather than a medicinal claim, enables broad retail availability without prescription restrictions. Moreover, long term clinical studies have reinforced efficacy perceptions, making glucosamine the default choice for both veterinarians and informed consumers seeking reliable joint support.

The antioxidants segment is predicted to witness the highest CAGR of 12.3% over the forecasts period owing to growing scientific understanding of oxidative stress as a contributor to cognitive decline cancer risk and skin aging in companion animals. Ingredients such as astaxanthin resveratrol and vitamin E are increasingly incorporated into premium formulations targeting senior pets and breeds predisposed to inflammatory conditions. Observations indicate that certain dietary antioxidant blends may be linked to improved cognitive performance in dogs during testing. Research suggests a rise in the purchase of antioxidant supplements for pets, potentially driven by increased owner awareness regarding environmental factors and long-term health. Regulatory trends show a faster approval process for plant-derived antioxidants in pet food, which supports a shift toward cleaner label ingredients. Reflecting the trend toward proactive senior pet health in Europe, antioxidants have become vital elements in comprehensive, holistic pet care regimens.

COMPETITIVE LANDSCAPE

Competition in the Europe pet supplements market is intensifying between established animal health corporations, specialized nutraceutical brands, and agile startups offering natural or personalized solutions. Large players like Virbac and Elanco leverage veterinary relationships and regulatory expertise to dominate clinical channels, while brands such as AniForte and Phytopet capture retail and e commerce segments through sustainability claims and transparent labeling. Differentiation hinges on scientific credibility, ingredient traceability, and alignment with regional consumer values particularly in Northern Europe where demand for organic and carbon neutral products is strongest. Regulatory fragmentation across member states creates barriers but also opportunities for localized innovation. As pet humanization deepens, competition is shifting from price to perceived health impact, with companies investing in diagnostics, digital platforms, and third party certifications to build trust. The market rewards those who balance veterinary legitimacy with consumer accessibility in an increasingly discerning and ethically conscious landscape.

KEY MARKET PLAYERS

Some of the notable key players in the European pet supplements market are

Virbac Royal Canin VetPlus NutraPet Labs Dechra Veterinary Products Hill’s Pet Nutrition Animonda Pet Naturals of Vermont Forthglade Hill’s Science Diet Top Players in the Market Virbac is a French multinational animal health company with a strong footprint in the European pet supplements market through its premium nutraceutical brands such as Flexadin and Easotic. The company integrates veterinary science with nutritional innovation to develop evidence based formulations for joint, skin, and digestive health. It also expanded its digital platform offering veterinarians personalized supplement protocols based on pet age breed and medical history. These initiatives reinforce Virbac’s position as a trusted partner in preventive care and strengthen its influence across both clinical and retail channels in Europe and beyond. Bayer Animal Health, now operating under Elanco following its acquisition, remains a key player in the Europe pet supplements sector through its well established brand Seresto and complementary wellness lines. The company leverages its extensive veterinary distribution network to deliver science backed supplements focused on immune support and dermatological health. It also enhanced traceability by implementing blockchain enabled batch tracking across its European supply chain. These actions underscore its commitment to transparency efficacy and integration within professional pet care ecosystems. AniForte is a German based leader in natural and organic pet supplements with a rapidly growing presence across Western and Central Europe. The company specializes in clean label formulations using ingredients like hemp seed oil insect protein and herbal extracts compliant with EU organic feed standards. It also partnered with independent veterinary clinics to offer microbiome testing kits bundled with personalized supplement plans. These efforts position AniForte at the forefront of the sustainable and precision nutrition movement reshaping consumer expectations in the European pet wellness landscape. Top Strategies Used by the Key Market Participants

Key players in the Europe pet supplements market prioritize scientific validation by conducting clinical trials and publishing peer reviewed studies to build trust among veterinarians and informed consumers. They invest in clean label and sustainable sourcing by replacing synthetic additives with natural alternatives and adopting eco friendly packaging aligned with EU green directives. Companies increasingly integrate digital tools such as pet health apps and microbiome diagnostics to enable personalized supplementation and enhance customer engagement. Strategic partnerships with veterinary clinics and pet insurance providers facilitate professional endorsement and reimbursement pathways. Additionally they pursue vertical integration by controlling ingredient sourcing and manufacturing to ensure quality consistency and regulatory compliance under EU feed additive regulations thereby differentiating through reliability and transparency.

Europe Pet Supplements Market News In March 2024, Virbac launched a microalgae derived omega-3 supplement for dogs and cats in France to enhance sustainability and strengthen its position in the Europe pet supplements market. In November 2023, Elanco introduced a clinically validated probiotic chew developed with the University of Leipzig to support canine digestive health and reinforce its scientific leadership in the Europe pet supplements market. In September 2023, AniForte rolled out a carbon neutral supplement line certified by TÜV Rheinland featuring fully recyclable packaging to meet eco conscious demand in the Europe pet supplements market. In February 2024, Virbac enhanced its digital veterinary platform to deliver personalized supplement protocols based on pet health data thereby deepening professional engagement in the Europe pet supplements market. In December 2023, AniForte partnered with independent veterinary clinics across Germany to offer bundled microbiome testing and tailored supplement plans expanding its precision nutrition footprint in the Europe pet supplements market. MARKET SEGMENTATION

This research report on the European pet supplements market has been segmented and sub-segmented based on categories.

By Functional Application

Skin and Coat Hips and Joints Digestive Health Immune Support Weight Management Oral and Dental Health Calming, Anxiety and Stress Relief

By Supplement Type

Multivitamins Probiotics and Prebiotics Antioxidants Protein and Peptides Glucosamine Omega 3 Fatty Acids Other Supplement Types

By Pet Type

Dogs Cats Horses Fish and Aquatic Pets

By Form

Capsules and Tablets Chewable Powders Liquids Other Forms

By Distribution Channel

Online Offline Supermarkets and Hypermarkets Pet Specialty Stores Other Offline Channels

By Country

UK France Spain Germany Italy Russia Sweden Denmark Switzerland Netherlands Turkey Czech Republic Rest of Europe