The coming year will be a test like no other for smaller growth-stage companies, attendees of webinars on Wednesday were told.

Webinars by the Naturally Network and the Natural Products Association (NPA) painted a picture of a 2026 characterized by wrenching change and uncertainty. Small brand holders were advised to look to their regulatory and funding fences with an aim to stay afloat in troubled waters.

Cara Welch, Ph.D., was the headline speaker on the NPA webinar. Welch, who is the head of the Office of Dietary Supplement Programs (ODSP) at the Food and Drug Administration gave listeners an overview of FDA’s priorities for the coming year.

Product listing pushed to back burner

Surprisingly, Welch told listeners that FDA would not push ahead with a requirement for premarket listing notification, something the agency has advocated for in the past with the support of some groups in the industry (but not NPA, which has consistently opposed the move).

Welch didn’t say FDA changed its mind on the desirability of the change, but rather implied that it appears to be a bridge too far politically speaking.

“We are really focused on what we can get done within our own abilities,” she said.

Welch also said the upcoming change in which the self-affirmed GRAS (generally recognized as safe) notification pathway to market will come off the books will mean FDA has to handle more new dietary ingredient notifications (NDINs). She said the agency had been getting 30 to 40 of these a year, but that number had risen to 70 in the past year, with more certainly to come.

Welch said the agency is working to implement AI (artificial intelligence) tools into its workflow to increase throughput to make meeting that increased demand feasible.

Israelsen: ‘Free electron’ politics are hard to predict

The Naturally Network webinar focused on the outlook for the broader supplement and natural foods markets for the coming year. Loren Israelsen, president of the United Natural Products Alliance (UNPA), was tasked with giving an overview of the regulatory landscape. He said the job of political prognosticators has never been more difficult.

“I think the most unsettling aspect is the ‘free electron’ nature of our political system. I really have never seen it like this,” said Israelsen, who spoke from his experience that included time on the staff of the late U.S. Sen. Orrin Hatch.

The most impactful part of the chaotic nature of politics under President Donald Trump’s administration has been the rapidly changing tariff picture. Israelsen said that Trump at first seemed to be harkening back more than a century to the Gilded Age during the administration of President William McKinley, when tariffs were the main funding tool of the federal government.

But that quickly changed to tariffs becoming a bargaining chip over perceived trade inequalities. Israelsen said the levels were set based on how the Trump administration viewed the barriers to trade in each respective country.

“He does not believe in the WTO (World Trade Organization) or unified tariffs,” Israelsen said.

New era of punitive tariffs

But that changed again to the present situation.

“Then tariffs became a weapon,” Israelsen said. “That is the uncertainty that destroys business confidence.”

Heather K. Terry, webinar host and founder of the food brand GoodSAM, asked the panel how companies can build-in resiliency to combat this uncertainty.

Another speaker, Jennifer Barney, a former company founder and now an investor at the Angel Group, said it’s going to take more funding to build-up the necessary inventory cushions.

“Have a conversation with your investors about the need to ‘forward buy’ an ingredient from a potentially tariff-impacted country,” she advised the audience.

Market trends

The webinar kicked off with a market overview hosted by Scott Dicker of SPINS; with the input of Annalea Krebs, founder and CEO of Social Nature; and Gabriela Reyes, manager of Fresh Growth Solutions at KeHE Distributors.

Dicker noted that input costs are accruing to the point that significant price hikes may be inevitable in 2026. This will hit smaller companies harder, as big firms with more SKUs can spread cost increases over many different products if the cost of a few ingredients might spike.

As for ingredients themselves, he predicted that protein and fiber will remain trending categories.

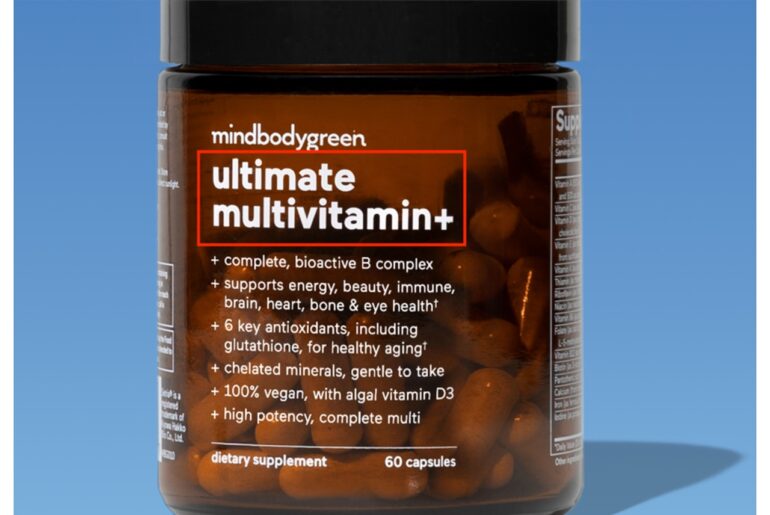

Among individual ingredients, Dicker singled out sea moss, shilajit, saffron, acetyl l-carnitine, colostrum and NMN (nicotinamide mononucleotide) for major growth spurts.

When looking at the conditions and/or product types that are trending among consumers, Dicker predicted that mood support, hangover remedies, liver support, healthy aging and GLP-1 (glucagon-like peptide) would all see upticks in 2026. Meanwhile, weight loss, cleanse/detox, cold & flu, joint health and respiratory health would see declines.