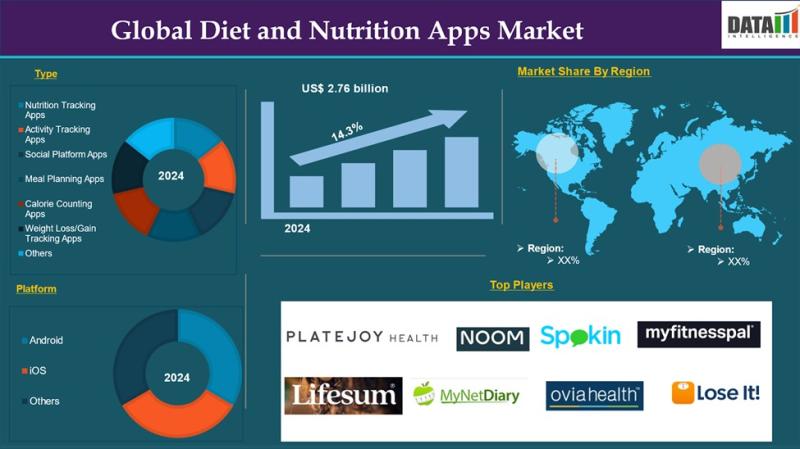

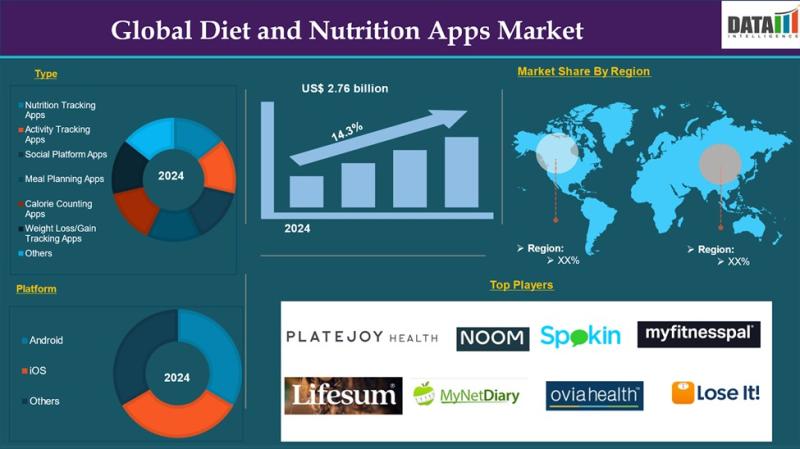

Diet and Nutrition Apps Market

The Diet and Nutrition Apps market reached US$ 2.76 billion in 2024 and is expected to reach US$ 9.58 billion by 2033, growing at a CAGR of 14.3% during the forecast period 2025-2033. Market growth is fueled by rising health awareness, increasing smartphone penetration, and growing adoption of digital tools for weight management, fitness tracking, and preventive healthcare. Consumers are increasingly relying on mobile apps for calorie tracking, meal planning, nutrition monitoring, and goal-based health management.

Strong momentum is coming from the rising demand for personalized nutrition and lifestyle management, supported by advanced features such as AI-driven recommendations, habit tracking, and data integration with wearables. These apps are gaining popularity among users focused on fitness, chronic disease prevention, and overall wellness. North America holds the largest market share due to high digital health adoption and strong consumer spending on wellness solutions, while Asia-Pacific is the fastest-growing region, driven by expanding mobile usage, increasing health consciousness, and rapid growth of digital health platforms.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/diet-and-nutrition-apps-market?sai-v

The Diet and Nutrition Apps market refers to the sector of mobile and digital applications that help users track, manage, and improve dietary habits and nutritional intake.

Key Developments

✅ January 2026: In North America, adoption of diet and nutrition apps surged among health-conscious consumers, with platforms such as MyFitnessPal (Under Armour), Noom, Lose It!, and Cronometer expanding AI-enabled personalized meal planning, real-time nutrient tracking, and integration with wearable devices to improve user engagement and long-term adherence.

✅ January 2026: In Europe, demand for localized nutrition guidance and culturally tailored meal planning tools increased, with Lifesum, Yazio, Foodvisor, and Rise Science enhancing multilingual support, GDPR-compliant data privacy features, and integration with regional food databases.

✅ December 2025: In Asia-Pacific, rising smartphone penetration and interest in wellness propelled growth of apps like HealthifyMe, EatRight (local brands), Calomeal, and Kabu (Japan), offering calorie counting, diet coaching, and AI-driven nutrition insights adapted to local diets and languages.

✅ December 2025: Globally, the integration of AI and machine learning into diet and nutrition platforms advanced personalized recommendations, predictive pattern analysis, and behavioral coaching, with Google Fit, Apple Health, Samsung Health, and Fitbit App enabling cross-platform data sharing and contextual wellness insights.

✅ November 2025: In Latin America, localized offerings from Mi Nutrición, FitPal, Vida Saludable, and NutriCoach expanded to meet demand for Spanish- and Portuguese-friendly interfaces, community challenges, and dietitian-supported programs tied to chronic disease prevention.

✅ October 2025: Worldwide, interest in holistic health and integrative nutrition led to increased app features linking diet tracking with stress management, sleep quality, and metabolic health, with partnerships forming between apps and telehealth providers to support comprehensive wellness journeys.

Mergers & Acquisitions

✅ January 2026: Noom, Inc. acquired NutriAI Labs, an AI-powered personalized nutrition and meal-optimization platform, to enhance its behavioral coaching and recommendation engine capabilities and deepen personalization across its diet programs.

✅ December 2025: Under Armour (MyFitnessPal) acquired MacroCoach Solutions, a macro-tracking and diet plan customization startup, to strengthen its nutritional analytics features and improve user dietary goal achievement.

✅ November 2025: HealthifyMe acquired CaloriePro Tech, a nutrition data and food recognition technology provider, to expand its AI-driven food logging accuracy and localized dietary insights for the Asia-Pacific market.

Key Players

Lifesum AB | MyNetDiary Inc. | PlateJoy LLC | Noom, Inc. | SPOKIN, Inc. | Ovia Health | MyFitnessPal, Inc. | FitNow, Inc. | Cronometer | YAZIO | FatSecret | WW International, Inc. | Others

Key Highlights

MyFitnessPal, Inc. holds 26% market share, driven by its massive global user base, comprehensive calorie and nutrient database, strong brand recognition, and integration with multiple fitness platforms and wearables.

Noom, Inc. accounts for 18% market share, supported by its psychology-based behavior change model, personalized coaching approach, and strong traction in weight management programs.

WW International, Inc. represents 15% market share, leveraging its long-standing leadership in weight management, digital transformation of its programs, and loyal subscriber base.

Lifesum AB holds 10% market share, driven by its clean user interface, personalized diet plans, and strong adoption across European markets.

FatSecret captures 8% market share, supported by its freemium model, global food database, and strong engagement in community-driven diet tracking.

Cronometer accounts for 7% market share, benefiting from its high-accuracy nutrient tracking, micronutrient-focused analytics, and popularity among health-conscious and clinical users.

YAZIO represents 6% market share, driven by its strong presence in Europe, intuitive meal planning tools, and growing premium subscriptions.

FitNow, Inc. holds 4% market share, supported by its long-standing calorie tracking platform and simple, goal-oriented user experience.

MyNetDiary Inc., PlateJoy LLC, SPOKIN, Inc., and Ovia Health together account for 4% market share, focusing on niche nutrition planning, food sensitivity management, and maternal health nutrition solutions.

Other players collectively hold 2% market share, comprising emerging health-tech startups and regional diet and nutrition application providers.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=diet-and-nutrition-apps-market?sai-v

(Single User Report: USD 4350 & One Year Database Subscription: USD 12K)

Market Drivers

Growing health and wellness awareness among consumers driving demand for diet and nutrition apps to support healthier eating habits, weight management, and lifestyle improvement.

Increasing smartphone penetration, mobile internet access, and digital health adoption enabling widespread use of diet tracking and nutrition management applications.

Rising prevalence of lifestyle-related conditions such as obesity, diabetes, and cardiovascular diseases prompting users to monitor food intake and nutritional metrics.

Integration of personalized nutrition, AI-based recommendations, and real-time tracking features enhancing user engagement and diet optimization.

Expansion of wearable devices and health ecosystems (e.g., fitness trackers, smart scales) supporting seamless data synchronization with diet and nutrition apps.

Industry Developments

Incorporation of AI and machine learning for personalized meal planning, nutrient suggestions, and automated food recognition.

Integration with wearable health devices and continuous glucose monitors (CGMs) to provide comprehensive insights on diet-health correlations.

Partnerships between app developers, nutritionists, dietitians, and healthcare providers to offer expert-guided content and premium subscription services.

Enhanced social sharing, gamification, and community features to boost user engagement and long-term adherence.

Introduction of localized content, culturally relevant meal plans, and multilingual support to expand usage across diverse populations.

Regional Insights

North America – 38% share: “Driven by high digital health adoption, widespread smartphone usage, strong fitness and wellness culture, and integration of diet apps with health ecosystems.”

Europe – 27% share: “Supported by growing health consciousness, regulatory support for digital health innovation, and increasing use of nutrition apps for preventive care.”

Asia Pacific – 26% share: “Fueled by rapid mobile penetration, rising health awareness, expanding middle-class population, and increasing adoption of digital health solutions.”

Latin America – 6% share: “Driven by rising interest in health and fitness, expanding smartphone usage, and growing availability of diet and nutrition apps.”

Middle East & Africa – 3% share: “Supported by increasing health awareness, improving digital infrastructure, and gradual adoption of wellness applications.”

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/diet-and-nutrition-apps-market?sai-v

Key Segments

By Type

Weight management apps dominate the market, driven by rising obesity rates and strong consumer focus on fitness and lifestyle improvement. Calorie counting and meal planning apps also hold a significant share, supported by growing awareness of portion control and balanced diets. Specialized apps for disease-specific nutrition and personalized diet recommendations are gaining traction as users seek tailored health solutions.

By Service

Subscription-based services account for a major share, offering premium features such as personalized plans, analytics, and coaching. Free services remain widely used, particularly among first-time users, while freemium models are growing as app providers balance user acquisition with monetization.

By Platform

Android leads the platform segment due to its large global user base and affordability across regions. iOS holds a strong share, supported by higher engagement levels and adoption among premium users. Cross-platform solutions are increasingly adopted to ensure seamless user experience across devices.

By Device

Smartphones represent the dominant device segment, driven by convenience and constant accessibility. Wearables are a fast-growing segment, supported by integration with smartwatches and fitness trackers for real-time health monitoring. Tablets and other devices contribute steadily, mainly in home and wellness settings.

By Age

Adults account for the largest share, driven by lifestyle management, fitness goals, and chronic disease prevention. The youth segment is growing rapidly with increased digital engagement and health awareness. Senior users are gradually adopting diet and nutrition apps, supported by simplified interfaces and features focused on chronic condition management.

By End-User

Individual consumers represent the largest end-user segment, supported by rising health consciousness and smartphone penetration. Healthcare providers are increasingly using these apps to support patient engagement and dietary monitoring. Fitness centers and other end-users are adopting nutrition apps to complement training programs and wellness services.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us –

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us –

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.