Some stocks are best avoided. We really hate to see fellow investors lose their hard-earned money. Anyone who held Petco Health and Wellness Company, Inc. (NASDAQ:WOOF) for five years would be nursing their metaphorical wounds since the share price dropped 90% in that time. Shareholders have had an even rougher run lately, with the share price down 14% in the last 90 days. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don’t have to lose the lesson.

Since Petco Health and Wellness Company has shed US$62m from its value in the past 7 days, let’s see if the longer term decline has been driven by the business’ economics.

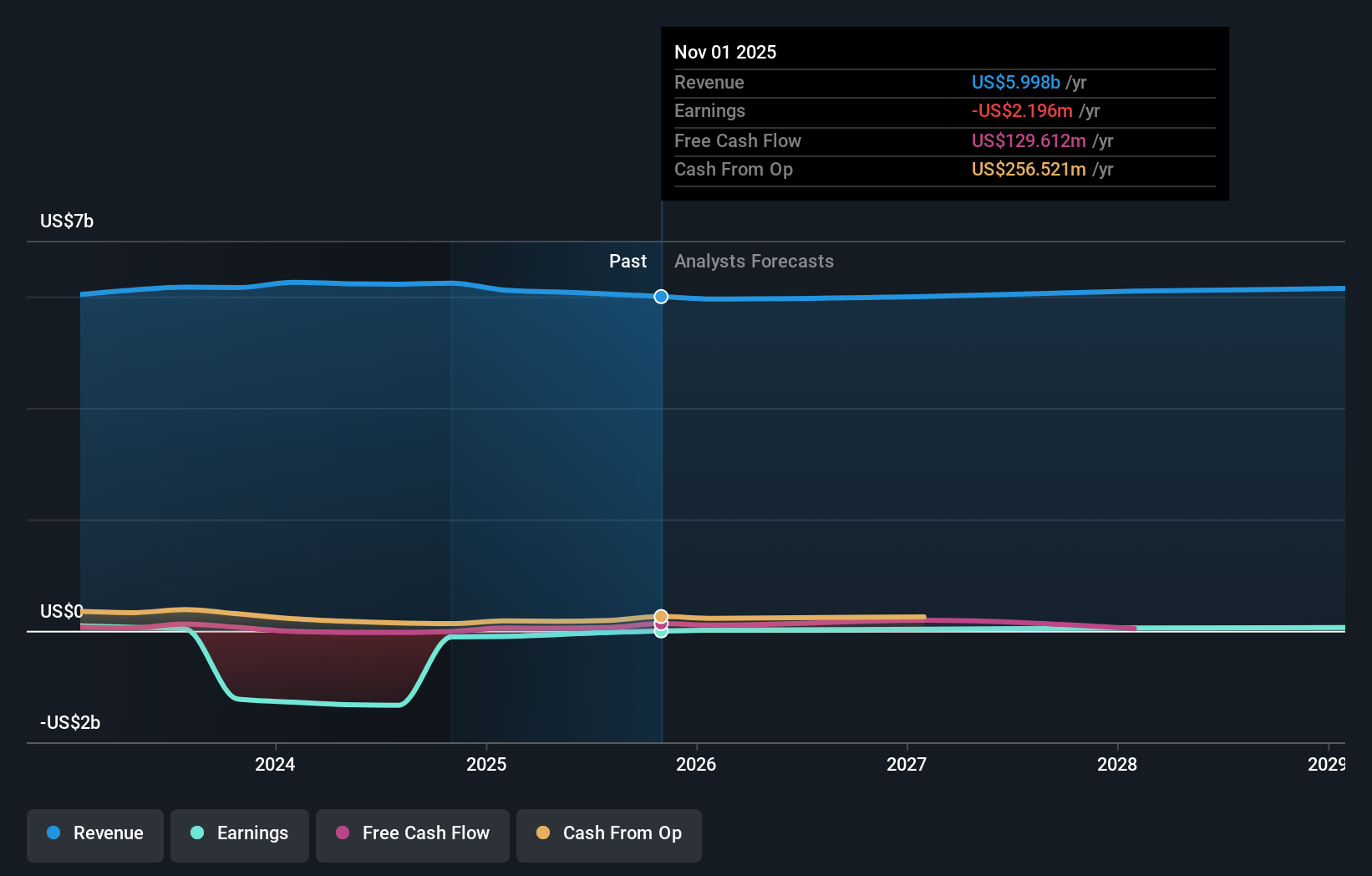

Given that Petco Health and Wellness Company didn’t make a profit in the last twelve months, we’ll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That’s because it’s hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over five years, Petco Health and Wellness Company grew its revenue at 3.8% per year. That’s far from impressive given all the money it is losing. It’s not so sure that share price crash of 14% per year is completely deserved, but the market is doubtless disappointed. We’d be pretty cautious about this one, although the sell-off may be too severe. We’d recommend focussing any further research on the likelihood of profitability in the foreseeable future, given the muted revenue growth.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

NasdaqGS:WOOF Earnings and Revenue Growth February 2nd 2026

NasdaqGS:WOOF Earnings and Revenue Growth February 2nd 2026

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free report showing analyst forecasts should help you form a view on Petco Health and Wellness Company

A Different Perspective

Investors in Petco Health and Wellness Company had a tough year, with a total loss of 18%, against a market gain of about 15%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 14% doled out over the last five years. We’d need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It’s always interesting to track share price performance over the longer term. But to understand Petco Health and Wellness Company better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we’ve spotted with Petco Health and Wellness Company .

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.