J-Beauty brands are positioned among major Western and K-Beauty brands, especially as the global popularity of K-pop continues to rise. Yet many people may not realize that many of the active ingredients used by these global brands actually originate with Japanese OEM manufacturers. Given this context, how do you view the current success and position of J-Beauty?

I believe the strength of J-Beauty lies in its philosophy. Its essence is about expressing one’s natural, inherent beauty rather than transforming oneself. To achieve that, Japanese brands place absolute priority on quality and safety—ensuring the skin is never burdened unnecessarily.

Our approach to active ingredients is also distinctive. We rely heavily on naturally derived components and on materials whose efficacy has been proven through decades of research. We continually refine our technology to ensure these ingredients are delivered effectively to the skin and remain stable within formulations.

Another key aspect of J-Beauty is the emphasis on how products are used. Proper use and ritual are part of the experience. True beauty care involves carefully cleansing, preparing, and nourishing the skin step by step—not simply washing and applying a cream. We believe that educating consumers on correct usage is essential because J-Beauty is not just about products; it’s a holistic approach to skincare.

In summary, J-Beauty is about nurturing the skin carefully and consistently to bring out its natural radiance. That careful, mindful approach is what lies at its heart.

In Kao’s cosmetics business, our vision is to create a portfolio of distinctive brands through the fusion of scientifically proven evidence and sensorial beauty that appeals to the five senses.

Japan has seen a dramatic increase in inbound visitors. It is projected that around 40 million visitors will arrive this year, with 60 million expected by 2030. As the President of Kao’s Cosmetics Business, how do you view this growing inbound and the business opportunities it presents?

Inbound tourism represents a truly valuable opportunity for us. When people visit Japan, they are not just traveling—they are immersing themselves in culture, experiences, and emotions. If, during that journey, they encounter our products and associate them with a positive, memorable moment, that impression becomes deeply personal.

I believe the most meaningful outcome of inbound engagement is when visitors connect our brands to the joy and memories of their trip. That emotional association turns into long-term brand loyalty, even after they return home. For that reason, we see inbound travelers not simply as short-term customers but as future global advocates who carry the image of Kao with them.

In particular, the product that caught our attention was the MOLTON BROWN range, and how it is frequently used in luxury hotels, which may serve as the first touchpoint between Kao and such international visitors. How do you plan to use this product as a gateway to your other offerings and build that long-term connection with your customers?

Our focus is on creating meaningful encounters through our brand experiences rather than just offering points of sale. MOLTON BROWN, for example, plays a key role in this strategy. Hotels are naturally major touchpoints, but we are also expanding into resorts and golf destinations where travelers can experience the brand in a relaxed, refined environment.

For instance, in Karuizawa, guests can encounter Molton Brown across golf clubs, hotels, and outlet malls—allowing them to enjoy the brand throughout their stay. Across Asia, we are introducing MOLTON BROWN primarily in luxury resorts and high-end hotels that reflect the brand’s philosophy.

These encounters create powerful emotional connections. When travelers return home, many continue their relationship with the brand via e-commerce or local retail partners. In this way, our focus is not on selling, but on building experiences that leave a lasting impression.

Turning to Kao’s global business model—under your K-27 strategy, cosmetics have been identified as a key driver of corporate growth. I understand you’ve categorized six major brands into three origin models: Japan-origin, Europe-origin, and Asia-origin. Could you explain the background and reasoning behind this model and how it supports your international expansion?

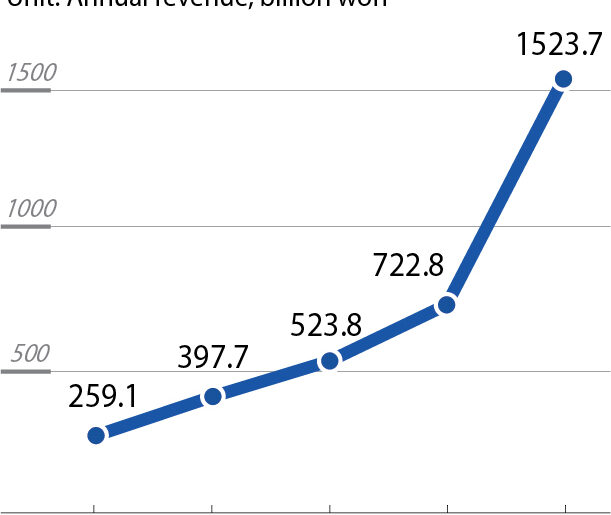

The cosmetics business is one of the key pillars supporting Kao Group’s global growth. To achieve this, we have been concentrating our investments and activities on six uniquely positioned brands in the global market —SENSAI, MOLTON BROWN, KANEBO, KATE, SOFINA, and Curél—and are now beginning to see tangible results.

In order to further expand these achievements and accelerate our global growth, we are strategically advancing the development of these six brands through three origin models.

We developed this three-origin framework because each brand has different strengths and competitive advantages. Naturally, their “winning zones” vary by region.

By considering regional characteristics, we aim to achieve leadership in each market by deploying the right brand, in the right category and price range, through the right channels.

From the perspective of Kao’s “Global Sharp Top” strategy, expanding every brand globally at once would be impractical. Instead, our strategy is to build success stories step by step—developing strong case examples before scaling them across other brands.

Each brand, therefore, begins its global journey in a specific region that best fits its DNA.

Our first stage of globalization is to establish success stories in markets where we can best leverage our strengths. Once that is achieved, we steadily assess economic and market conditions to determine the next stage of expansion.

Could you tell us more about the specific strategies behind each of the three origin models?

Certainly. The first, the Japan-Origin Model, is represented by Curél. Curél is Japan’s No.1 derma care brand, trusted by consumers and supported by more than 25 years of ceramide research and over 40 years of studies on dry and sensitive skin.

In Europe—where the proportion of people who identify as having dry and sensitive skin reaches around 40%, comparable to Japan’s 44% and significantly higher than 17% in Asia—we are accelerating new market launches to expand Curél’s presence.

The second is the Europe-Origin Model, represented by SENSAI and MOLTON BROWN.

In addition to the British-born MOLTON BROWN, SENSAI is a rare example of a Japanese company successfully cultivating a European luxury brand. Both brands are being operated under a borderless, integrated management approach, treating Asia as a single high-growth market and expanding the brand equity built up in Europe to new regions.

The third is the Asia Model, which focuses on leveraging values established in Japan and adapting them to the unique characteristics of each country and region.

For instance, in the Asian region, KANEBO and KATE are the first brands taking on this challenge. In particular, we are focusing on Thailand, where the number of inbound tourists continues to rise thanks to its cultural affinity with Japan and the similarity in national temperament.

Backed by Thailand’s strong economic growth and rising cosmetics consumption, we aim to establish a successful business model there—one that can serve as a blueprint for future expansion across other Southeast Asian markets.

Their goal is to establish clear examples of success. Once those are proven, other Kao brands can follow the same path.

We’ll then expand horizontally—adapting strategies across markets. After completing this second phase, I believe new, emerging countries will begin to rise. These developing markets—where we have yet to enter—may form our third phase of expansion. We’ll continue observing them carefully to identify the right moment for entry.

Curel has been performing particularly well in Europe. Could you elaborate on how the brand is being positioned there, and what you see as its unique competitive edge?

Curel’s most distinctive strength is its proprietary ceramide technology. Unlike natural ceramides, which are difficult to formulate because they tend to crystallize and separate, our in-house developed ceramide functions as an active ingredient and integrates smoothly into products.

There are two major benefits. First, it allows stable formulation. Second, it’s cost-effective, enabling us to use higher concentrations—leading to stronger efficacy. This combination gives Curel a clear advantage over competitors.

Moreover, the scientific credibility of our ceramide technology strengthens trust—not only among consumers but also within the medical community. Many dermatologists actively recommend Curel products. We place strong emphasis on maintaining robust scientific evidence to ensure Curel remains a brand that consumers can rely on with complete confidence.

In a previous interview, you mentioned that regional and ethnic differences affect skin condition—for instance, Chinese consumers tend to experience redness from dryness, while Western consumers often struggle with flakiness or roughness. How does Kao research and address these diverse needs across markets?

Our foundation is always scientific research-based in Japan. We build our formulations upon this fundamental baseline, which applies to human skin in general. From there, we adapt only when specific regional challenges—such as redness or severe dryness—demand localized solutions.

In short, we develop globally applicable formulas rooted in Japanese expertise and fine-tune them as needed. This ensures both scientific integrity and relevance to local consumers.

Given your professional background in R&D, how has that shaped your leadership and business philosophy as President of Kao’s Cosmetics Business?

My experience in research and development is one of my greatest assets. During my time in Kao’s R&D division, I worked on everything from basic research to applied product development—spanning household items like laundry detergents to haircare products. This gave me a broad view of Kao’s technological capabilities.

Because of that, I have a clear picture of what our internal resources can achieve and how far innovation can go. That perspective is a real strength when making business decisions.

In R&D, we constantly compared our products against competitors’. That experience helped me grasp both our strengths and our areas for improvement. Understanding how and where Kao can outperform others—technically and emotionally—now shapes our business strategy.

I believe that effective management means maintaining a constant awareness of the technological advantages that underpin our success.

Demographically, Japan’s population is shrinking while surrounding Asian countries are growing rapidly. This is particularly true among younger generations with increasing disposable incomes. What strategies are you using to connect with such younger consumers in Asia?

Young consumers live in the digital world. They discover brands through social media, influencers, and online communities. That’s why our communication strategy emphasizes digital engagement.

We actively collaborate with Key Opinion Leaders (KOLs) who resonate with younger audiences and represent their values. Creating campaigns that reflect their aesthetics and aspirations is key. In Asia, staying culturally relevant to younger generations is essential for sustained growth.

Kao has been strengthening its omnichannel strategy, connecting online and offline experiences. How are you integrating in-store experiences with digital engagement to create a seamless customer journey?

Our starting point is always experience. We want consumers to engage with our products in person—through consultations at counters or beauty advisors—before transitioning to digital channels for repurchase or ongoing care.

We do this by creating unified membership IDs that link in-store consultations with online purchases. For example, a customer’s skin analysis or product recommendations from a consultation are recorded and synced with their online account. This allows us to make tailored suggestions later through our e-commerce platforms.

Because Kao is a company with a comprehensive range of products beyond cosmetics, leveraging these connected data sources, we can offer more personalized product recommendations and deepen engagement through Kao’s broader membership ecosystem. Ultimately, our goal is to enrich people’s lives through meaningful connections between digital convenience and real-world experience.

Kao is known for its active use of AI in areas such as skin analysis. How are these digital tools enhancing engagement with consumers?

Face-to-face interaction remains fundamental. The experience of being personally advised by a beauty consultant cannot be replaced. However, AI helps us elevate that experience.

For instance, in department stores and large retail chains, customers can now experience AI-based skin diagnostics. This allows them to understand their skin condition more precisely and track changes over time.

Our vision is for consumers to enjoy revisiting our counters periodically, observing how their skin evolves, and adjusting their care accordingly. As these AI tools become more sophisticated, we aim to provide fresh insights and personalized guidance at every visit.

Kao has been very active internationally, with brands like MOLTON BROWN partnering with luxury hotels. Are you seeking further partnerships—perhaps with distributors, technology partners, or production collaborators—to support future expansion?

Yes, partnerships are extremely important, particularly distribution partnerships. When entering a new country, the local distributor is our most crucial partner.

We start with small-scale test launches in collaboration with reliable distributors, building up successful cases step by step and gradually expanding our presence. Through these hands-on collaborations, we not only reach new customers but also gain valuable insights into local preferences and business dynamics. Strengthening these partnerships will remain a major focus going forward. Our fundamental approach is to prioritize sustainable growth based on trust over short-term expansion.

Kao is a diversified company with many product categories beyond cosmetics. Are you exploring any cross-category collaborations or new initiatives that could create synergy between cosmetics and other areas of the Kao Group?

That’s a fascinating idea—and one we find very inspiring. While I can’t yet share concrete plans, I’m personally very interested in cross-category collaboration.

In cosmetics, we often focus on the face, but true confidence comes from the harmony of the whole self—appearance, health, and lifestyle. Apparel, wellness, and bodycare all contribute to how people feel about themselves. So yes, I believe partnerships that extend beyond cosmetics into broader aspects of daily life hold great potential.

Finally, as you take on your role as President, what is your vision for your tenure? How do you envision leading the division in the years ahead?

My foremost priority is to maintain a broad, forward-looking perspective. I want to manage our organization with a broad perspective—looking beyond our immediate business to the wider world around us. Collaboration across divisions is key; by connecting different parts of Kao, we can discover new possibilities and create innovations that might not emerge within a single department.

I’m also deeply committed to inclusivity. Beauty should empower everyone, not just those who fit within mainstream trends. For example, cosmetics can help people overcome personal insecurities and express their individuality.

While maintaining a broad, forward-looking perspective as a business leader, I aim to exercise leadership based on the belief that no one should be left behind. Through our products and innovations, I want to help ensure that everyone can live with confidence, express their individuality, and feel beautiful in their own way.

For more information, please visit their site: https://www.kao.com/global/en/