e.l.f. Beauty (NYSE:ELF) reported 38% net sales growth in its third quarter and raised its full year outlook. The company advanced integration of Rhode and Naturium while pushing those brands into new international markets. It launched its first fragrance line with H&M and prepared a Super Bowl campaign centered on cultural inclusion, featuring Melissa McCarthy and a partnership with Duolingo.

At a share price of $84.63, e.l.f. Beauty comes into this news with a mixed return profile, including a 10.1% gain over the past 30 days and an 8.8% gain year to date, alongside a 3.1% decline over the past year. Over a longer horizon, the stock has returned 18.2% over three years and 267.0% over five years, which provides context for how the latest quarter fits into the broader story.

For investors tracking NYSE:ELF, the combination of Q3 sales growth, brand integration progress and high visibility marketing around the Super Bowl indicates a busy period ahead. The focus on cultural inclusion and global reach may influence how the market evaluates the company’s growth prospects and brand strength as new data and campaigns roll out.

Stay updated on the most important news stories for e.l.f. Beauty by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on e.l.f. Beauty.

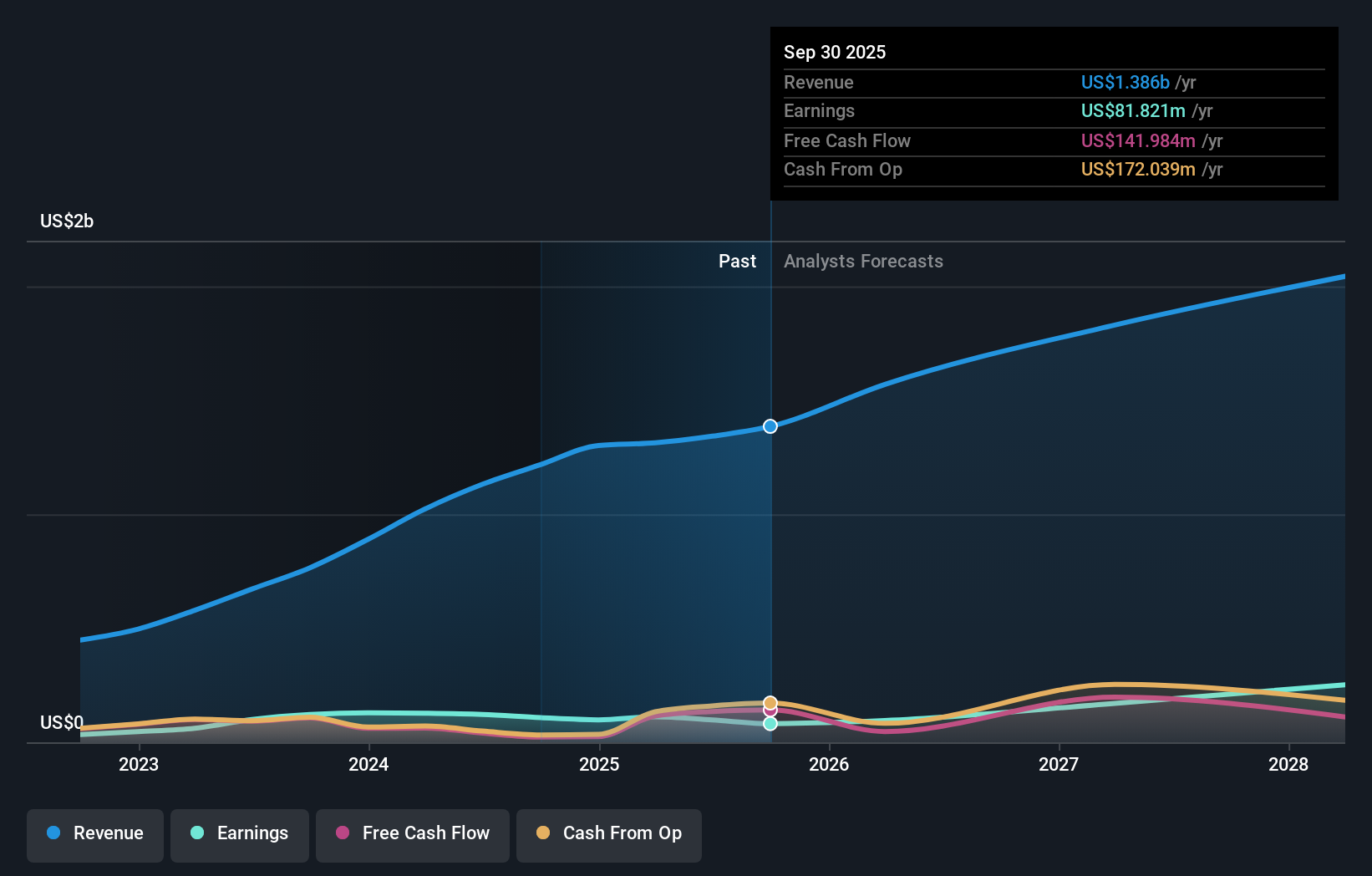

NYSE:ELF Earnings & Revenue Growth as at Feb 2026

NYSE:ELF Earnings & Revenue Growth as at Feb 2026

How e.l.f. Beauty stacks up against its biggest competitors

e.l.f. Beauty’s Q3 update ties together several threads that matter for investors: strong reported sales of US$489.51m versus US$355.32m a year earlier, higher quarterly net income, and raised fiscal 2026 net sales guidance to US$1.60b to US$1.61b. The integration of Rhode and Naturium, alongside a bigger push into international channels and a Super Bowl campaign focused on cultural inclusion, indicates that the company is using acquisitions and brand-building to compete more directly with players like L’Oréal, Estée Lauder, and Coty across price points and regions.

How this fits the e.l.f. Beauty narrative investors have been watching

This news aligns with the existing narrative that centers on market share gains, global expansion, and the use of digital and influencer-led marketing. Rhode’s contribution and new shelf space at retailers such as Walmart and Dollar General reflect a playbook of pairing affordable, trend-led products with broad distribution. The Super Bowl telenovela-style campaign and Duolingo tie up also reinforce the focus on inclusivity and community-led branding that many investors already associate with e.l.f.

Risks and rewards investors should keep in mind 🎁 Raised fiscal 2026 net sales guidance to an expected 22% to 23% growth range indicates management confidence in the combined e.l.f., Rhode, and Naturium portfolio. 🎁 Q3 net income of US$39.38m versus US$17.26m a year earlier, and higher adjusted EBITDA, show that scale from acquisitions and international expansion can support profitability. ⚠️ For the nine months, net income of US$75.68m versus US$83.84m a year earlier, and lower EPS, point to cost pressures and integration spending that could limit earnings even with strong top line growth. ⚠️ Analysts have noted tariff exposure, higher SG&A, and competitive pressure from global beauty groups as key risks that could affect margins if growth from Rhode, Naturium, and new markets does not keep pace. What to watch next

From here, it is worth watching whether the raised revenue outlook translates into sustained improvement in full year earnings, and how international growth, especially in Europe and new markets, tracks against management’s ambitions and competitors like L’Oréal and Estée Lauder. It may also be useful to monitor how marketing-heavy initiatives such as the Super Bowl and fragrance collaboration with H&M feed into underlying demand and whether margin trends change as integration costs for Rhode and Naturium evolve. If you want to see how different investors are framing this story, check out community narratives on e.l.f. Beauty’s dedicated page.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com