Rising demand for immunity, gut health, and performance nutrition is reshaping the global colostrum market across supplements, infant nutrition, and clinical use.

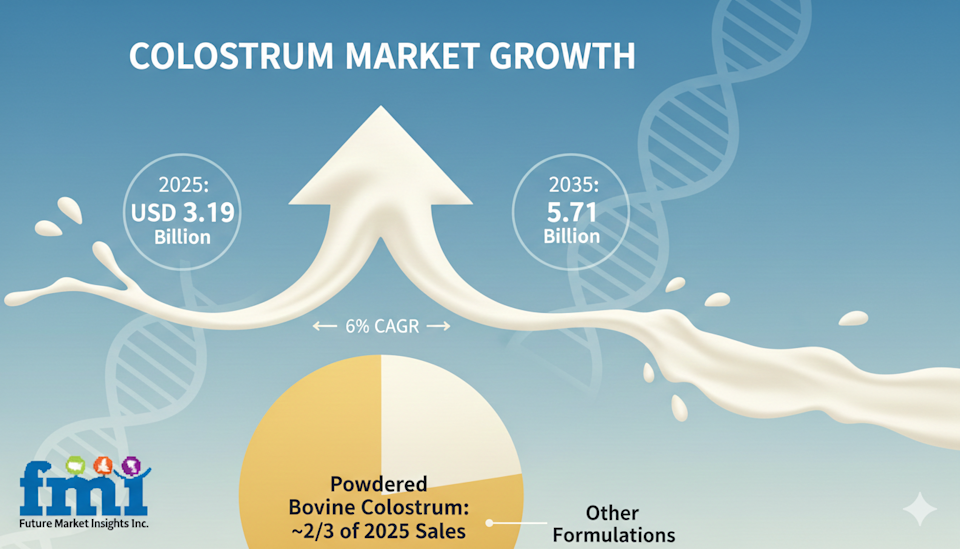

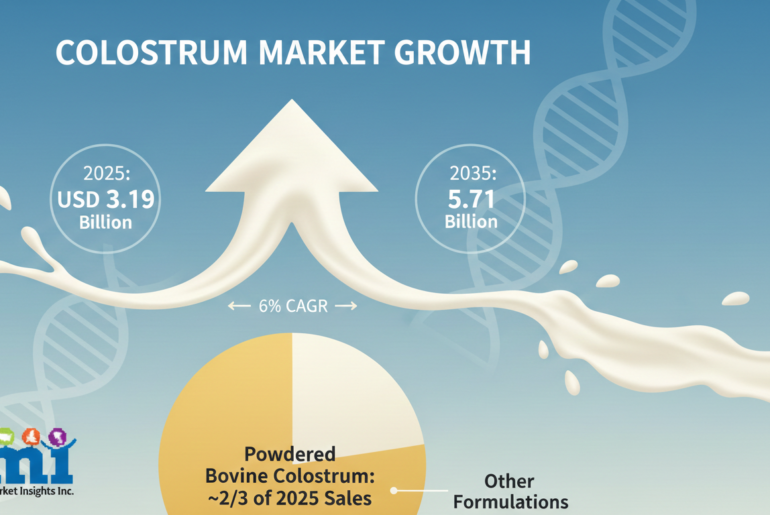

NEWARK, DELAWARE / ACCESS Newswire / February 9, 2026 / The global colostrum market is entering a decisive growth phase, driven by expanding applications in sports nutrition, immunity support, infant formula, and emerging medical nutrition. Sales of colostrum are valued at USD 3.19 billion in 2025 and are projected to reach USD 5.71 billion by 2035, advancing at a 6.0% CAGR over the forecast period. This growth reflects a broader consumer pivot toward bioactive, naturally sourced ingredients with clinically supported benefits.

Powdered bovine colostrum continues to anchor the category, accounting for nearly two-thirds of 2025 sales, owing to its stability, scalability, and ability to preserve immunoglobulins, lactoferrin, and growth factors. Its dominance highlights how formulation efficiency and functional integrity remain central to buyer decisions across nutraceutical and infant-nutrition supply chains.

Performance Nutrition Fuels Category Acceleration

Colostrum’s fastest gains are being recorded in performance and sports nutrition, where immune resilience, gut integrity, and recovery are core value propositions. SPINS retail analytics reported a 155% year-on-year increase in sports-nutrition products containing colostrum, marking it as the fastest-growing ingredient within the segment.

This momentum has attracted mainstream brands. In January 2025, Vital Proteins launched colostrum capsules, extending its collagen franchise toward immune-health consumers, as reported by Nutraceuticals World. The move reflects how established players are repositioning colostrum beyond niche wellness into everyday functional supplementation.

Innovation and Capital Reallocation Reshape Competitive Strategies

Strategic product innovation is intensifying. In November 2024, PanTheryx introduced Relesium, a patented colostrum-egg formulation targeting gastrointestinal discomfort associated with GLP-1 medications. Commenting on the launch, Tom Feeley stated that the product addresses “a largely untapped market” of millions of GLP-1 users seeking digestive support.

At the corporate level, Fonterra has signaled a sharper focus on high-value B2B nutrition ingredients. CEO Miles Hurrell confirmed in November 2024 that both a trade sale and an IPO of its consumer unit were under consideration, allowing capital redeployment toward advanced nutrition solutions, according to Reuters. This shift underscores how suppliers are prioritizing margins, science-backed differentiation, and long-term demand stability.

Story Continues

Regulatory Oversight Strengthens Market Credibility

Regulatory vigilance is reinforcing consumer trust. In May 2024, the U.S. Food and Drug Administration tested 297 retail dairy samples across 17 states for pathogens, finding no live threats-an outcome that strengthened confidence in bovine-derived supplements. Parallel media coverage, including The Guardian’s focus on colostrum’s barrier-support benefits, has amplified mainstream awareness and encouraged brands to emphasize traceable sourcing and transparent compositional data.

Asia Pacific Emerges as the Primary Growth Engine

Asia Pacific remains the market’s most dynamic region. China alone is forecast to generate USD 1.3 billion in incremental demand by 2035, as sports nutrition adoption expands beyond tier-one cities and immunity-focused supplementation gains traction. The rebound of infant-nutrition applications following South Korea’s 2023 relaxation of cross-border e-commerce rules has further lifted regional volumes, prompting DSM-Firmenich to triple its microencapsulation capacity in Buk.

Sustainability and traceability are also shaping procurement. Synlait’s blockchain-enabled tracking of on-farm antibiotic usage provides hormone-free assurances increasingly demanded by EU nutraceutical buyers, aligning ethical sourcing with regulatory compliance.

Whole Colostrum Powder Leads Product Innovation

Whole colostrum powder accounts for 50% of global revenue in 2025, supported by evidence that intact bioactive compounds survive gentle spray-drying better than fractionated alternatives. Peer-reviewed research published in Frontiers in Immunology (2024) links whole bovine colostrum to improvements in post-exercise recovery biomarkers and intestinal permeability, reinforcing its scientific credibility.

Sports-nutrition and infant-formula manufacturers increasingly position whole powder as a “complete first-milk” ingredient for immunity, endurance, and healthy aging. Regulatory facilitation-such as China’s dedicated HS code introduced in 2025-has further streamlined imports while enforcing farm-level traceability.

Supplements Dominate End-Use Demand

Colostrum supplements, including capsules, chewables, and ready-to-drink shots, command approximately 25% of total demand in 2025. Growth is driven by wellness consumers seeking convenient, dosage-controlled immunity and gut-health solutions. Differentiation now centers on microencapsulation, third-party IgG verification, NSF Certified for Sport credentials, and independent lab testing-factors that strengthen trust among athletes and healthcare professionals.

Notably, physicians at the Mayo Clinic have initiated a phase-II trial evaluating hyper-immunized colostrum for long-COVID-related gut dysbiosis, a development that could unlock reimbursement-backed medical-nutrition channels within the next three years.

Regional Growth Snapshot

United States: 4.2% CAGR, supported by sports culture, functional foods, and expanding retail availability

Germany: 5.7% CAGR, driven by aging demographics and immunity-focused supplementation

China: 7.2% CAGR, fueled by infant nutrition, cosmetics, and immunity-boosting products

Competitive Landscape

The market reflects a tiered structure, with Tier-1 leaders holding roughly 50% share, mid-size Tier-2 firms accounting for 30%, and niche Tier-3 players comprising the remaining 20%. Competition increasingly revolves around innovation, clinical validation, distribution partnerships, and strategic mergers.

Leading Manufacturers Include:

Colostrum BioTec GmbH

Good Health New Zealand

Zuche Pharmaceuticals

Biodane Pharma A/S

Agati Healthcare Pvt. Ltd.

Ingredia Nutritional (Ingredia S.A.)

McePharma

Australian by Nature

Cure Nutraceuticals Pvt. Ltd.

NIG Nutritionals Limited

La Belle Inc.

Biotaris B.V.

BiostrumNutritechPvt. Ltd.

Sterling Technology

Pantheryx Inc.

For an in-depth analysis of evolving formulation trends and to access the complete strategic outlook for the Colostrum Market through 2035, visit the official report page at: https://www.futuremarketinsights.com/reports/colostrum-market

Browse Related Insights

About Future Market Insights (FMI)

Future Market Insights (FMI) is a leading provider of market intelligence and consulting services, serving clients in over 150 countries. Headquartered in Delaware, USA, with a global delivery center in India and offices in the UK and UAE, FMI delivers actionable insights to businesses across industries including automotive, technology, consumer products, manufacturing, energy, and chemicals.

An ESOMAR-certified research organization, FMI provides custom and syndicated market reports and consulting services, supporting both Fortune 1,000 companies and SMEs. Its team of 300+ experienced analysts ensures credible, data-driven insights to help clients navigate global markets and identify growth opportunities.

For Press & Corporate Inquiries

Rahul Singh

AVP – Marketing and Growth Strategy

Future Market Insights, Inc.

+91 8600020075

For Sales – sales@futuremarketinsights.com

For Media – Rahul.singh@futuremarketinsights.com

For web – https://www.futuremarketinsights.com/

SOURCE: Future Market Insights, Inc.

View the original press release on ACCESS Newswire