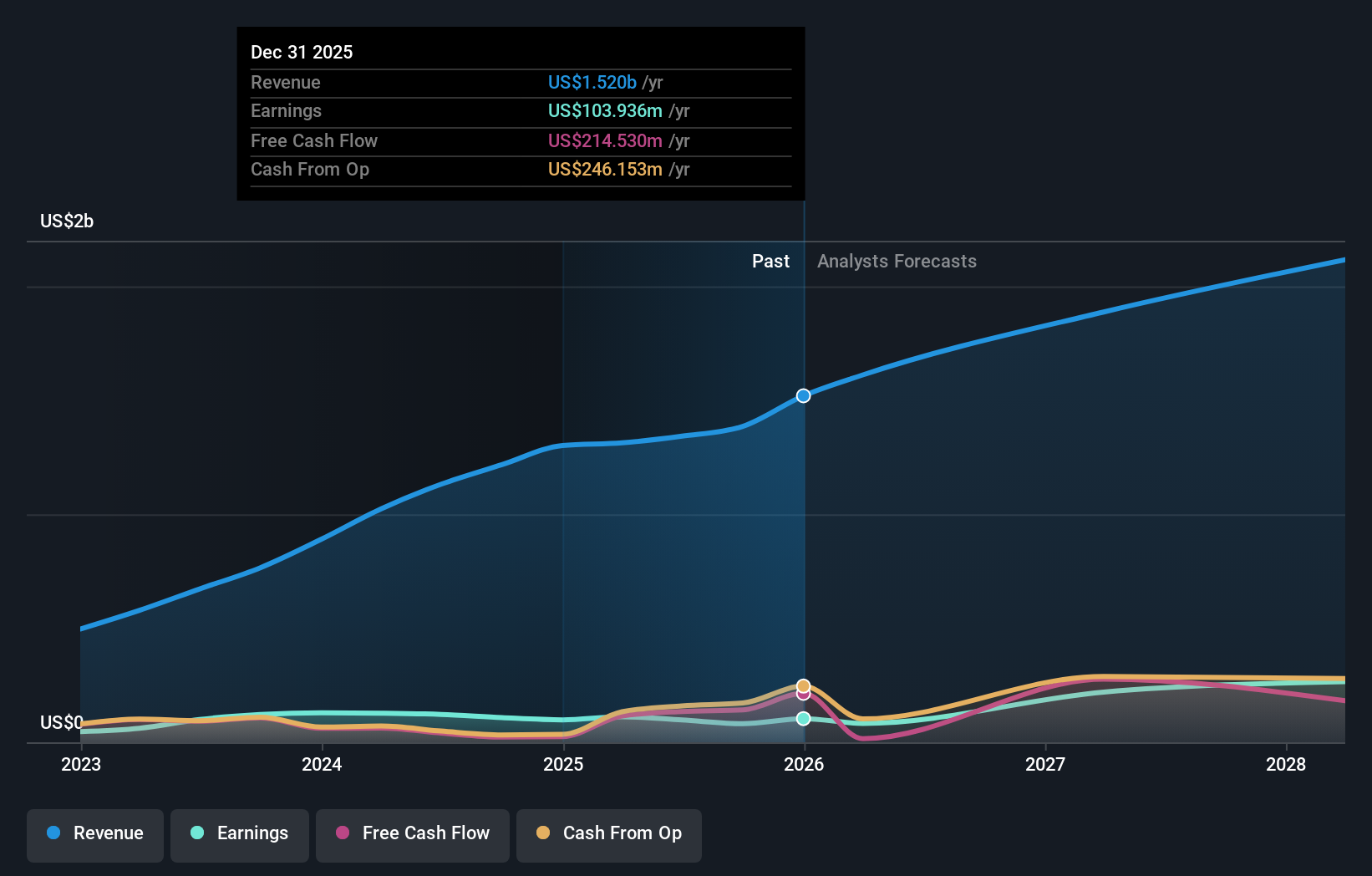

e.l.f. Beauty (NYSE:ELF) reported strong Q3 results supported by the integration of the Rhode brand. The company expanded its international footprint, including the global rollout of Rhode and Naturium’s entry into Walmart. e.l.f. Beauty ran a Super Bowl campaign featuring Melissa McCarthy that highlighted and celebrated the Latin community. Management raised earnings guidance, signaling confidence in its current business approach.

e.l.f. Beauty, known for its accessible color cosmetics and skin care offerings, is building around a portfolio that now includes Rhode and Naturium. The latest quarter brought together brand integration, retail expansion and large scale marketing, all within a beauty sector where consumers continue to show interest in both value and influencer driven labels.

For you as an investor, the key questions are how effectively NYSE:ELF can keep growing its newer brands, deepen retail partnerships and turn large campaigns like the Super Bowl spot into lasting customer loyalty. The company’s raised earnings guidance and broader reach set the context for future updates on execution, margins and brand health across channels.

Stay updated on the most important news stories for e.l.f. Beauty by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on e.l.f. Beauty.

NYSE:ELF Earnings & Revenue Growth as at Feb 2026

NYSE:ELF Earnings & Revenue Growth as at Feb 2026

How e.l.f. Beauty stacks up against its biggest competitors

Investor Checklist Quick Assessment ✅ Price vs Analyst Target: At US$74.46, the share price sits about 33% below the US$112.79 analyst target. ❌ Simply Wall St Valuation: Shares are trading 33.7% above the Simply Wall St estimated fair value. ❌ Recent Momentum: The stock has recorded a 14.4% decline over the last 30 days.

Check out Simply Wall St’s

in depth valuation analysis for e.l.f. Beauty.

Key Considerations 📊 Rhode integration, international expansion and a high profile Super Bowl campaign all point to management leaning into brand scale and reach. 📊 Keep an eye on how Q3 strength flows through to revenue, margins and Rhode and Naturium performance across key retailers and new markets. ⚠️ With the stock flagged as 33.7% overvalued by Simply Wall St, valuation risk matters if execution on these growth initiatives stalls. Dig Deeper

For the full picture including more risks and rewards, check out the

complete e.l.f. Beauty analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com