For investors looking to merge the possibility of high-growth companies with the exact timing of technical analysis, a plan centered on “Strong Growth Stocks with good Technical Setup Ratings” can be a noteworthy method. This process first finds companies with solid fundamental growth paths, firm profitability, and sound finances. It then adds a technical view, looking for stocks that are in a period of sideways movement or creating formations that indicate a possible price move may be near. The aim is to locate companies where solid business momentum might be close to being acknowledged by the wider market, which could result in notable price gains. One stock presently matching this screening outline is Planet Fitness Inc, Class A (NYSE:PLNT).

A Fundamental Case for Growth

At its center, this plan needs a company showing clear, speeding growth, and Planet Fitness meets this need. The company’s fundamental report shows a business in a phase of growth. Revenue growth has been solid, with a 14.4% rise over the last year and an 11.4% compound annual growth rate over several years. More significantly, earnings per share (EPS) growth is speeding up, a main sign for growth investors. The last year saw EPS jump by almost 19%, and this pace is forecast to keep going, with experts predicting yearly EPS growth of more than 17% in the next few years.

Beyond revenue growth, the company shows operational soundness that backs its growth. Main profit measures are notable:

Operating Margin of 29.3%, which beats 96% of similar companies in the Hotels, Restaurants & Leisure industry.

Profit Margin of 16.0%, higher than almost 89% of industry rivals.

Return on Invested Capital (ROIC) of 9.9%, showing effective use of capital to create profits.

While the valuation, with a P/E ratio above 31, seems high initially, it is mostly similar to industry peers. The solid and speeding earnings growth gives a reason for this higher valuation, as shown by its firm Growth Rating of 7 out of 10. For a growth-centered plan, these are the necessary parts: a shown capacity to grow sales and profits at a speeding rate within a financially steady structure. You can examine all the information in the fundamental analysis report for PLNT.

The Technical Setup: Sideways Movement Before a Possible Move

The fundamental story is only one part of the situation. The technical analysis aims to find a favorable entry point by evaluating market feeling and price movement. At this time, Planet Fitness shows a typical example of a stock in a period of sideways movement after a drop, which can sometimes come before a new price move.

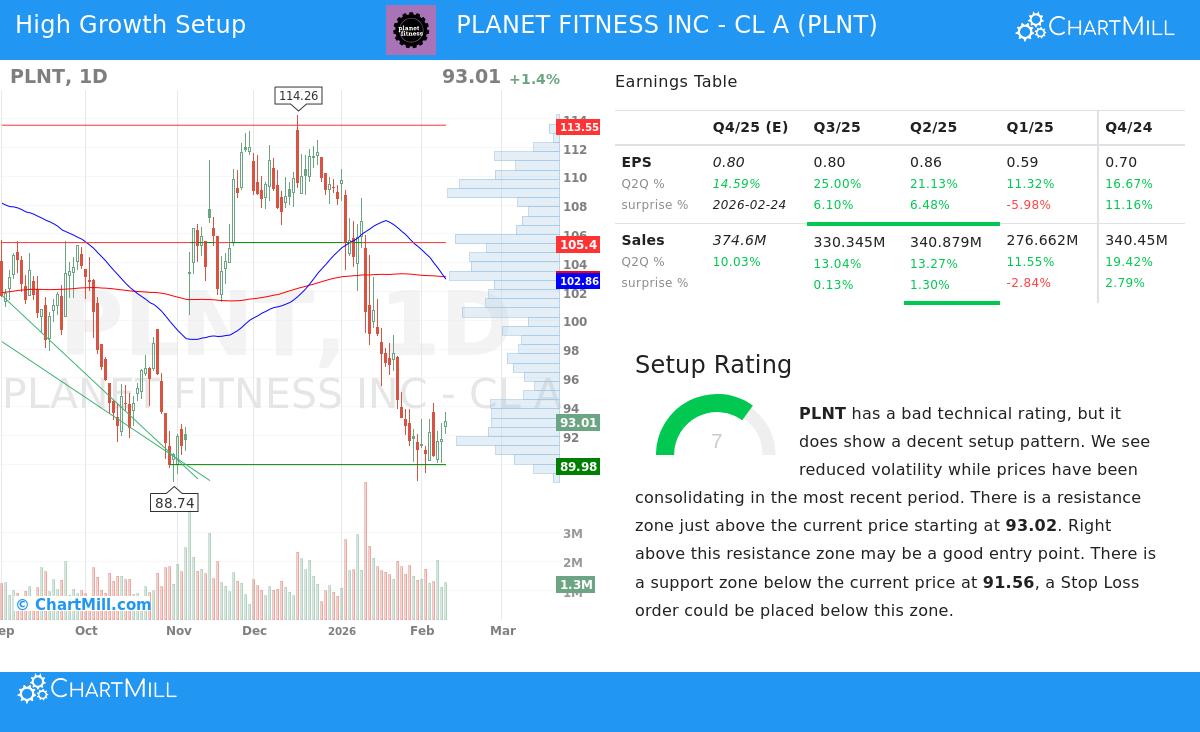

The stock’s technical rating is not high, showing its negative short and long-term directions and its place in the lower part of its 52-week range. However, within this setting, a positive formation has appeared. The stock has been trading in a fairly wide band between about $88 and $104 over the last month and is now near the lower edge of this band. This time of lower volatility and sideways price action after a downward trend is often where foundations are formed.

Importantly, the technical analysis points out a clear and close resistance area between $93.02 and $94.21, made from a mix of moving averages and trend lines. The nearness of the present price to this resistance creates a specific setup. The plan proposes that a clear move above this area, joined by high trading volume, could indicate a change in momentum and act as a possible entry signal. A support area exists around $90, which could be used to control risk. This exact arrangement, sideways movement near resistance with solid fundamentals below, is exactly what the combined screening process tries to find. The full technical view is in the technical analysis report for PLNT.

Why This Combination Matters

This merged method lessens some of the main risks found in only growth or only technical investing. Putting money into a growth stock based only on fundamentals can mean buying during a time of prolonged price softness or decline. On the other hand, trading a price move based only on chart formations can be risky if the basic company is financially weak or its growth is slowing. By needing both a solid growth story and a positive technical setup, the plan looks for companies where good business fundamentals might be ready to match a good change in market price behavior.

Finding Similar Opportunities

Planet Fitness shows how a company with speeding earnings and solid margins can form a technical setup that may present a specific chance. For investors wanting to use this same strict filter on the wider market, this stock was found using a preset screen.

You can find more stocks that meet this “Strong Growth Stocks with good Technical Setup Ratings” standard by viewing the full screen results here.

Disclaimer: This article is for information only and does not make up financial advice, a suggestion, or an offer or request to buy or sell any securities. The study presented is based on data and reports thought to be dependable, but its correctness cannot be sure. Putting money into stocks includes risk, including the possible loss of the original investment. You should do your own study and talk with a qualified financial advisor before making any investment choices.