Report Overview

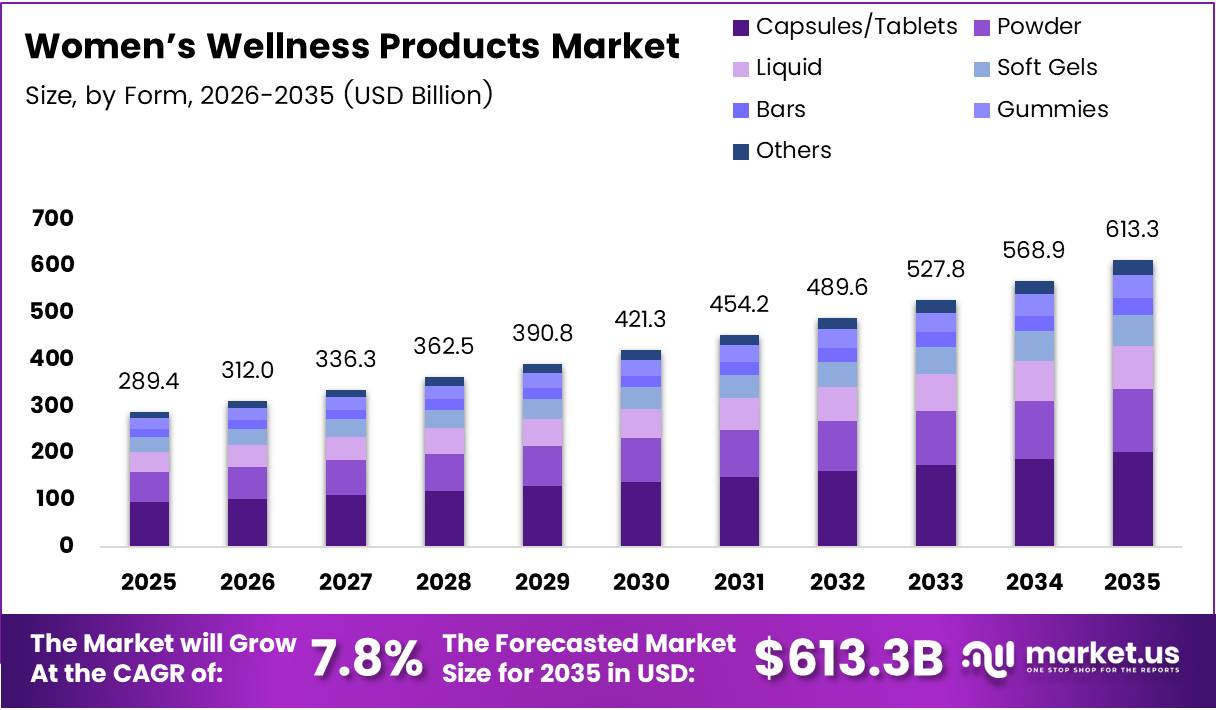

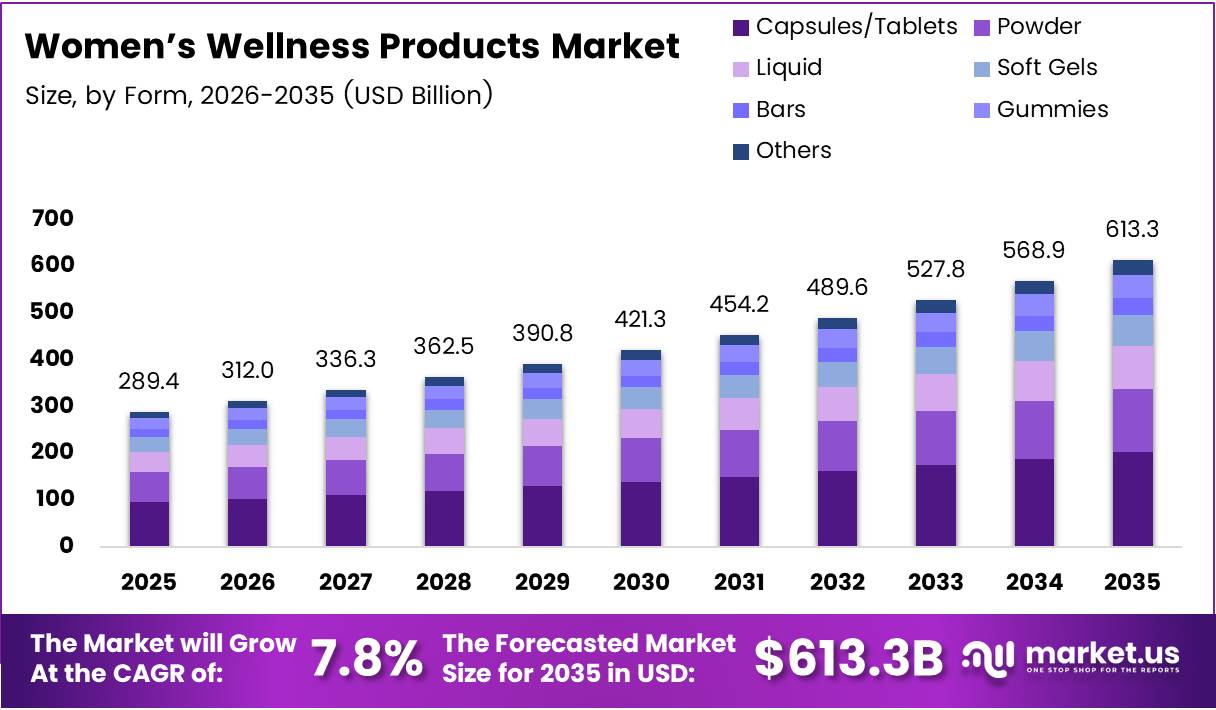

Global Women’s Wellness Products Market size is expected to be worth around USD 613.3 Billion by 2035 from USD 289.4 Billion in 2025, growing at a CAGR of 7.8% during the forecast period 2026 to 2035.

Women’s wellness products encompass dietary supplements, functional foods, beauty supplements, and sports nutrition designed specifically for female health needs. These products address hormonal balance, reproductive health, bone density, mental wellness, and beauty concerns. The market serves diverse age groups with targeted formulations for menstrual health, pregnancy, menopause, and aging.

Product categories include vitamins, minerals, protein supplements, herbal extracts, and probiotics. Additionally, the market covers hormone health supplements, cognitive support formulas, and longevity-focused nutraceuticals. Manufacturers develop specialized delivery formats including capsules, powders, liquids, soft gels, gummies, and functional bars.

Rising health consciousness among women drives market expansion globally. Consumers increasingly seek preventive healthcare solutions and personalized nutrition approaches. Moreover, digital wellness platforms and telemedicine services enhance product accessibility and consumer education. Consequently, brands invest in research-backed formulations and transparent ingredient sourcing.

Government initiatives promote women’s health awareness and nutrition programs worldwide. Regulatory bodies establish safety standards for dietary supplements and functional foods. Furthermore, public health campaigns emphasize preventive care and holistic wellness approaches. Therefore, policy support strengthens market infrastructure and consumer confidence.

E-commerce platforms transform product distribution and consumer engagement strategies. Online channels offer personalized recommendations, subscription models, and direct-to-consumer sales. Additionally, social media influencers and wellness communities drive product discovery and brand loyalty. However, digital marketing requires authentic messaging and evidence-based claims.

According to Women’s Business Daily, 35% of American women regularly use wearable fitness devices, indicating strong technology adoption in wellness behaviors. This trend demonstrates how digital health tools complement traditional supplement use. Consequently, brands develop integrated wellness ecosystems combining products with tracking applications.

According to Women’s Business Daily, smartwatches account for approximately 60% of total wearable usage among female users, with 71% tracking heart rate digitally. This data reflects growing interest in biometric monitoring and data-driven health decisions. Moreover, wearable integration enables personalized supplement timing and efficacy tracking for better outcomes.

Despite broader economic challenges, venture funding in women’s health technologies grew by approximately 5% from 2022 to 2023, totaling $671 million invested in 2024 toward digital wellness solutions, according to Women’s Business Daily. This investment surge signals strong market confidence and innovation momentum. Therefore, startups develop novel delivery systems, personalized formulations, and connected wellness devices.

Key Takeaways

Global Women’s Wellness Products Market projected to reach USD 613.3 Billion by 2035 from USD 289.4 Billion in 2025 at 7.8% CAGR

Dietary Supplements segment dominates with 37.8% market share in 2025

Capsules/Tablets form leads with 39.9% share due to convenience and dosage accuracy

Reproductive & Hormonal Health application holds 23.4% share reflecting growing awareness

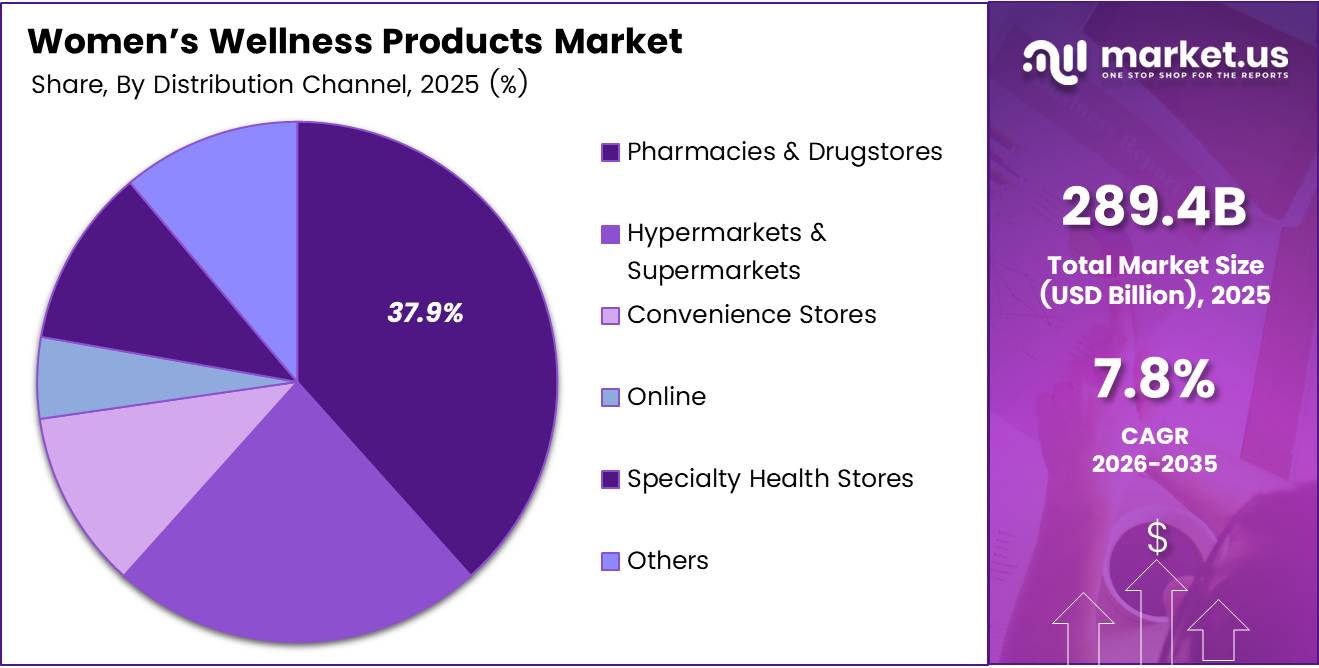

Pharmacies & Drugstores channel commands 37.9% share through trusted distribution

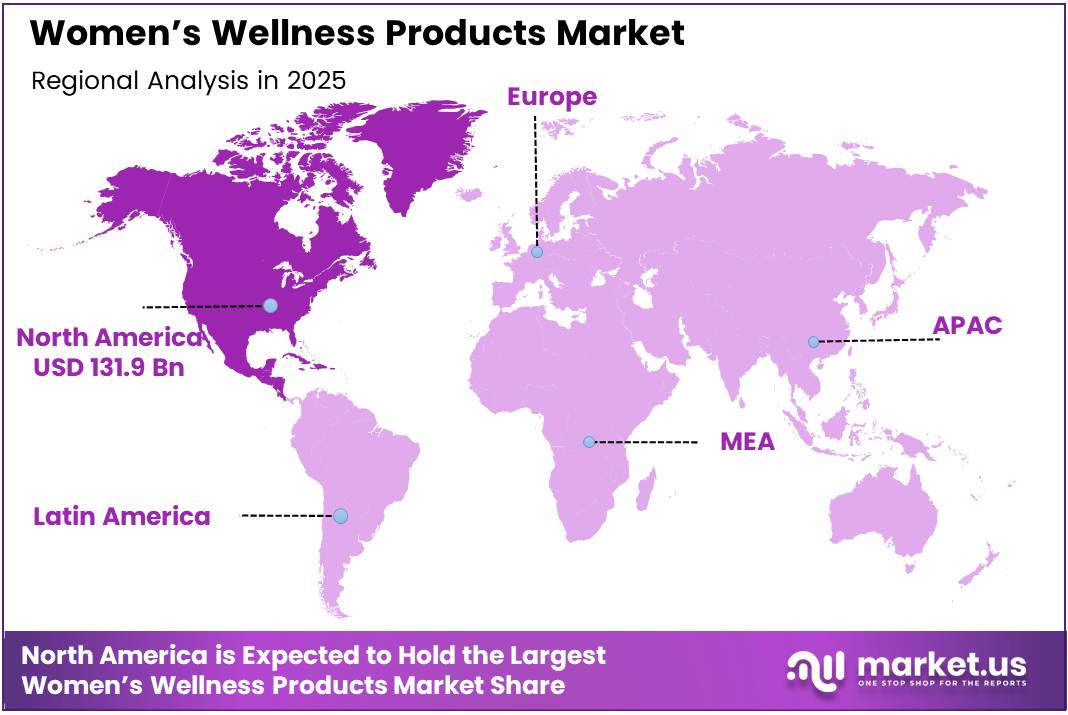

North America dominates with 45.60% market share valued at USD 131.9 Billion

Type Analysis

Dietary Supplements dominates with 37.8% due to comprehensive health benefits and scientific validation.

In 2025, Dietary Supplements held a dominant market position in the By Type segment of Women’s Wellness Products Market, with a 37.8% share. This category includes vitamins, minerals, protein supplements, omega fatty acids, probiotics, and herbal extracts. Consumers prefer supplements for targeted health outcomes and preventive care approaches. Moreover, clinical research supports efficacy claims for various formulations.

Women’s Hormone Health Supplements address menstrual irregularities, menopause symptoms, and reproductive wellness needs. These products contain adaptogens, phytoestrogens, and micronutrients supporting endocrine balance. Additionally, hormone health formulas target specific life stages from puberty through post-menopause. Therefore, personalized hormone support drives segment growth.

Nootropics & Cognitive Support supplements enhance mental clarity, focus, and stress resilience among women. Ingredients include omega-3 fatty acids, B-vitamins, and botanical extracts supporting brain health. Furthermore, cognitive supplements address multitasking demands and age-related cognitive decline. Consequently, working professionals and students represent key consumer groups.

Longevity & Cellular Health Supplements incorporate antioxidants, NAD+ precursors, and anti-aging compounds. These formulations support cellular repair, mitochondrial function, and healthy aging processes. Moreover, longevity products align with preventive healthcare trends and wellness optimization. However, this category requires extensive consumer education and scientific communication.

Functional Foods & Beverages deliver wellness benefits through fortified everyday products. Categories include protein bars, collagen drinks, and nutrient-enhanced snacks designed for women. Additionally, functional formats offer convenient nutrition for busy lifestyles. Therefore, brands innovate with taste profiles and clean ingredient lists.

Beauty & Cosmeceutical Supplements support skin health, hair growth, and anti-aging from within. Key ingredients include collagen peptides, biotin, hyaluronic acid, and antioxidants. Furthermore, ingestible beauty products complement topical skincare routines. Consequently, the beauty-from-within trend drives market expansion.

Sports Nutrition Products cater to female athletes and fitness enthusiasts with specialized formulations. These products address energy needs, muscle recovery, and performance optimization for women. Additionally, sports nutrition considers hormonal fluctuations affecting training and recovery cycles. Moreover, brands develop gender-specific protein ratios and micronutrient profiles.

Form Analysis

Capsules/Tablets dominates with 39.9% due to precise dosing and convenient consumption.

In 2025, Capsules/Tablets held a dominant market position in the By Form segment of Women’s Wellness Products Market, with a 39.9% share. This format provides accurate dosage control and shelf stability for active ingredients. Consumers appreciate ease of storage, portability, and standardized supplementation routines. Moreover, capsules mask unpleasant tastes of certain botanical extracts.

Powder formats offer versatility for mixing into beverages, smoothies, and foods. This form allows flexible dosing and rapid absorption of nutrients. Additionally, powders appeal to consumers seeking customizable supplementation and beverage fortification. Therefore, protein powders and collagen supplements commonly use this delivery method.

Liquid formulations provide fast absorption and high bioavailability of nutrients. These products suit consumers with swallowing difficulties or preference for drink-based supplements. Furthermore, liquid formats enable precise concentration adjustments and flavor customization. However, liquids require refrigeration and have shorter shelf lives.

Soft Gels encapsulate oil-based nutrients like omega fatty acids and fat-soluble vitamins. This form protects sensitive ingredients from oxidation and degradation. Moreover, soft gels offer easier swallowing compared to hard tablets. Consequently, consumers choose soft gels for essential fatty acid supplementation.

Gummies combine supplementation with enjoyable consumption experiences and taste appeal. This format particularly attracts younger consumers and those averse to traditional pills. Additionally, gummies enable micro-dosing and gradual nutrient intake throughout the day. Therefore, vitamin and mineral gummies show strong growth momentum.

Application Analysis

Reproductive & Hormonal Health dominates with 23.4% due to critical wellness priorities across life stages.

In 2025, Reproductive & Hormonal Health held a dominant market position in the By Application segment of Women’s Wellness Products Market, with a 23.4% share. This category addresses menstrual cycle regulation, fertility support, pregnancy nutrition, and menopause management. Women prioritize hormonal balance for overall health and quality of life. Moreover, increasing awareness about PCOS and endometriosis drives demand.

Bone & Joint Health supplements prevent osteoporosis and support skeletal strength throughout aging. Key ingredients include calcium, vitamin D, magnesium, and collagen for bone density. Additionally, joint health products address arthritis risks and mobility maintenance. Therefore, postmenopausal women represent primary consumers for bone health formulations.

Weight Management products support healthy metabolism, appetite control, and body composition goals. These supplements contain thermogenic compounds, fiber, and appetite suppressants formulated for women. Furthermore, weight management solutions consider hormonal influences on metabolism and fat distribution. Consequently, holistic approaches combine supplementation with lifestyle modifications.

Sports & Fitness applications enhance athletic performance, muscle recovery, and endurance for active women. Products include pre-workout formulas, BCAAs, and electrolyte replacements designed specifically for females. Additionally, sports supplements address iron deficiency and energy needs related to menstrual cycles. Moreover, female athlete awareness drives specialized product development.

Beauty & Anti-Aging supplements promote skin elasticity, hair strength, and cellular rejuvenation. Formulations incorporate collagen, hyaluronic acid, antioxidants, and phytonutrients supporting aesthetic goals. Furthermore, beauty supplements complement skincare routines with systemic nutritional support. Therefore, the ingestible beauty category experiences rapid growth.

Digestive Health products improve gut microbiome balance, nutrient absorption, and gastrointestinal comfort. Probiotics, prebiotics, digestive enzymes, and fiber supplements address common digestive concerns. Additionally, gut health influences hormonal balance, immunity, and mental wellness. Consequently, digestive wellness represents foundational health priority.

Mental Wellness supplements support stress management, mood balance, and cognitive function. Ingredients include adaptogens, omega-3s, B-vitamins, and botanical extracts for emotional resilience. Moreover, mental health awareness reduces stigma and encourages proactive supplementation. Therefore, anxiety and stress relief products show increasing demand.

Immunity & General Wellness formulations strengthen immune defenses and overall vitality. These products contain vitamins C and D, zinc, elderberry, and immune-modulating botanicals. Additionally, preventive wellness approaches drive year-round immunity supplement consumption. Furthermore, pandemic awareness heightened focus on immune health maintenance.

Heart & Cardiovascular Health supplements reduce cardiovascular disease risks through targeted nutrition. Key ingredients include omega-3 fatty acids, CoQ10, and plant sterols supporting heart function. Moreover, cardiovascular health concerns increase with age and metabolic changes. Therefore, women adopt preventive supplementation for long-term wellness.

Distribution Channel Analysis

Pharmacies & Drugstores dominates with 37.9% due to trusted expertise and immediate product availability.

In 2025, Pharmacies & Drugstores held a dominant market position in the By Distribution Channel segment of Women’s Wellness Products Market, with a 37.9% share. These outlets provide professional consultation, product authenticity assurance, and convenient accessibility. Consumers trust pharmacist recommendations for supplement selection and usage guidance. Moreover, prescription and over-the-counter products coexist in pharmacy settings.

Hypermarkets & Supermarkets offer one-stop shopping convenience and competitive pricing for wellness products. These channels display extensive product ranges alongside grocery shopping experiences. Additionally, promotional activities and loyalty programs drive purchase decisions. Therefore, mainstream consumers discover wellness products through supermarket aisles.

Convenience Stores provide quick access to basic wellness products in neighborhood locations. This channel suits impulse purchases and immediate need fulfillment for supplements. Furthermore, extended operating hours accommodate diverse shopping schedules. However, limited product variety constrains selection compared to specialized retailers.

Online platforms deliver personalized recommendations, subscription services, and direct-to-consumer brand access. E-commerce enables detailed product information, customer reviews, and home delivery convenience. Additionally, online channels facilitate price comparisons and exclusive digital-only promotions. In April 2025, Walmart launched expanded women’s intimate health product assortments in over 1,000 stores, including brands such as Womaness and plusOne, demonstrating omnichannel integration strategies.

Specialty Health Stores provide expert consultation, premium product selections, and wellness education. These retailers focus on natural, organic, and science-backed supplement brands. Moreover, knowledgeable staff offer personalized recommendations based on individual health goals. Consequently, health-conscious consumers prefer specialty stores for curated product experiences.

Drivers

Rising Health Consciousness and Preventive Care Adoption Drive Market Expansion

Women increasingly prioritize proactive health management and preventive wellness strategies. Lifestyle diseases, hormonal imbalances, and stress-related conditions motivate supplement adoption. Moreover, social media influencers and wellness communities amplify health awareness messages. Consequently, younger demographics embrace supplementation earlier in life.

According to Women’s Business Daily, smartwatches account for approximately 60% of total wearable usage among female users, demonstrating technology integration in wellness routines. This digital health adoption enables data-driven supplement choices and efficacy tracking. Therefore, wearable devices complement traditional wellness products with personalized insights.

E-commerce platforms expand product accessibility beyond geographical and temporal constraints. Online channels provide detailed ingredient information, customer reviews, and educational content. Additionally, subscription models ensure consistent supplementation without purchase friction. Furthermore, direct-to-consumer brands build community engagement through digital platforms. Consequently, digital commerce reshapes wellness product discovery and purchasing behavior.

Restraints

High Product Costs and Regulatory Complexity Limit Market Penetration

Premium wellness products remain financially inaccessible for middle-income and price-sensitive consumers. Quality supplements require expensive ingredients, clinical testing, and manufacturing standards. Moreover, ongoing subscription costs accumulate to significant annual expenditures. Consequently, affordability barriers restrict market expansion in developing economies.

Regulatory fragmentation across countries creates compliance challenges for global brands. Safety standards, labeling requirements, and permissible ingredient lists vary significantly. Additionally, lack of standardized certification confuses consumers about product quality. Therefore, regulatory inconsistency hinders international market growth and consumer trust.

Misinformation and unsubstantiated health claims erode consumer confidence in supplements. Some brands make exaggerated promises without scientific evidence or clinical validation. Furthermore, contamination scandals and quality control failures damage category credibility. Consequently, skepticism about efficacy and safety restrains broader market adoption.

Growth Factors

Technological Innovation and Personalization Accelerate Market Development

Personalized nutrition platforms analyze individual health data to recommend tailored supplement regimens. Genetic testing, microbiome analysis, and biomarker assessments enable precision wellness approaches. Moreover, artificial intelligence optimizes formulation combinations based on user profiles. Consequently, personalization increases supplement efficacy and customer satisfaction.

According to CertifyHealth, unified healthcare platforms achieve approximately 40% higher operational efficiency and 66% increase in revenue inflow for women’s health service workflows. These systems integrate telehealth, prescription management, and wellness product recommendations. Therefore, connected healthcare ecosystems drive supplement adoption through professional guidance.

Those platforms show approximately 90% patient loyalty and satisfaction, reflecting performance improvements in women’s wellness delivery, according to CertifyHealth. High engagement rates validate integrated care models combining medical services with preventive products. Moreover, trust in healthcare provider recommendations converts patients into long-term supplement consumers.

Strategic partnerships between supplement brands and healthcare providers legitimize products. Gynecologists, nutritionists, and wellness coaches recommend evidence-based supplements to patients. Additionally, clinical integration enables outcome tracking and efficacy validation. In February 2025, Epicore Biosystems raised $26 million in Series B funding to scale its sweat-sensing wearable and cloud analytics platform for personalized health insights, demonstrating investor confidence in connected wellness solutions.

Emerging Trends

Plant-Based Formulations and Holistic Wellness Reshape Product Development

Vegan and plant-based supplements gain traction among environmentally conscious consumers. Botanical extracts, algae-derived omega-3s, and plant proteins replace animal-sourced ingredients. Moreover, clean-label products emphasize minimal processing and recognizable ingredient lists. Consequently, brands reformulate existing products to meet plant-based preferences.

According to DXBillion News Network, approximately 30% of women prioritize managing energy and fatigue over traditional weight-loss goals, signaling demand shifts toward functional wellness. This trend reflects holistic health perspectives beyond aesthetic concerns. Therefore, brands develop energy-supporting formulations addressing mitochondrial health and adrenal function.

Mobile applications and online communities provide peer support and wellness guidance. Women share experiences, track progress, and discover products through digital platforms. Additionally, gamification features encourage consistent supplementation and healthy habit formation. In August 2025, Iris Nutrition debuted its women’s functional wellness brand with electrolyte drink mixes formulated to support hormone health, hydration, and cycle regulation, addressing specific female physiological needs.

At-home wellness treatments and self-care rituals gain popularity post-pandemic. Women invest in home spa experiences, meditation apps, and supplement routines. Furthermore, self-care emphasis destigmatizes mental health support and stress management. In April 2025, Beacon Wellness Brands launched the plusOne Weighted Kegel Exerciser in Walmart stores and online, a pelvic floor strengthening device designed with peri-menopausal women in mind, expanding wellness product categories.

Regional Analysis

North America Dominates the Women’s Wellness Products Market with a Market Share of 45.60%, Valued at USD 131.9 Billion

North America leads through high health awareness, disposable income levels, and established wellness culture. The region benefits from advanced healthcare infrastructure and strong e-commerce penetration. Moreover, regulatory frameworks support supplement industry growth while ensuring safety standards. Additionally, influencer marketing and wellness trends originate predominantly from North American markets. Therefore, the region commands 45.60% market share valued at USD 131.9 Billion.

Europe Women’s Wellness Products Market Trends

Europe demonstrates strong demand for organic, sustainably sourced wellness products. Stringent regulatory standards ensure high product quality and consumer protection. Moreover, aging populations drive demand for bone health and longevity supplements. Additionally, holistic healthcare approaches integrate supplements into preventive care strategies.

Asia Pacific Women’s Wellness Products Market Trends

Asia Pacific experiences rapid market growth through rising middle-class populations and urbanization. Traditional herbal medicine integration creates unique product formulations blending modern science with ancient wisdom. Moreover, increasing women’s workforce participation elevates health awareness and purchasing power. Additionally, e-commerce platforms overcome distribution challenges in geographically dispersed markets.

Latin America Women’s Wellness Products Market Trends

Latin America shows growing interest in beauty and anti-aging supplements. Economic development increases disposable incomes for wellness product purchases. Moreover, social media influence drives product awareness and trend adoption. Additionally, local manufacturing capabilities reduce import dependencies and product costs.

Middle East & Africa Women’s Wellness Products Market Trends

Middle East & Africa demonstrates emerging demand despite affordability challenges. Urban populations show increasing health consciousness and wellness product adoption. Moreover, expatriate communities introduce international wellness trends and product preferences. Additionally, government health initiatives promote nutritional awareness and preventive healthcare approaches.

Key Regions and Countries

North America

Europe

Germany

France

The UK

Spain

Italy

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

Rest of APAC

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

GCC

South Africa

Rest of MEA

Key Company Insights

Amway Corp maintains leadership through extensive direct-selling networks and diverse product portfolios. The company offers vitamins, minerals, and specialty supplements targeting women’s health needs. Moreover, Amway emphasizes quality assurance and scientific research backing product formulations. Additionally, their global distribution system provides accessibility across multiple markets and demographic segments.

Herbalife Nutrition Ltd focuses on weight management and sports nutrition products for female consumers. The company leverages multilevel marketing strategies and wellness coaching programs. Furthermore, Herbalife develops targeted formulations addressing metabolic health and active lifestyle requirements. Consequently, their community-based approach builds strong customer loyalty and repeat purchases.

GNC Holdings, Inc operates specialty retail stores providing expert consultation and premium product selections. The company curates science-backed supplements and maintains strict quality control standards. Moreover, GNC’s retail presence enables personalized recommendations and immediate product availability. Additionally, their loyalty programs and educational resources strengthen customer engagement and brand preference.

Bayer AG brings pharmaceutical expertise and research capabilities to consumer wellness products. The company develops evidence-based supplements leveraging clinical trial data and medical knowledge. Furthermore, Bayer’s established brand reputation provides consumer trust and credibility. In April 2024, Beacon Wellness Brands introduced the plusOne Wellness Collective, a panel of board-certified experts to guide product development and consumer education in intimate wellness.

Key players

Amway Corp

Herbalife Nutrition Ltd

GNC Holding, Inc

Bayer AG

Nestlé Health Science

Blackmores Limited

Swisse Wellness Pty. Ltd

Advanced Enzyme Technologies

Nu Skin Enterprises, Inc

Prozis

Recent Developments

May 2025 – Epicore Biosystems raised an additional $6 million, expanding its Series B funding to a total of $32 million to accelerate global growth of its Connected Hydration wearable technologies for personalized wellness monitoring and hydration tracking.

September 2025 – plusOne® launched its Wellness Care Collection, a comprehensive suite of menopause support products addressing symptoms like dryness, libido changes, sleep issues, and energy imbalance with science-backed formulations.

April 2025 – Womaness expanded its retail footprint by bringing its perimenopause and menopause care products into Walmart stores and online, increasing accessibility for women seeking hormone health solutions nationwide.

April 2025 – Walmart launched an expanded women’s intimate health product assortment in over 1,000 stores, including brands such as Womaness and plusOne, demonstrating mainstream retail commitment to women’s wellness categories.

Report Scope