The Beauty Health Company (NASDAQ:SKIN) shareholders won’t be pleased to see that the share price has had a very rough month, dropping 30% and undoing the prior period’s positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 35% share price drop.

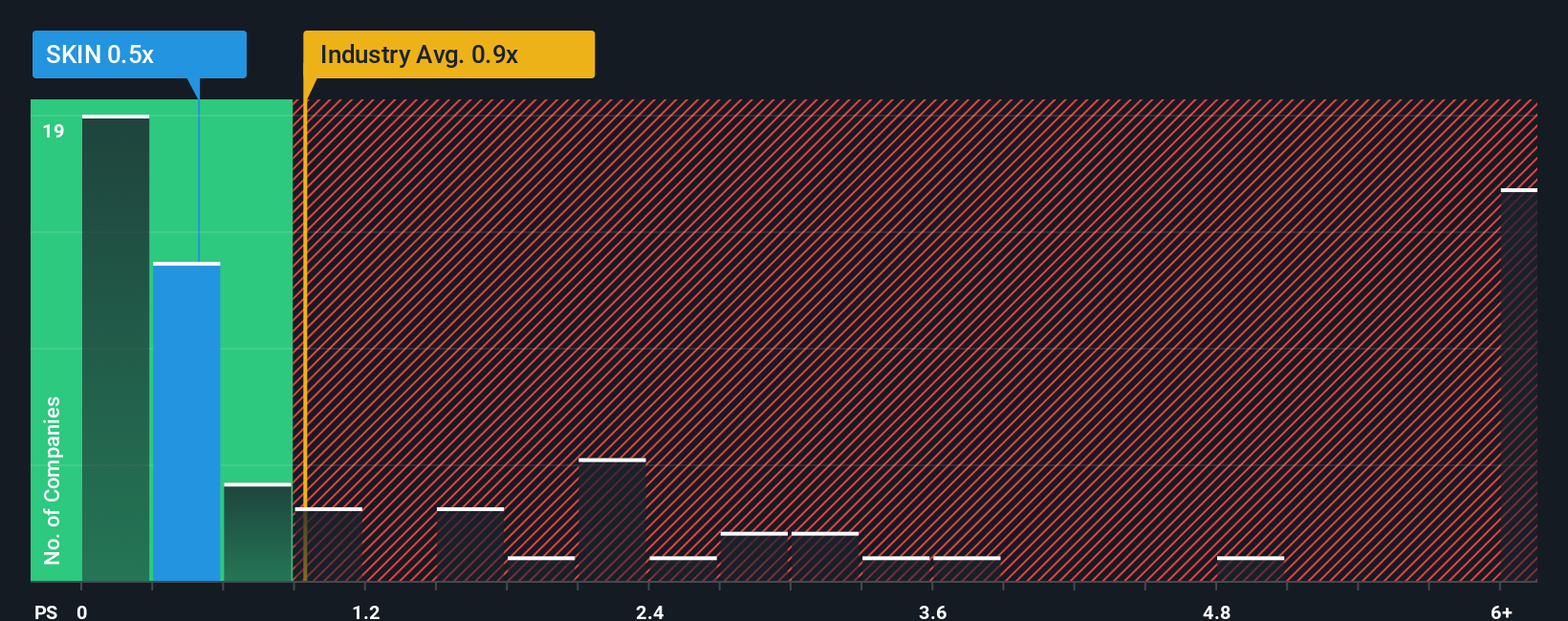

Following the heavy fall in price, Beauty Health may be sending bullish signals at the moment with its price-to-sales (or “P/S”) ratio of 0.4x, since almost half of all companies in the Personal Products industry in the United States have P/S ratios greater than 1x and even P/S higher than 3x are not unusual. Although, it’s not wise to just take the P/S at face value as there may be an explanation why it’s limited.

See our latest analysis for Beauty Health

NasdaqCM:SKIN Price to Sales Ratio vs Industry February 12th 2026 How Beauty Health Has Been Performing

NasdaqCM:SKIN Price to Sales Ratio vs Industry February 12th 2026 How Beauty Health Has Been Performing

Recent times haven’t been great for Beauty Health as its revenue has been falling quicker than most other companies. Perhaps the market isn’t expecting future revenue performance to improve, which has kept the P/S suppressed. You’d much rather the company improve its revenue performance if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Beauty Health’s future stacks up against the industry? In that case, our free report is a great place to start. Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Beauty Health would need to produce sluggish growth that’s trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company’s revenues fell to the tune of 13%. The last three years don’t look nice either as the company has shrunk revenue by 13% in aggregate. Therefore, it’s fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 3.0% per year during the coming three years according to the eight analysts following the company. With the industry predicted to deliver 4.8% growth each year, the company is positioned for a comparable revenue result.

With this information, we find it odd that Beauty Health is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Beauty Health’s P/S?

Beauty Health’s recently weak share price has pulled its P/S back below other Personal Products companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn’t sensible, however it can be a practical guide to the company’s future prospects.

It looks to us like the P/S figures for Beauty Health remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

It’s always necessary to consider the ever-present spectre of investment risk. We’ve identified 2 warning signs with Beauty Health (at least 1 which is concerning), and understanding them should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we’re here to simplify it.

Discover if Beauty Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.