Beauty Devices Market Revenue Insights

Key Highlights

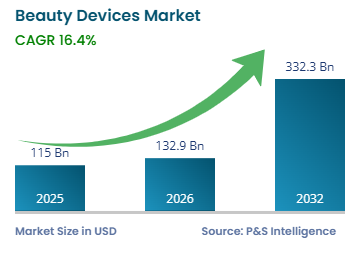

Study Period 2021 – 2032

Market Size in 2025USD 115.0 Billion

Market Size in 2026USD 132.9 Billion

Market Size by 2032USD 332.3 Billion

Projected CAGR 16.4%

Largest ReginNorth America

Fastest-Growing RegionAsia-Pacific

Market Structure Fragmented

Market Size

Explore the market potential with our data-driven report Get Sample Pages

Beauty Devices Market Overview

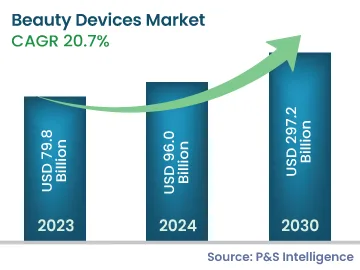

In 2025, the global beauty device market is worth USD 115.0 billion, and growing at a compound annual growth rate (CAGR) of 16.4 % between 2026 and 2032, it will reach around USD 332.3 billion by 2032. The rapid expansion of technology into both professional aesthetic clinics and the home-use market (e.g., LED photobiomodulation, microcurrent stimulation, radiofrequency energy, IPL) has driven this growth. The convergence of the dermatological sciences and consumer electronics has made beauty devices an integral part of many consumers’ daily skincare routines, providing non-invasive treatment options formerly only available in medical or spa environments.

Increasing demand for home-based beauty treatments is indicative of larger societal trends toward self-managed wellness treatments. According to the World Health Organization (WHO), the number of people worldwide aged 60 years and older is projected to increase from 1.1 billion to 2.1 billion by 2050. As such, there are significant long-term opportunities for anti-aging products and treatments focused on wrinkles, skin laxity, and hyperpigmentation issues. In addition, the increased availability of FDA-approved home use products has helped drive the growth of the at-home beauty product market, with over 90% of individuals who used either an at-home LED therapy or a microcurrent device in a clinical study reported to see some level of improvement.

Beauty Devices Market Trends & Drivers

At-Home Device Adoption and Digital Technology Integration Are Trending

The at-home beauty industry is transforming. As consumers are using high-end technology for beauty at home, more and more are using digital connectivity to personalize treatments and track treatment effectiveness.

Smart beauty devices that include Bluetooth, artificial intelligence to analyze your skin, and a mobile app to track treatment in real time and monitor your progress over time, are providing consumers with a way to measure treatment success through the creation of data-driven feedback loops.

These loops provide consumers with data to help them adhere to treatment plans and increase the efficacy of treatments; they also generate valuable information for manufacturers to enhance future product offerings.

According to the British Beauty Council’s “Value of Beauty” report, the amount spent by UK consumers on personal care is expected to grow by 8 percent and be GBP 32.4 billion in 2024.

This represents the increased popularity of at-home beauty treatments, which is one reason why many device manufacturers are offering subscription-based models of consumables and software-as-a-service platforms to increase repeat business from customers.

Demographic Trends Increase Consumer Spending on Devices

Population aging trends and the increasing awareness of aesthetics by all generations of consumers are driving sustained structural demand for beauty devices.

According to the UNFPA, between 1974 and 2024, the percentage of the world population aged 65 doubled from 5.5 percent to 10.3 percent, and this trend is projected to continue to 20.7 percent by 2074.

The growing numbers of older consumers are looking for solutions to age-related skin problems, such as wrinkles, volume loss, and hyperpigmentation, which drive demand for beauty devices.

Younger consumers, influenced by social media and greater awareness of skin health, are adopting preventative skincare approaches earlier than previous generations.

In the UK, 89 percent of adults feel that physical appearance is important today, with nearly half stating that physical appearance is very important and fewer than 9 percent feeling that physical beauty is not important.

Most (87 percent) of those surveyed felt that physically attractive individuals are treated differently than those who are not.

According to the survey, 69 percent of the respondents believed that physical beauty was subjective, or dependent upon personal opinion versus universal standards.

Premium Pricing Limits Accessibility, Creates Safety Fears

While growth trends in the beauty device market appear strong, the market faces significant barriers to broader adoption.

Premium pricing for advanced devices limits access to upper-income consumers, while fears related to safety limit interest from other segments of the market.

Advanced LED masks, micro-current devices, and RF devices typically sell for $200-$600, or more. Such pricing makes them less likely to be purchased by the majority of consumers in the mass market.

According to a recent study, nearly 44% of potential consumers stated that advanced beauty devices were too expensive.

Nearly 38% of respondents stated that they delayed purchasing due to cost considerations, particularly in lower-priced regions.

Misuse of light-based and energy-based devices can lead to burns, hyperpigmentation, or skin sensitivity, and thus raises concern in consumers that do not have professional training to guide their use of these devices.

Regulations regarding device approvals differ widely by region, with some countries requiring significant clinical testing before approval, while others allow for less stringent testing prior to permitting consumer marketing.

Manufacturers of beauty devices must strike a balance between creating effective devices that meet consumer expectations while creating safety features into their designs, as well as creating educational materials and usage instructions to alleviate concerns of consumers that could potentially raise the cost of production and therefore the retail price of their products.

Growing Demand from Emerging Male Grooming Segment

Male grooming is becoming another area of opportunity for the global beauty device market. With significant changes in how males engage with technology, grooming habits, and societal attitudes toward beauty, there is no question that male grooming devices represent a viable opportunity for the beauty device industry.

Men—particularly Gen Z and Millennials—are increasingly engaged in daily grooming and skincare regimens.

According to recent studies, 41% of men are currently using skincare products and 70% of Gen Z men are regularly using facial care products.

Grooming devices, such as electric razors, beard and body trimmers, and multi-functional kits are fast-becoming essential items for males in terms of grooming.

There is increasing interest in more intelligent, skin-friendly, and technologically-enhanced devices that offer customization, ease-of-use, and performance. Social media and influencer culture have normalized the concept of beauty and grooming for males, greatly enhancing visibility and acceptance of at-home beauty technology—including advanced skincare and laser devices.

At the same time, males are showing strong preferences for functional, results-oriented tools that support the concepts of wellness and self-care, positioning beauty devices—and not just grooming products—as a central component of modern male grooming practices.

A recent lifestyle survey indicated that 62% of men are interested in dyeing their pubic hair, with 58% manscaping every month and 34% doing so weekly.

These findings suggest that there are evolving consumer preferences for grooming products beyond basic trimming.

Beauty Devices Industry Segmentation Analysis

Product Type Analysis

Hair removal products hold 30% of the total facial aesthetic devices market in 2025 — which reflects the continued consumer interest in permanent hair reduction products, eliminating recurring visits to salons. The market share of hair removal devices is supported by the advancement and miniaturization of both IPL and laser technologies from professional systems to consumer devices — providing salon quality results at substantially lower long term costs than salons. In addition, the FDA has cleared many IPL and laser devices for home use; and thus created regulatory validation that has increased consumer confidence.

The use of hair removal devices is further supported by the fact that they provide clear efficacy metrics and result in a permanent solution; allowing for premium pricing and driving positive adoption trends among a wide range of demographics. A recent YouGov survey conducted in the United Kingdom found that individuals have a general preference for trimmed pubic styles and there are significant variations between the preferred styles of pubic hair across different regions such as armpits and legs. Younger individuals were less concerned with these differences overall. In the U.S., the most popular pubic hair style for women was trimmed (52%), followed by completely shaved (38%) and natural (36%). Men are generally more inclined to want their female partners to have trimmed or shaved pubic hair styles.

Forty-two percent of men said they preferred their partner to have trimmed pubic hair, and thirty-six percent said they preferred a natural look; and very few of either sex said they wanted their female partner to be completely shaved. Additionally, twenty-one percent of respondents said that women should remove all pubic hair, while eight percent of respondents said that men should remove all pubic hair; indicating that there are differing grooming standards based on gender.

Photorejuvenation/LED therapy devices are anticipated to grow the fastest from 2026 – 2032 due to increasing clinical data supporting the efficacy of photobiomodulation and increasing consumer awareness of the benefits of using light for skincare purposes. Research published in the International Journal of Molecular Sciences confirmed the efficacy of LED in treating acne vulgaris, herpes simplex, skin rejuvenation, and psoriasis via photobiomodulation mechanisms. The ability of red (630–660 nm), and near infrared (800–860 nm) wavelength LED masks and panels to stimulate cellular metabolism, collagen synthesis and tissue repair without causing thermal damage or downtime, creates a favorable climate for the rapid adoption of LED therapy devices.

The following product types are analyzed:

Hair Removal (Largest Category)

Cleansing

Acne Treatment

LED Therapy & Photorejuvenation (Fastest Growing Category)

Oxygen/Facial Steaming

Hair Growth

Dermarolling

Cellulite Reduction

Others

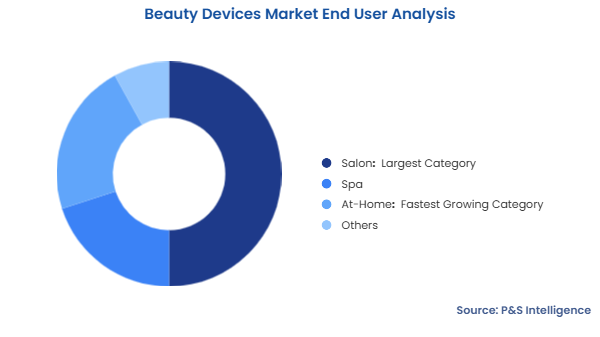

End User Analysis

Salons hold the greatest market share in 2025 at 50% due to the concentration of capital equipment purchases and the recurring revenue streams generated from service treatments in this space. Advanced equipment capable of delivering higher energy levels and multiple treatment modalities that can withstand the rigors of commercial use drive the premium pricing of professional-grade equipment. According to the American Academy of Dermatology, physicians are increasingly adopting LED photobiomodulation and microcurrent technologies in clinical practices. Professional environments allow for treatment protocols to be supervised, adherence to regulatory requirements, and liability protection that allows for the use of devices with greater intensity than is permitted for home use.

Beauty services are commonly provided on a relatively frequent basis worldwide, and the average client of a salon typically visits a salon about five times a year. Clients tend to seek out haircuts every four to six weeks, nail services every four to six weeks, and skin care services every two to three months. Approximately forty to forty-six percent of respondents reported visiting beauty centers one to two times per month. Overall, forty-three percent of respondents reported visiting hair or beauty salons four to five times per year. Females account for slightly more than fifty percent of the clientele; however, male interest in cosmetic services is increasing, which is indicative of the increasing habituation of consumers across demographics and types of service to utilize professional beauty services.

The at-home category is expected to demonstrate the fastest rate of growth during the forecasting period, as consumers increasingly seek the convenience, privacy, and cost effectiveness of performing treatments at home. Consumer surveys indicate that eighteen percent of U.S. adults currently own microcurrent or LED devices for at-home use, while nine percent of respondents plan to purchase a device in the future. The COVID-19 pandemic contributed to the acceleration of the adoption of at-home devices as consumers sought alternative methods to receive salon services; thereby creating behavior patterns that continue to exist after the end of lockdowns. Manufacturers of devices are responding to these consumer behaviors with simplified user interfaces, safety limits, and education that enables consumers to effectively administer treatments themselves, while maintaining the efficacy of the treatments.

The market segments into the following end users:

Salon (Largest Category)

Spa

At-Home (Fastest Growing Category)

Others

Drive strategic growth with comprehensive market analysis Preview With a Free Sample

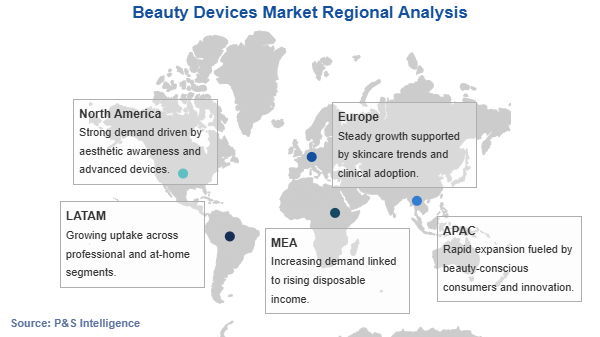

Beauty Devices Market Geographical Analysis

North America Beauty Device Market Outlook

North America will be responsible for approximately 35% of the global beauty device market in 2025 due to its dominant position in terms of mature digital health infrastructure, high purchasing power of consumers, and sustained investment in innovation. As such, the region is also home to well-established regulatory frameworks that provide clarity around market access and that meet the safety standards of consumers. According to U.S. Census Bureau data, Americans collectively spend an average of $322.88 annually on skincare products, providing a high level of baseline investment into personal care that can extend into the area of device purchases.

North American consumers are embracing beauty devices, specifically at-home devices used for skincare, anti-aging, acne treatment, and light-based therapy; this reflects a growing demand for non-invasive, technology-based solutions that meet the needs of busy lives. Approximately 65% of U.S. consumers report using at least one electronic skincare or haircare device on a regular basis, indicating a high degree of routine integration of beauty tech. In addition, nearly 50% of North American consumers prefer smart, connected devices; further, over 50% of households in urban areas currently utilize at-home beauty solutions, signifying a wide-scale adoption of technology and comfort with do-it-yourself treatments. Among the most highly-sought after categories for beauty devices are LED masks, microcurrent devices and AI-enhanced diagnostic tools; these are driven by factors including convenience, personalization and wellness-oriented skincare practices.

U.S. Beauty Device Market Analysis

The U.S., in 2025, will be the largest country market for beauty devices worldwide, as it is home to high levels of consumer awareness regarding aesthetics, a developed distribution infrastructure and significant innovation in technology. The FDA has established clear pathways for beauty device clearance under the 510(k) equivalence determination process, allowing for rapid market entry for new and innovative products. The U.S. marketplace benefits from significant direct-to-consumer e-commerce channels, influential beauty content creators and high levels of social media engagement that drive awareness and adoption of products. The U.S. marketplace is expected to remain robust, as consumers increasingly prioritize their investments in skincare and as device manufacturers increase their retail partnerships.

Asia-Pacific Beauty Device Market Trends

During 2026–2032, the Asia-Pacific region is projected to experience the fastest rate of growth in the global beauty device market. This growth is being driven by increasing disposable income, a growing middle-class population, and a cultural emphasis on skincare throughout the region. The marketplace in the Asia-Pacific (APAC) region is characterized by high rates of technology adoption, significant influence from Korean (K-beauty) and Japanese (J-beauty) beauty trends on consumer preferences, and rapidly developing e-commerce infrastructure that facilitates the distribution of beauty devices.

Sales of beauty devices in the APAC region are rapidly expanding as digitally savvy consumers increasingly adopt at-home skincare and grooming technologies, and online platforms and social media play a major role in influencing purchase decisions and discovering products. Younger consumers in the APAC region exhibit a high degree of engagement with tech-enabled tools such as LED masks, microcurrent devices and smart cleansing devices, while mobile e-commerce is widely prevalent in China, where a majority of beauty shoppers research and purchase products via smartphone.

Consumers in the APAC region are also displaying a strong desire for multifunctional and personalized devices, as well as increasing awareness of skin health and advanced beauty trends from Korea and Japan, which are resulting in continued growth of the marketplace in the region.

China Beauty Device Market Expansion

China will be the largest market in the APAC region, driven by rapid urbanization, a growing middle-class population and a strong cultural emphasis on skincare. Chinese consumers are demonstrating a high level of receptiveness to technology-enabled beauty solutions, and live streaming commerce and social platforms such as Xiaohongshu are playing a major role in shaping the discovery and purchase decision of beauty products. Domestic manufacturers are capturing market share based on competitive pricing and localized product development, while international brands are positioned at a premium in the market.

Chinese consumers are increasingly emphasizing ingredient literacy, clean and natural formulations and personalized skincare when evaluating beauty trends. When assessing the efficacy of beauty products, consumers in China are increasingly looking for science-backed solutions and traditional botanicals incorporated into modern formulations. Younger Chinese shoppers are increasingly attracted to domestic brands that combine cultural heritage with innovation, and consumers in China are increasingly influenced by tech-enabled experiences such as AR try-ons and AI diagnostics when making purchase decisions, reflecting a heightened awareness of skin health and digital engagement in beauty routines.

Europe Beauty Device Market Growth

Europe is projected to hold approximately 25% of the global market in 2025, primarily due to high consumer awareness, strong regulatory standards and a well-established professional aesthetic service infrastructure. Based on Office for National Statistics (ONS) data, household spending on miscellaneous goods and services averaged £38.70 per week in 2024. Germany, the United Kingdom and France represent three of the primary country markets in Europe, each with unique characteristics related to consumer preferences and distribution channel dynamics. European regulatory frameworks, including CE marking requirements, establish safety and efficacy standards for beauty devices that enable manufacturers to charge a premium price and build consumer confidence.

The regions and countries analyzed in this report include:

North America (Largest Region)

U.S. (Larger and Faster-Growing Country Market)

Canada

Europe

Germany (Largest and Fastest-Growing Country Market)

U.K.

France

Italy

Spain

Rest of Europe

Asia-Pacific (Fastest-Growing Region)

China (Largest Country Market)

Japan

India (Fastest-Growing Country Market)

South Korea

Australia

Rest of APAC

Latin America

Brazil (Largest and Fastest-Growing Country Market)

Mexico

Rest of LATAM

Middle East & Africa

Saudi Arabia (Largest and Fastest-Growing Country Market)

South Africa

U.A.E.

Rest of MEA

Beauty Devices Market Share

While the global beauty device market is relatively fragmented, it also includes large multinational companies, smaller beauty technology companies, and newer entrants into this space. The relative level of fragmentation of the global beauty device market reflects the many categories of products available; the number of platforms available to deliver these products; and the many channels available to distribute them, which creates opportunities for a variety of firms to create and capture value in different segments of the global beauty device market in different geographic areas.

Entry into the global beauty device market varies dramatically depending upon the type of device being sold; entry costs for developing and selling professional-grade beauty devices are substantially higher than for developing and selling consumer grade beauty devices; however, both types of devices require substantial marketing expenditures to gain consumer awareness in the highly competitive consumer device marketplace.

Established players have a significant advantage in terms of their ability to develop, manufacture and distribute technology-enabled beauty devices, leveraging their knowledge and experience in the beauty industry, combined with their established global distribution networks. These players also benefit from their well-known consumer electronics brands, enabling them to utilize economies of scale in the design, development and production of their technology-enabled beauty devices and promote them to consumers directly.

Professional aesthetic device manufacturers tend to be located in Japan and have a strong position within the Asian market; and the clinical/medical spa segments are served by companies specializing in professional aesthetic devices.

Manufacturers compete with each other primarily through innovation; specifically, the integration of artificial intelligence enabled skin analysis and connectivity to devices enable manufacturers to differentiate themselves in increasingly commoditized categories.

Consolidation among larger players has increased significantly over recent years as larger players acquire new technologies and expand their reach in the global beauty device market.

In order to remain successful in the rapidly evolving beauty device market, companies will need to effectively integrate multiple technology platforms, continue to validate the clinical safety and efficacy of their devices, and implement effective omnichannel distribution strategies across both professional and consumer segments of the global beauty device market.

Top Beauty Devices Companies:

Panasonic CorporationLumenis Be Ltd.Nu Skin Enterprises Inc.The Beauty Tech Group Ltd.Home Skinovations Ltd.Carol Cole Company Inc. (NuFACE)L’Oréal SACandela CorporationYA-MAN LTD.MTG Co. Ltd.Koninklijke Philips N.V.LightStimSpectrum Brands Holdings Inc.Conair CorporationAmorepacific CorporationThe Procter & Gamble CompanyFOREO AB

Beauty Devices Market News & Updates

In January 2025, L’Oréal S.A., the French multinational cosmetics company, debuted the Cell BioPrint device at CES 2025 in Las Vegas. Cell BioPrint is a tabletop hardware device that provides personal skin analysis based on advanced proteomics technology. Cell BioPrint was developed in collaboration with NanoEnTek, a South Korea-based startup. Cell BioPrint measures protein biomarkers to calculate a person’s biological age of the skin, identify how responsive they will be to ingredients, and allow them to take a proactive approach to their skincare, placing L’Oréal at the forefront of integrating personalized beauty technology into their business model.

In October 2024, The Beauty Tech Group Ltd., the UK-headquartered global at-home beauty device company, announced the acquisition of TRIA Beauty Inc. With the completion of the acquisition of TRIA Beauty, The Beauty Tech Group expanded its technology portfolio to include LED, radio frequency, microcurrent, and laser technologies across its CurrentBody Skin, ZIIP Beauty, and Tria Laser brands. The combination of The Beauty Tech Group’s existing brands and the newly acquired brands of TRIA Beauty, now enables The Beauty Tech Group to offer consumers a comprehensive ecosystem of at-home beauty devices.

In October 2024, Carol Cole Company Inc., (NuFACE), introduced the Trinity+ Complete at-home facial toning device. The Trinity+ Complete is an advanced at-home facial toning device that incorporates red light technology along with microcurrent therapy. The Trinity+ Complete features three interchangeable magnetized attachments, 36 red LEDs, and is capable of delivering up to 425 microamps through precision microcurrent tips that target the facial muscles for non-surgical skin rejuvenation.

In February 2024, Nu Skin Enterprises Inc., a Utah-based direct sales company, launched RenuSpa iO. RenuSpa iO is a microcurrent body device that has been cleared by the FDA and retails for USD 375. RenuSpa iO features Nu Skin’s proprietary Adaptive Microcurrent Technology, which adjusts over 80 times per second to changes in skin conductivity. RenuSpa iO represents Nu Skin’s first foray into the integrated beauty/wellness device space in the US, and is intended for use on legs, arms, and abdomen.

In January 2024, L’Oréal S.A. announced the AirLight Pro hair dryer at CES 2024, and the device was developed in conjunction with Zuvi, a California-based startup. AirLight Pro combines high speed wind with infrared light using patented LightCare technology, and helps to protect the internal moisture of the hair. AirLight Pro won a CES 2024 Innovation Award in the Digital Health category, further solidifying L’Oréal’s reputation as one of the most innovative beauty technology companies.

Frequently Asked Questions About This Report

What will be the beauty devices market 2032 size?+

In 2032, the market for beauty devices is projected to reach USD 332.2 billion.

Which type is the most popular in the beauty devices industry?+

Hair removal devices dominate the beauty devices industry with 30% revenue share.

Which is the most-productive region in the beauty devices market?+

North America is the largest market for beauty devices, accounting for 35% share.

What are the key beauty devices industry drivers?+

The beauty devices industry is driven by the rising incidence of dermatological diseases, increasing appearance consciousness, and a growing geriatric population.

What is the beauty devices market nature?+

The beauty devices market is fragmented in nature.