Panthenol Market Summary

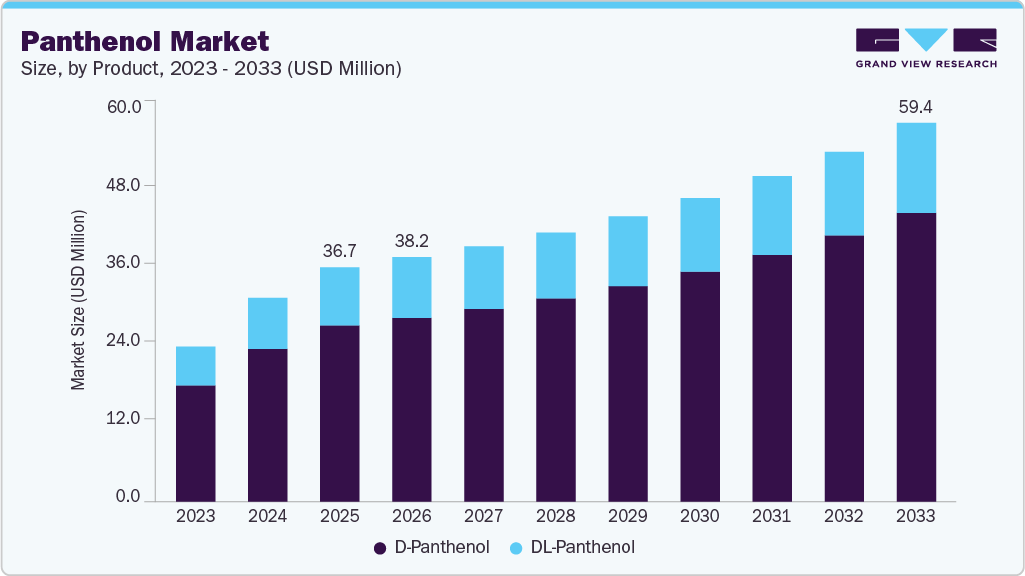

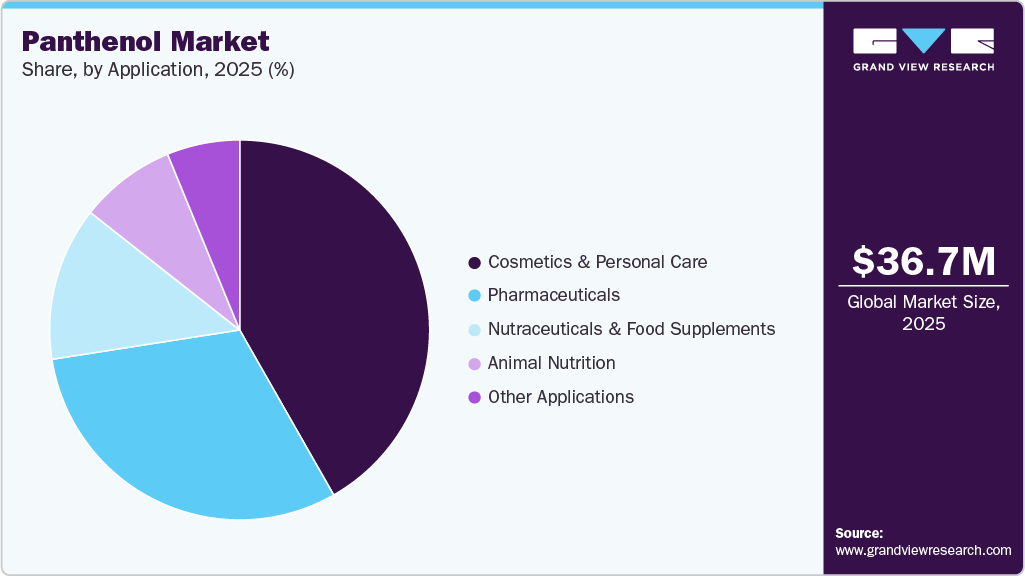

The global panthenol market size was estimated at USD 36.7 million in 2025 and is projected to reach USD 59.4 million by 2033, growing at a CAGR of 6.5% from 2026 to 2033. The industry is primarily driven by the expanding cosmetics and personal care industry, supported by rising consumer demand for premium skincare, haircare, and dermatologically active ingredients with proven moisturizing and healing properties.

Key Market Trends & Insights

Asia Pacific dominated the panthenol market with the largest revenue share of 39.8% in 2025.

The market in China is expected to grow at the fastest CAGR of 6.8% from 2026 to 2033 in terms of revenue.

By product, the D-Panthenol segment dominated the global industry with the largest revenue share of 75.1% in 2025.

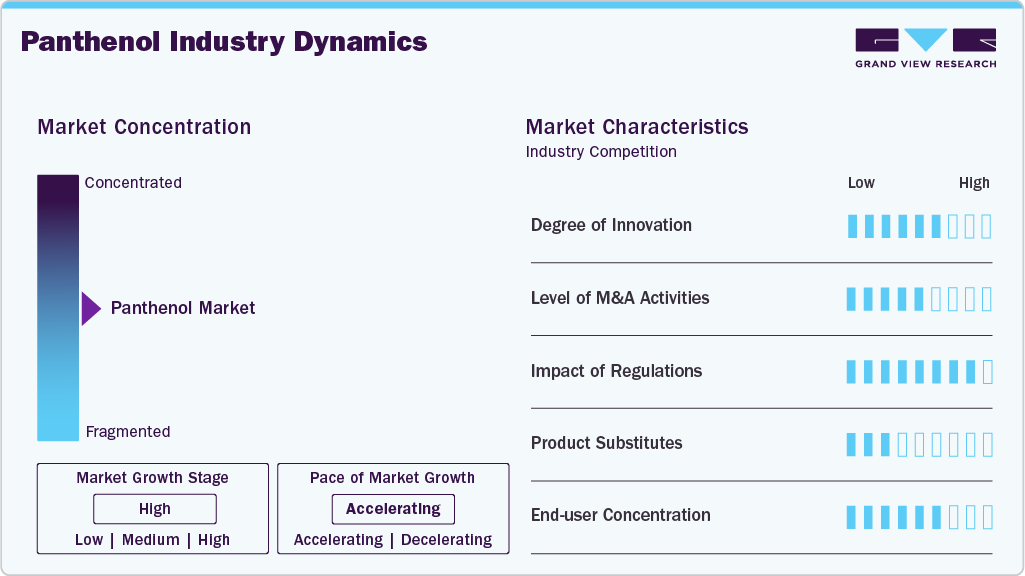

By application, the cosmetics & personal care segment held the largest revenue share of 41.8% in 2025 in terms of value.

Market Size & Forecast

2025 Market Size: USD 36.7 Million

2033 Projected Market Size: USD 59.4 Million

CAGR (2026-2033): 6.5%

Asia Pacific: Largest market in 2025

North America: Fastest growing market

Increasing pharmaceutical applications in wound care, dermatology, and topical formulations, along with growing awareness of functional vitamins and bioactive ingredients in nutraceuticals, are further accelerating demand. The rapid urbanization, rising disposable incomes, and the shift toward multifunctional and clean-label formulations across emerging economies are strengthening the adoption of panthenol across multiple end-use sectors.

The industry presents significant growth opportunities driven by the rising penetration of natural, organic, and multifunctional cosmetic formulations, where panthenol is increasingly positioned as a value-added active ingredient. Expanding demand from emerging markets, particularly in Asia Pacific and Latin America, coupled with the growth of e-commerce and direct-to-consumer beauty brands, is creating new avenues for volume expansion. Furthermore, innovation in pharmaceutical and nutraceutical formulations, along with increasing R&D investments in dermatological and therapeutic applications, is expected to unlock high-margin opportunities for manufacturers and ingredient suppliers.

The global panthenol industry faces challenges related to price volatility of raw materials, complex synthesis processes, and dependence on upstream chemical intermediates, which can impact production costs and margins. Intense competition from alternative moisturizing and conditioning agents, including hyaluronic acid, glycerin, and botanical extracts, is exerting pressure on market positioning and pricing. Moreover, stringent regulatory requirements for cosmetic and pharmaceutical ingredients across key regions, along with sustainability concerns and evolving compliance standards, pose operational and strategic challenges for market participants.

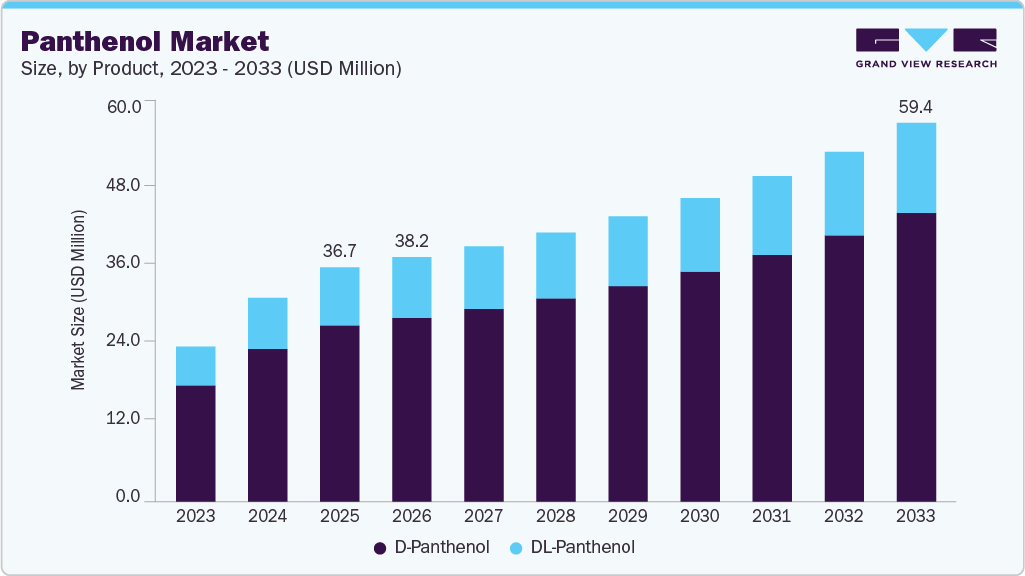

Market Concentration & Characteristics

The industry is moderately consolidated, led by multinational specialty chemical and ingredient companies such as BASF SE, DSM-firmenich, Evonik Industries AG, Merck KGaA, and TRI-K Industries, which benefit from advanced R&D capabilities, high-purity production, and global distribution networks. These players focus on innovation, premium-grade formulations, and strategic partnerships with cosmetics and pharmaceutical manufacturers to strengthen their market positions.

At the same time, Chinese manufacturers including Yifan Pharmaceutical, Xinfa Pharmaceutical, and Jiangxi Tongde Chemical Technology are gaining traction through cost-efficient manufacturing and expanding production capacities, intensifying competition in bulk and mid-grade segments. Niche players such as Croma-Pharma GmbH and RITA Corporation address specialized pharmaceutical and cosmetic applications, while overall competition is driven by technological differentiation, pricing pressure, and increasing demand for high-quality and sustainable panthenol products.

Product Insights

The D-Panthenol segment dominated the global industry with the largest revenue share of 75.1% in 2025, driven by its superior biological activity, higher efficacy in skincare and pharmaceutical applications, and strong preference in premium cosmetic formulations. As the biologically active form of provitamin B5, D-Panthenol is widely used in dermatological products, haircare solutions, and therapeutic formulations, where performance and purity are critical. The growing demand for high-value personal care products, rising consumer awareness of functional ingredients, and increasing adoption in pharmaceutical applications have reinforced the dominance of D-Panthenol in the industry.

In contrast, the DL-Panthenol segment accounted for the remaining market share, supported by its cost-effectiveness and suitability for mass-market cosmetic and industrial applications. Although DL-Panthenol exhibits lower biological activity compared to D-Panthenol, its competitive pricing and stable formulation properties make it attractive for large-scale production of personal care products and animal nutrition formulations. Looking ahead, the DL-Panthenol segment is expected to witness relatively faster growth over the forecast period, driven by expanding demand in emerging markets and price-sensitive applications, while D-Panthenol will continue to maintain its leadership due to its strong positioning in high-value end-use sectors.

Application Insights

The cosmetics & personal care segment held the largest revenue share of 41.8% in 2025, driven by the extensive use of panthenol as a multifunctional active ingredient in skincare, haircare, and dermatological formulations. Its proven moisturizing, anti-inflammatory, and barrier-repair properties have led to widespread adoption in premium and mass-market beauty products, supported by rising consumer demand for functional and scientifically backed cosmetic ingredients. The rapid growth in the global beauty industry, the expansion of e-commerce channels, and increasing focus on ingredient transparency and performance have significantly strengthened panthenol consumption in this segment.

The pharmaceuticals segment represented a substantial share of the market, supported by the growing use of panthenol in topical medications, wound-healing products, and dermatological therapies. Meanwhile, Nutraceuticals & Food Supplements and Animal Nutrition segments are witnessing steady growth due to increasing awareness of vitamin B5 benefits and rising demand for fortified formulations. Other applications, including industrial and specialty formulations, contribute a smaller but stable share, reflecting the diversified end-use profile of panthenol. Overall, application-wise demand is increasingly driven by innovation in formulation science, expansion of health and wellness markets, and rising penetration across emerging economies.

Regional Insights

Asia Pacific panthenol market accounted for a 39.8% share in 2025, driven by the region’s large-scale cosmetics manufacturing base, rapid expansion of pharmaceutical production, and rising consumer demand for personal care products. Strong industrial ecosystems in China, India, Japan, and South Korea, coupled with increasing disposable incomes and urbanization, have significantly boosted the consumption of panthenol across multiple applications. Additionally, the presence of cost-efficient manufacturing facilities and a growing focus on value-added cosmetic ingredients continue to reinforce the region’s market leadership.

China panthenol market represented 43.4% of the Asia Pacific market in 2025, supported by its dominant role in global cosmetics and pharmaceutical manufacturing and its extensive chemical production infrastructure. The country’s large domestic consumer base, strong export-oriented personal care industry, and availability of competitively priced raw materials have positioned China as the primary demand and supply hub for panthenol in the region. Moreover, continuous capacity expansions by domestic manufacturers and increasing investments in high-purity specialty chemicals are further strengthening China’s market position.

North America Panthenol Market Trends

The panthenol market in North America held a 28.3% share in 2025, driven by high consumption of premium personal care products and advanced pharmaceutical formulations. The region benefits from strong innovation capabilities, well-established regulatory frameworks, and high consumer awareness regarding functional cosmetic ingredients. Additionally, sustained demand from dermatological applications and nutraceutical products, along with the presence of major multinational ingredient suppliers, continues to support market growth across North America.

U.S. Panthenol Market Trends

The panthenol market in the U.S. accounted for 78.7% of the North American market in 2025, reflecting its dominance in the regional cosmetics, pharmaceutical, and nutraceutical industries. High per capita spending on personal care products, strong R&D investments in dermatological and therapeutic applications, and the presence of leading global cosmetic brands have significantly driven panthenol consumption in the country. Furthermore, growing demand for premium and multifunctional cosmetic formulations continues to reinforce the US market’s leadership within the region.

Europe Panthenol Market Trends

The panthenol market in Europe captured 22.0% of the global market in 2025, supported by a strong cosmetics and pharmaceutical manufacturing ecosystem and a high emphasis on product quality and regulatory compliance. The region’s mature personal care market, coupled with rising demand for natural and functional ingredients, has driven steady adoption of panthenol across skincare and pharmaceutical applications. The presence of leading specialty chemical companies and stringent quality standards has positioned Europe as a key high-value market.

Germany emerged as one of the leading markets for panthenol in Europe, driven by its advanced chemical industry, strong pharmaceutical manufacturing base, and presence of major cosmetic brands. The country’s focus on high-purity specialty chemicals, innovation in dermatological formulations, and a strong export-oriented cosmetics sector has significantly contributed to panthenol demand. Moreover, Germany’s robust R&D infrastructure and compliance with stringent EU regulatory standards continue to support sustained market growth.

Middle East & Africa Panthenol Market Trends

The panthenol market in the Middle East & Africa is experiencing steady growth, driven by increasing demand for personal care products, expanding pharmaceutical sectors, and rising consumer awareness of premium cosmetic ingredients. The Gulf countries, particularly Saudi Arabia and the UAE, are emerging as key demand centers due to high per capita spending on beauty and wellness products, while Africa is witnessing gradual market expansion supported by urbanization and improving distribution networks. Overall, the region offers long-term growth potential as international cosmetic brands continue to strengthen their presence.

Latin America Panthenol Market Trends

The panthenol market in Latin America is supported by the expansion of the regional cosmetics industry and increasing consumer spending on personal care products. Countries such as Brazil and Mexico are witnessing rising demand for functional cosmetic ingredients, driven by urbanization, growing middle-class populations, and the proliferation of international beauty brands. Additionally, improving pharmaceutical manufacturing capabilities and increasing awareness of health and wellness products are contributing to the gradual expansion of the panthenol market in the region.

Key Panthenol Companies Insights

Key players operating in the panthenol market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. Key players, such as dsm-firmenich, Yifan Pharmaceutical Co., Ltd., Xinfa Pharmaceutical Co., Ltd, Evonik Industries AG , Croma-Pharma GmbH , and BASF SE are dominating the market.

dsm-firmenich is a leading global science-based company specializing in nutrition, health, and beauty ingredients, with a strong presence in the panthenol market through its high-purity vitamin B5 derivatives and specialty cosmetic ingredients portfolio. The company leverages advanced R&D capabilities, integrated manufacturing, and a global distribution network to serve premium cosmetics, pharmaceutical, and nutraceutical applications, positioning itself as a key supplier of value-added panthenol solutions. Its strategic focus on innovation, sustainability, and customer-centric formulation development enables DSM-firmenich to maintain a competitive edge in high-growth personal care and life sciences markets.

Key Panthenol Companies:

The following key companies have been profiled for this study on the Panthenol market.

dsm-firmenich

Yifan Pharmaceutical Co., Ltd.

Xinfa Pharmaceutical Co., Ltd

Evonik Industries AG

Croma-Pharma GmbH

BASF SE

TRI-K Industries, Inc.

Merck KGaA

Jiangxi Tongde Chemical Technology Co., Ltd.

RITA Corporation

Recent Developments

In January 2026, Evonik expanded its personal care ingredients portfolio with launches such as biosurfactants and biotechnology-based cosmetic actives, signaling sustained R&D investment in high-value specialty ingredients.

Panthenol Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 38.2 million

Revenue forecast in 2033

USD 59.4 million

Growth rate

CAGR of 6.5% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 – 2024

Forecast period

2026 – 2033

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

dsm-firmenich; Yifan Pharmaceutical Co., Ltd.; Xinfa Pharmaceutical Co., Ltd; Evonik Industries AG; Croma-Pharma GmbH; BASF SE; TRI-K Industries, Inc.; Merck KGaA; Jiangxi Tongde Chemical Technology Co., Ltd.; RITA Corporation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

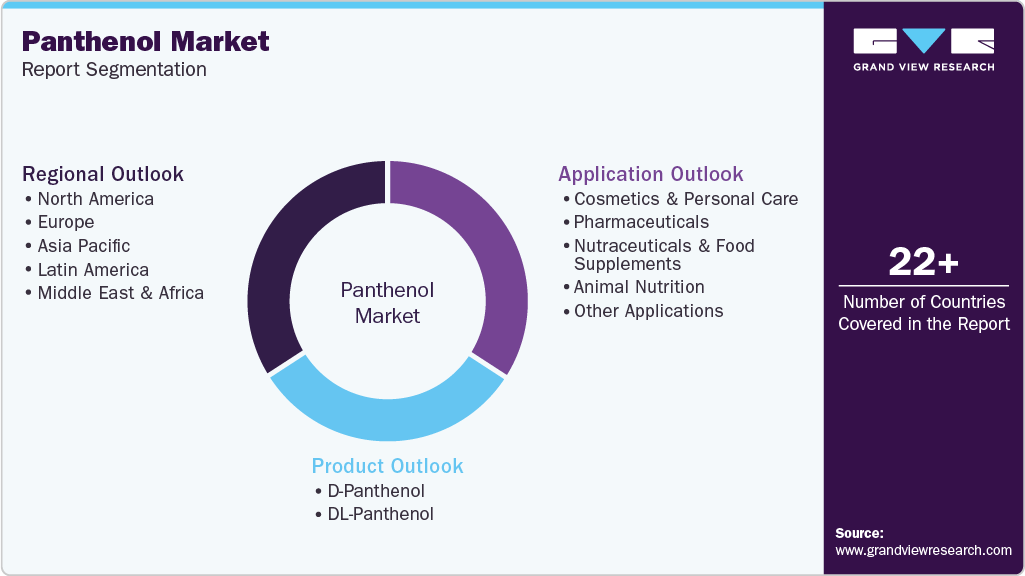

Global Panthenol Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global panthenol market report based on product, application, and region.

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 – 2033)

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 – 2033)

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 – 2033)

North America

Europe

Germany

UK

France

Italy

Spain

Asia Pacific

China

India

Japan

South Korea

Middle East & Africa

Saudi Arabia

South Africa

Latin America

Frequently Asked Questions About This Report

b. The global panthenol market size was estimated at USD 36.7 million in 2025 and is expected to reach 38.2 million in 2026.

b. The global panthenol market is expected to grow at a compound annual growth rate of 6.5% from 2026 to 2033 to reach USD 59.4 million by 2033.

b. The D-panthenol segment dominated the market with a 75.1% revenue share in 2025 due to its superior biological activity and higher efficacy compared to DL-panthenol, making it the preferred form in premium cosmetics and pharmaceutical formulations. The strong demand for high-purity, performance-driven ingredients in skincare, haircare, and dermatological applications reinforced its widespread adoption and market leadership.

b. Some of the key players operating in the panthenol market include dsm-firmenich, Yifan Pharmaceutical Co., Ltd., Xinfa Pharmaceutical Co., Ltd, Evonik Industries AG, Croma-Pharma GmbH, BASF SE, TRI-K Industries, Inc., Merck KGaA, Jiangxi Tongde Chemical Technology Co., Ltd., RITA Corporation, BASF SE, Dow, Honeywell International Inc., Royal Dutch Shell P.L.C, and Mitsui Chemicals, Inc.

b. The global panthenol market is driven by the rapid expansion of the cosmetics and personal care industry, supported by rising demand for multifunctional, high-performance active ingredients in skincare and haircare formulations. The growing pharmaceutical and nutraceutical applications, coupled with increasing consumer awareness of vitamin-based and dermatological benefits, are accelerating market growth.