e.l.f. Beauty (NYSE:ELF) has seen a rapid impact from its Rhode acquisition, which management credits with helping deliver a standout quarter. The company attributes its newly issued 2026 sales guidance to strong contributions from Rhode alongside continued traction in new markets. Management highlights Rhode’s market position and recent product launches as key drivers of the upgraded full year outlook.

For investors tracking NYSE:ELF, the Rhode deal is already showing up as a meaningful swing factor in the story. The stock closed at $74.33, with a 5 year return of 199.0%, and shorter term returns over 7 days, 30 days, year to date, and 1 year hovering close to flat. That mix reflects a company that has already created significant long term value, while more recent trading has been subdued.

In that context, the stronger guidance tied to Rhode’s contribution and international momentum represents a notable development for the thesis. Looking ahead, a central question for investors is how e.l.f. Beauty will integrate and scale Rhode while maintaining its position in core channels and price points.

Stay updated on the most important news stories for e.l.f. Beauty by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on e.l.f. Beauty.

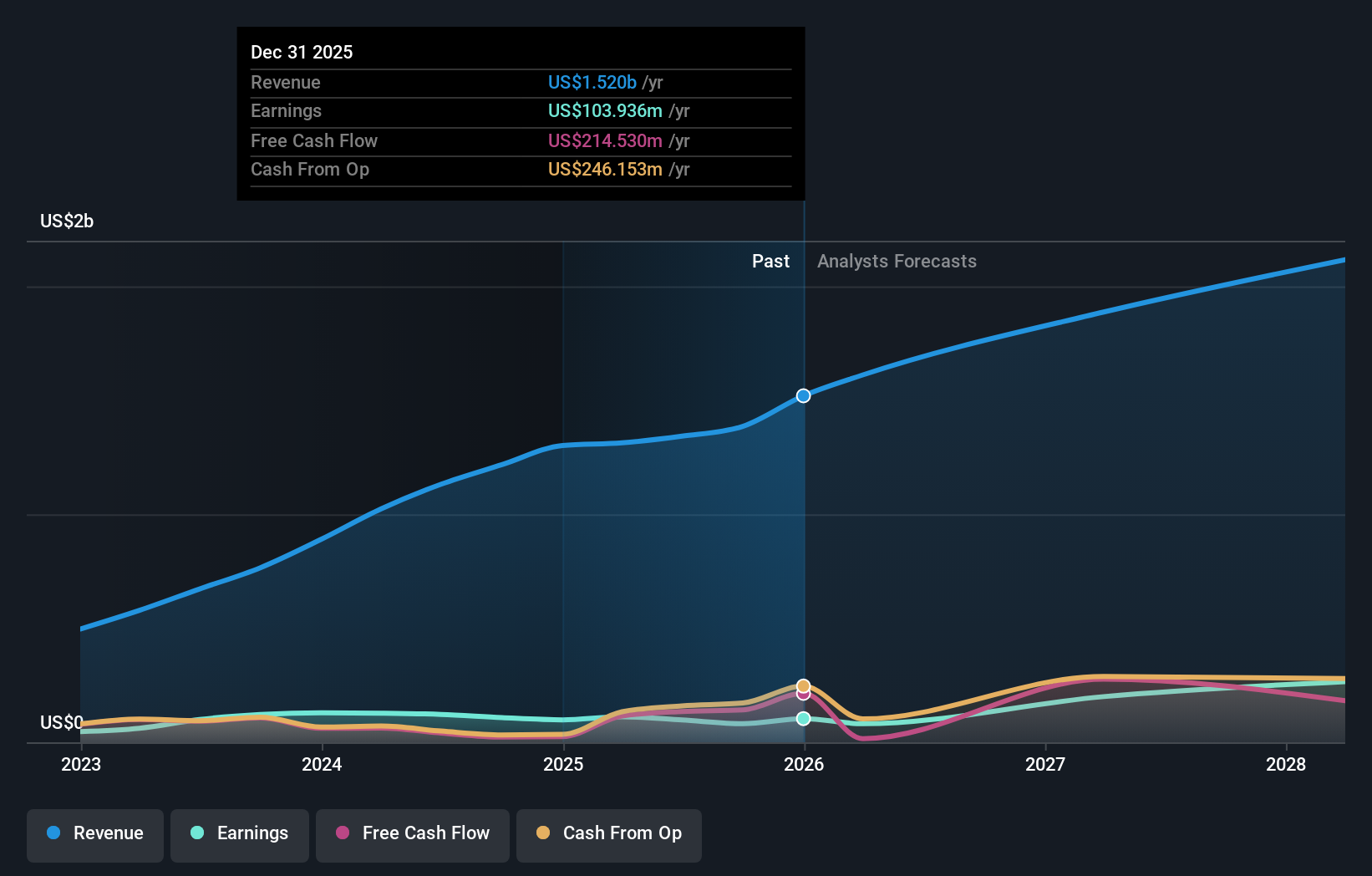

NYSE:ELF Earnings & Revenue Growth as at Feb 2026

NYSE:ELF Earnings & Revenue Growth as at Feb 2026

3 things going right for e.l.f. Beauty that this headline doesn’t cover.

The Rhode deal is showing up clearly in e.l.f. Beauty’s latest numbers. Quarterly sales reached US$489.51 million compared with US$355.32 million a year earlier, and management now expects fiscal 2026 net sales of US$1.60b to US$1.612b, up from prior guidance of US$1.55b to US$1.57b. Rhode is a big swing factor in that change, with management pointing to strong performance in Sephora North America and meaningful traction in new markets and channels. For you as an investor, the key takeaway is that acquisitions are not just additive to revenue, they are influencing how management thinks about the company’s medium term scale.

How This Fits Into The e.l.f. Beauty Narrative The stronger guidance and Rhode’s contribution line up with the narrative that acquisitions and international expansion can support higher long term revenue and brand diversification. Higher SG&A and integration spending tied to Rhode could pressure margins, which connects directly to the narrative risk that cost growth may outpace revenue if synergies take time. Rhode’s rapid success in Sephora and options activity in ELF may not be fully captured in older narratives that focused more on core e.l.f. Cosmetics and early stage global rollout.

Knowing what a company is worth starts with understanding its story.

Check out one of the top narratives in the Simply Wall St Community for e.l.f. Beauty to help decide what it’s worth to you.

The Risks and Rewards Investors Should Consider ⚠️ Integration and marketing costs for Rhode and other high growth brands could weigh on earnings if revenue synergies or international expansion slow. ⚠️ Analysts have flagged that core growth may cool to low single digits in the second half, which could leave the stock sensitive to any further reset in expectations. 🎁 Rhode’s performance, including strong retailer rankings and new product launches, is supporting higher fiscal 2026 net sales guidance of 22% to 23% year over year growth instead of 18% to 20%. 🎁 e.l.f. Beauty continues to grow through retailer and e commerce channels in the US and internationally, which broadens the revenue base beyond any single brand or market. What To Watch Going Forward

From here, you may want to watch how e.l.f. Beauty balances Rhode driven growth with profitability, especially as tariffs and higher operating expenses influence margins. Monitor whether Rhode keeps its momentum in Sephora and how quickly it scales internationally, as those trends will help explain whether the raised 2026 sales guidance proves conservative or ambitious. It is also worth tracking how analyst expectations evolve, including any further changes to price targets or commentary on core growth and acquisition payback periods, as these can influence how the market prices the stock relative to peers like L’Oréal and Coty.

To ensure you’re always in the loop on how the latest news impacts the investment narrative for e.l.f. Beauty, head to the

community page for e.l.f. Beauty to never miss an update on the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com