Europe Vitamin Market Size

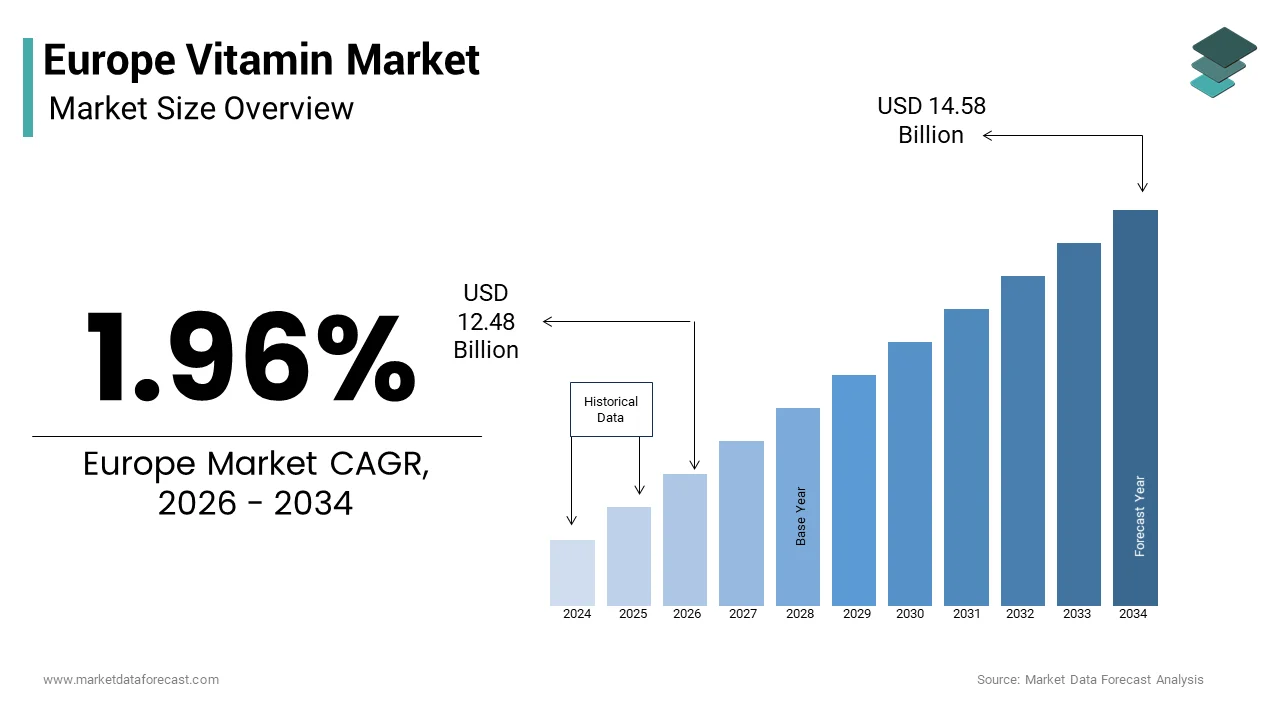

The Europe vitamin market size was valued at USD 12.24 billion in 2025 and is anticipated to reach USD 12.48 billion in 2026 to USD 14.58 billion by 2034, growing at a CAGR of 1.96% during the forecast period from 2026 to 2034.

Vitamins are individual and blended essential micronutrients including vitamins A, B-complex, C, D, E, and K in various formats such as tablets, capsules, gummies, powders, and fortified foods. These products are primarily used to address dietary insufficiencies, support physiological functions, and promote preventive health across diverse demographics. Unlike pharmaceuticals, vitamins in Europe are regulated as food supplements under Directive 2002/46/EC, which mandates strict safety assessments, labeling transparency, and permissible upper limits for each nutrient. As per the European Food Safety Authority’s consumer exposure survey, many adults in the European Union reported regular vitamin intake in 2023, with vitamin D, C, and B12 being the most commonly consumed. National health bodies in countries like Finland and Ireland actively recommend daily vitamin D supplementation due to limited sunlight exposure, while Germany’s Federal Institute for Risk Assessment notes rising self-directed use among urban populations seeking immune and cognitive support. This interplay of public health guidance, regulatory structure, and consumer driven wellness defines the unique contours of Europe’s vitamin landscape.

MARKET DRIVERS Widespread Vitamin D Deficiency and Public Health Endorsement

Vitamin D deficiency is a pervasive public health concern across Europe, which is directly fuelling sustained demand for supplementation and is a major factor propelling the European vitamin market growth. Due to high latitudes, seasonal sunlight variation, and indoor lifestyles, many Europeans exhibit suboptimal serum vitamin D levels during winter months, as documented by the European Commission’s Joint Research Centre. National health authorities have responded with clear guidance: the UK Scientific Advisory Committee on Nutrition recommends daily vitamin D intake for all adults from October to March, while Finland provides free vitamin D supplements to children and elderly citizens through its public health system. As per the Robert Koch Institute, a large portion of German adults have insufficient vitamin D status, prompting widespread self-supplementation. As per IQVIA, vitamin D supplement volumes grew in Western Europe in 2023. This convergence of clinical evidence, institutional endorsement, and consumer awareness transforms vitamin D from a niche supplement into a mainstream public health necessity.

Rising Focus on Immune Resilience and Preventive Self Care

The growing emphasis on immune health has significantly amplified demand for vitamins C, D, and zinc across Europe, which is further boosting the expansion of the European vitamin market. Consumers increasingly view these nutrients as accessible tools to bolster natural defences without medical intervention. As per the European Consumer Organisation, many supplement users cite supporting immunity as a primary motivation, with peak purchasing occurring during autumn and winter. National campaigns reinforce this trend; France’s Santé Publique regularly highlights the role of vitamin C in immune cell function, while Sweden’s Public Health Agency acknowledges the synergy between vitamins D and C in respiratory health. Retailers like DM in Germany and Boots in the UK report consistent growth in immune focused vitamin sales. As preventive self-care becomes culturally normalized, vitamins transition from reactive remedies to proactive wellness staples embedded in daily routines.

MARKET RESTRAINTS EU Wide Caps on Permitted Vitamin Dosages

The European vitamin market is significantly constrained by legally mandated upper limits on nutrient content in supplements, often set below clinically effective or commonly used doses elsewhere. Under Directive 2002/46/EC and subsequent national implementations, vitamin B6 is capped at 25 milligrams per daily dose, far below the 50 to 100 milligrams used in some neurological protocols. Similarly, vitamin D is restricted to 25 micrograms (1,000 IU) in many member states, despite EFSA acknowledging safety up to 100 micrograms. As per the European Federation of Associations of Health Product Manufacturers, these ceilings prevent companies from offering formulations aligned with emerging scientific evidence or consumer needs. As a result, European consumers seeking higher potency often resort to unregulated online imports, undermining local market integrity. This regulatory rigidity stifles innovation and forces homogenization, limiting the ability of manufacturers to differentiate based on efficacy or therapeutic relevance.

Scientific and Medical Skepticism Toward Routine Supplementation

Persistent skepticism among healthcare professionals and academic institutions dampens broader adoption of vitamins in Europe, which is further impeding the growth of the European vitamin market. Major reviews published in The Lancet and BMJ have concluded that routine multivitamin use offers no mortality benefit for healthy individuals, reinforcing physician reluctance to recommend them outside diagnosed deficiencies. As per a 2023 Eurobarometer survey, only a portion of Europeans trust the health benefits of vitamins, with distrust particularly high in Southern Europe. Unlike in the United States, where supplements are integrated into integrative medicine, European clinical guidelines typically restrict recommendations to at risk groups such as pregnant women or the elderly. This credibility gap discourages first time users and confines the market to already convinced segments. Without stronger alignment between public health messaging and clinical practice, the vitamin market remains vulnerable to narratives framing supplementation as unnecessary or commercially driven.

MARKET OPPORTUNITIES Personalized Nutrition Through Digital Health Platforms

The integration of at home diagnostics, AI driven analysis, and direct to consumer models presents a transformative opportunity for the European vitamin market. Startups across Europe now offer blood or DNA based testing kits that generate personalized vitamin recommendations based on individual biomarkers. As per the European Nutrigenomics Organisation, many personalized nutrition services launched in the EU between 2022 and 2024, focusing on vitamin D, B12, and folate optimization. Companies like ZOE in the UK and Lifeline Care in Sweden combine microbiome insights with micronutrient status to formulate custom vitamin plans. As per the European Commission’s Horizon Europe program, funding has been allocated to support digital personalized nutrition research, validating its scientific legitimacy. As wearable devices track sleep, stress, and sun exposure, future vitamin protocols could dynamically adjust dosing, which is positioning vitamins not as static pills but as responsive elements of a data driven wellness ecosystem.

Clean Label and Sustainable Vitamin Formulations

Consumer demand for transparency and environmental responsibility is reshaping vitamin product development across Europe, which is another promising opportunity in the European vitamin market. Shoppers increasingly reject synthetic additives, artificial colors, and plastic packaging, favoring plant derived nutrients, organic certification, and eco-friendly delivery systems. As per a 2023 Forsa Institute survey, many German consumers prefer vitamins with recognizable ingredients and minimal processing. Brands like Norsan and Vivo Life now offer algae sourced vitamin D3, lichen based B12, and natural vitamin E in glass bottles or compostable pouches. The upcoming EU Green Claims Directive will further incentivize verifiable sustainability credentials. Innovations in gummy and powder formats using stevia or fruit extracts cater to clean label preferences while improving palatability. This shift allows brands to differentiate beyond nutrient content and build loyalty through ethical sourcing, sensory quality, and environmental stewardship.

MARKET CHALLENGES Intense Private Label Competition and Price Compression

Despite growing interest, the European vitamin market faces severe margin pressure from aggressive private label expansion in pharmacies and supermarkets. Retailers like Rossmann, DM, and Carrefour offer store brand vitamins priced significantly lower than national brands, capturing substantial volume share. As per NielsenIQ, private label vitamins accounted for a large portion of unit sales in Western Europe in 2023, increasing from earlier years. Consumers often perceive little functional difference between generic and branded products, especially when health claims are legally restricted. This commoditization forces manufacturers to compete on cost rather than innovation, leading to formula simplification and reduced investment in bioavailability research. Without regulatory pathways to communicate superior sourcing or absorption, premium brands struggle to justify higher prices, undermining the market’s capacity to evolve toward science backed, high value offerings.

Fragmented Regulatory Interpretation Across Member States

Although governed by EU wide directives, vitamin regulations are inconsistently applied across national borders, which is creating compliance complexity and market access barriers and is another major challenge to the European vitamin market. For example, Germany requires pre-market notification for all supplements through its BfArM portal, while Spain permits immediate sale post labeling compliance. Some countries impose stricter national limits, such as Belgium capping vitamin A below the EU threshold. As per the European Responsible Nutrition Alliance, companies spend significant time and resources annually navigating divergent national requirements. This fragmentation deters small innovators and delays pan European launches, contradicting the single market ideal. Until harmonization improves, businesses face elevated operational costs and strategic uncertainty, particularly when scaling new formulations across diverse regulatory landscapes.

REPORT COVERAGE

REPORT METRIC

DETAILS

Market Size Available

2025 to 2034

Base Year

2025

Forecast Period

2026 to 2034

CAGR

1.96%

Segments Covered

By Source, Type, Application, End-user and Region.

Various Analyses Covered

Global, Regional, an, Country-Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities

Regions Covered

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, the Czech Republic, and the Rest of Europe

Market Leaders Profiled

Herbalife (US), Amway (US), GNC Holdings (US), Nature’s Bounty (US), NOW Foods (US), Solgar (US), Swanson Health Products (US), NutraBlast (US)

SEGMENTAL ANALYSIS By Source Insights

The synthetic vitamins segment held the largest share of the Europe vitamin market by accounting for 68.2% of the regional market share in 2025. This dominance is driven by cost efficiency, consistent potency, and scalability in meeting mass market demand across supplements and fortified foods. Synthetic vitamins such as ascorbic acid (vitamin C) and cyanocobalamin (vitamin B12) are produced through controlled chemical processes that ensure batch to batch uniformity and stability, critical for industrial applications. As per the European Food Safety Authority, a large majority of fortified breakfast cereals and dairy alternatives in the EU use synthetic vitamins due to their solubility, shelf life, and regulatory acceptance. Pharmaceutical grade supplement manufacturers also favor synthetic forms for precise dosing and compliance with EU maximum limits. Additionally, synthetic production avoids agricultural variability and supply chain disruptions associated with natural sources. While consumer perception often favors “natural,” the reality of large-scale public health fortification and affordable supplementation relies heavily on synthetics, which is making them the structural backbone of Europe’s vitamin infrastructure.

The natural vitamins segment is the fastest growing segment in the Europe vitamin market and is expected to expand at a CAGR of 8.84% over the forecast period owing to the rising consumer preference for whole food derived nutrients perceived as more bioavailable and environmentally aligned. Vitamins sourced from acerola cherries (vitamin C), algae (vitamin D3), sunflower oil (vitamin E), and nutritional yeast (B complex) resonate with clean label and plant-based movements. As per the European Consumer Organisation, many consumers aged 18 to 45 actively seek supplements labeled naturally sourced. Brands like Norsan in Germany and Vivo Life in the UK have capitalized on this trend by offering certified organic, non-GMO vitamin blends in sustainable packaging. The European Commission’s Farm to Fork Strategy further supports this shift by promoting bio-based ingredients in food and supplements. As transparency and traceability become competitive differentiators, natural vitamins transition from niche appeal to mainstream premium positioning.

By Type Insights

The Vitamin D segment commanded for the leading share of 30.3% of the European market in 2025. The growth of the vitamin D segment in the European market is driven by widespread deficiency across the continent due to limited UVB exposure, especially during autumn and winter months. As per the European Commission’s Joint Research Centre, many Europeans exhibit serum vitamin D levels below sufficiency thresholds. National health authorities reinforce supplementation: the UK recommends daily vitamin D for all adults from October to March, while Finland provides free supplements to children and seniors. As per IQVIA, vitamin D sales grew in Western Europe in 2023. Its role in bone health, immune modulation, and muscle function makes it relevant across age groups, from infants to the elderly. Unlike other vitamins, vitamin D functions as a prohormone, amplifying its physiological significance and justifying year-round consumption beyond seasonal trends.

The vitamin B complex segment is the fastest growing category in the Europe vitamin market and is estimated to witness a CAGR of 8.12% over the forecast period. This surge is driven by increasing awareness of B vitamins’ role in energy metabolism, cognitive function, and stress resilience. Vitamins B6, B9 (folate), and B12 are particularly sought after for their involvement in neurotransmitter synthesis and homocysteine regulation. As per the European Food Information Council, many working age adults report chronic fatigue, prompting self-directed use of B complex supplements. National guidelines support this: Germany’s Nutrition Society recommends B12 supplementation for vegans, while France mandates folic acid fortification counselling for women of childbearing age. Innovations in bioactive forms such as methylcobalamin and 5 MTHF enhance absorption and appeal to health literate consumers. As mental well-being gains policy attention, B complex vitamins emerge as essential tools for cognitive and metabolic vitality.

By Application Insights

The healthcare products segment dominated the market in 2025 by capturing 53.9% of the regional market share. Healthcare products is the primary route through which Europeans consume concentrated vitamins outside of fortified foods. Pharmacies, supermarkets, and e commerce platforms offer a vast array of single nutrient and multivitamin formulations tailored to immunity, energy, bone health, and aging. As per the European Responsible Nutrition Alliance, many Europeans use dietary supplements annually, with vitamins being the most common category. The segment benefits from high consumer autonomy, minimal medical gatekeeping, and strong brand trust in established players like Bayer and Haleon. National health campaigns such as Ireland’s vitamin D initiative further normalize supplement use. Unlike fortified foods, supplements allow precise dosing and targeted intake, making them indispensable for addressing specific deficiencies or lifestyle driven needs in a preventive health paradigm.

Within the food and beverages application, the fortified plant-based alternatives segment is the fastest growing sub segment and is estimated to record a CAGR of 9.1% over the forecast period. As vegan and flexitarian diets rise, consumers seek nutritionally complete dairy and meat substitutes. Since plant-based milks, yogurts, and meat analogs naturally lack key vitamins like B12, D, and calcium, manufacturers routinely fortify them to match or exceed dairy nutrition. As per the European Plant Based Foods Association, a large majority of oat and soy milk sold in Germany and Sweden are fortified with vitamins D2/D3 and B12. Regulatory frameworks permit such enrichment under EU fortification guidelines, enabling brands like Alpro and Oatly to position products as functional foods. This convergence of ethical consumption and nutritional adequacy transforms plant-based categories into high growth vectors for vitamin delivery beyond traditional supplement channels.

COUNTRY-LEVEL ANALYSIS Germany Vitamin Market Analysis

Germany was the largest player in the European vitamin market in 2025 and held 23.2% of the regional market share. The dominance of Germany in the European market is driven by its rigorous scientific standards, pharmacy centric distribution, and high health literacy. Many Germans regularly consume vitamins, primarily through Apotheken (pharmacies), where trained professionals guide purchases based on individual needs. As per the Robert Koch Institute, vitamin D deficiency affects a significant portion of adults in winter, which is driving consistent demand for evidence-based supplementation. German consumers prioritize purity, bioavailability, and compliance with BfArM regulations, favoring brands like Abtei and Doppelherz that emphasize clinical validation. The government’s National Reduction and Innovation Strategy actively promote micronutrient awareness, particularly for B12 among vegans and folate for women of childbearing age. This fusion of regulatory discipline, professional retail, and public health engagement makes Germany the most influential and mature vitamin market in Europe.

United Kingdom Vitamin Market Analysis

The United Kingdom accounted for the second largest share of the European vitamin market in 2025. The growth of the UK in the European market is driven by its openness to digital health integration and preventive self-care. British consumers are early adopters of personalized vitamin services. As per the UK Food Standards Agency, many consumers have used an online nutrition platform. Brands like Ritual and Heights leverage subscription models and clean label positioning to capture urban millennials seeking transparency and convenience. The NHS’s clear guidance recommending daily vitamin D for all adults normalizes supplementation as public health policy. Post Brexit, the UK has shown greater flexibility in approving novel nutrient forms, attracting innovation. As per the Health Food Manufacturers’ Association, online sales represent a significant portion of the market, driven by direct-to-consumer engagement. This dynamic ecosystem of digital access, regulatory agility, and wellness culture positions the UK as Europe’s most adaptive and forward-looking vitamin market.

France Vitamin Market Analysis

France is estimated to capture a prominent share of the Europe vitamin market over the forecast period owing to its pharmacist led distribution model and emphasis on preventive medicine. A large majority of vitamins are sold through pharmacies, where professionals provide personalized advice based on health status and lifestyle. As per Santé Publique France, national campaigns on vitamin D and folate have significantly increased public awareness, especially among women and seniors. French consumers favor minimalist, natural formulations and trust brands like Arkopharma that blend herbal traditions with micronutrient science. The government’s NutriNet Santé cohort study provides real world evidence that informs both public health messaging and product development. This synergy of professional oversight, scientific validation, and cultural alignment sustains France’s distinct and resilient vitamin landscape, where trust outweighs marketing.

Italy Vitamin Market Analysis

Italy is expected to register a healthy CAGR in the European vitamin market during the forecast period owing to its integration of supplementation into the Mediterranean lifestyle rather than as a clinical intervention. While traditional diets are rich in produce, modern shifts toward processed foods have created gaps, particularly in vitamin D and B12 among urban populations. As per Italy’s National Institute of Health, many adults show suboptimal vitamin D levels in winter, prompting increased supplement use. Italian consumers prefer gentle, food-based vitamins often combined with olive polyphenols or citrus bioflavonoids to enhance absorption. Pharmacies and para-pharmacies serve as key channels, with brands like Bios Line emphasizing digestibility and natural sourcing. The government’s National Prevention Plan includes micronutrient education, especially for pregnant women and the elderly. This holistic approach positions Italy as a bridge between tradition and modern nutritional science.

Netherlands Vitamin Market Analysis

The Netherlands is anticipated to record a healthy CAGR in the European vitamin market over the forecast period. Netherlands is marked by high consumer trust in scientific validation and environmental responsibility. Dutch shoppers prioritize transparency, with many checking ingredient origins and sustainability certifications as per Statistics Netherlands. The country hosts leading research institutions like Wageningen University, which collaborates with brands on bioavailability studies and clean label innovation. Companies such as Orthica and AOV offer vitamins in recyclable packaging with plant-based capsules and no synthetic additives. The Dutch Nutrition Centre actively promotes evidence-based supplementation, particularly for vitamin D and iodine, which are commonly deficient. Additionally, the Netherlands serves as a logistics hub for pan European e commerce distribution, enabling rapid delivery of fresh inventory. This combination of scientific rigor, ecological consciousness, and efficient infrastructure makes the Netherlands a progressive and influential player in Europe’s evolving vitamin sector.

COMPETITIVE LANDSCAPE

The Europe vitamin market features intense competition among multinational consumer health companies, national pharmacy brands and agile digital natives. Legacy players like Haleon and Bayer dominate through brand recognition scientific credibility and extensive retail distribution particularly in pharmacies. However, they face growing pressure from direct-to-consumer startups offering personalized clean label and sustainably packaged alternatives at competitive prices. Private label offerings from retailers like DM Rossmann and Carrefour further compress margins in the mass segment. Regulatory complexity creates high barriers to entry yet also limits innovation due to strict nutrient limits and claim restrictions. Differentiation increasingly hinges on transparency sourcing ethics and digital engagement rather than price alone. As consumers become more discerning about ingredient quality and environmental impact the competitive landscape is shifting toward value driven propositions that blend science sustainability and personalization across fragmented yet sophisticated European markets.

KEY MARKET PLAYERS

A dominating players that are in the Europe vitamin market are

Herbalife (US) Amway (US) Haleon Nestlé Health Science Bayer AG GNC Holdings (US), Nature’s Bounty (US) NOW Foods (US) Solgar (US) Swanson Health Products (US) NutraBlast (US) Top Players In The Market Bayer AG is a global life science leader with deep integration in the Europe vitamin market through its well established One A Day and Berocca brands. The company supplies a comprehensive portfolio of single and multivitamin formulations across pharmacies supermarkets and e commerce channels throughout the continent. Bayer leverages its scientific heritage to ensure product quality regulatory compliance and clinical relevance under EU food supplement directives. Recently the company reformulated its core vitamin lines to include bioavailable forms such as vitamin D3 B12 as methylcobalamin and folate as 5 MTHF while eliminating artificial colors and preservatives. It also launched a digital wellness platform in Germany and France offering personalized vitamin recommendations based on lifestyle assessments reinforcing its shift toward preventive consumer health solutions. Haleon is a major force in the Europe vitamin market as the owner of globally recognized brands including Centrum Supradyn and Emergen C. Headquartered in the UK the company serves millions of European consumers with science backed vitamin products tailored for immunity energy bone health and general wellness. Haleon invests heavily in clinical research to substantiate nutrient efficacy and collaborates with European universities on bioavailability and absorption studies. In recent years it has prioritized sustainability by transitioning packaging to recyclable materials and introducing plant based capsule options. The company also enhanced its direct-to-consumer capabilities across Western Europe enabling subscription models and personalized delivery that align with modern purchasing behaviors and digital health trends. Nestlé Health Science plays a strategic role in the Europe vitamin market through its medical nutrition and targeted supplementation portfolio including the Garden of Life and Vital Proteins brands. While traditionally known for clinical nutrition the company has expanded into consumer vitamins with a focus on clean label organic and whole food derived nutrients. Its offerings emphasize transparency traceability and natural sourcing resonating with health-conscious Europeans. Recently Nestlé Health Science integrated vitamin D and B12 into its plant-based protein lines to address common deficiencies in vegan diets. It also partnered with European telehealth platforms to offer personalized vitamin plans based on dietary intake analysis strengthening its position at the intersection of nutrition science and digital wellness. Top Strategies Used By The Key Market Participants

Key players in the Europe vitamin market prioritize scientific validation through clinical studies and academic collaborations to build consumer trust and comply with strict EU health claim regulations. They reformulate products using bioavailable nutrient forms such as cholecalciferol methylcobalamin and 5 MTHF while removing artificial additives to meet clean label demands. Companies invest in sustainable packaging including recyclable bottles and plant-based capsules to align with EU Green Deal objectives. Digital transformation is central with personalized recommendation engines subscription models and e commerce optimization enhancing direct consumer engagement. Additionally, they tailor formulations for specific demographics such as seniors, vegans and urban professionals to address evolving nutritional gaps and lifestyle trends across diverse European markets.

MARKET SEGMENTATION

This research report on the Europe vitamin market size is segmented and sub-segmented into the following categories.

By Form

Tablets Capsules Powders Liquids

By Type

Vitamins A Vitamins B Vitamins C Vitamins D Vitamins E

By End-Use

Dietary Supplements Pharmaceuticals Food Beverage

By Distribution Channel

Online Retail Pharmacies Supermarkets Health Stores

By Country

UK France Spain Germany Italy Russia Sweden Denmark Switzerland Netherlands Turkey Czech Republic Rest of Europe