Not everyone thinks it’s a bargain, but I do.

Smart investors debate whether it’s smart to keep some cash on the sidelines, waiting to be invested opportunistically. I see merit in both perspectives. But I’ve kept a cash position in recent years, hoping to use it once I saw some better deals.

The S&P 500 has provided above-average returns in recent years, meaning I’ve used less of this cash than I originally anticipated. But thankfully, I’ve been finding opportunities I like in recent months, allowing me to finally invest some of this cash.

My most recent addition is a small position in e.l.f. Beauty (ELF +9.53%). Allow me to briefly explain why I just bought this consumer discretionary stock.

A beautiful portfolio addition

As an investor, I’m prioritizing stocks where I actually like the business (as opposed to companies with good numbers but that I’m otherwise disinterested in), and members of my household are avid fans of e.l.f. Beauty’s products. This alone was enough to put the stock on my watch list. But it rose in the rankings due to its growth rate.

Image source: Getty Images.

e.l.f. Beauty expects to grow its fiscal 2026 net sales by at least 22% year over year — it’s already completed three quarters of fiscal 2026, and its net sales are up 21%. The company has found a growing base of adopters attracted to the low prices of its products.

On Aug. 1, e.l.f. Beauty raised its prices by about 15%, which is a substantial increase. But the company’s products are still roughly 20% cheaper than competitive mass-market brands, allowing it to remain a low-cost leader. In other words, it quickly boosted sales and margins without sacrificing its market position, which is a move I love.

Today’s Change

(9.53%) $7.08

Current Price

$81.41

Key Data Points

Market Cap

$4.8B

Day’s Range

$74.64 – $81.50

52wk Range

$49.40 – $150.99

Volume

112K

Avg Vol

2.1M

Gross Margin

65.91%

To be clear, e.l.f. Beauty is a profitable business, but profits are down. Tariffs have hit the company’s gross margin, considering its products are made in heavily hit China. And in May, it acquired beauty brand rhode for $1 billion, which has also impacted the financial statements for now.

Nevertheless, e.l.f. Beauty is growing its top line by double digits, navigating macro-economic volatility, and making acquisitions while still delivering profits according to generally accepted accounting principles (GAAP). I think that’s commendable.

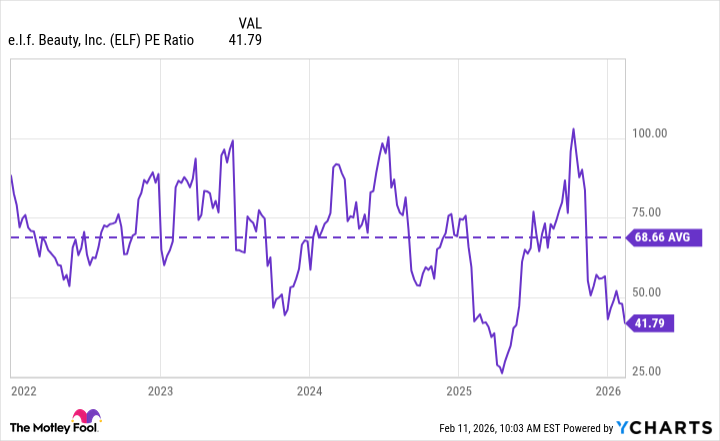

Moreover, e.l.f. Beauty stock has dropped significantly from its highs, and it now trades at a price-to-earnings (P/E) ratio of 42. While that’s considered expensive, it’s below its average valuation since the start of 2022, as the chart below shows.

ELF PE Ratio data by YCharts

Keep in mind that profits are down for e.l.f. Beauty, and the valuation is below average already. If profits return to more normalized levels as it works through what are (hopefully) temporary headwinds, profits should rise, further lowering the valuation.

In conclusion, e.l.f. Beauty stock provides what I’m looking for: a growing business generating profits that trades at a valuation I can support. Moreover, the company’s products are used in my own house, meaning I’ll likely be interested in watching the business and holding the stock for years to come.