e.l.f. Beauty (ELF) just delivered a quarter that beat expectations, raised its full year outlook, and highlighted strong demand for its Rhode brand, a mix that has clearly caught investors’ attention.

See our latest analysis for e.l.f. Beauty.

The latest earnings and guidance upgrade landed alongside a sharp 1 day share price return of 9.65%, which stands in contrast to the 1 month share price return of a 5.52% decline and a more moderate 1 year total shareholder return of 11.64%. This suggests that momentum has picked back up after a softer patch.

If this quarter has you rethinking what growth can look like in consumer names, it could be worth scanning our list of 23 top founder-led companies as a way to uncover other potential long term compounders.

With e.l.f. shares up sharply on the print but still below many analyst targets, the key question now is simple: is this renewed momentum giving you an attractive entry point, or is the market already baking in the next leg of growth?

Most Popular Narrative: 67.5% Undervalued

According to the most widely followed narrative, e.l.f. Beauty’s fair value sits at $251.03 per share versus the last close of $81.50, a wide gap that frames the current debate around the stock.

Catalysts: e.l.f. Beauty has experienced tremendous growth in recent years, and several key catalysts have contributed to this success. Here are some of the most significant factors driving the company’s expansion:

• Strong Brand Positioning and Product Innovation: e.l.f. Beauty has established itself as a leading brand in the masstige beauty category, offering high-quality products at affordable prices. The company is known for its innovative approach to product development, consistently introducing new and exciting items that appeal to a wide range of consumers.

According to WallStreetWontons, this valuation leans heavily on how fast e.l.f. can keep scaling its brand reach, how much revenue can build on that base, and what kind of profit margins it can hold onto as it grows.

Result: Fair Value of $251.03 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, you still need to weigh risks such as decelerating sales growth and rising costs, which could pressure margins and challenge the optimistic undervaluation case.

Find out about the key risks to this e.l.f. Beauty narrative.

Another View: What The P/E Ratio Is Saying

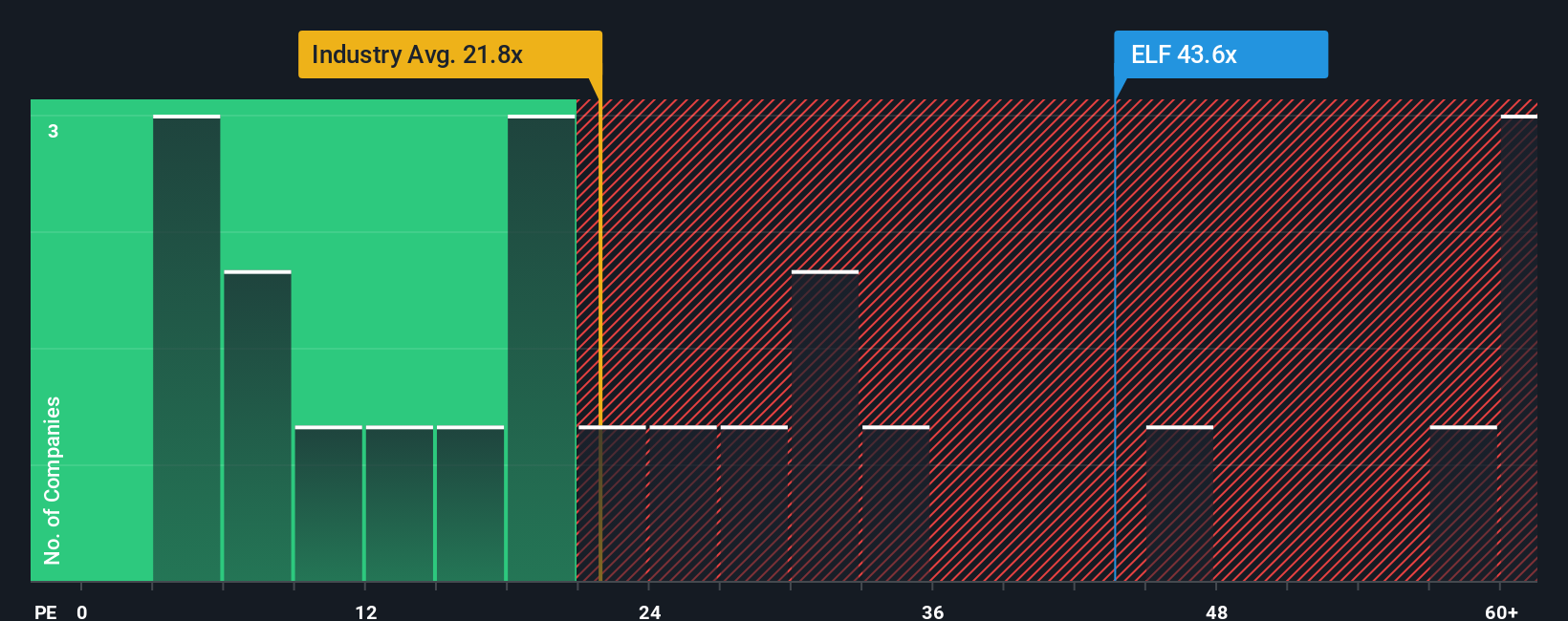

That $251.03 fair value from the popular narrative sits awkwardly next to the current P/E of 46.3x, which is more than double the North American Personal Products industry at 22.2x and well above the peer average of 12.8x. Even versus a fair ratio of 50.1x, you are paying up. Is this a quality premium or a valuation risk to you?

See what the numbers say about this price — find out in our valuation breakdown.

NYSE:ELF P/E Ratio as at Feb 2026 Build Your Own e.l.f. Beauty Narrative

NYSE:ELF P/E Ratio as at Feb 2026 Build Your Own e.l.f. Beauty Narrative

If you see the numbers differently or simply prefer to test your own assumptions, you can build a complete e.l.f. thesis in just a few minutes, starting with Do it your way.

A great starting point for your e.l.f. Beauty research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready to hunt for more ideas?

If e.l.f. has sparked new questions for you, do not stop here, use the Simply Wall St screener to spot other stocks that might suit your approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com