WeShop Holdings (NasdaqCM:WSHP) is expanding its marketplace into the health and fitness category with leading global brands. The company is rolling out new platform features focused on user trust, safety, and a smoother onboarding process. Key additions include a two-layer content moderation system and username reservation to support community growth and retention.

For you as an investor, this move places NasdaqCM:WSHP in the middle of two large, active online segments: e-commerce and health and wellness. Adding fitness and wellness brands to its social commerce model, which already ties shopping activity to ownership-driven rewards, may make the platform more relevant for frequent, high-engagement categories.

The renewed focus on trust tools and onboarding, including layered moderation and reserved usernames, is also worth tracking. If these features help more users feel comfortable joining and returning to the app, they may influence how sticky the community becomes over time and how the business model of NasdaqCM:WSHP develops.

Stay updated on the most important news stories for WeShop Holdings by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on WeShop Holdings.

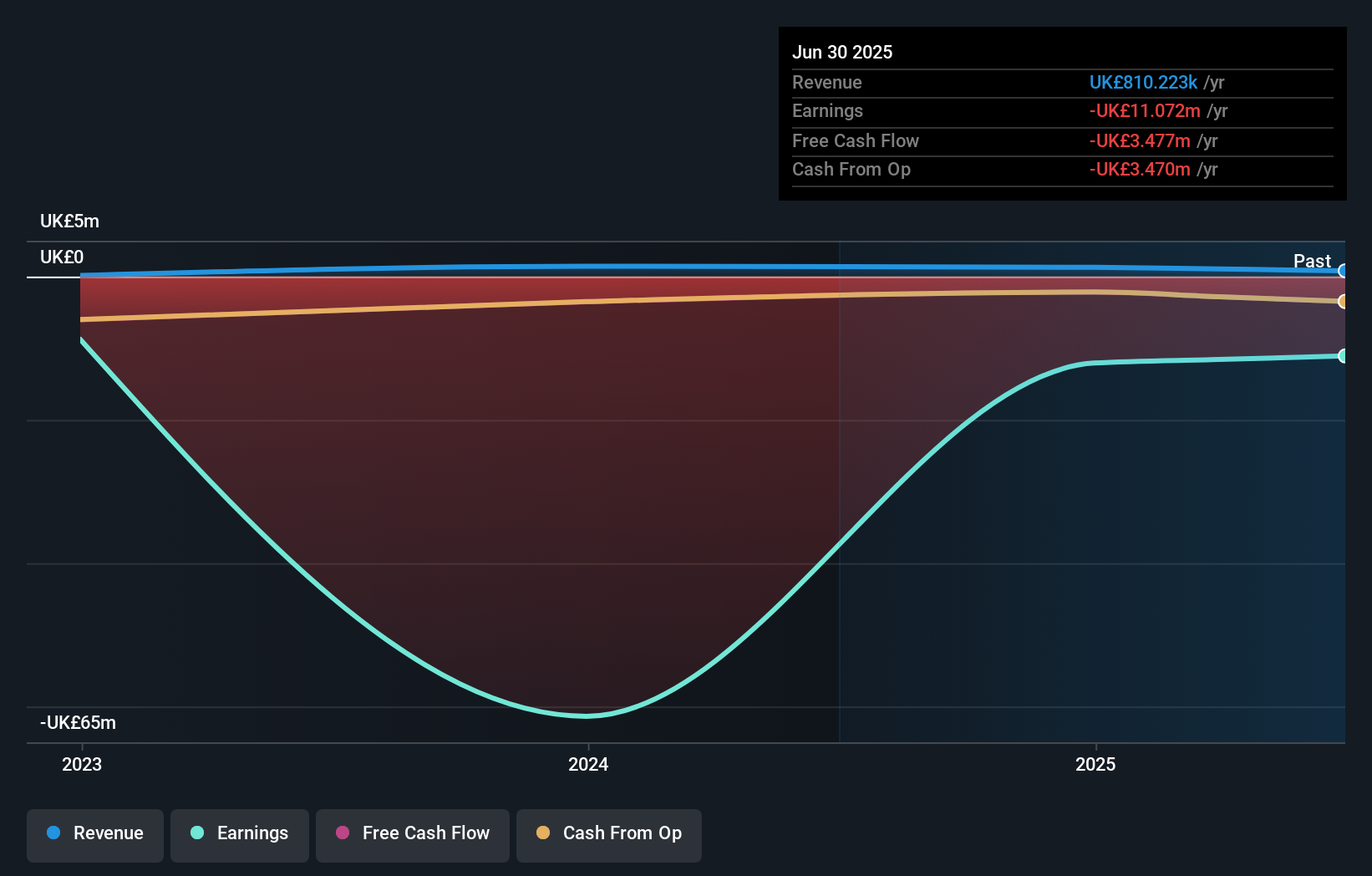

NasdaqCM:WSHP Earnings & Revenue Growth as at Feb 2026

NasdaqCM:WSHP Earnings & Revenue Growth as at Feb 2026

We’ve flagged 4 risks for WeShop Holdings. See which could impact your investment.

Quick Assessment ⚖️ Simply Wall St Valuation: Valuation status is currently unknown, so the US$37.41 share price cannot be compared to an internal fair value yet. ❌ Recent Momentum: The 30 day return of roughly 51% decline suggests weak short term sentiment around the stock.

There is only one way to know the right time to buy, sell or hold WeShop Holdings. Head to Simply Wall St’s

company report for the latest analysis of WeShop Holdings’s Fair Value.

Key Considerations 📊 Expanding into health and fitness with global brands links WeShop’s social commerce model to a large, engagement heavy category that could influence user activity over time. 📊 Given the negative earnings, P/E of roughly 58 and limited revenue, you may want to watch how new categories and trust features affect user growth and monetisation metrics. ⚠️ Major risks include revenue that has fallen 41% over the past year, less than one year of cash runway and a highly volatile share price. Dig Deeper

For the full picture including more risks and rewards, check out the

complete WeShop Holdings analysis. Alternatively, you can check out the

community page for WeShop Holdings to see how other investors believe this latest news will impact the company’s narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if WeShop Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com