Planet Fitness (NYSE:PLNT) has signed a new franchise agreement with Impulso Gym to expand its footprint in Mexico. The company is growing its presence in markets where fitness club penetration is relatively low. Planet Fitness has also appointed Stephen Beard, an experienced executive in education and organizational transformation, to its board of directors.

For investors, this move into Mexico highlights how Planet Fitness is focusing on international opportunities where gym membership levels are still developing. The partnership model with Impulso Gym allows the company to scale its low-cost fitness offering without owning every location directly, which is core to how NYSE:PLNT operates.

The addition of Stephen Beard to the board adds experience in leadership and organizational change at a time when the company is broadening its global reach. Together, the Mexico expansion and the new board appointment may influence how Planet Fitness prioritizes capital, growth markets and member experience.

Stay updated on the most important news stories for Planet Fitness by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Planet Fitness.

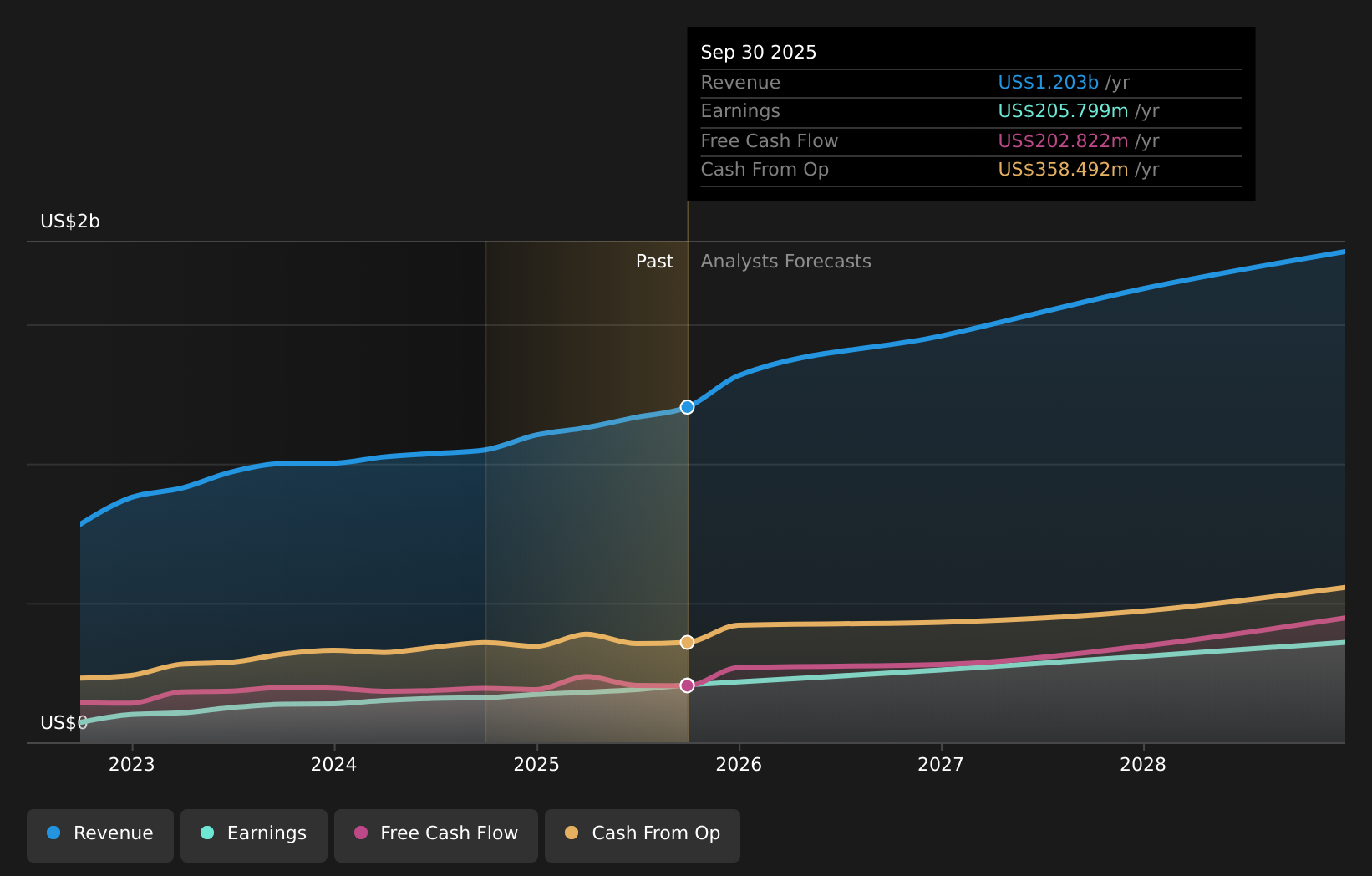

NYSE:PLNT Earnings & Revenue Growth as at Feb 2026

NYSE:PLNT Earnings & Revenue Growth as at Feb 2026

4 things going right for Planet Fitness that this headline doesn’t cover.

For Planet Fitness, the franchise agreement with Impulso Gym looks like a continuation of its asset light playbook, using local partners to reach new members without tying up large amounts of capital. Impulso’s experience running other U.S. consumer brands in Mexico, and its prior role in building early Planet Fitness clubs in Monterrey, suggests operational know how that could matter in markets like Tijuana and Mexicali. With gym penetration in Mexico reportedly below 7%, expansion here is more about capturing first time gym users than displacing rivals such as Smart Fit or local independents, which can support the company’s beginner focused positioning.

How This Fits Into The Planet Fitness Narrative The Mexico rollout lines up with the narrative of growth from new markets and younger members, as low cost Classic and PF Black Card memberships can appeal to first time gym goers who are price sensitive. Reliance on franchisees and rapid club openings could test the assumption that expansion remains smooth and profitable if franchise economics or member churn come under pressure. The specific contribution from international markets like Mexico and Spain, and how cross border Black Card access shapes member behavior, is not fully reflected in the high level narrative about expansion and pricing.

Knowing what a company is worth starts with understanding its story.

Check out one of the top narratives in the Simply Wall St Community for Planet Fitness to help decide what it’s worth to you.

The Risks and Rewards Investors Should Consider ⚠️ The franchise heavy model means Planet Fitness depends on partners like Impulso Gym to maintain club quality, which can be a concern if franchisees face financial strain or execution issues. ⚠️ Analysts have flagged 2 major risks, including negative shareholders equity and debt that is not well covered by operating cash flow, which could limit flexibility if expansion plans require more support. 🎁 Analysts currently see several rewards, such as earnings growth forecasts and an assessment that the shares trade slightly below an internal fair value estimate. 🎁 International growth, including Mexico, adds another potential source of members on top of the existing U.S. base, which may help the brand compete with other low cost operators like Crunch Fitness and regional chains. What To Watch Going Forward

From here, it is worth watching how quickly clubs in Tijuana and Mexicali ramp up membership and whether pricing at MXN 279 for Classic and MXN 499 for PF Black Card supports healthy franchise returns. The cross border perk of using any Planet Fitness club worldwide could be an extra draw for members who travel between Mexico and the U.S., but it will be important to see if this benefit drives enough Black Card uptake to matter. On the governance side, investors may track how Stephen Beard’s board role influences decisions on international expansion, capital allocation, and franchise standards.

To ensure you’re always in the loop on how the latest news impacts the investment narrative for Planet Fitness, head to the

community page for Planet Fitness to never miss an update on the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com