Nestlé, the Swiss food giant, is facing a challenge in its attempt to divest from its mass-market vitamin brands. The rise in demand for expensive, scientifically-backed products among health-conscious consumers is complicating the corporation’s efforts to secure a high price for its low-growth, low-margin brands.

A Shift in Consumer Preferences

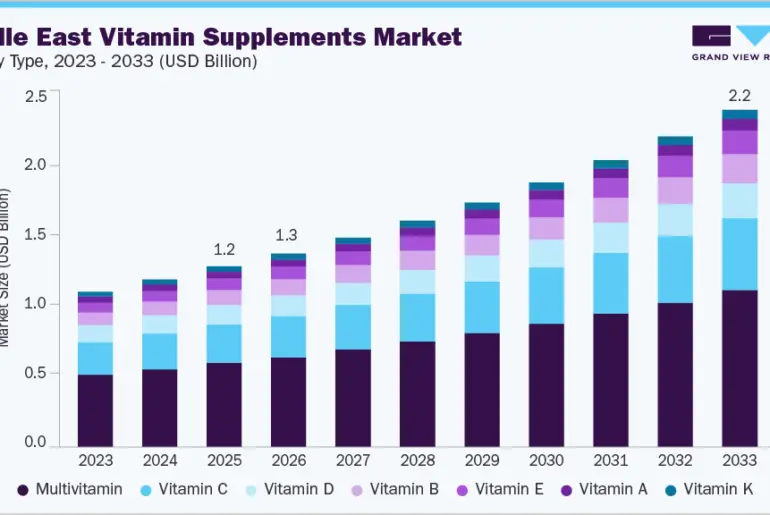

In July, Nestlé announced a strategic review of its brands in the vitamins, minerals, and supplements category with an eye towards a potential sale. This decision, reaffirmed by new CEO Philipp Navratil, is driven by a growing consumer trend. Global supplement market trends indicate a shift towards brands offering supplements with scientifically proven ingredients. This trend is a potential hurdle for Nestlé, as it considers the sale of affordable mainstream brands such as Nature’s Bounty, Osteo Bi-Flex, and Puritan’s Pride, as well as its US private label business.

The supplement market itself is quite fragmented, with its regulatory landscape continually changing. This adds an element of risk to any potential acquisition. Although industry players are showing a lack of interest, private equity funds appear more likely to be potential purchasers.

The brands Nestlé is contemplating selling account for 2.8 per cent of its yearly sales, approximately $1.25 billion. Nestlé intends to increase its focus on premium dietary supplement brands, like Solgar, which offers a range of products from standard vitamins to those aimed at promoting brain health, hair growth, and stress reduction.

A Potential Opportunity for Private Equity

Nestlé’s acquisition of these vitamin brands in 2021, for US$5.75 billion, was the third-largest transaction in the vitamin, mineral, and supplement space of the last 12 years. However, matching these valuations could be challenging given the high consumer interest in brands offering products that have undergone rigorous clinical testing.

Competitors such as Danone and Unilever are showing a preference for high-end brands with evident growth potential. Both companies are exercising caution regarding the mass supplements market due to the stringent European consumer protection regulation, which poses challenges to making promises about a product’s health benefits.

Moreover, the return on investment is uncertain in such a fragmented industry. No brand that Nestlé is considering selling owns more than 2.1 per cent of the US vitamin market.

Future Regulatory Challenges

The future US regulatory landscape is another factor to consider. In March, the US Health Secretary expressed a desire to tighten the federal approval process for new food additives. Should this be finalized, it could increase scrutiny of new ingredients, making it more difficult for companies to market new food additives without US Food and Drug Administration review. This has elicited opposition from the Council for Responsible Nutrition, a supplement industry trade group.

The preference against Nestlé’s mass-market vitamins is not limited to direct competitors in the packaged goods arena. GNC, a supplement retailer, is focusing on innovation within its own range and aligning with science-backed standards.

Despite these challenges, the potential upside is significant. The global dietary supplement market, valued at US$192.7 billion in 2024, is projected to surge to $414.5 billion by 2033. This could attract buyout funds, but they are likely to drive a hard bargain.

Questions & Answers

What is the main hurdle Nestlé is facing in selling its vitamin brands?

The main hurdle is the shift in consumer preferences towards expensive, scientifically-backed supplement products, which contrasts with the affordable, mass-market positioning of the brands Nestlé is considering selling.

What are the potential regulatory challenges for the supplement industry?

The regulatory landscape is continually changing, and there is talk of tightening the federal approval process for new food additives in the US. This could increase scrutiny of new ingredients and make it more difficult for companies to market new food additives without review.

What is the potential future growth of the global dietary supplement market?

The global dietary supplement market, valued at US$192.7 billion in 2024, is projected to increase to $414.5 billion by 2033. This substantial growth could attract potential buyers despite the current challenges.