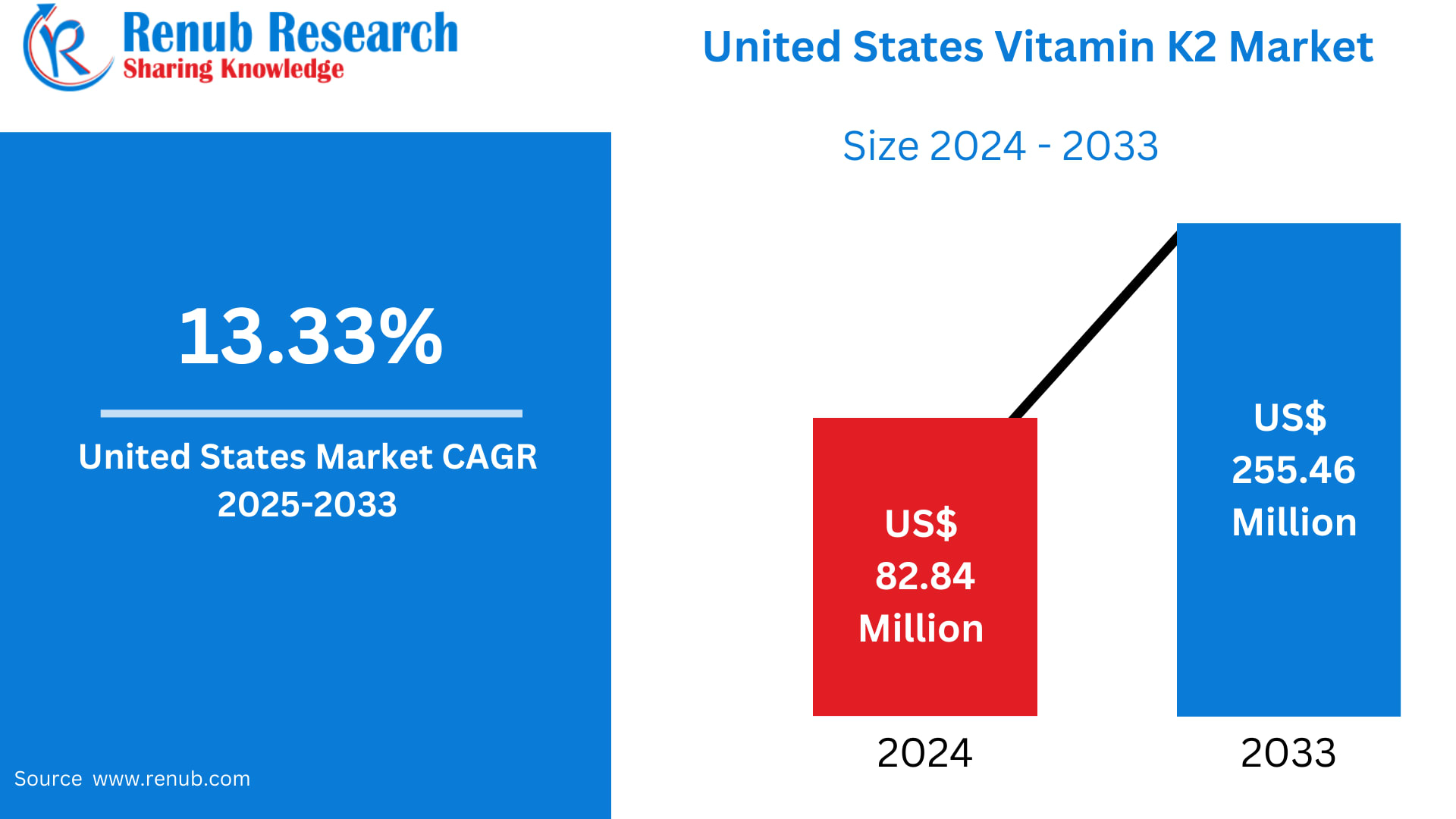

The United States Vitamin K2 Market is positioned for a dramatic expansion over the next decade. According to Renub Research, the market will surge from US$ 82.84 million in 2024 to US$ 255.46 million by 2033, growing at a strong CAGR of 13.33% (2025–2033). This powerful trajectory reflects a combination of rising consumer health awareness, the shifting landscape of preventive healthcare, the aging U.S. population, and the massive growth of the nation’s dietary supplement and functional food industries.

While Vitamin K1 has long been recognized for its role in blood coagulation, Vitamin K2 (menaquinone) has recently taken center stage due to its superior benefits for calcium metabolism, bone mineralization, and cardiovascular protection. With Americans increasingly focused on long-term wellness, heart health, mobility, and quality of life, Vitamin K2 has quickly evolved from a niche nutrient to a mainstream health essential.

Understanding the U.S. Vitamin K2 Market: What Makes It so Important?

Vitamin K2 is a fat-soluble vitamin naturally found in fermented foods (like natto), cheese, eggs, and some meats. It belongs to a family of menaquinones—most notably MK-4 and MK-7—which play a critical role in regulating where calcium goes in the body.

The Science Behind the Surge

Vitamin K2 activates specific proteins that ensure:

Calcium reaches bones and teeth

Calcium does not accumulate in soft tissues and arteries

Arterial calcification risk is reduced

Bone density and strength are enhanced

This dual action makes Vitamin K2 essential in:

Preventing osteoporosis, especially in older adults

Reducing cardiovascular disease risk

Supporting long-term mobility and wellness

New studies continue to underline K2’s potential in preventing chronic illnesses such as atherosclerosis, osteoporosis, and even some forms of metabolic disorders. As a result, U.S. consumers, physicians, and nutritionists are increasingly incorporating Vitamin K2 into daily health regimens.

Growth Drivers Fueling the U.S. Vitamin K2 Market

1. Rising Awareness of Bone & Cardiovascular Health

Heart disease remains the leading cause of death in the United States. With February recognized nationally as Heart Month, public education campaigns have increased awareness about cardiovascular risks.

Vitamin K2’s unique ability to direct calcium into the bones and away from arteries has become a major selling point. As osteoporosis and CVD cases rise, more Americans are purchasing supplements that offer proven long-term benefits.

Healthcare professionals—particularly cardiologists and endocrinologists—are now recommending Vitamin K2 alongside Vitamin D3 and calcium supplements, creating a major boost for market demand.

2. A Rapidly Aging U.S. Population

The U.S. Census Bureau predicts that one in every five Americans will be 65+ by 2030. Claritas Pop-Facts 2024 reports:

U.S. population in 2025: 337.6 million

Expected to surpass 345.7 million by 2030, up 2.4%

Older adults face higher risks of:

Bone fractures

Osteoporosis

Cardiovascular calcification

Thus, preventive healthcare is becoming a lifestyle, not a trend. Seniors are increasingly gravitating toward evidence-backed supplements like Vitamin K2, especially MK-7, due to its higher bioavailability and longer half-life.

Manufacturers are responding with consumer-friendly formats:

Gummies

Effervescent drinks

Liquid drops

Softgels

Fortified food products

This aligns with the broader shift toward proactive, longevity-focused healthcare.

3. Explosion of Functional Foods & Nutraceuticals

The U.S. nutraceuticals industry is growing at record pace, with consumers preferring foods that offer added health benefits. Vitamin K2 is now being integrated into:

Dairy products

Yogurts

Nutrition bars

Breakfast cereals

Beverages

Plant-based foods

A major breakthrough came in July 2024, when Kappa Bioscience launched K2VITAL MCT Organic, the first USDA-certified organic all-trans MK-7 for U.S. markets. This development has opened the doors for a new generation of organic Vitamin K2 supplements and fortified foods.

The clean-label movement—emphasizing natural, minimally processed ingredients—has propelled demand for natural K2 sourced from fermented soybeans (natto) and bacterial fermentation.

Key Market Challenges

Despite strong growth, the U.S. Vitamin K2 market faces several bottlenecks:

1. High Production Costs & Raw Material Shortages

Producing Vitamin K2—especially MK-7—involves:

Complex fermentation processes

Expensive purification methods

Limited availability of specialized bacterial strains

These factors result in higher retail prices compared to popular vitamins like C, D, or B-complex, making K2 less accessible for price-sensitive consumers.

2. Low Consumer Awareness

Even though scientific studies strongly support Vitamin K2’s benefits, public awareness lags behind.

Most consumers still confuse:

Vitamin K1 (for blood clotting)

Vitamin K2 (for heart & bone health)

This knowledge gap slows supplement adoption.

3. Regulatory Restrictions on Health Claims

In the U.S., supplement manufacturers must comply with strict FDA and FTC guidelines.

Claims related to:

Cardiovascular health

Arterial calcification

Disease prevention

…require careful wording, making marketing and product labeling more complicated.

These regulatory boundaries create challenges for brands looking to educate consumers aggressively.

Market Overview by Key Segments

United States Vitamin MK2 Market

Though less researched than MK-7, MK-4 remains popular for bone health benefits. It is increasingly included in:

Specialized bone health formulas

Combination supplements

Clinical nutrition products

Demand is rising in niche consumer groups looking for faster absorption and short-term action.

Vitamin K2 Powder & Crystalline Market

These formats are preferred by:

Nutraceutical manufacturers

Functional food brands

Supplement formulators

Benefits include:

High stability

Easy blending

Long shelf life

Powder form is particularly favored for beverage blends, tablets, and high-dose capsules.

Natural Vitamin K2 Market

Driven by clean-label preferences, natural K2 from fermented sources is gaining traction among:

Vegans

Organic consumers

The premium supplement segment

Manufacturers are investing heavily in natural fermentation processes to meet the rising demand.

Vitamin K2 Health Supplements Market

Supplements constitute the largest share of the U.S. Vitamin K2 market. Popular forms include:

Capsules

Tablets

Softgels

Gummies

The supplement category benefits from:

Physician endorsements

E-commerce expansion

Consumer familiarity and convenience

Offline Distribution Market

Despite the growth of online retail, the offline channel remains dominant, with major sales through:

Drugstore chains

Supermarkets

Specialty health stores

Nutrition retailers

Consumers often rely on in-person advice, brand trust, and professional recommendations when purchasing supplements.

Regional Market Highlights

Washington

Health-conscious consumers and a strong nutraceutical industry ecosystem make Washington a rapidly expanding Vitamin K2 market. Urban and suburban populations are actively investing in preventive health supplements.

California

California represents one of the strongest state markets due to:

A large wellness-driven population

Major nutraceutical headquarters

Strong adoption of functional foods and clean-label supplements

Its cultural emphasis on holistic health fuels innovation and product launches.

New York

New York’s booming Vitamin K2 market is driven by:

High consumer awareness

Strong healthcare sector influence

High retail availability in pharmacies and health stores

Vitamin K2 has become a mainstream nutrient for bone and heart health among New Yorkers prioritizing preventive wellness.

Market Segmentations Overview

Product:

MK-7

MK-4

Dosage Form:

Powder & Crystalline

Capsules & Tablets

Oils & Liquid

Source:

Natural

Synthetic

Application:

Health Supplements

Functional Foods & Beverages

Distribution Channel:

Offline

Online

Top States Covered:

California, Texas, New York, Florida, Illinois, Pennsylvania, Ohio, Georgia, New Jersey, Washington, North Carolina, Massachusetts, Virginia, Michigan, Maryland, Colorado, Tennessee, Indiana, Arizona, Minnesota, Wisconsin, Missouri, Connecticut, South Carolina, Oregon, Louisiana, Alabama, Kentucky, and the Rest of the U.S.

Major Companies Operating in the U.S. Vitamin K2 Market

Each company can be analyzed across five viewpoints: Overview, Key Person, Recent Developments, SWOT Analysis, and Revenue Analysis.

Key Players

NOW Foods

Life Extension

Nestlé

Bronson

NatureWise

Solaray

Natural Factors

Source Naturals

These companies are expanding portfolios with high-bioavailability MK-7 formulations, organic ingredients, and innovative delivery formats.

Final Thoughts: The Future of Vitamin K2 in the United States

The U.S. Vitamin K2 market is moving from niche supplement to mainstream wellness essential, driven by growing awareness of its critical role in:

Bone health

Cardiovascular protection

Longevity

Preventive wellness

With Renub Research projecting the market to reach US$ 255.46 million by 2033, the decade ahead promises rapid innovation, new functional food launches, expanding retail distribution, and greater adoption among seniors and health-focused consumers.

As more Americans prioritize healthy aging, heart health, and nutrient-based preventive care, Vitamin K2 is set to become one of the most important nutraceuticals shaping the future of U.S. healthcare.