Women’s Wellness Products Market Summary

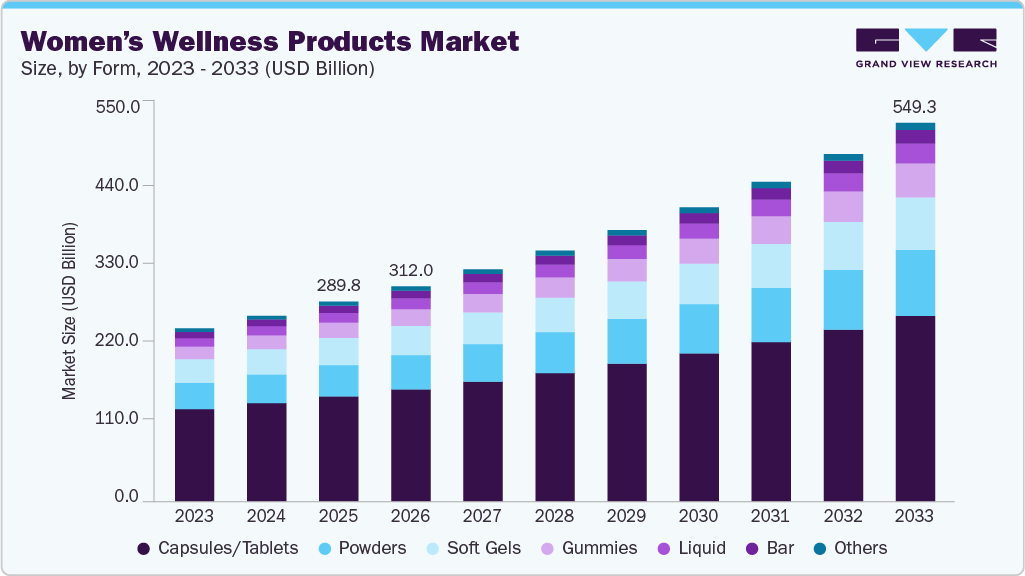

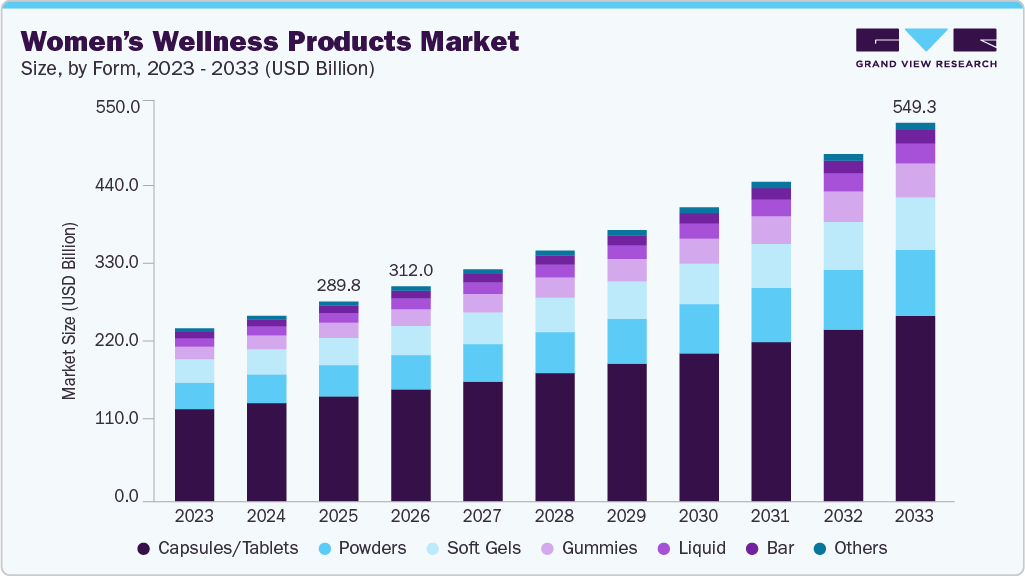

The global women’s wellness products market size was estimated at USD 289.77 billion in 2025 and is projected to reach USD 549.35 billion by 2033, growing at a CAGR of 8.4% from 2026 to 2033. The market is being propelled by a convergence of socio-economic, health, and technological factors that reflect shifting consumer priorities and broader demographic changes.

Key Market Trends & Insights

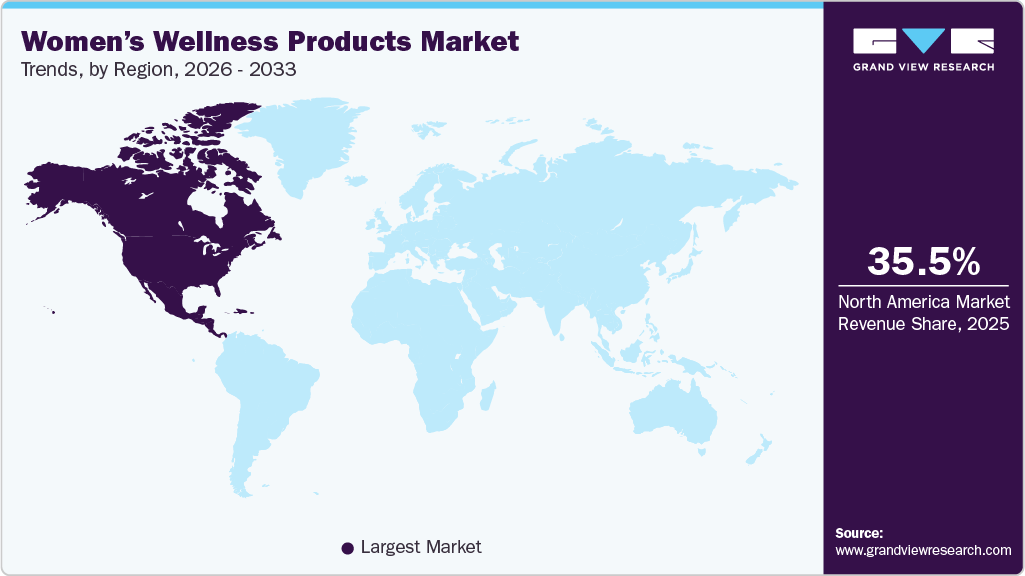

North America dominated the global women’s wellness products market in 2025 with a share of 35.48%.

The women’s wellness products market in the U.S. is projected to grow at a CAGR of 7.1% from 2026 to 2033.

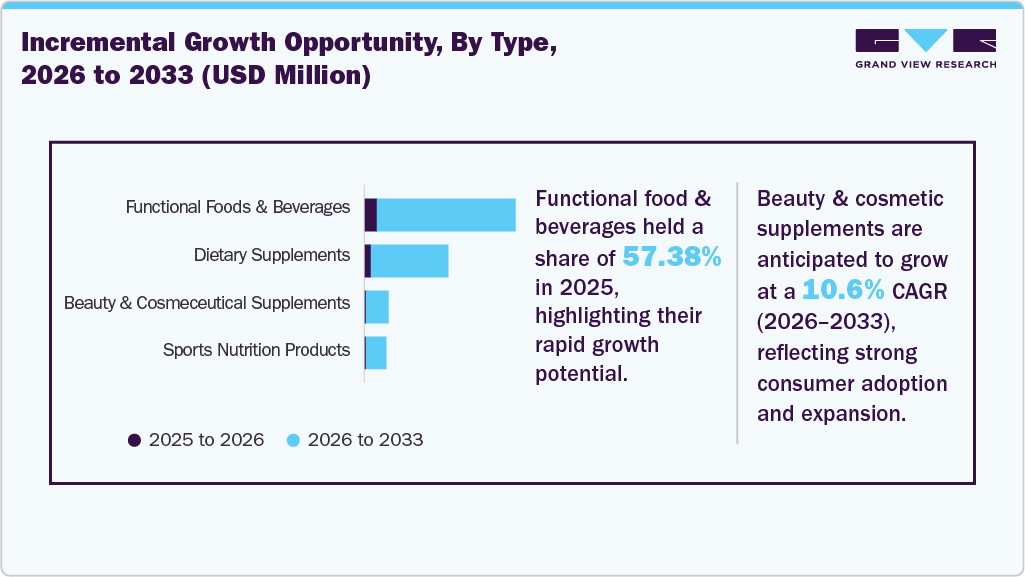

Based on type, the functional food & beverages segment accounted for a share of 57.38% in 2025.

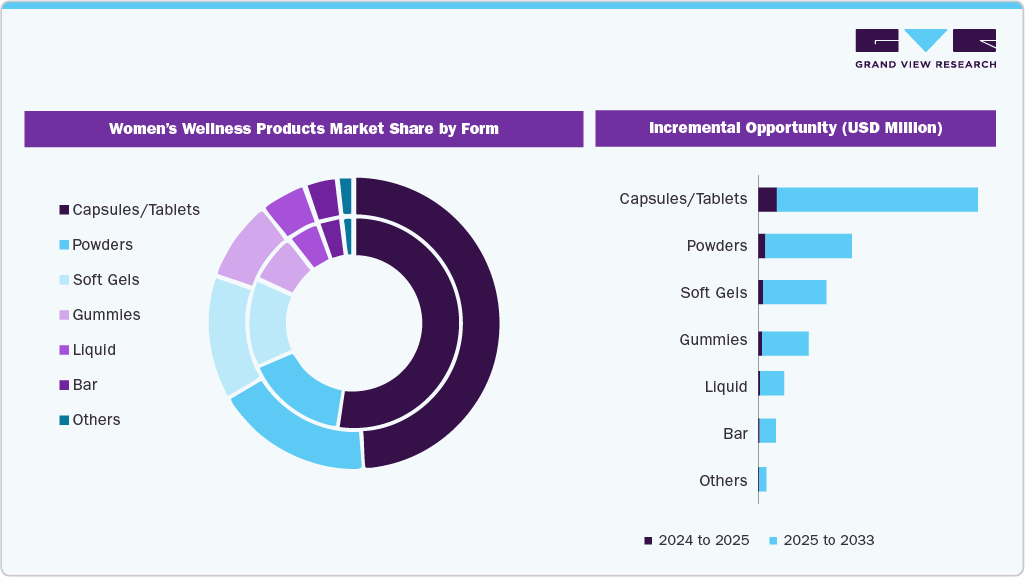

Based on form, gummies are expected to witness a CAGR of 10.7% from 2026 to 2033.

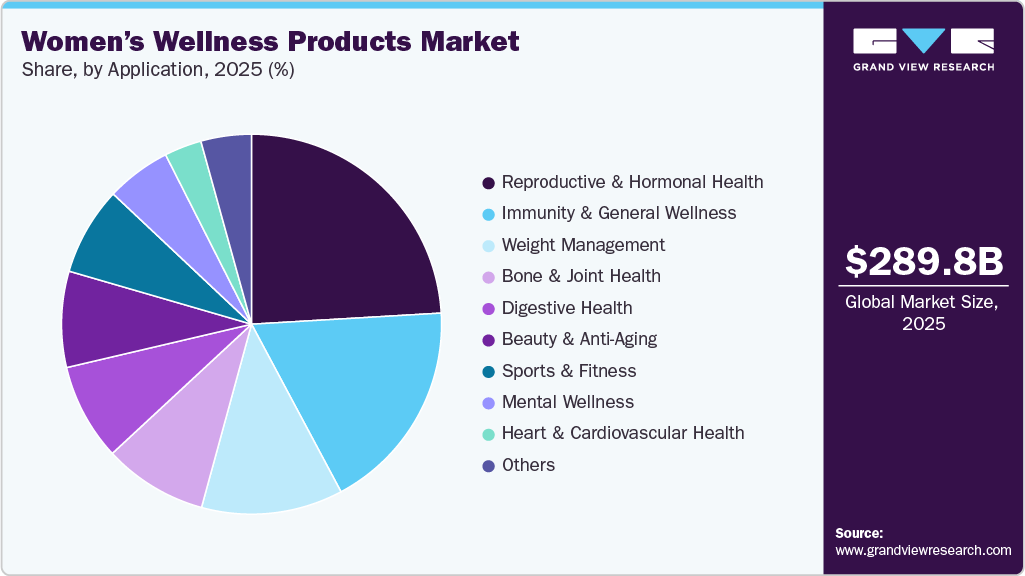

By application, the reproductive & hormonal health segment accounted for a share of 24.07% in 2025.

Key Market Trends & Insights

2025 Market Size: USD 289.77 Billion

2033 Projected Market Size: USD 549.35 Billion

CAGR (2026-2033): 8.4%

North America: Largest market in 2025

A primary driver is the growing awareness and proactive approach toward women’s health and preventive care. As education levels rise and conversations around reproductive health, menstrual hygiene, fertility challenges, menopause symptoms, and chronic conditions become less stigmatized, women are increasingly seeking products tailored to their unique physiological needs, from menstrual care and reproductive support to supplements that aid hormonal balance and bone health. This heightened health consciousness is supported by global health campaigns and information access through digital platforms, encouraging regular use of preventive wellness products and early screening tools.

The rapid expansion of femtech, including wearable health devices, mobile apps for cycle tracking, telemedicine interfaces, and AI-driven personalized wellness solutions, is redefining how women monitor and manage their health. Products that offer personalized insights based on biomarkers, hormonal cycles, or lifestyle data are gaining traction, especially among younger, digitally savvy consumers. E-commerce platforms and direct-to-consumer models have further enhanced accessibility and convenience, underpinning sustained growth in online sales and subscription services for wellness supplements and products.

Consumer preferences are also evolving toward natural, organic, and multifunctional formulations. There is a marked shift toward clean-label, plant-based options, especially in nutritional supplements, intimate care, and beauty-wellness hybrids that promise both internal health benefits and external aesthetic enhancements. Sustainability and eco-conscious packaging are increasingly influencing purchasing decisions, aligning with broader trends in conscious consumerism. At the same time, innovations addressing life-stage needs such as postnatal recovery and menopause support are expanding market scope and demographic reach.

Finally, rising disposable incomes and greater financial independence among women worldwide are enabling higher investment in premium wellness products. Emerging markets in Asia-Pacific and Latin America are witnessing rapid uptake as urbanization and healthcare infrastructure improvements increase product availability. Coupled with impactful social media advocacy and influencer-driven engagement, these trends collectively signal a robust future trajectory for the market.

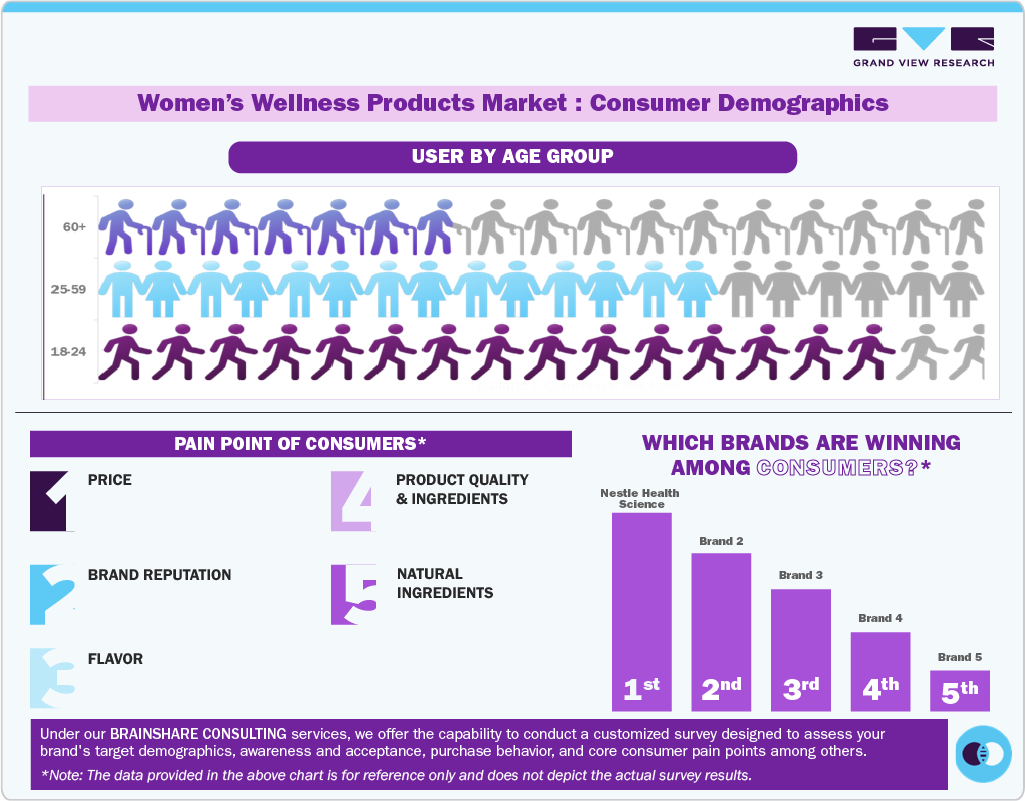

Consumer Insight

Consumer insights for the market by age reveal distinct preferences and purchasing behaviors across different age groups. Millennial women (25-40 years) are the largest adopters of wellness supplements, functional foods, and beauty‑from‑within products, prioritizing immunity, energy, and mental wellness, often influenced by social media, influencers, and e-commerce convenience. Gen Z consumers (18-24 years) are increasingly exploring plant-based, clean-label, and personalized wellness solutions, with a focus on sustainability and holistic self-care. Women aged 41-60 prioritize hormonal balance, bone health, and cardiovascular wellness, seeking clinically validated supplements and trusted brands. Older women (60+) focus on joint health, digestive support, and overall longevity, often relying on recommendations from healthcare providers. Across all groups, convenience, transparency, and scientifically backed claims are key purchase drivers.

Type Insights

Functional food & beverages for women’s wellness accounted for the largest share of 57.38% of the global revenues in 2025, driven by rising demand for convenient, nutrition-focused solutions addressing hormonal balance, gut health, bone strength, and energy management. Products such as fortified dairy alternatives, probiotic drinks, herbal teas, protein blends, and collagen-infused beverages are increasingly preferred as part of daily routines rather than medicinal interventions. Growing awareness of preventive health, clean-label formulations, and personalized nutrition has further accelerated adoption. In addition, strong penetration of functional beverages through e-commerce and modern retail channels continues to reinforce this segment’s market dominance.

The demand for beauty & cosmeceutical supplements is expected to grow at a CAGR of 10.6% from 2026 to 2033 in the women’s wellness industry, driven by increasing consumer focus on holistic beauty, skin health, and age-defying solutions. Women are increasingly adopting ingestible beauty products such as collagen peptides, biotin, hyaluronic acid, and antioxidant blends that support skin radiance, hair strength, and nail health from within. The rising influence of social media, dermatologist-backed claims, and clean-label, science-driven formulations is further accelerating adoption, particularly among urban and digitally engaged consumers seeking preventive and long-term beauty wellness benefits.

Form Insight

The capsule and tablet form dominated the market, with a revenue share of 52.49% in 2025, owing to their convenience, precise dosage, and longer shelf life compared to alternative formats. These forms are widely preferred for daily supplementation addressing hormonal balance, bone health, immunity, and prenatal nutrition. Strong consumer trust in pharmaceutical-style delivery, ease of storage, and broad availability across pharmacies and online channels have further supported adoption. In addition, manufacturers favor capsules and tablets due to formulation stability, scalability, and cost efficiency, reinforcing their continued dominance across both developed and emerging women’s wellness markets.

The gummies segment is expected to grow at a CAGR of 10.7% from 2026 to 2033, driven by rising consumer preference for palatable, easy-to-consume supplement formats. Gummies appeal strongly to younger demographics and first-time users who seek alternatives to traditional pills, particularly for beauty, immunity, and stress-relief applications. Innovations in low-sugar, vegan, and clean-label formulations have expanded their acceptance among health-conscious consumers. In addition, attractive packaging, flavor variety, and strong marketing through social media and e-commerce platforms are further accelerating the adoption of gummy-based women’s wellness products.

Distribution Channel Insights

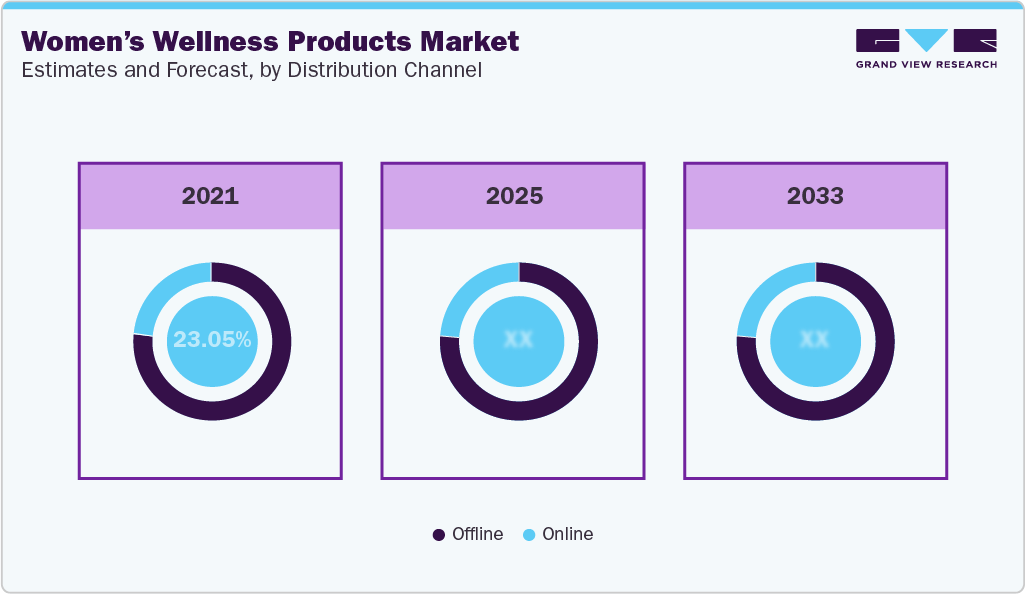

The sales of women’s wellness products through the offline channel accounted for a share of 76.19% in 2025, driven by strong consumer trust in pharmacies, health stores, and retail chains for product authenticity and expert guidance. Traditional retail continues to dominate due to the widespread presence of supermarkets, drugstores, and specialty stores offering a broad range of dietary supplements, functional foods, and beauty-focused wellness products. Consumers often prefer in-store experiences for personalized advice, product trials, and immediate availability. In addition, established distribution networks, promotional campaigns, and loyalty programs reinforce offline sales, particularly in regions with limited digital penetration or where personal interaction remains a key factor in purchasing decisions.

The sales of women’s wellness products through online channels are expected to grow at a CAGR of 9.3% from 2026 to 2033, driven by increasing health awareness, convenience, and the rising adoption of e-commerce platforms. Consumers are increasingly turning to online channels for purchasing vitamins, dietary supplements, probiotics, and beauty‑from‑within products that support hormonal balance, immunity, and overall wellness. Social media, influencer marketing, and personalized recommendation engines are further accelerating online sales. In addition, subscription-based models and direct-to-consumer strategies allow brands to engage with consumers more effectively, offering tailored wellness solutions and regular product deliveries, thereby boosting market penetration and fostering long-term customer loyalty in the women’s wellness segment.

Application Insights

The reproductive and hormonal health application accounted for the largest share of 24.07% in 2025, reflecting heightened awareness of menstrual health, fertility management, pregnancy support, and menopause care. Increasing diagnosis of hormonal imbalances, polycystic ovary syndrome (PCOS), and fertility-related issues has driven demand for targeted supplements, functional foods, and therapeutic products. Greater openness around reproductive health discussions, supported by digital health platforms and medical guidance, has further encouraged product adoption. In addition, growing emphasis on preventive care and personalized hormonal solutions across different life stages continues to strengthen this segment’s leading position in the market.

Women’s wellness products for mental wellness are projected to grow at a CAGR of 9.8% from 2026 to 2033, driven by increasing awareness of stress, anxiety, sleep disorders, and mood-related challenges among women. Rising workplace pressures, digital fatigue, and lifestyle changes have heightened demand for supplements and functional products containing adaptogens, magnesium, omega-3s, and herbal extracts. Greater acceptance of mental health care, along with growing preference for natural and preventive solutions, is supporting market expansion. In addition, endorsements from healthcare professionals and strong online marketing are accelerating adoption across diverse age groups.

Regional Insights

The market in North America accounted for 35.48% of global revenue in 2025, driven by high consumer awareness, strong purchasing power, and advanced healthcare infrastructure. Women in the region demonstrate a proactive approach toward preventive health, fueling demand for supplements, functional foods, mental wellness products, and reproductive health solutions. Widespread acceptance of personalized nutrition, clean-label formulations, and science-backed wellness products has further supported market growth. The strong presence of leading wellness brands, extensive product innovation, and effective marketing through digital platforms and influencers also contribute to regional dominance. In addition, well-established e-commerce channels and retail pharmacies ensure easy product accessibility. Growing focus on mental health, hormonal balance, and healthy aging, along with increasing participation of women in the workforce, continues to drive sustained demand, positioning North America as a mature yet rapidly evolving hub for women’s wellness solutions.

U.S. Women’s Wellness Products Market Trends

The women’s wellness products market in the U.S. is projected to grow at a CAGR of 7.1% from 2026 to 2033, supported by increasing emphasis on preventive healthcare and holistic well-being. Rising awareness of hormonal health, mental wellness, fertility management, and healthy aging is driving sustained demand for supplements, functional foods, and lifestyle-oriented wellness solutions. Consumers are increasingly seeking personalized, clean-label, and clinically supported products, encouraging continuous innovation among manufacturers. The strong influence of digital health platforms, subscription-based models, and e-commerce channels is enhancing product accessibility and engagement. In addition, growing acceptance of mental health support and beauty-from-within concepts continues to expand the scope of women’s wellness offerings across diverse age groups.

Europe Women’s Wellness Products Market Trends

The women’s wellness products market in Europe is projected to grow at a CAGR of 7.7% from 2026 to 2033, driven by increasing health awareness, an aging female population, and strong demand for preventive and natural healthcare solutions. European consumers show a high preference for organic, clean-label, and sustainably sourced wellness products, particularly in supplements, functional foods, and intimate care. Supportive regulatory frameworks, along with rising focus on menopause management, mental well-being, and hormonal balance, are further fueling growth. In addition, expanding e-commerce adoption, growing femtech innovation, and the strong presence of established wellness brands continue to strengthen market expansion across key European countries.

The UK women’s wellness products market is projected to grow at a CAGR of 7.8% from 2026 to 2033, supported by increasing awareness of preventive healthcare, mental well-being, and hormonal health among women. Rising demand for clean-label, plant-based, and science-backed supplements is driving adoption across reproductive, beauty, and mental wellness categories. The growing openness around menopause care and fertility management, along with strong support from healthcare professionals, is further accelerating market growth. In addition, expanding e-commerce platforms, subscription-based wellness services, and the influence of digital health campaigns continue to enhance product accessibility and consumer engagement across the market.

Asia Pacific Women’s Wellness Products Market Trends

The women’s wellness products market in the Asia Pacific is projected to grow at a CAGR of 10.0% from 2026 to 2033, driven by rising health awareness, rapid urbanization, and increasing disposable incomes across emerging economies such as China, India, and Southeast Asia. Growing participation of women in the workforce and changing lifestyle patterns are fueling demand for nutritional supplements, functional foods, and reproductive health products. Expanding access to digital health platforms, e-commerce, and social media education is improving awareness and product reach. In addition, strong cultural acceptance of herbal and traditional wellness ingredients, combined with ongoing product innovation, continues to support robust regional market growth.

Central & South America Women’s Wellness Products Market Trends

The women’s wellness products market in Central & South America is projected to grow at a CAGR of 8.6% from 2026 to 2033. supported by improving healthcare awareness and expanding access to wellness products across urban areas. Rising disposable incomes and a growing middle-class population are encouraging greater spending on nutritional supplements, beauty wellness, and reproductive health products. Increased focus on preventive care, along with the influence of social media and wellness education campaigns, is further driving demand. In addition, the gradual expansion of e-commerce and pharmacy retail networks is enhancing product availability, supporting sustained market growth across the region.

Middle East & Africa Women’s Wellness Products Market Trends

The women’s wellness products market in the Middle East & Africa is projected to grow at a CAGR of 8.8% from 2026 to 2033, driven by rising awareness of women’s health, improving healthcare infrastructure, and increasing participation of women in the workforce. Growing demand for nutritional supplements, reproductive health products, and beauty wellness solutions is supported by urbanization and higher disposable incomes in key markets. Cultural shifts toward preventive care, along with greater acceptance of natural and herbal formulations, are further accelerating adoption. In addition, the expansion of pharmacy chains, digital health platforms, and e-commerce channels is enhancing product accessibility across the region.

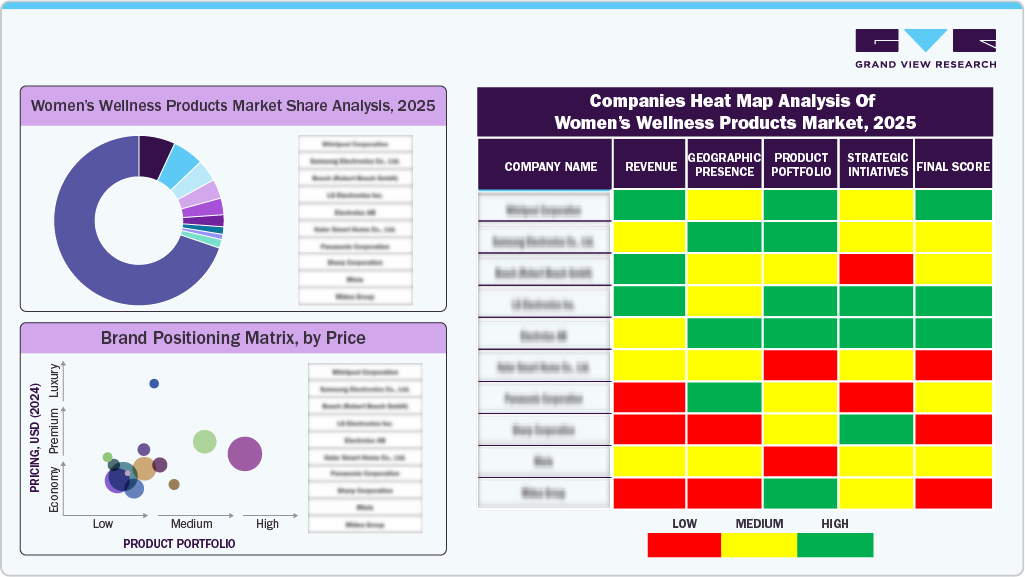

Key Women’s Wellness Products Company Insights

Established companies and emerging players in the market are fostering a highly competitive landscape by focusing on product innovation, quality enhancement, and strategic pricing strategies. This competition is fueled by continuous investments in advanced processing technologies, automation, and a skilled workforce to maintain operational efficiency and comply with stringent regulatory standards.

Key Women’s Wellness Products Companies:

The following are the leading companies in the women’s wellness products market. These companies collectively hold the largest market share and dictate industry trends.

Amway Corp

Herbalife Nutrition Ltd

GNC Holding, Inc

Bayer AG

Nestlé Health Science

Blackmores Limited

Swisse Wellness Pty. Ltd

Advanced Enzyme Technologies

Nu Skin Enterprises, Inc

Prozis

Recent Developments

In November 2025, GNC expanded its wellness portfolio with the nationwide launch of Mojo Energy & Focus Gummies, formulated with adaptogens and botanical nootropics for sustained energy and cognitive support.

In September 2025, Beacon Wellness Brands rolled out a new lineup of menopause‑focused products, including vaginal gels, libido patches, sleep sprays, and energy support patches, available online from Sept. 16 and in major retailers from Oct. 1, 2025. This collection targets peri‑, mid‑, and post‑menopause relief with hormone‑free, clean formulations.

In September 2025, Iris Nutrition launched an electrolyte drink mix tailored for women, formulated with vitamin B6, folic acid, magnesium, and a clinically studied myo‑ and d‑chiro‑inositol blend to support hormonal balance, energy, mood resilience, and gut health. The on‑the‑go mixes are offered in flavors like Blood Orange, Blackberry, and Lemon Raspberry, designed to make hydration and cycle support convenient.

Women’s Wellness Products Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 312.02 billion

Revenue Forecast in 2033

USD 549.35 billion

Growth rate

CAGR of 8.4% from 2026 to 2033

Actuals

2021 – 2025

Forecast period

2026 – 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, form, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; Argentina; South Africa

Key companies profiled

Amway Corp.; Herbalife Nutrition Ltd; GNC Holding, Inc; Bayer AG.; Nestlé Health Science; Blackmores Limited.; Swisse Wellness Pty. Ltd; Advanced Enzyme Technologies; Nu Skin Enterprises, Inc; Prozis

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Women’s Wellness Products Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global women’s wellness products market based on type, form, application, distribution channel, and region:

Type Outlook (Revenue, USD Million, 2021 – 2033)

Dietary Supplements

Vitamins

Multivitamins

Vitamin D

B-Complex

Vitamin C

Standard Vitamin C

Liposomal Vitamin C

Others

Minerals

Iron

Calcium

Magnesium

Zinc

Others

Protein Supplements

Whey Protein

Standard Whey Protein

Grass-Fed Whey Protein

Plant Protein

Clear Protein

Others

Omega Fatty Acids

Krill Oil

Fish Oil

Flaxseed Oil

Others

Probiotics & Prebiotics

Herbal & Botanical Supplements

Ashwagandha

Maca Root

Evening Primrose Oil

Irish Sea Moss

Berberine

Rhodiola

Holy Basil

Others

Women’s Hormone Health Supplements

Amino Acids & BCAAs

NAC (N-Acetyl Cysteine)

L-Theanine

L-Tyrosine

L-Carnitine

Others

Nootropics & Cognitive Support

Bacopa

Lion’s Mane

Others

Longevity & Cellular Health Supplements

Others

Functional Foods & Beverages

Beauty & Cosmeceutical Supplements

Sports Nutrition Products

Pre-Workout Supplements

Post-Workout Recovery Products

Energy & Endurance Boosters

Muscle Building Supplements

Electrolyte & Hydration Products

Electrolyte Powders

Hydration Supplements

Others

Form Outlook (Revenue, USD Million, 2021 – 2033)

Capsules/Tablets

Powder

Liquid

Soft Gels

Bars

Gummies

Others

Application Outlook (Revenue, USD Million, 2021 – 2033)

Reproductive & Hormonal Health

Bone & Joint Health

Weight Management

Sports & Fitness

Beauty & Anti-Aging

Digestive Health

Mental Wellness

Immunity & General Wellness

Heart & Cardiovascular Health

Others

Distribution Channel Outlook (Revenue, USD Million, 2021 – 2033)

Regional Outlook (Revenue, USD Million, 2021 – 2033)

North America

Europe

Germany

U.K.

France

Italy

Spain

Asia Pacific

China

Japan

India

Australia & New Zealand

South Korea

Central & South America

Middle East & Africa

Frequently Asked Questions About This Report

b. The global women’s wellness products market size was estimated at USD 289.77 billion in 2025 and is expected to reach USD 312.02 billion in 2026.

b. The global women’s wellness products market is expected to grow at a compound annual growth rate (CAGR) of 8.4% from 2026 to 2033 to reach USD 549.35 billion by 2033.

b. Functional food & beverages for women’s wellness accounted for the largest share of 57.38% of the global revenues in 2025, driven by rising demand for convenient, nutrition-focused solutions addressing hormonal balance, gut health, bone strength, and energy management.

b. Some key players operating in the global women’s wellness products market include Amway Corp.; Herbalife Nutrition Ltd; GNC Holding, Inc; Bayer AG.; Nestle Health Science; Blackmores Limited.; Swisse Wellness Pty. Ltd; Advanced Enzyme Technologies; Nu Skin Enterprises, Inc; Prozis.

b. Key factors driving growth in the global women’s wellness products market include rising health awareness, hormonal care demand, preventive healthcare focus, and lifestyle-related wellness adoption.