Report Overview

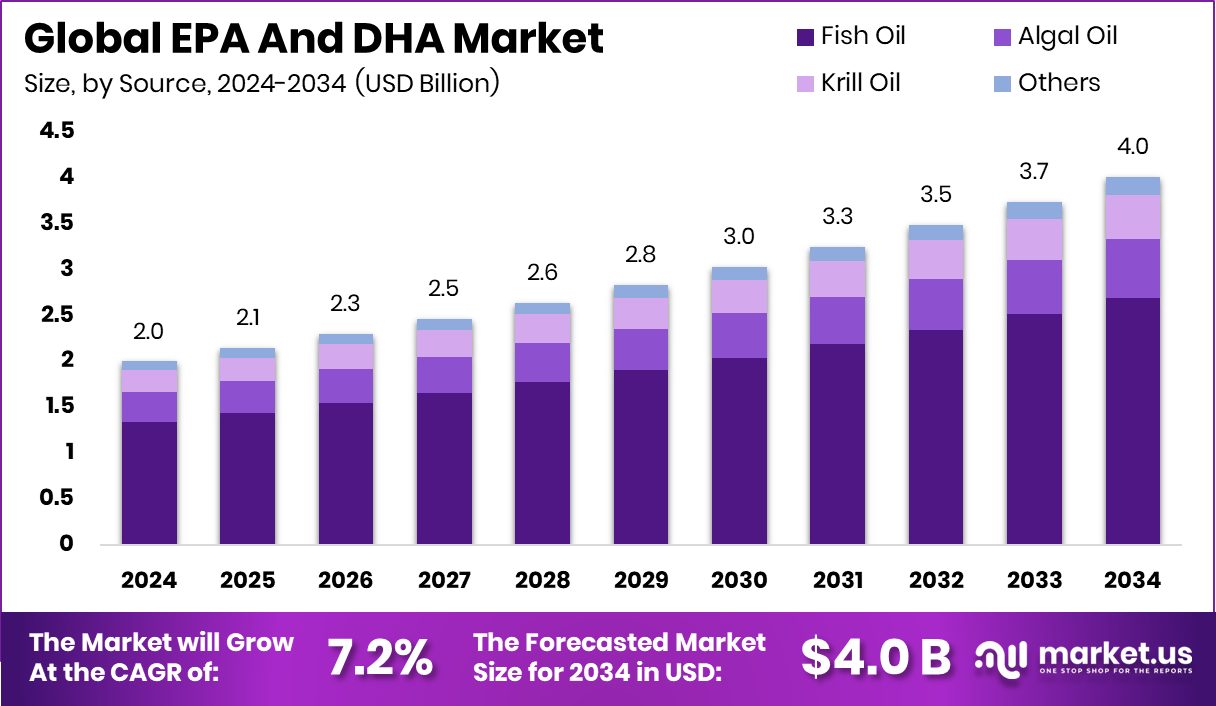

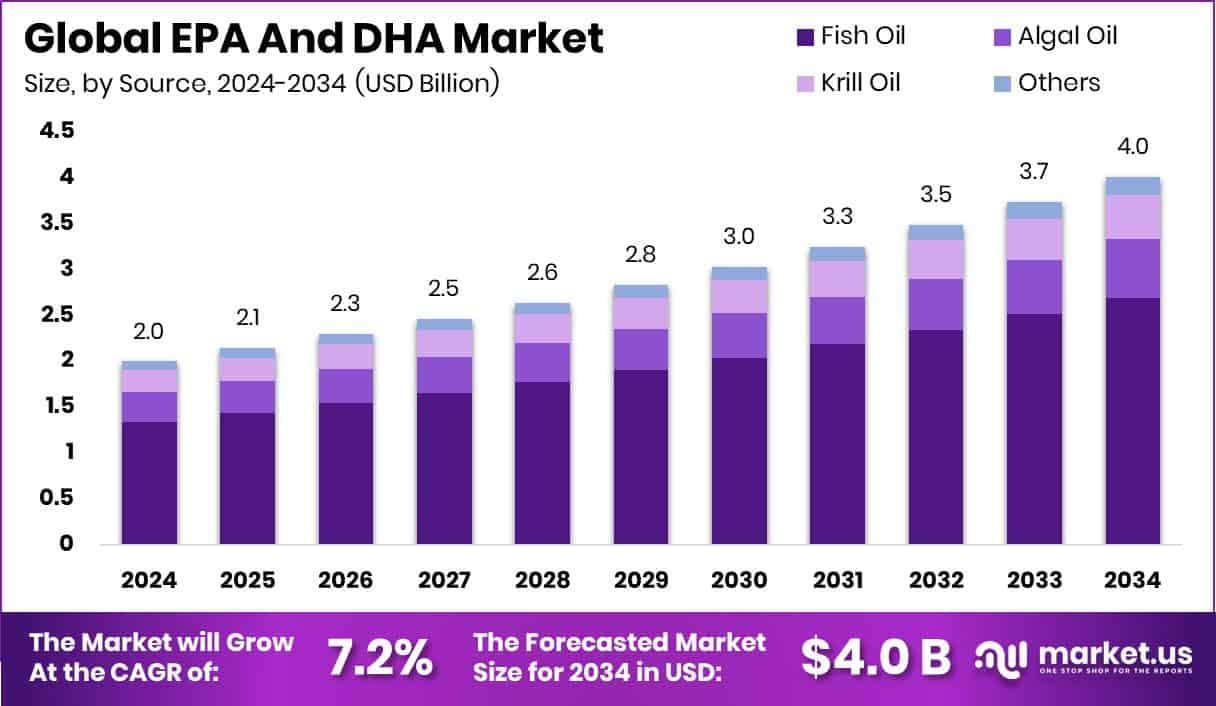

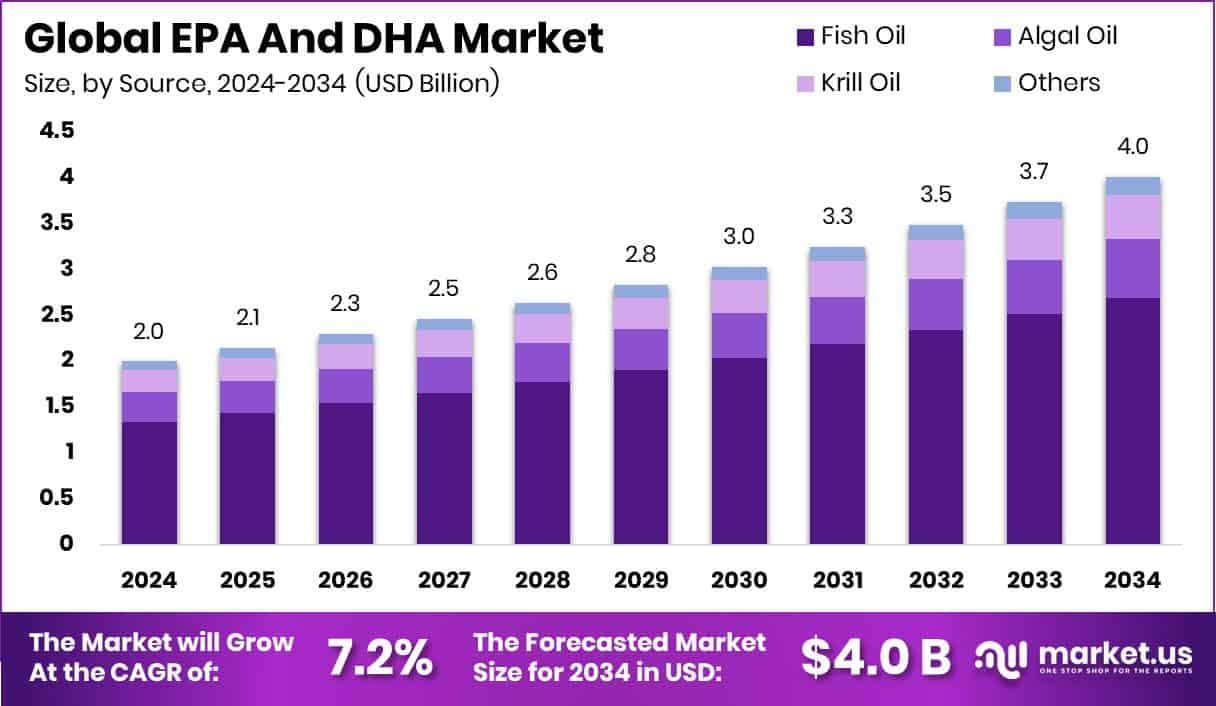

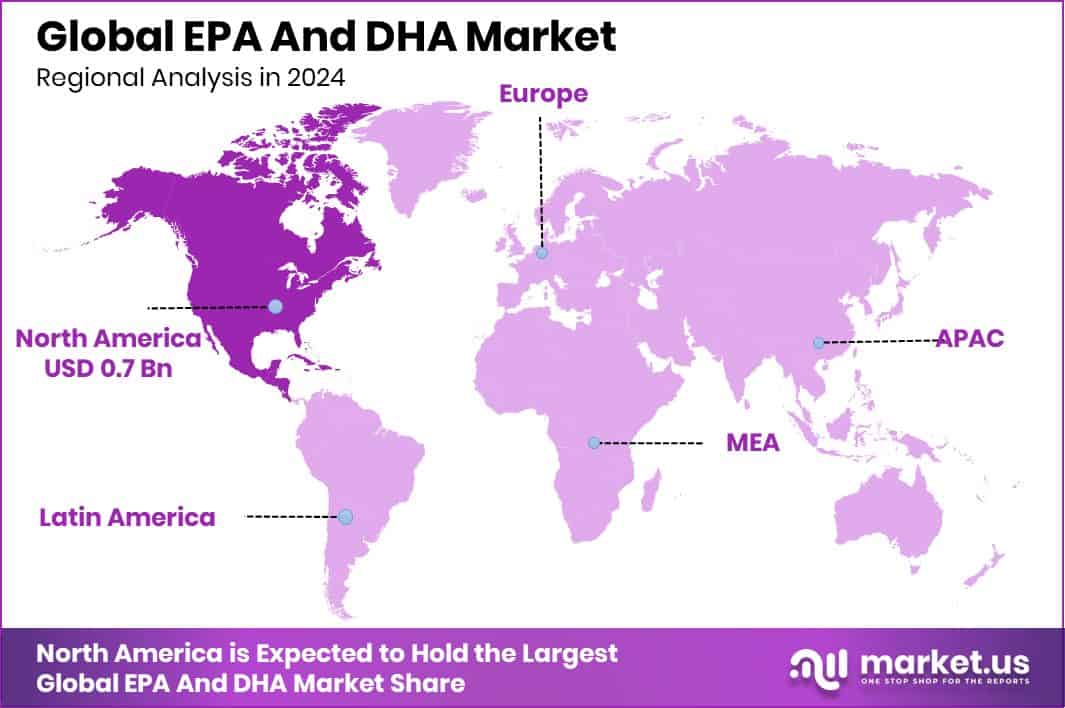

The Global EPA And DHA Market is expected to be worth around USD 4.0 billion by 2034, up from USD 2.0 billion in 2024, and is projected to grow at a CAGR of 7.2% from 2025 to 2034. EPA and DHA Market growth in North America reflects a 38.7% share totaling USD 0.7 Bn.

EPA and DHA are long-chain omega-3 fatty acids mainly found in marine sources and microalgae. They play an important role in heart health, brain function, eye development, and inflammation control. EPA is widely linked with cardiovascular and anti-inflammatory benefits, while DHA is essential for cognitive performance and vision. Because the human body cannot produce enough of these fatty acids on its own, EPA and DHA are commonly consumed through dietary supplements, fortified foods, and specialized nutrition products.

The EPA and DHA market represents the global ecosystem involved in producing, processing, and supplying these omega-3 ingredients for nutrition, feed, and wellness applications. The market includes traditional marine sources as well as newer algae-based alternatives. Growing consumer focus on preventive health and sustainable nutrition continues to shape how EPA and DHA products are developed and delivered.

Growth factors are strongly tied to innovation and funding in sustainable omega-3 production. Mara Renewables secured USD 9.1 million from S2G Investments to expand algae-based omega-3 solutions. MiAlgae raised USD 18.5 million to scale omega-3 production from microalgae, while Algiecel obtained €6.5 million in equity funding to grow its microalgae platforms. Slàinte, producing omega-3 from whisky waste, raised £14 million for expansion, alongside Scots biotech MiAlgae securing £14 million in new funding. Additionally, UK biotechnology projects received a £20 million funding boost, supporting omega-3 innovation.

Demand for EPA and DHA continues to rise as consumers prioritize daily nutrition for heart, brain, and overall wellness. Supplements remain a preferred choice due to ease of use and consistent intake. Demand is also supported by growing awareness of omega-3 benefits across all age groups, from prenatal nutrition to healthy aging.

Opportunities are expanding through alternative raw materials and circular production models. Advances in algae fermentation, waste-based omega-3 extraction, and biotech scaling open pathways for a stable supply and lower environmental impact. Industry success stories, including entrepreneurs who previously built large fish oil businesses worth USD 600 million, highlight the long-term value and reinvestment potential within the EPA and DHA space.

Key Takeaways

The Global EPA And DHA Market is expected to be worth around USD 4.0 billion by 2034, up from USD 2.0 billion in 2024, and is projected to grow at a CAGR of 7.2% from 2025 to 2034.

EPA And DHA Market sees Fish Oil sources dominating with 67.2% share due to availability.

EPA And DHA Market reports Capsules and Soft gels leading forms holding 56.4% preference globally.

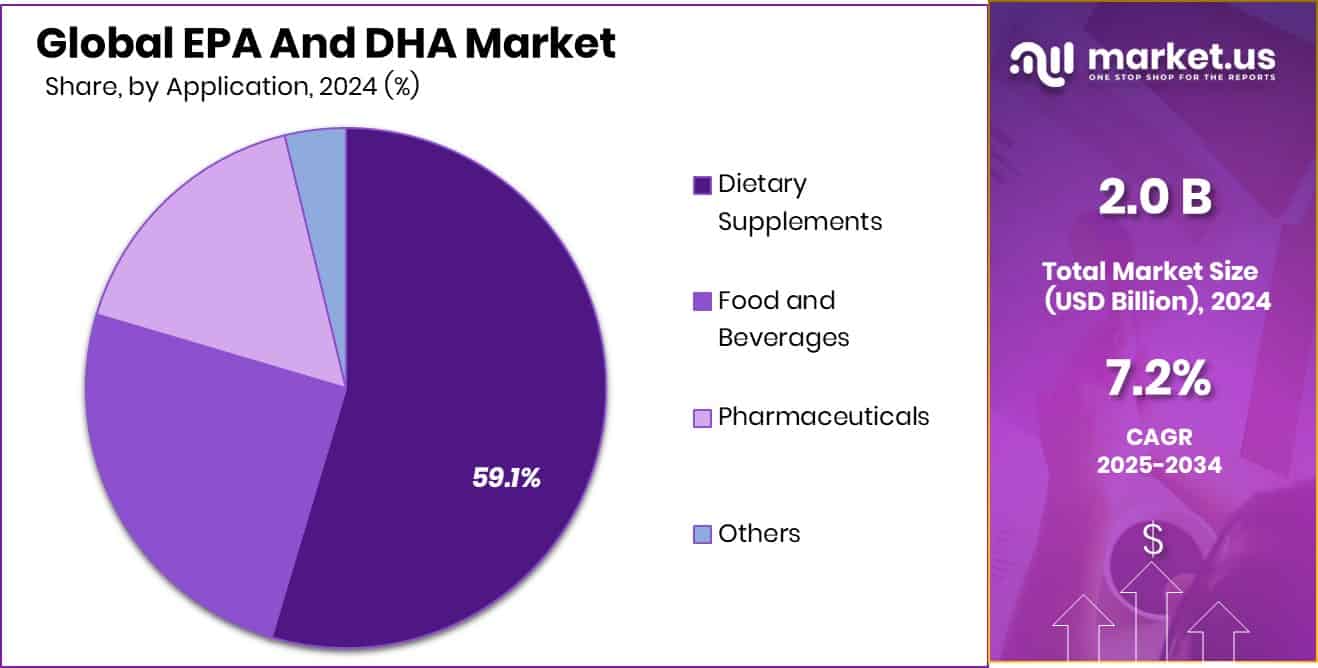

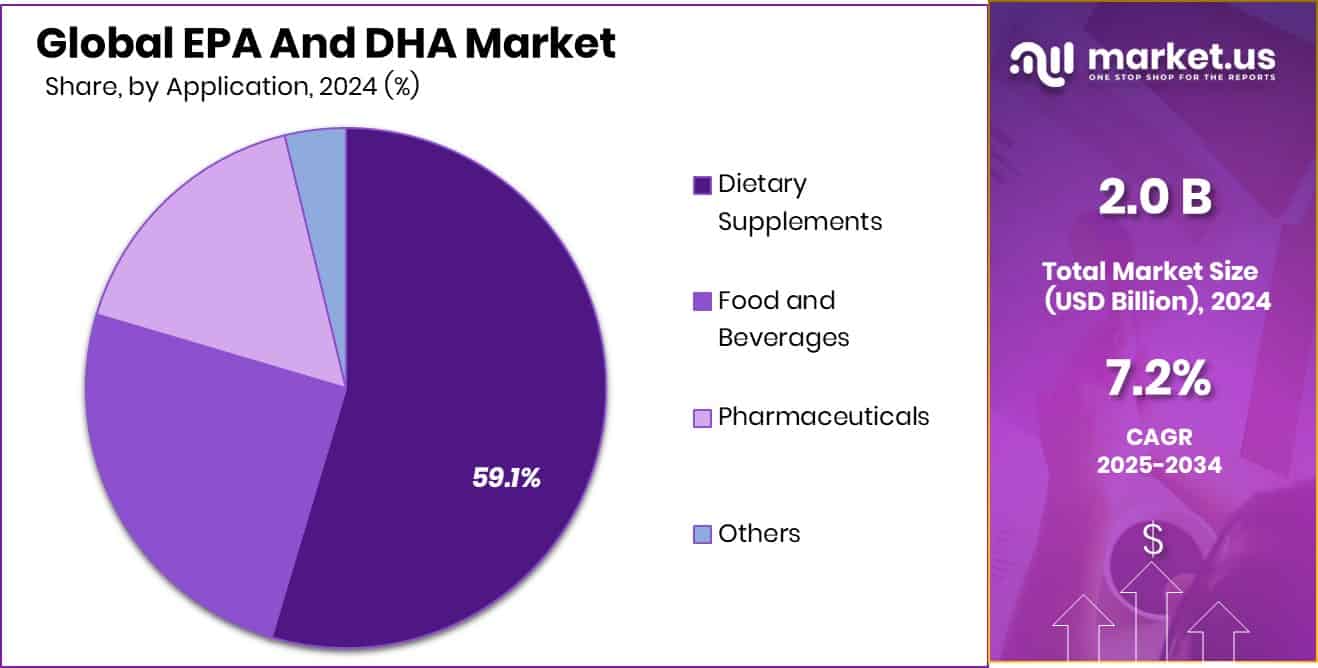

EPA And DHA Market highlights Dietary Supplements application dominating demand with 59.1% market share overall.

North America leads the EPA and DHA market with 38.7% dominance, generating USD 0.7 Bn revenue.

By Source Analysis

EPA And DHA Market: Source fish oil dominates with 67.2% share globally

EPA And DHA Market analysis by source highlights fish oil as the dominant contributor, accounting for 67.2% of total demand. Fish oil remains the most widely used raw material due to its high concentration of omega-3 fatty acids, established supply chains, and long-term acceptance by manufacturers and consumers. Large-scale marine sourcing from anchovy, sardine, and mackerel fisheries supports consistent production volumes.

In addition, fish oil-based EPA and DHA benefit from strong clinical backing related to heart health, brain function, and inflammation management. Compared with algal or krill alternatives, fish oil offers cost advantages, making it attractive for mass-market products. This dominance reflects continued consumer trust, scalable refining technologies, and stable availability supporting global EPA and DHA formulations.

By Form Analysis

EPA And DHA Market form capsules and soft gels lead at 56.4%.

EPA And DHA Market segmentation by form shows capsules and soft gels holding a leading share of 56.4%, driven by convenience and consumer preference. These formats are easy to swallow, odor-masked, and offer precise dosage control, which is critical for daily omega-3 intake.

Capsules and soft gels also provide better shelf stability and protection against oxidation compared to liquid forms. Their portability supports consistent consumption among working professionals and aging populations.

Manufacturers favor these forms because they are compatible with high-speed encapsulation lines and allow branding through size, color, and coating variations. As preventive healthcare awareness rises, capsules and soft gels continue to dominate retail shelves, reinforcing their strong position within the EPA and DHA market.

By Application Analysis

EPA And DHA Market application dietary supplements dominate, holding 59.1% share worldwide.

EPA And DHA Market demand by application is led by dietary supplements, representing 59.1% of total usage. Rising health awareness, aging populations, and preventive nutrition trends are driving supplement consumption worldwide. EPA and DHA supplements are commonly associated with cardiovascular health, cognitive support, joint mobility, and eye health, making them a daily wellness choice rather than a treatment-based product.

Growth is further supported by increased recommendations from healthcare professionals and wider availability through pharmacies and online platforms. Compared to pharmaceutical or functional food applications, dietary supplements face fewer formulation complexities and faster product launches. This strong share reflects sustained consumer reliance on omega-3 supplements as a simple, long-term health maintenance solution.

Key Market Segments

By Source

By Form

Liquid

Capsules and Soft gels

Powder

Others

By Application

Dietary Supplements

Food and Beverages

Pharmaceuticals

Others

Driving Factors

Rising Nutrition Focus Drives Omega-3 Consumption Globally

A major driving factor for the EPA and DHA market is the growing focus on food safety, nutrition quality, and preventive healthcare. Governments are strengthening oversight to ensure better nutritional outcomes for consumers. The U.S. FDA seeking USD 7.2 billion to enhance food safety, improve nutrition standards, and advance medical product safety reflects this priority shift. This push increases confidence in regulated dietary supplements, including EPA and DHA products.

At the same time, private investment is supporting market expansion. ARTAH Nutrition securing £2.85 million to grow its dietary supplement business highlights rising demand for trusted, science-backed nutrition solutions. Together, stronger regulation and targeted investments are encouraging wider adoption of omega-3 supplements across daily wellness routines.

Restraining Factors

High Production Costs Limit Wider Market Penetration

One key restraining factor in the EPA and DHA market is the high cost of sourcing and producing quality omega-3 ingredients. Whether derived from marine or algae-based sources, production requires advanced processing, quality testing, and stable raw material supply. Startups entering this space often face scaling challenges despite strong consumer interest.

Food startup GetSupp raising Rs 9.5 crore, shows growing demand but also reflects the capital needed to compete in supplements. Similarly, Canada’s Mara Renewables securing USD 9.1 million to scale algae-based omega-3 production highlights how funding is essential just to reach commercial volumes. These cost pressures can slow price reductions and limit affordability in emerging consumer markets.

Growth Opportunity

Fish-Free Omega-3 Expands Sustainable Nutrition Opportunities

A major growth opportunity in the EPA and DHA market lies in fish-free omega-3 solutions. Sustainability concerns and supply volatility in marine sources are pushing innovation toward algae-based EPA and DHA. Mara Renewables, bringing fish-free omega-3 to global markets with USD 12.5 million from S2G Investments, shows strong confidence in this approach.

Algae-based production offers consistent quality, controlled output, and lower environmental impact. This opens new opportunities across dietary supplements, functional foods, and animal nutrition. As production scales, fish-free omega-3 can reach markets where marine sourcing is limited, creating long-term growth potential and helping the industry meet both health and sustainability expectations.

Latest Trends

Algae Innovation Shapes Future Omega-3 Production

One of the latest trends in the EPA and DHA market is the rapid expansion of algae-based technologies. Companies working on algae platforms are attracting strong investor interest, not only for nutrition but also for climate-linked solutions. Viridos raising USD 25 million for algae-based biofuels reflects broader confidence in algae innovation, which also benefits omega-3 development.

In parallel, an algal carbon capture startup raising €1.3 million shows how algae is being positioned as a multifunctional solution. These developments support advances in strain optimization, fermentation, and scaling methods, which are directly improving the efficiency and future supply of algae-derived EPA and DHA.

Regional Analysis

EPA and DHA Market in North America holds 38.7% share valued at USD 0.7 Bn.

.The EPA and DHA Market shows clear regional variation, with North America remaining the dominating region, holding a 38.7% share and valued at USD 0.7 Bn. This leadership is supported by strong consumer awareness of omega-3 benefits, high dietary supplement penetration, and well-established retail and online distribution channels.

Europe follows with steady demand driven by preventive healthcare habits, aging populations, and consistent use of EPA and DHA in daily nutrition routines. The Asia Pacific region reflects expanding consumption as urban lifestyles, rising disposable income, and growing interest in wellness products increase omega-3 adoption across major economies.

In the Middle East & Africa, market growth remains gradual, supported by improving access to dietary supplements and increasing focus on general health maintenance in urban centers. Latin America represents an emerging opportunity, where awareness of heart and brain health is gradually translating into higher consumption of EPA and DHA products.

Key Regions and Countries

North America

Europe

Germany

France

The UK

Spain

Italy

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

Rest of APAC

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

GCC

South Africa

Rest of MEA

Key Players Analysis

Koninklijke DSM NV continues to play a strategic role in the global EPA and DHA market in 2024 through its strong focus on science-based nutrition and high-purity omega-3 solutions. The company’s long-standing expertise in human nutrition allows it to position EPA and DHA not just as supplements, but as essential functional ingredients for long-term health. Its emphasis on quality, traceability, and regulatory compliance strengthens trust among healthcare brands and premium supplement manufacturers, especially in mature markets where product credibility matters most.

KD Pharma Group is viewed as a specialist leader, known for its deep technical focus on concentrated EPA and DHA ingredients. The company’s strength lies in customized formulations, pharmaceutical-grade processing, and the ability to meet strict purity standards. This positions KD Pharma strongly within prescription omega-3s and high-strength dietary supplements. Analysts note that its vertically integrated operations support consistency and scalability, making it a preferred partner for brands targeting clinical, sports nutrition, and therapeutic segments.

Meanwhile, the Archer Daniels Midland Company brings scale, supply reliability, and global distribution strength to the EPA and DHA market. ADM’s broad nutrition portfolio and ingredient manufacturing expertise enable seamless integration of omega-3s into supplements and functional nutrition products. Its global footprint and sourcing capabilities provide resilience against supply fluctuations, reinforcing its role as a stable, long-term supplier in the evolving omega-3 value chain.

Top Key Players in the Market

Koninklijke DSM NV

KD Pharma Group

The Archer Daniels Midland Company

Corbion NV

BASF SE

Omega Protein Corporation

Croda International PLC

Novotech Nutraceuticals

Herbalife Nutrition Ltd.

Fonterra Co-operative Group Limited

Recent Developments

In October 2025, management and stakeholders of Omega Protein raised concerns about new catch limits set by the Atlantic menhaden fisheries board. These limits reduce how much menhaden (the key fish species Omega Protein harvests for fish oil and fishmeal production) can be caught along the Atlantic coast. Omega Protein stated that this change could significantly impact its fishing operations and fish oil supply chain, which forms the basis for EPA and DHA raw materials used in animal feed and nutrition products. This development reflects ongoing regulatory challenges for its primary sourcing strategy.

In July 2025, Corbion successfully obtained multiple regulatory approvals from China’s General Administration of Customs (GACC) for its algae-derived omega-3 DHA products, including AlgaPrime™ DHA and AlgaVia™ DHA. These approvals allow Corbion to officially launch and supply these sustainable omega-3 solutions in both human and animal nutrition markets in China, supporting growing demand for high-quality DHA ingredients.

In December 2024, BASF signed a binding agreement to sell its Food & Health Performance Ingredients business to Louis Dreyfus Company (LDC). This business included production of omega-3 oils for human nutrition, along with other health ingredients like plant sterol esters and CLA from its Illertissen, Germany site. The move was part of BASF’s decision to refocus its portfolio and exit non-core nutrition segments. The transaction is expected to transfer around 300 employees and includes application labs supporting product development.

Report Scope