Vietnam has become the second-largest importer of Australia’s health supplements, trailing only China. A Euromonitor reported that Vietnam’s health supplements market was valued at US$2.9 billion last year and was forecast to reach US$4.6 billion by 2030, making it the fastest-growing health supplements market in SEA.

It was also last year that the discovery of an illegal milk production ring, counterfeit health supplements, and false advertising sparked widespread concern over nutritional products sold in the country.

The first series of VitamINSIGHTS this year will look at how the local and overseas players view opportunities in Vietnam’s health supplement market in 2026 and where the potential growth areas are.

What approach to take this year? Two perspectives

Some viewed last year’s saga with optimism, choosing to see it as a year of “purification” of the functional foods industry.

With rogue players purged and regulatory revamp underway, Dr. Le Van Truyen, vice president of industry body Vietnam Association of Functional Foods (VAFF), told an executive board meeting on Dec. 26 last year that consumers would regain their trust in the industry eventually, as only trusted players could stand up to scrutiny.

“The functional food industry in 2025 suffered a serious upheaval, partly due to incomplete institutional frameworks,” added Dr. Nguyen Xuan Hoang, permanent vice president of VAFF during the meeting. “In 2026, with new laws and decrees, I hope that next year, thanks to the solidarity of the association’s members, the industry will recover and have a new look.”

Right after the scandal broke, Vietnam’s Prime Minister Pham Minh Chinh ordered a review of food safety regulations. Manufacturers can also expect more surprise inspections and a tighter product registration process.

With potentially stricter regulations on the horizon, some are advising a “wait-and-see” approach.

“Within ASEAN, I think that the country we should look out for is Vietnam, because the country is currently looking to review its decree no. 15/2018/nd-cp, which is the regulation for the registration of products,” said Wai Mun Poon, principal regulatory consultant at SJ Wong Asia.

She noted that, to her understanding, some companies were restricted the number of times that they could review their product registration.

There have also been proposals for companies to include stability test findings in their product registration process, which is not a requirement at this point.

“The situation is very fluid because of the counterfeit scandals,” Mun Poon said. “I think the best that companies can do is to monitor the situation, and if they’re entering the Vietnamese market now, it is best to wait and see.”

Leadership at the Vietnam Functional Foods Association (VAFF) believes that the outlook of Vietnam’s consumer health supplement market remains optimistic, while regulatory expert Wai Mun Poon has advised overseas brands to continue monitoring the situation before entering the market due to the potential of stricter regulatory requirements. (123ducu/Getty Images)

Leadership at the Vietnam Functional Foods Association (VAFF) believes that the outlook of Vietnam’s consumer health supplement market remains optimistic, while regulatory expert Wai Mun Poon has advised overseas brands to continue monitoring the situation before entering the market due to the potential of stricter regulatory requirements. (123ducu/Getty Images)

The VAFF said a priority this year was to help the public understand and use health supplements correctly.

It will also work with the authorities to address pressing issues such as false advertising, counterfeit goods, and promote the development of standards for dietary supplements.

“The association proposes that the State should soon enact a law on associations and clearly define the roles of state management and associations in providing public services such as testing and training,” VAFF said in a press release on December 27 last year.

Growth so far

Vietnam’s counterfeit scandal has happened against the backdrop of a flourishing health and nutrition market.

In the past decade, Australian health supplements have found commercial success in China, with brands like Blackmores and Swisse leading the way. Last year, China continued to take the top spot for Australia’s health supplements exports, purchasing AUD 697 million (US$466 million) or 68% of Australia’s total supplements.

However, Vietnam is fast climbing the charts.

Last year, the country became the second-largest importer of Australian health supplements.

About AUD 86 million (US$57.5 million) or 8% of Australia’s total supplements exports went to Vietnam in 2024, according to an industry snapshot report from Complementary Medicines Australia (CMA) last year.

This places Vietnam ahead of New Zealand, South Korea, and Thailand in terms of demand for Australian supplements, which are regulated by the Therapeutic Goods Administration (TGA).

Citing data from Euromonitor, CMA wrote in its annual industry snapshot that Vietnam has become the fastest-growing health supplements or complementary medicines market in SEA.

Vietnam has become the fastest-growing health supplements in Southeast Asia, according to Euromonitor International’s Consumer Health Market Data 2026. (anilakkus/Getty Images)

Vietnam has become the fastest-growing health supplements in Southeast Asia, according to Euromonitor International’s Consumer Health Market Data 2026. (anilakkus/Getty Images)

“The domestic complementary medicines market—covering vitamins and dietary supplements, sports nutrition, herbal/ traditional and weight management products—is expanding at one of the fastest rates in the region,” CMA stated. “Valued at US$2.9 billion in 2025, it is forecast to nearly double to US$4.6 billion by 2030 (CAGR 9.2%). This makes Vietnam the fastest-growing complementary medicines market in Southeast Asia.”

Careline Australia is one of the Australian health supplements companies that has hit new milestones in Vietnam.

Last month, it announced that its Careline Blue Summit Natural Health Supplements Range is available in over 550 retail touch points in the pharmacy channels across Vietnam.

Con Cung, a major Vietnamese mother-and-baby chain, is similarly seeing a growth spurt.

Founder and CEO Anh Tien Luu announced last month that the chain has hit its 1,000th store milestone, and he is aiming to open the 2,000th store in three years’ time.

Vietnam: What’s in store for health supplement firms?

Although Vietnamese consumers’ purchasing power and spending may not be as strong as their Southern neighbors, Careline Australia is eyeing the country’s increasing readiness to spend on health products, as well as its influence on other SEA countries, Cambodia, and Laos.

“The purchasing power and spending in Vietnam may not be as big as other regions like Thailand or Singapore; however, the appetite to spend for health and well-being products, whether they’re health supplements like ours or in other areas for self-care, is growing,” said Peter Bosevski, sales and business manager at Careline Australia.

In 2025, Vietnam’s gross domestic product (GDP) per capita crossed US$5,000. That of Thailand was US$7,940 last year, according to the International Monetary Fund (IMF).

Careline Australia also believes that it can leverage Vietnam as a springboard into neighboring countries like Cambodia, Myanmar, and Laos.

Cambodia, in particular, has become increasingly attractive to Singapore and Australian supplement companies.

“Mainland China, Taiwan, Hong Kong, they all look at each other, and they feed off each other in terms of trends and consumerism,” said Bosevski.” Vietnam, Laos, Myanmar, and Cambodia are sort of similar to a degree, and they look at Vietnam as the benchmark. Vietnam is our success story for SEA, and so we’re using it as a benchmark.”

Founder Norman Li added that countries like Cambodia and Myanmar have a relatively larger group of younger demographics that can revitalize spending.

“These places have a big population with young people and growth, so the purchasing power is growing really fast,” he said.

For Australian health supplement brands, there is also the added advantage of ethnic diasporas, tourists, and the throngs of overseas students wanting to export or introduce Australian products in their home countries.

“Because we are Sydney-based, there are also ethnic communities from these countries, Laos, Cambodia, Vietnam, and Thailand, etc, that recognize our brand,” Bosevski said. “There are entrepreneurs, exporters, and wholesalers who want to become our partners in those regions, which works in our favor as well, and with Vietnam, we have a nice case study to springboard to the rest of SEA.”

Careline Australia has been selling its health supplements products in Vietnam’s independent pharmacies since 2015. (Careline Australia)

Careline Australia has been selling its health supplements products in Vietnam’s independent pharmacies since 2015. (Careline Australia)

Korean supplement companies, which have been aggressively exporting overseas, are also seeing opportunities in Vietnam.

The VAFF said last November that it had held a meeting with Bogoshinyak Co., Ltd. (South Korea) to discuss legal procedures, labeling regulations and advertising of health food products, as well as to discuss strategic cooperation directions between the two sides.

According to the VAFF, Bogoshinyak had introduced a catalogue of beverage products during their meeting that help boost immunity, reduce fatigue, support digestion, care for the skin, protect the liver and supplement vitamins.

Popular categories

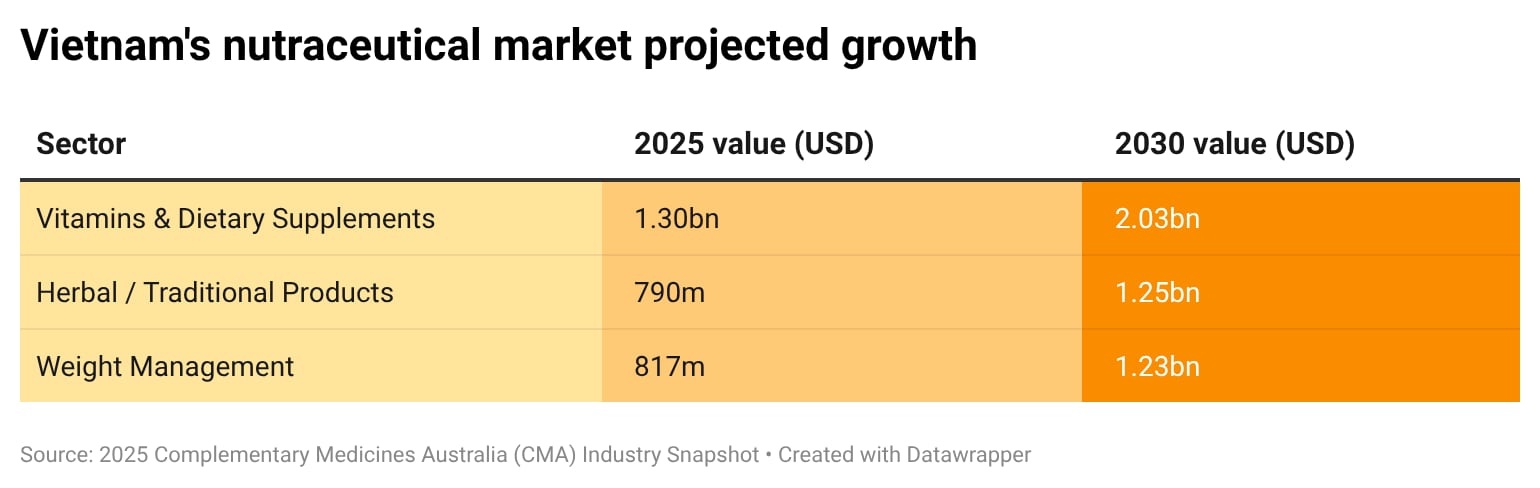

Key supplement categories in Vietnam are vitamins and dietary supplements, herbal/ traditional products and weight management products.

Vietnam’s nutraceutical market projected growth (2025-2030) (Tingmin Koe)

Vietnam’s nutraceutical market projected growth (2025-2030) (Tingmin Koe)

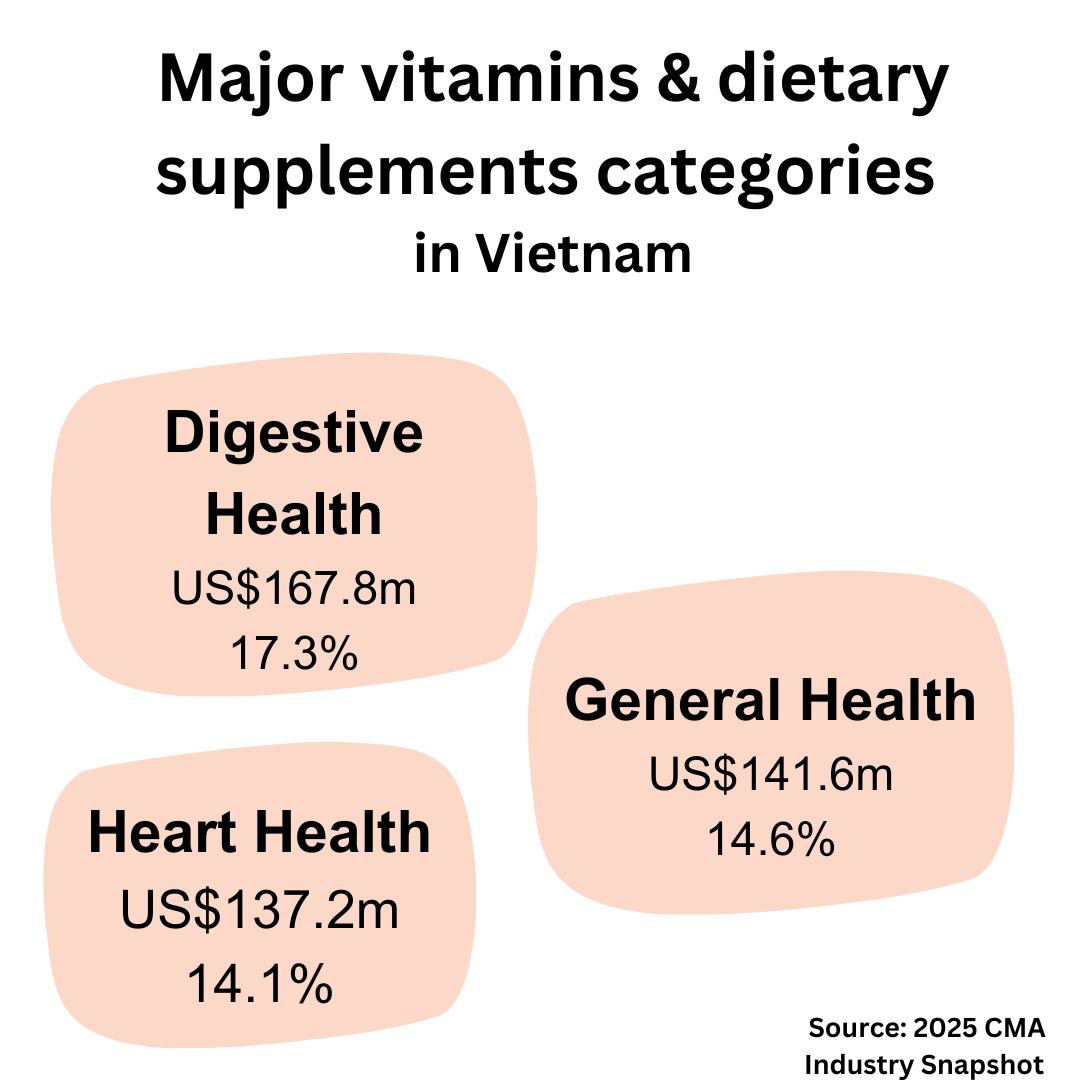

Digestive health products made up the largest segment of the vitamins and dietary supplements category, followed by general health and heart health products.

Growth in the herbal/traditional products sector reflects Vietnam’s cultural heritage of traditional medicine and the rising adoption of fitness and active lifestyle trends among younger consumers.

Don’t overlook the healthy aging category

The consumption of health supplements is not only driven by the younger population, which Vietnam is commonly associated with, but is also fueled by the emerging healthy aging product category.

Vietnam has about 16.1 million residents aged 60 and above, representing about 16% of the national population, Minister of Health Dao Hong Lan said last year.

“What this means for our company and our products is that most of the people in this age category are facing chronic diseases like hypertension, joint problems, arthritis, diabetes, osteoporosis, etc, so this is a category that’s growing for us,” Bosevski said.

Having entered the Vietnamese market a decade ago, he noticed that the healthy aging category in Vietnam is still at an emerging stage, which is a market opportunity for supplement brands.

“Our local distributor in Vietnam sees this as an emerging category for our brand of products, Careline Blue Summit,” he said. “That’s also something that a few brands may not have looked at lately for Vietnam. Ten years ago, the younger demographics were spending money on supplements, and they wanted the international brands and products, but the local Vietnamese, who are now aging, are similarly seeking international products to manage their health.”

The younger population, on the other hand, is more interested in products for lifestyle maintenance.

Overall, the company sees beauty-from-within products, such as marine collagen, as well as immune support products like royal jelly capsules, evening primrose oil for women, and fish oil for cardiovascular health, among its bestselling products in Vietnam.

This also coincides with CMA’s observations, which pointed to growth opportunities in categories like beauty-from-within and healthy aging.

Major VDS categories in Vietnam 2025 (Tingmin Koe)

Major VDS categories in Vietnam 2025 (Tingmin Koe)

“Beyond these, smaller but faster-growing segments— including beauty-from-within, women’s health and mood/sleep support—illustrate how younger consumers, particularly women, are reshaping Vietnam’s modern health concerns,” CMA wrote in the industry snapshot. “At the same time, a regional focus on healthy aging is taking hold, with supplements targeting health span, brain health, and resilience gaining traction as life expectancy rises alongside chronic disease prevalence.”

This year, Careline Australia will be looking at vitamin C, probiotics, and menopause for new product development.

“There are quite a lot of women’s health supplements that we can develop and introduce into the Vietnamese market because we actually sell these products to Hong Kong, to China, and other markets, but there’s also quite a high demand for these products here as well,” Li said.

With presence in independent pharmacies and mum-and-pop stores across Hanoi and Ho Chi Minh City, it is also looking to expand into mid-tier or top-tier pharmacy chains like Guardian or Pharmacity.

“We do get more sales from the offline space,” Bosevski said. “At the moment, Vietnamese consumers are generally used to buying something when they’re given advice face-to-face from a professional, which is a health specialist or a pharmacist. I think in Vietnam, the trust that people have in pharmacies is still very high, which is why we think there are opportunities that we have not yet tapped into across big pharmacy chains in Vietnam.”