The investments put the combined company at a valuation of $7.5 billionPlaylist CEO Fritz Lanman and Egym co-founder and CEO Philipp Roesch-Schlanderer will be named and serve as co-founders of the new Playlist organizationAs part of the transaction, Roesch-Schlanderer will also join Monti Saroya, co-head of Vista Equity Partners’ Flagship Fund, as co-chairman of Playlist.

Playlist, a San Luis Obispo, California-based parent company of fitness and wellness brands and Egym, a Denver-based provider of smart fitness technology, AI-enabled workout programming, and corporate wellness solutions, have agreed to merge.

The transaction includes $785 million in new equity investments led by Affinity Partners with participation from an investor group that includes Vista Equity Partners, Temasek and L Catterton.

Also, Mayfair has backed EGYM since 2021 and will be a shareholder in the combined group.

The investments put the combined company at a valuation of $7.5 billion.

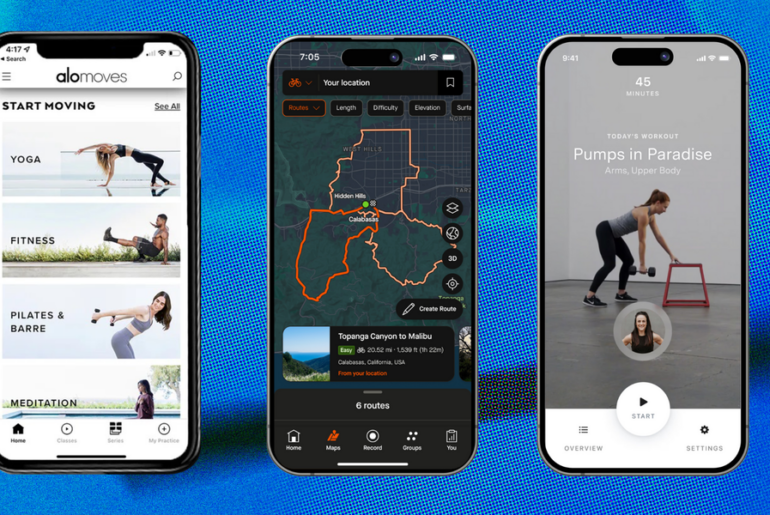

Playlist’s fitness and wellness brands include Mindbody, Booker and ClassPass.

Upon the closing of this deal, Playlist’s suite of brands will operate as they do today, while EGYM will continue its operations as a subsidiary within the Playlist portfolio. Playlist CEO Fritz Lanman and EGYM co-founder and CEO Philipp Roesch-Schlanderer will be named and serve as co-founders of the new Playlist organization. As part of the transaction, Roesch-Schlanderer will also join Monti Saroya, co-head of Vista Equity Partners’ Flagship Fund, as co-chairman of Playlist.

On the transaction, Asad Naqvi, a partner at Affinity Partners, said in a statement, “We have been impressed by the exceptional execution of both companies and believe the combination will create a unique platform that will bring even more value to its customers. Playlist is still in the early innings!”