Middle East Vitamin Supplements Market Summary

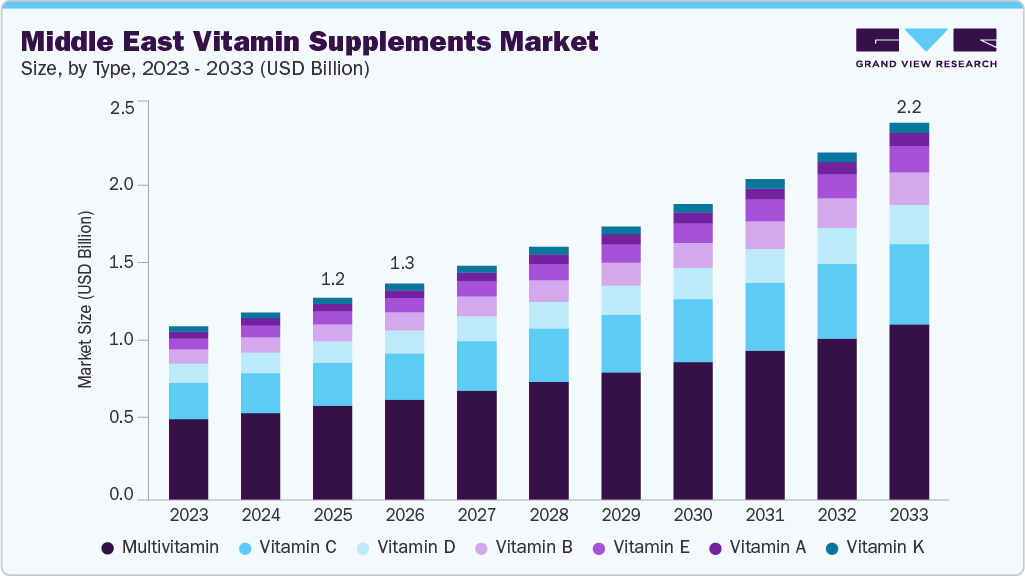

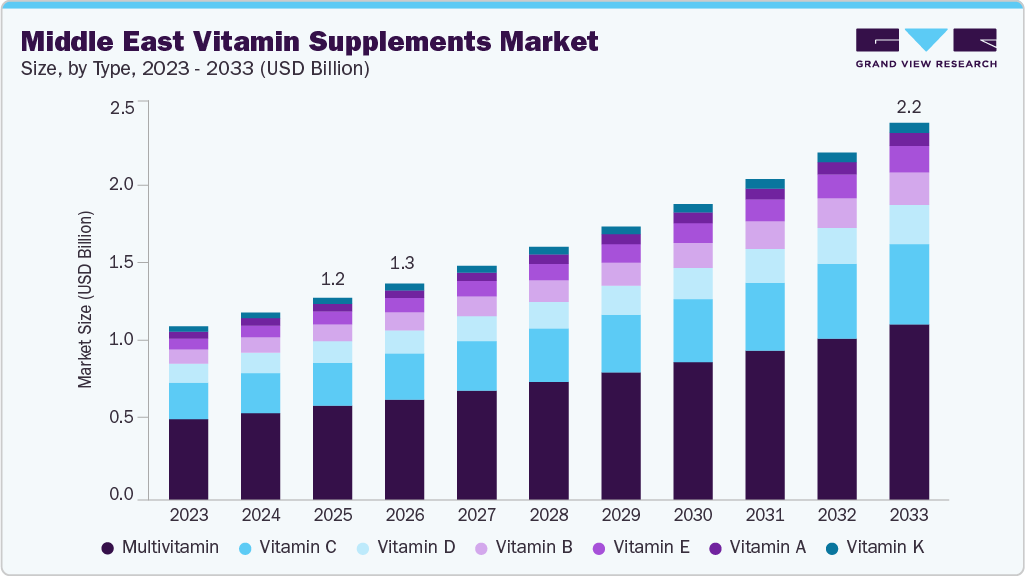

The Middle East vitamin supplements market size was estimated at USD 1,183.7 million in 2025 and is projected to reach USD 2,209.0 million by 2033, growing at a CAGR of 8.3% from 2026 to 2033. The regional growth of vitamin supplements in the Middle East has been driven by rising lifestyle-related health concerns, particularly deficiencies associated with limited sun exposure, sedentary work patterns, and dietary imbalances.

Key Market Trends & Insights

Saudi Arabia dominated the Middle East vitamin supplements market with the largest revenue share of 26.2% in 2025.

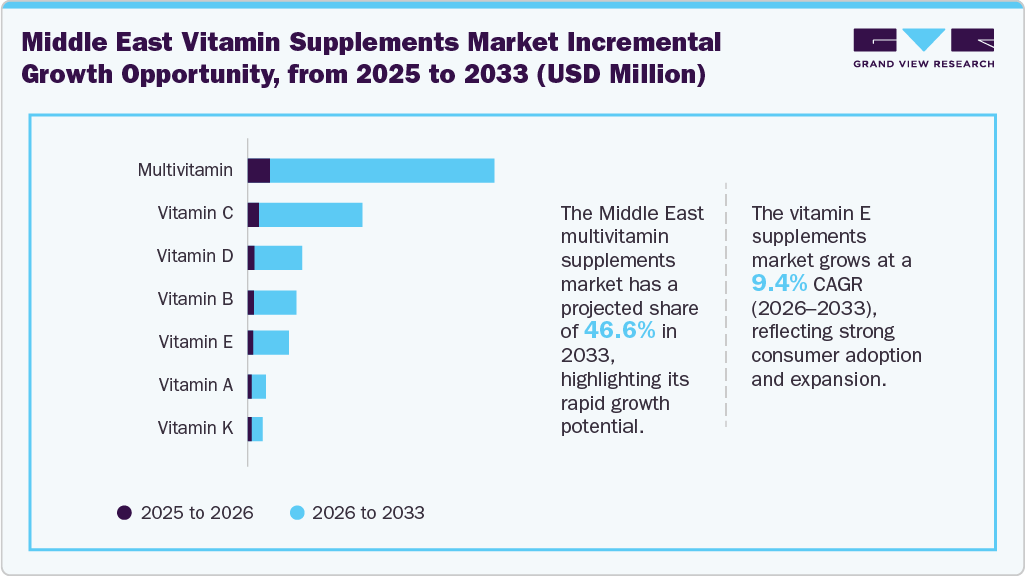

By type, the multivitamin supplements segment led the market with the largest revenue share of 46.6% in 2025.

By form, the gummies vitamin supplements is anticipated to grow at the fastest CAGR of 9.3% during the forecast period.

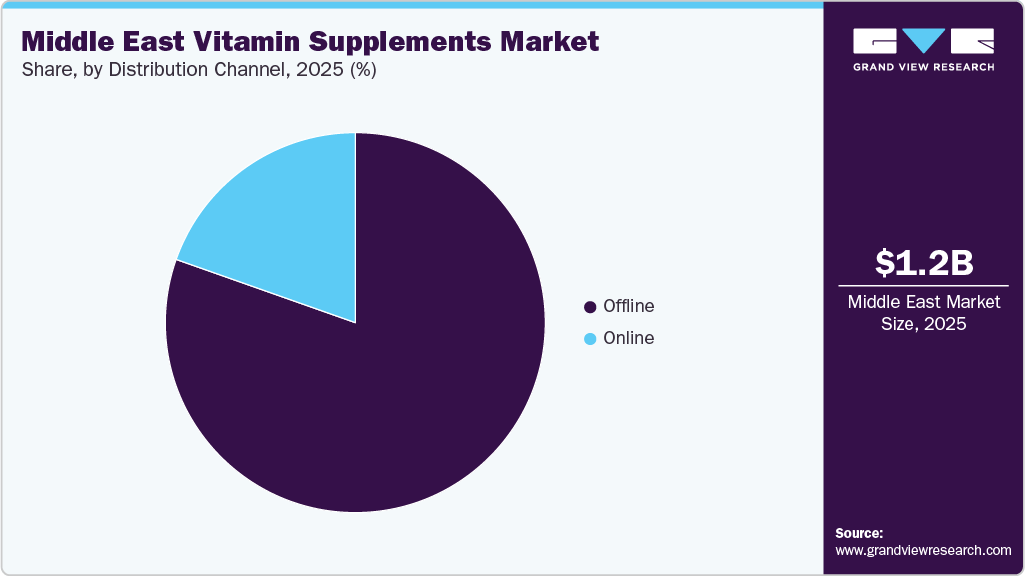

By distribution channel, the offline channel led the market with the largest revenue share of 80.4% in 2025.

Market Size & Forecast

2025 Market Size: USD 1,183.7 Million

2033 Projected Market Size: USD 2,209.0 Million

CAGR (2026-2033): 8.3%

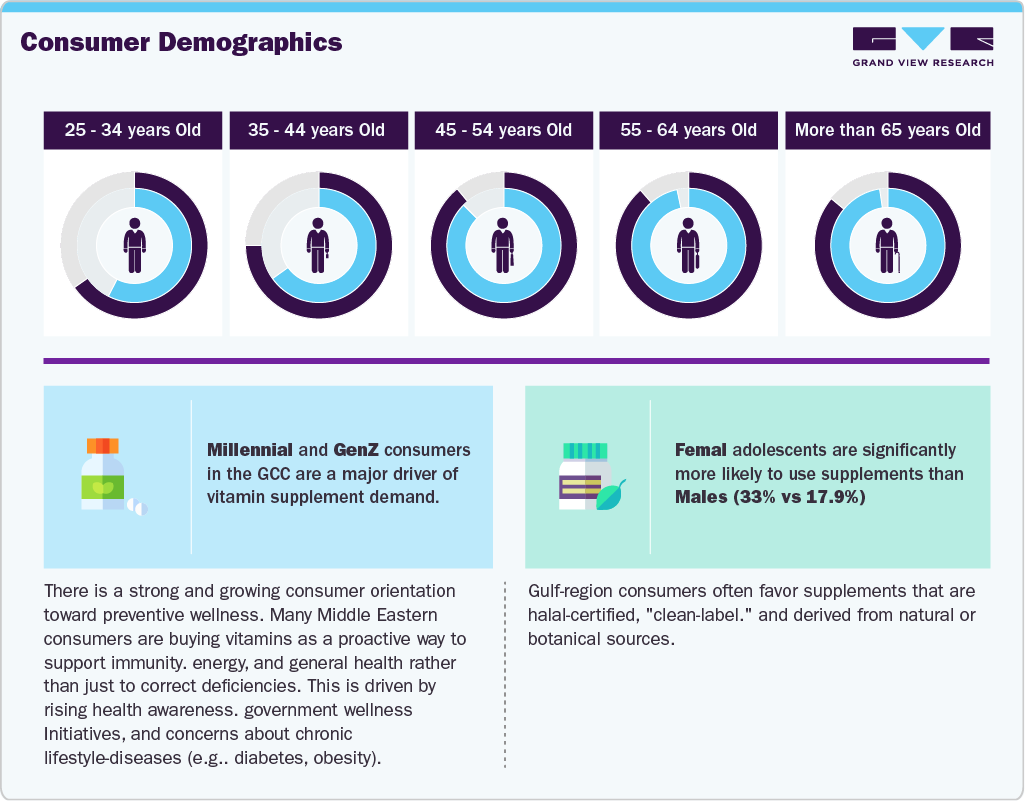

Health-conscious consumer behavior, reinforced by post-pandemic preventive care priorities, is also driving the growth of the Middle East vitamin supplements industry. Government health reports in GCC countries, including the UAE Ministry of Health’s statements on the prevalence of vitamin D deficiency (2021-2023), have highlighted widespread micronutrient gaps in adult populations. This policy-level visibility has positioned vitamins as a preventive health tool, encouraging pharmacies and FMCG retailers to expand their assortments of multivitamins, vitamin D, vitamin C, and iron-based supplements. As a result, greater consumer awareness has been stimulated through physician recommendations, pharmacy consultations, and national wellness programs.

There has been an increase in consumer demand for immunity-support vitamins, particularly vitamin C and multivitamin complexes. This shift has been accompanied by corporate communications from global players such as Haleon (Centrum) and Bayer (Supradyn), which reported increased traction in Middle Eastern markets between 2022 and 2024. As consumers adopt consistent daily-wellness routines, vitamins have been repositioned as essential household products rather than discretionary purchases.

Digital transformation has supported an accelerated shift toward hybrid retail models and omnichannel purchasing, which has become a defining market trend. Leading e-commerce platforms, such as Noon, Amazon UAE, and Talabat Mart, have expanded their supplement assortments and delivery capabilities, enabling higher product accessibility.

Moreover, there has been significant growth in online orders for vitamins and immunity-support products, reflecting consumer preferences for rapid delivery and subscription-enabled convenience. This digital adoption has been further boosted by the region’s young, mobile-savvy demographic profile, resulting in increased market traction for online-exclusive vitamin brands.

Another notable trend has been premiumization and clinical-quality positioning, influenced by rising disposable income in GCC markets and increased trust in science-backed formulations. Companies with strong clinical credibility, such as Solgar, NOW Foods, and Thorne, have expanded their GCC retail footprints through partnerships with regional distributors.

Growing consumer interest in clean-label vitamins, third-party testing, and evidence-based claims is driving the market growth. This premium shift has also been reflected in the proliferation of imported supplements across UAE and Saudi specialty retailers, where consumer preference leans toward U.S. and European nutraceutical brands.

Local and regional manufacturers have also increasingly adopted innovation-focused strategies, driving market penetration. UAE-based companies have launched plant-based, sugar-free gummy vitamins and specialized formulations for women’s health, as noted in recent product announcements by Pharmalife UAE and Wellness Arabia.

Government initiatives supporting local manufacturing, such as Saudi Arabia’s Vision 2030 industrial diversification roadmap, have further encouraged supplement producers to build or expand regional facilities. As a result, the market has seen an uplift in locally made vitamins that appeal to cultural preferences, halal certification requirements, and affordability considerations.

Consumer Insights for the Middle East Vitamin Supplements Industry

In the UAE, according to a consumer survey by BMC Complementary and Alternative Medicine, 37.8% of respondents were using health supplements. Amongst these users, reasons for use were to improve health (66.1%), for bodybuilding (9.9%), disease prevention (6.8%), and weight management (5.3%). Vitamins were the most commonly used health supplements (87.9%), followed by minerals (10.5%), and sports nutrition products (10.5%). Despite 88.2% reporting Vitamin C consumption, only 30.1% demonstrated adequate knowledge, with significant age-related differences. Younger participants had significantly higher knowledge scores than other age groups.

In Saudi Arabia, 53.6% of vitamin supplement users were female, and 42.5% of users were male. The supplement that most participants used was a single vitamin. The supplement that was taken by the majority of participants was a multivitamin and/or multimineral by 65% of the users. In addition, 60.7% of the participants used vitamin D, and more than half of the participants used iron. A difference was also found in the occupation, as those who worked in the health sector were significantly more likely to use vitamin supplements than were those working in other fields.

Type Insights

The multivitamin segment led the market with the largest revenue share of 46.6% in 2025, supported by their positioning as comprehensive, preventive-wellness solutions. Demand has been reinforced by high micronutrient deficiency rates reported by GCC health ministries, particularly vitamin D, iron, and B-complex deficiencies. Multivitamins have continued to achieve high penetration across both pharmacy and e-commerce channels, supported by physician recommendations and household-level repeat use.

The vitamin E segment is projected to grow at the fastest CAGR of 9.4% from 2026 to 2033. Vitamin E, has been driven by rising consumer focus on skin health, antioxidant support, and women’s wellness, which have been consistently highlighted in retailer blogs and regional wellness content. Growth has been further accelerated by dermatology-driven demand, with Vitamin E being recommended in skincare routines for oxidative-stress protection and cellular repair.

Form Insights

The tablets segment led the market with the largest revenue share of 46.1% in 2025, due to its perceived reliability, long shelf-life, and cost-efficiency. Demand has been reinforced by procurement decisions made by pharmacy chains such as Aster Pharmacy (UAE) and Nahdi Medical Company (Saudi Arabia), where tablet-based multivitamins continue to be prioritized within OTC assortments. Preference for standardized dosing has been emphasized across regional regulatory bodies.

The gummies segment is projected to grow at the fastest CAGR of 9.3% from 2026 to 2033. The gummies segment has been positioned as the fastest-growing format, driven by consumer preference for convenience, palatability, and on-the-go supplementation. Growth has been propelled by rising millennial and Gen Z adoption, particularly across the UAE and Saudi Arabia, where increased disposable incomes and lifestyle-driven wellness spending. Product innovation has been accelerated by companies such as Unilever’s OLLY, Vitafusion, and regional operators introducing sugar-free, vegan, and halal-certified gummies to address cultural and health requirements.

Distribution Channel Insights

The offline segment led the market with the largest revenue share of 80.4% in 2025, due to strong consumer reliance on pharmacy-led guidance, in-store credibility, and regulated merchandising practices. High-footfall pharmacy networks, such as Aster Pharmacy, Boots Middle East, Nahdi Medical Company, Al-Dawaa Pharmacies, and BinSina Pharmacy, have maintained extensive OTC vitamin assortments that benefit from pharmacist consultations, which are preferred by families and senior consumers in the GCC.

The online segment is projected to grow at the fastest CAGR of 9.0% from 2026 to 2033. The online channel has emerged as the fastest-growing distribution segment, driven by rising digital adoption, smartphone penetration, and expanding e-commerce logistics capabilities across the GCC. Platforms such as Amazon.ae, Noon, Aster Online, Nahdi Online, and Life Pharmacy’s digital storefront have reported substantial growth in vitamin supplement sales between 2022 and 2024, supported by subscription models, auto-replenishment programs, and AI-driven product recommendation engines.

Country Insights

Saudi Arabia Vitamin Supplements Market Trends

Saudi Arabia dominated the Middle East vitamin supplements market with the largest revenue share of 26.2% in 2025. Saudi Arabia has been positioned as the largest market in the Middle East’s vitamin supplements landscape, supported by strong preventive healthcare spending and nationwide wellness directives. Demand has been reinforced by public health findings issued by the Saudi Ministry of Health and Saudi Food & Drug Authority (SFDA) between 2021 and 2023, which highlighted high prevalence of vitamin D deficiency, rising obesity levels, and micronutrient gaps in adults and adolescents. Extensive pharmacy networks, including Nahdi Medical Company and Al-Dawaa Pharmacies, have played a key role in category expansion by increasing shelf space for multivitamins, immunity blends, and gummy formats.

UAE Vitamin Supplements Market Trends

The vitamin supplements market in the UAE is anticipated to grow at the fastest CAGR of 8.6% from 2026 to 2033. The UAE has emerged as the fastest-growing market, driven by high urbanization, a strong expatriate population, and rapid digital transformation across the health and wellness sector. The increased demand for premium, imported, and clean-label vitamins, particularly U.S. brands such as Nature Made, Solgar, and NOW Foods, has been supported by the expansion of omnichannel retailers, including Aster Pharmacy, Life Pharmacy, and BinSina. The UAE’s strong e-commerce ecosystem, high disposable incomes, and rapid adoption of gummies, vegan formulations, and beauty-from-within supplements have collectively positioned the country as the fastest-growing market within the regional vitamin supplements category.

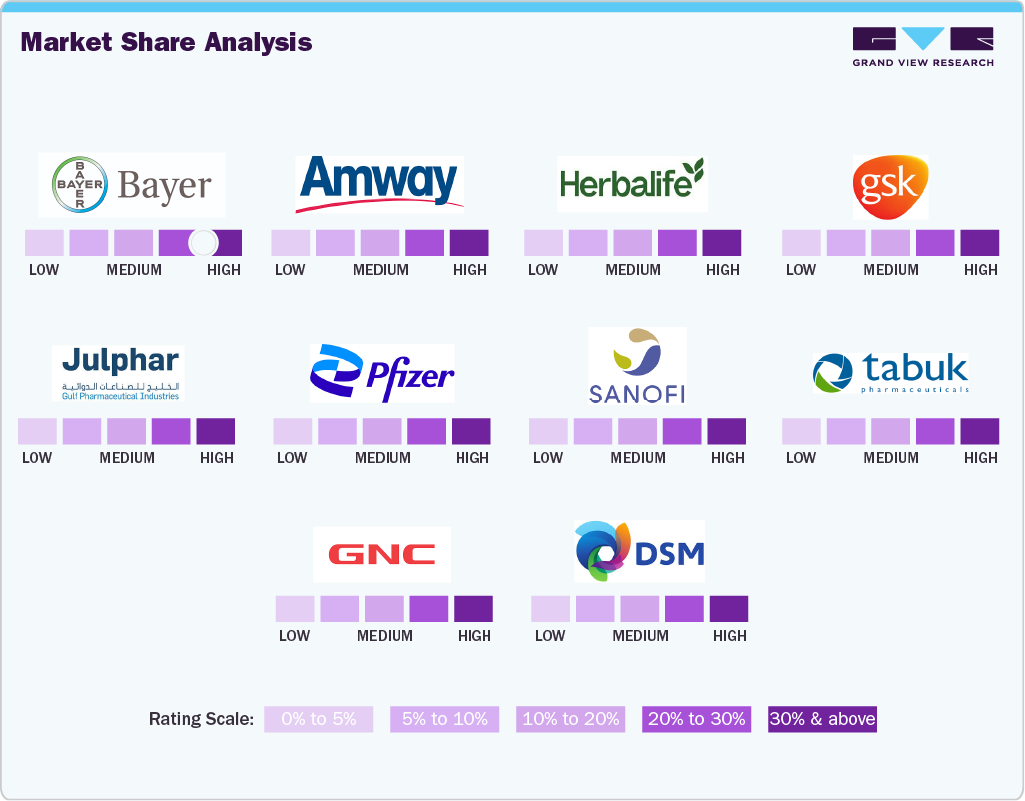

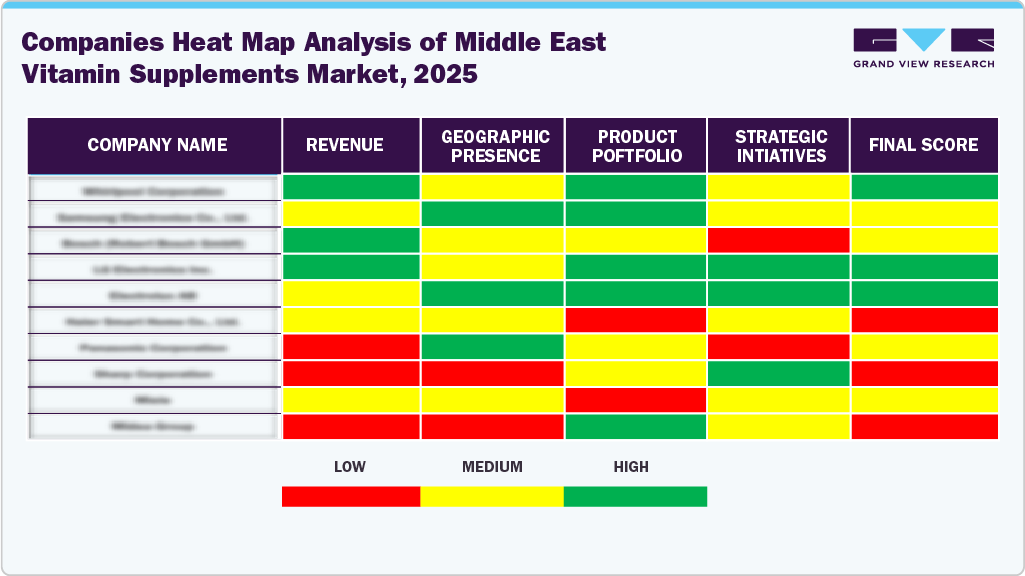

Key Middle East Vitamin Supplements Company Insights

The Middle East vitamin supplements industry has been characterized as a dual-tier structure in which large multinationals and established regional distributors dominate mainstream retail. At the same time, digital-native and niche premium brands capture higher-margin segments (gummies, beauty-from-within, clinical-grade formulas). Market scale and growth projections for the Middle East vitamin supplement industry have been reported at the regional level, with multivitamins identified as the largest type and vitamin E among the fastest-growing types, supporting sustained multinational participation across GCC markets.

Global consumer-health manufacturers (Haleon/GSK, Bayer, Pharmavite/Nature Made, Nestlé/The Bountiful Company, Glanbia, Abbott) were noted to maintain broad GCC distribution via national distributors, retail pharmacy agreements, and e-commerce listings; regional and local brands/distributors were also reported to be active in halal-certified and price-sensitive segments. Large pharmacy chains and wholesalers have been used as primary distribution partners to accelerate market penetration.

Key Middle East Vitamin Supplements Companies:

Bayer AG

Amway Corporation

Herbalife Nutrition

GlaxoSmithKline (GSK)

Pfizer Inc.

Julphar (Gulf Pharmaceutical Industries)

Sanofi

DSM Nutritional Products

Tabuk Pharmaceuticals

GNC Holdings, Inc.

Recent Developments

In July 2025, Bayer released Supradyn Naturals Ginseng, its first multivitamin targeted specifically for men, blending ginseng, grapeseed extract, 12 vitamins, and 5 minerals.

In June 2025, Amway (Nutrilite) launched a stick-pack version of its “All Plant Protein Powder” (18 stick packs per box) for on-the-go use.

Middle East Vitamin Supplements Market Report Scope

Report Attribute

Details

Market value size in 2026

USD 1,267.9 million

Revenue Forecast in 2033

USD 2,209.0 million

Growth rate

CAGR of 8.3% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 – 2024

Forecast period

2026 – 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, form, distribution channel, country

Regional scope

Middle East

Country scope

Saudi Arabia; UAE; Qatar

Key companies profiled

Bayer AG; Amway Corporation; Herbalife Nutrition; GlaxoSmithKline (GSK); Pfizer Inc.; Julphar (Gulf Pharmaceutical Industries); Sanofi; DSM Nutritional Products; Tabuk; Pharmaceuticals; GNC Holdings, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Vitamin Supplements Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East vitamin supplements market report based on the type, form, distribution channel, and country.

Type Outlook (Revenue, USD Million, 2021 – 2033)

Multivitamin

Vitamin A

Vitamin B

Vitamin C

Vitamin D

Vitamin E

Vitamin K

Form Outlook (Revenue, USD Million, 2021 – 2033)

Powder

Tablets

Capsules

Softgels

Gummies

Others

Distribution Channel Outlook (Revenue, USD Million, 2021 – 2033)

Country Outlook (Revenue, USD Million, 2021 – 2033)