Abbott Laboratories (NYSE:ABT) is addressing ongoing headwinds in its Nutrition segment with changes to pricing, promotions, and cost structures, with a shift signaled to begin in the fourth quarter. The company is moving ahead with the pending acquisition of Exact Sciences to expand its presence in cancer diagnostics. Abbott is also rolling out new products in diabetes care and cardiovascular devices, supported by recent regulatory approvals.

For investors watching NYSE:ABT, the key story right now is how the business is rebalancing between challenged Nutrition operations and areas such as diabetes care and medical devices. Nutrition has weighed on recent sentiment, so the planned reset in pricing, promotions, and costs is an important development. This comes alongside efforts to keep its device franchises competitive through new product launches.

At the same time, the pending Exact Sciences acquisition signals a push into cancer diagnostics, which would add a new vertical to Abbott’s existing portfolio in diagnostics, devices, and nutrition. Together, these moves frame a period of portfolio adjustment that may reshape how the company allocates capital and attention across its major business lines.

Stay updated on the most important news stories for Abbott Laboratories by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Abbott Laboratories.

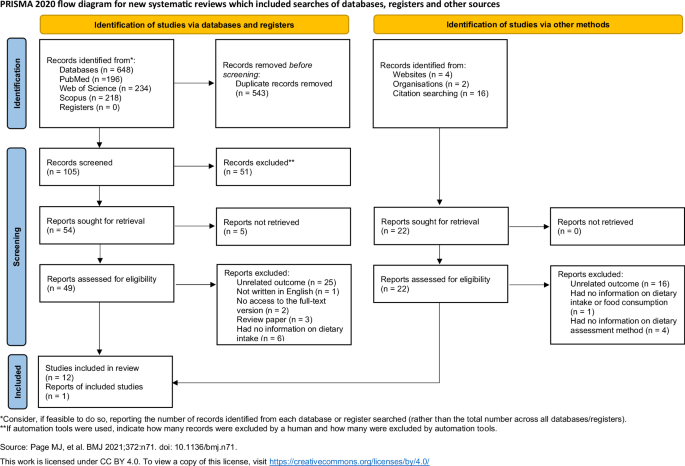

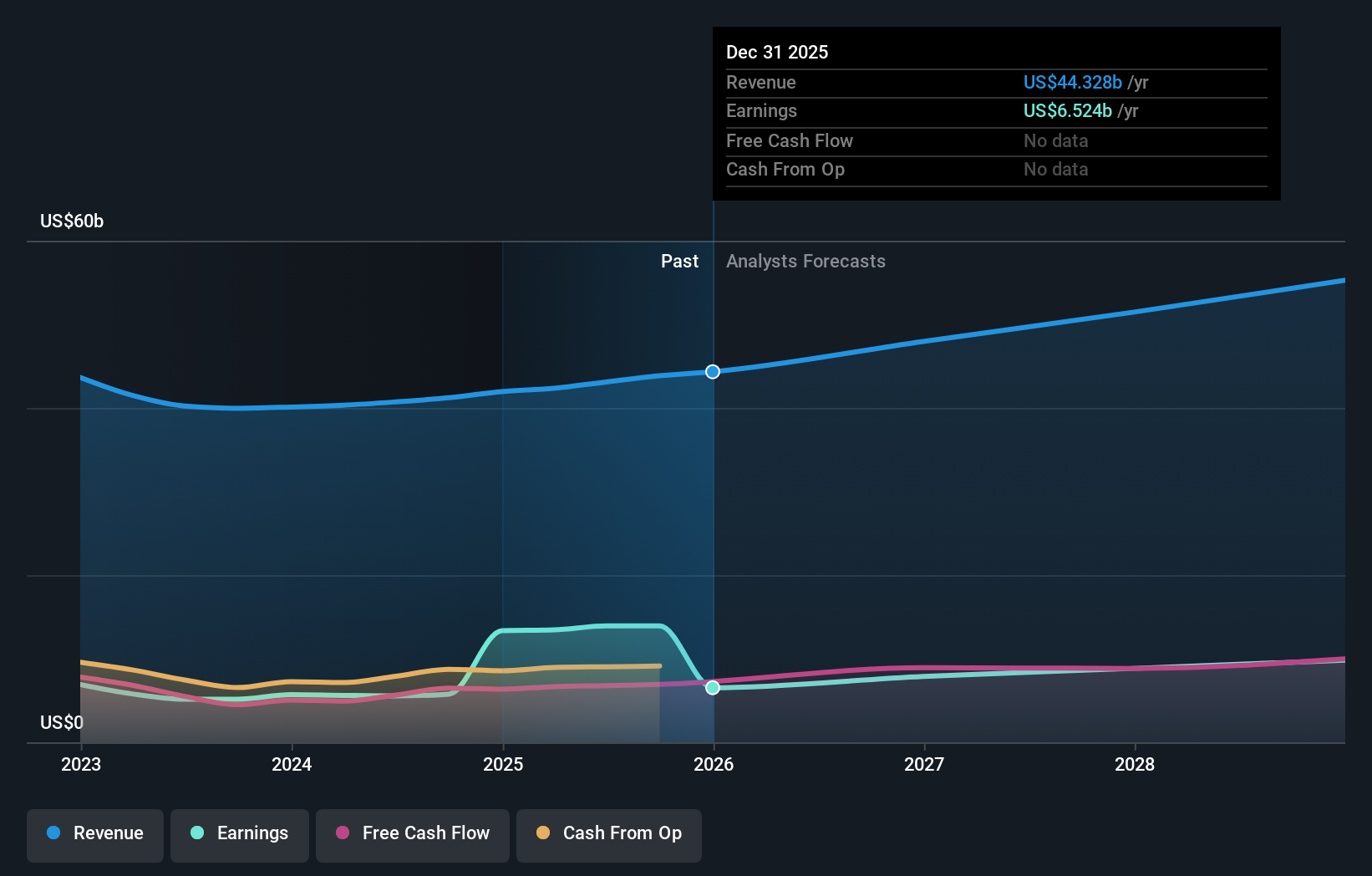

NYSE:ABT Earnings & Revenue Growth as at Jan 2026

NYSE:ABT Earnings & Revenue Growth as at Jan 2026

How Abbott Laboratories stacks up against its biggest competitors

For you as an investor, the key takeaway is that Abbott is using a tough quarter in Nutrition as a catalyst to rebalance the business mix, while leaning into areas like diabetes care and cardiovascular devices where product launches and regulatory approvals are already in motion. The pending US$21b Exact Sciences deal would further tilt the company toward diagnostics and cancer screening, placing it more squarely alongside diversified peers such as Johnson & Johnson and Medtronic in higher-technology categories.

How this fits the Abbott Laboratories narrative

The latest moves line up with the existing narrative that Abbott’s long term story is tied to a broad, multi segment healthcare portfolio and continued product development in diabetes and heart health. Adding Exact Sciences on top of its device pipeline would deepen that multi pronged model, which some analysts already view as a way to smooth earnings between more cyclical businesses like Nutrition and recurring, test based or device driven revenue streams.

Risks and rewards investors should weigh ⚠️ The Nutrition reset follows lost contracts, higher manufacturing costs and softer demand after price increases, which could keep pressure on margins if execution is slow. ⚠️ A US$21b acquisition brings integration risk and the possibility that expected synergies or cancer diagnostics growth do not fully materialize. 🎁 New diabetes and cardiovascular device launches, including continuous glucose monitoring, give Abbott products that compete directly with players like Dexcom and Medtronic. 🎁 A larger diagnostics footprint from Exact Sciences could increase Abbott’s exposure to recurring test volumes across hospitals and at home settings. What to watch next

From here, it is worth watching how quickly Nutrition trends respond to the pricing and promotional changes, the regulatory and closing timeline for the Exact Sciences transaction, and early sales traction from the latest diabetes and cardiovascular products. If you want the broader context around these moves and how other investors see the story playing out, check the community narratives on Abbott Laboratories here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com