e.l.f. Beauty (NYSE:ELF) has agreed to acquire the Rhode skincare brand, adding a recognizable name in skincare to its portfolio. The deal comes as the company reports solid results in its home market alongside ongoing softness in some international channels. Rhode is expected to broaden e.l.f. Beauty’s reach in skincare and reshape how its overall brand mix is perceived by consumers and investors.

For investors watching NYSE:ELF, the Rhode acquisition lands at a time when the stock trades around $86.15 and the long term return profile has been very strong, with a 5 year gain of 269.3%. Over the past month, the share price return of 10.7% contrasts with a 7.8% decline over the past year, which indicates that sentiment has been mixed more recently.

The addition of Rhode gives e.l.f. Beauty another potential lever for growth and may help offset weaker areas outside the US if the brand scales as planned. For investors, the key question is how effectively management can integrate Rhode, support it with marketing and distribution, and balance that effort with the core e.l.f. franchise.

Stay updated on the most important news stories for e.l.f. Beauty by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on e.l.f. Beauty.

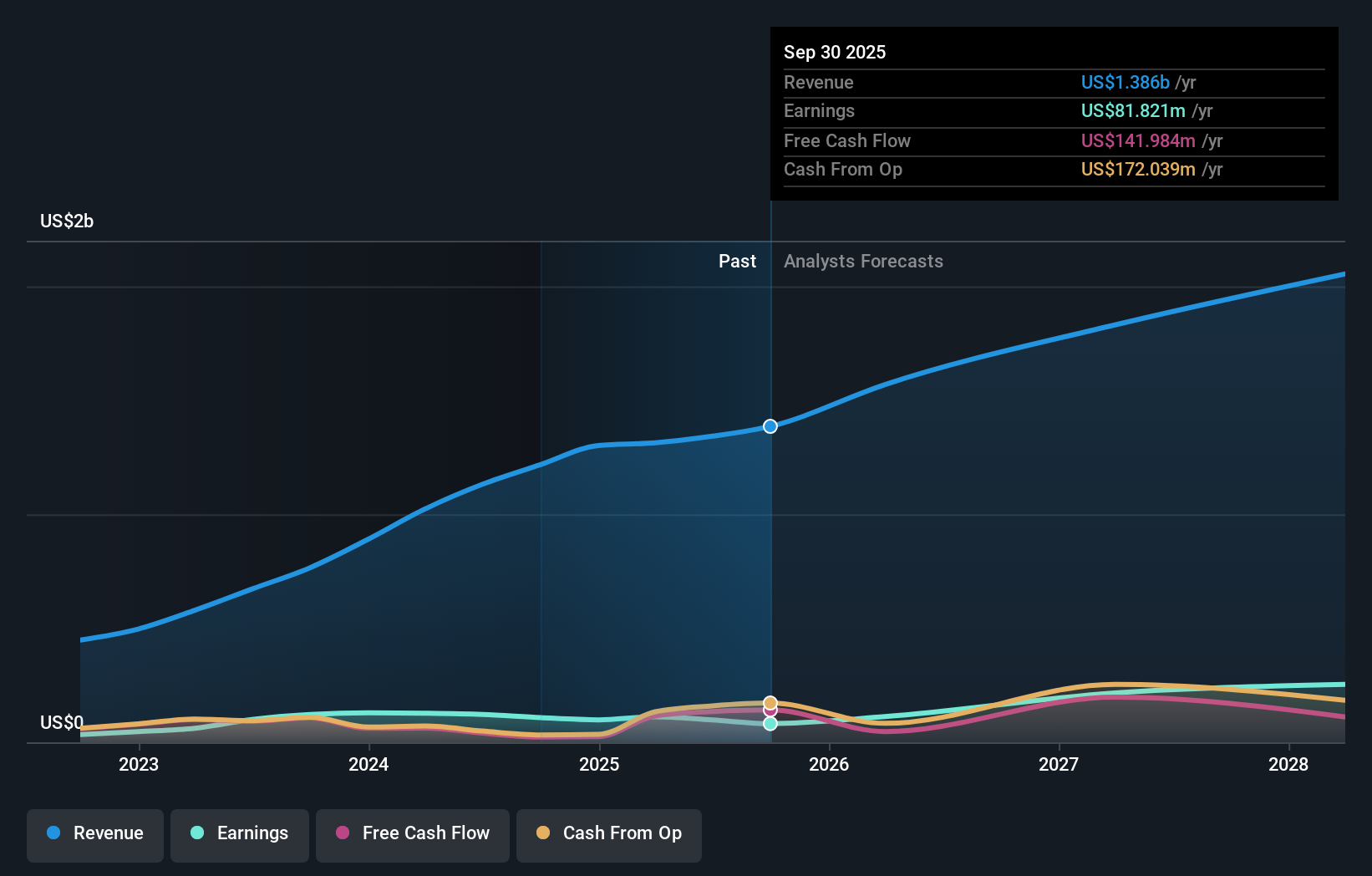

NYSE:ELF Earnings & Revenue Growth as at Feb 2026

NYSE:ELF Earnings & Revenue Growth as at Feb 2026

How e.l.f. Beauty stacks up against its biggest competitors

The Rhode deal plugs directly into e.l.f. Beauty’s push to build out a broader, higher-profile skincare portfolio, while its core US business continues to hold up and some international channels remain weaker. For you as an investor, this adds a second branded pillar in skincare that could sit alongside mass-market peers like L’Oréal and Coty by attracting a slightly different consumer and potentially helping e.l.f. keep shelf space and negotiating power with key retailers.

How This Fits The e.l.f. Beauty Narrative

The acquisition ties in closely with the existing narrative that e.l.f. is leaning into influencer marketing and community-led brands, as Rhode brings a direct-to-consumer model and celebrity reach that can complement e.l.f.’s own social media playbook. It also lines up with the view that management is using acquisitions and new distribution to widen its global footprint, even as tariffs and international softness have created some friction in recent periods.

Key Risks And Rewards To Keep In Mind 🎁 Rhode broadens the product mix into higher-awareness skincare, which could support brand perception and help attract new consumers to the overall portfolio. 🎁 The acquisition offers more ways to leverage influencer marketing and digital channels, which have been important for e.l.f.’s growth story so far. ⚠️ Integration adds complexity at a time when analysts have flagged three key risks around profitability trends, share price volatility, and debt profile. ⚠️ International softness, tariff-related cost pressures, and execution risk around scaling Rhode could limit how much benefit investors actually see from the deal. What To Watch From Here

From here, it is worth watching how quickly Rhode products show up across new retailers, how the combined marketing spend affects margins, and whether international sales start to move in a healthier direction alongside the new brand. If you want more context on how this fits into the longer term story, check the community narratives on e.l.f. Beauty’s dedicated page to see different investor views on growth, risks, and valuation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com