LAS VEGAS — With shoppers navigating economic uncertainty and shifting between retail channels, grocers are facing mounting pressure to build loyalty and increase basket size. During NGA 2026, at a Main Stage session titled “Driving Growth Through Specialty: How Global Flavors and Wellness Can Supercharge Your Basket,” Leana Salamah, Senior vice president of Marketing & Communications at the Specialty Food Association, outlined how emerging wellness behaviors and global flavor experimentation are reshaping consumer demand — and offering retailers new opportunities for growth.

Consumers Are “Frustrated” — and Turning to Food

Salamah opened by describing today’s shopper as emotionally volatile and economically cautious, citing research showing consumers are “vacillating between resilience and recklessness.” Sudden swings in mood, triggered by economic news and cultural shifts, are influencing how people shop and eat.

One-third of adults now use food — especially treats — as a tool for emotional regulation, she noted. And against the backdrop of rising anxiety over artificial intelligence, many consumers are reacting with a newfound appreciation for sensory, high-quality, human-made experiences. That pushback has crystallized in the popularization of the term “slop,” Merriam-Webster’s 2025 word of the year, referring to low-quality mass-produced AI content. Food, Salamah suggested, is experiencing its own “anti-slop” movement.

Wellness Priorities: Appetite Reset and Honest Processing

Salamah identified two dominant wellness trends:

1. Appetite Reset

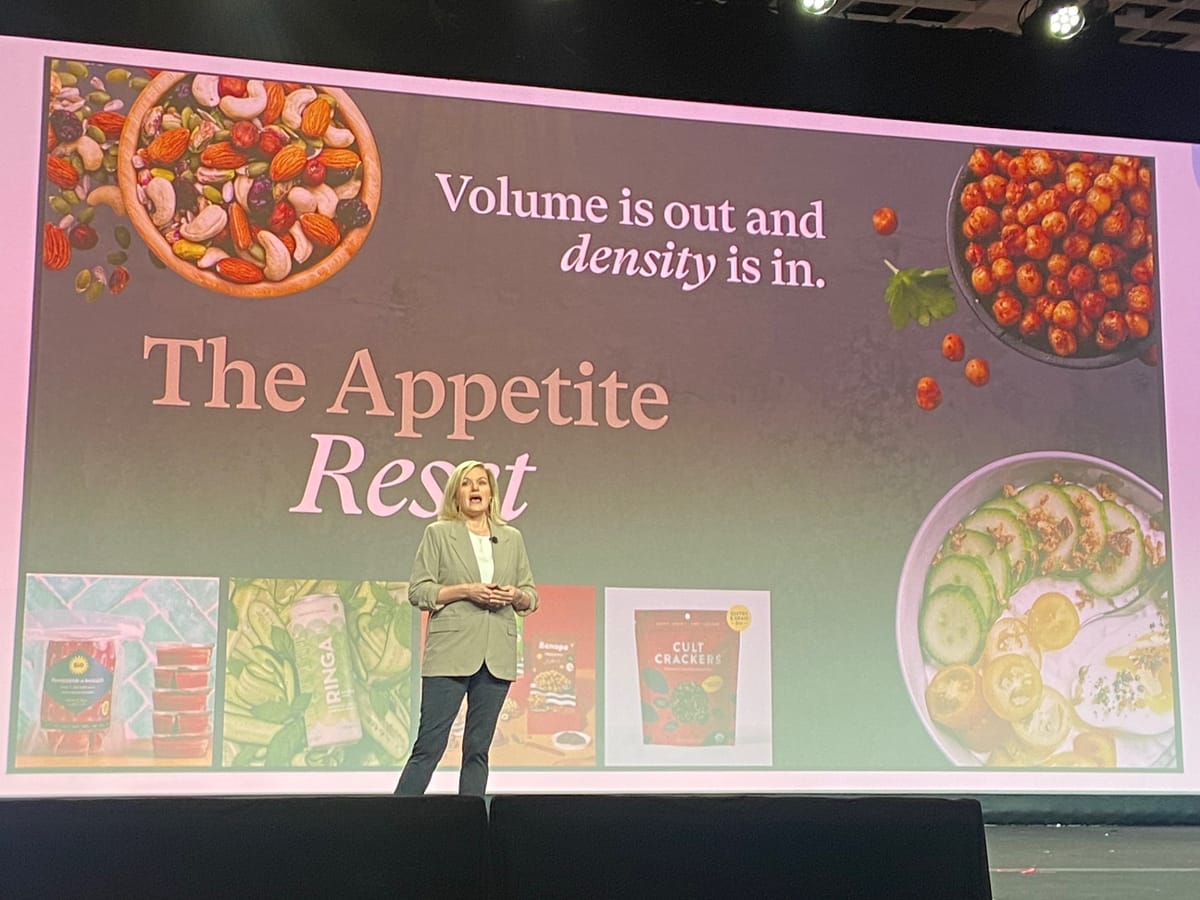

The rise of GLP-1 weight‑loss medications is having a profound impact on food choices. With millions of adults either on or considering the drugs, consumers are gravitating toward nutrient-dense, smaller-portion foods.

“This is here to stay,” Salamah emphasized, noting that roughly half of GLP‑1 users expect to remain on the medications for years. Retailers, she said, can respond with:

Mechanics-based merchandising that groups nutrient-dense snacks, proteins, and high-fiber itemsClinical crossover opportunities, such as in-store partnerships with pharmacies or telehealth providers“Precision portioning” — smaller sizes marketed not as shrinkflation, but as “satisfaction sizing” or “perfect portions”2. Honest Processing

While consumers say they want minimally processed foods, many misunderstand what “processing” actually means. Salamah argued the opportunity lies in visible, purposeful, and trustworthy processing — such as fermentation, freeze-drying, or natural separation in nut butters and cheeses.

She encouraged retailers to:

Train staff to point out natural imperfections that signal authenticityUse in-store “digital windows” to showcase behind-the-scenes food preparationOffer demos that help shoppers compare products (e.g., heat‑pasteurized vs. freeze‑dried juices)Global Flavors: From Purity to Playfulness

Consumers are exploring global cuisines with unprecedented creativity. Unlike past years — when authenticity was strictly policed — shoppers now remix global ingredients without guilt.

Platforms like TikTok have popularized dishes such as chili‑crisp eggs and “dumpling lasagna,” which Salamah cited as examples of consumers using global flavors as identity and self-expression tools.

Retailers can harness the trend through:

Functional signage that focuses on flavor experiences (e.g., “punchy, smoky heat”) rather than country of originFlavor‑system merchandising, grouping hot sauces or spices across cultures in single displaysTrend‑driven demos tied to viral social momentsSpecialty Foods as High-Margin Growth Engines

Salamah emphasized that the evolving landscape favors challenger brands — smaller, more nimble companies that innovate quickly and authentically.

“Specialty products deliver three to four times the gross margin return of mainstream items,” she noted, citing Specialty Food Association research. While they may move more slowly, they significantly increase profitability per basket.

Looking Ahead

The Specialty Food Association recently identified six major consumer trends for 2026, unveiling them at its Winter Fancy Food event. Among them: “sense snacking,” an accelerated desire for intense flavors and textures that celebrate the human sensory experience — an antidote, Salamah suggested, to an increasingly AI‑shaped world.

The Association will release a full trend report and plans to spotlight further insights at the upcoming Summer Fancy Food Show in New York.

Salamah closed with a reminder that food trends ultimately reflect human needs.

“It’s not just about lavender or black garlic,” she said. “It’s about what those flavors fulfill for the consumer — emotionally and rationally. Food is becoming both medicine and personality.”