Ulta Beauty (NasdaqGS:ULTA) has opened its first store in the United Arab Emirates at Mall of the Emirates. The launch is part of a wider entrance into the Gulf region, with additional stores planned in Dubai and Jeddah. Regional celebrations, partnerships with local beauty entrepreneurs, and exclusive product offerings accompanied the opening.

For investors watching global retail, this move takes Ulta Beauty’s off-mall, specialty beauty format into a new region that is already familiar with premium and mass market cosmetics. The company is adding its mix of products and services to a market where beauty spending is an established consumer category and where international brands are increasingly present.

By combining store openings with regional collaborations, Ulta Beauty is introducing its loyalty-driven model and curated assortments to a new customer base. Readers may want to monitor how quickly the concept scales across the Gulf region and how the international store set fits alongside the company’s core US network over time.

Stay updated on the most important news stories for Ulta Beauty by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Ulta Beauty.

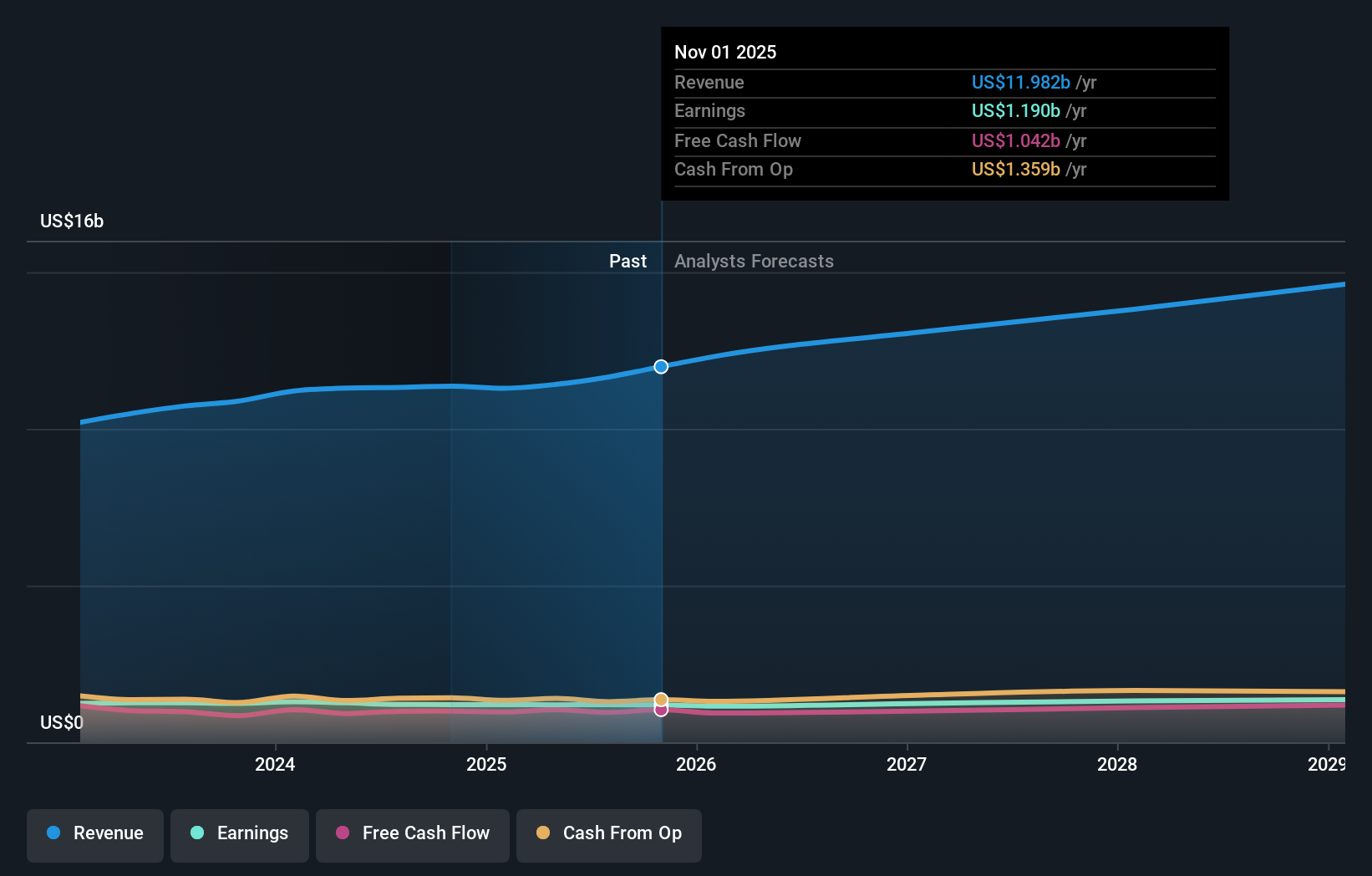

NasdaqGS:ULTA Earnings & Revenue Growth as at Feb 2026

NasdaqGS:ULTA Earnings & Revenue Growth as at Feb 2026

How Ulta Beauty stacks up against its biggest competitors

Ulta Beauty’s first UAE store, operated with franchise partner Alshaya Group, takes its full-service, off-mall model into a region where beauty and fragrance are already core consumer categories, and where rivals like Sephora and local multi-brand retailers are well established. For investors, the key angle is how successfully Ulta’s mix of services, exclusive US brands and loyalty program converts existing beauty spend rather than relying on entirely new demand.

How This Fits The Ulta Beauty Narrative

The move into the Gulf adds another leg to the company’s international story that already includes Mexico and the Space NK acquisition. Both of these feature in existing investor narratives about broadening revenue sources beyond the US store base. Those narratives also highlight wellness, exclusive partnerships and a large loyalty program as growth drivers, and the UAE launch leans into all three by blending services, curated brands and events that can feed back into Ulta’s digital and rewards ecosystem.

Risks And Rewards To Keep In Mind Entry into the UAE, followed by Dubai and Jeddah, gives Ulta access to incremental store-driven revenue streams outside the US. The partnership model with Alshaya and the focus on exclusive and local brands could support differentiation versus Sephora and department-store counters. International expansion requires upfront investment and carries execution risk if consumer response or store productivity in the Gulf region falls short of expectations. Analysts have flagged cost inflation, intense beauty retail competition and the loss of the Target shop-in-shop relationship as broader headwinds that could limit the benefits from new markets. What To Watch Next

From here, it is useful to watch early traffic, service uptake and brand mix in the Gulf stores, as well as any commentary on how this international footprint balances other pressures on earnings. If you want more context on how this fits with earnings expectations, wellness growth and overseas expansion, check community narratives on Ulta Beauty’s dedicated page.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com