ADM (NYSE:ADM) and Alltech have launched Akralos, a North American animal nutrition joint venture, which is now fully operational. The venture combines ADM’s feed operations with Alltech’s brands and expertise in animal nutrition. Akralos is positioned as one of the largest animal feed and nutrition platforms in North America.

For you as an investor looking at ADM (NYSE:ADM), Akralos ties directly into the company’s existing footprint in agricultural processing and animal feed. Animal nutrition has been an important part of ADM’s broader business mix, and this joint venture brings that activity together with Alltech’s established brands and technical know how in feed and nutritional products.

The launch of Akralos could influence how ADM competes with other large feed and nutrition providers, as well as how it allocates resources across its broader portfolio. You may want to watch for future disclosures on volumes, product mix, and any reported financial contributions from Akralos to help gauge how this new platform fits into ADM’s overall animal nutrition strategy.

Stay updated on the most important news stories for Archer-Daniels-Midland by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Archer-Daniels-Midland.

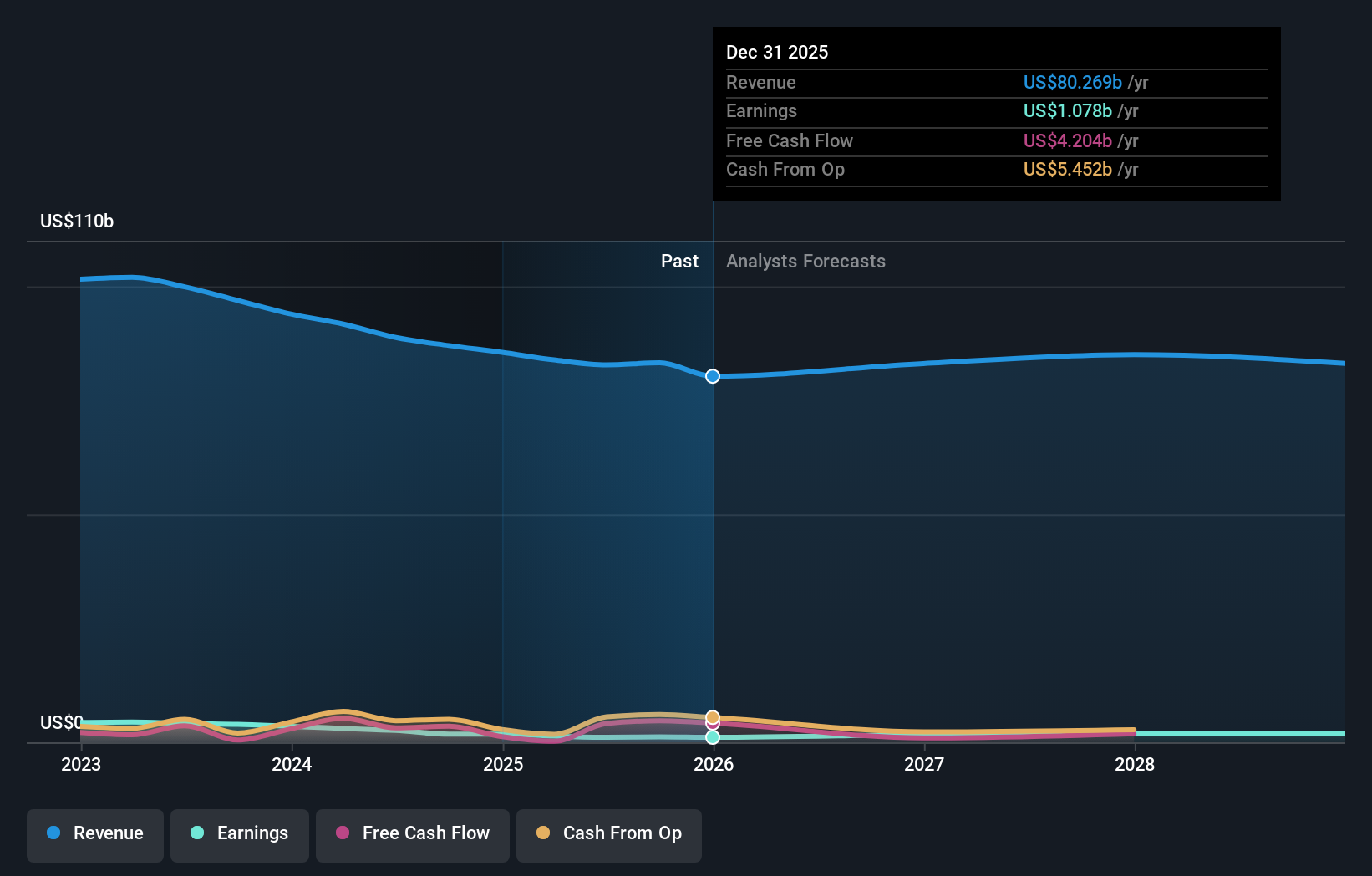

NYSE:ADM Earnings & Revenue Growth as at Feb 2026

NYSE:ADM Earnings & Revenue Growth as at Feb 2026

Quick Assessment ❌ Price vs Analyst Target: At US$69.50, ADM trades about 15.7% above the US$60.09 analyst price target midpoint. ✅ Simply Wall St Valuation: ADM is described as trading about 16.4% below the Simply Wall St fair value estimate. ✅ Recent Momentum: The 30 day return of roughly 9.7% suggests positive short term momentum around the time Akralos went live.

There is only one way to know the right time to buy, sell or hold Archer-Daniels-Midland. Head to Simply Wall St’s

company report for the latest analysis of Archer-Daniels-Midland’s Fair Value.

Key Considerations 📊 Akralos folds ADM’s existing animal nutrition footprint into a larger platform, which could affect how investors think about the mix of earnings across its Food segment. 📊 Keep an eye on management commentary around Akralos volumes, margins and any separate disclosure that helps you see how this venture contributes relative to ADM’s US$80.3b in revenue. ⚠️ Profit margins of 1.3%, lower than last year’s 2.1%, and earnings-based concerns such as one-off items and dividend coverage remain key risks when assessing how much weight to give this new venture. Dig Deeper

For the full picture including more risks and rewards, check out the

complete Archer-Daniels-Midland analysis. Alternatively, you can visit the

community page for Archer-Daniels-Midland to see how other investors believe this latest news will impact the company’s narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com