Find your next quality investment with Simply Wall St’s easy and powerful screener, trusted by over 7 million individual investors worldwide.

L’Oréal (ENXTPA:OR) has completed acquisitions including Kering Beauté and a larger stake in Galderma, reshaping its luxury beauty and dermatology footprint.

The group has entered the nutricosmetics space with Vichy Laboratoires’ first collagen supplement, expanding beyond traditional topical products.

L’Oréal has reinforced its sustainability agenda through an investment in P2 Science for green ingredient technologies and participation in large scale reuse packaging pilots.

L’Oréal, the global beauty group behind mass market, luxury and dermatology brands, is pushing into new product categories and capabilities that sit alongside its existing portfolio. The move into nutricosmetics via Vichy and the closer ties to Galderma point to a broader health and beauty platform. Luxury assets from Kering Beauté deepen its reach with premium consumers.

For investors, these steps highlight how L’Oréal is positioning around beauty, wellness and sustainability themes that have drawn growing consumer and regulatory attention. The combination of acquisitions, new formats such as supplements, and work on reuse and upcycling could influence how the company allocates capital, builds brands and manages its environmental footprint over the coming years.

Stay updated on the most important news stories for L’Oréal by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on L’Oréal.

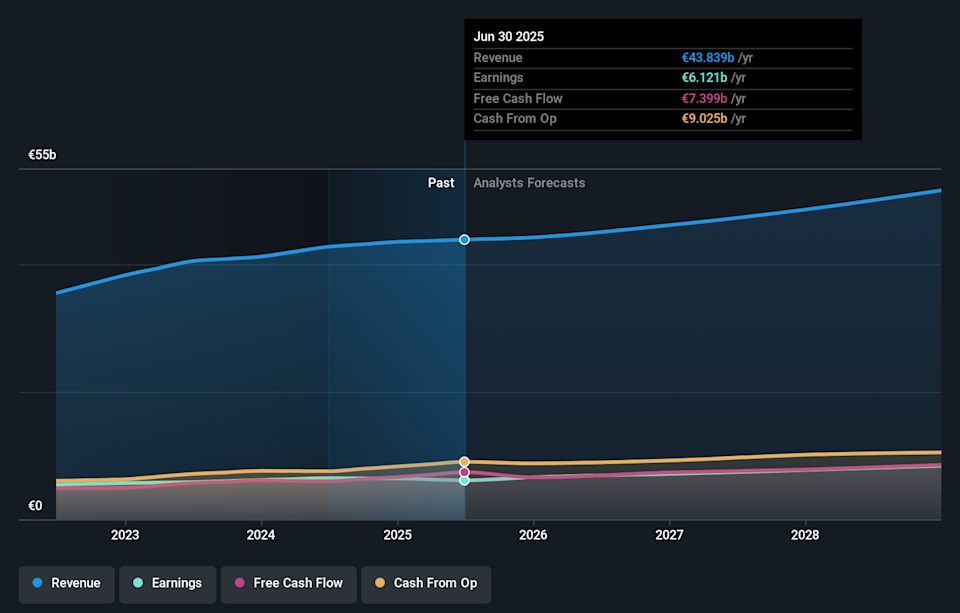

ENXTPA:OR Earnings & Revenue Growth as at Feb 2026

ENXTPA:OR Earnings & Revenue Growth as at Feb 2026

📰 Beyond the headline: 0 risks and 2 things going right for L’Oréal that every investor should see.

L’Oréal’s recent deals and sustainability moves sit alongside a year where sales reached €44.05b, while net income and earnings per share were slightly lower than the prior year. That mix indicates these initiatives are arriving at a time when management is still spending to support growth and reposition the portfolio, rather than only focusing on short term profit metrics. The Kering Beauté acquisition and larger Galderma stake lean into luxury and dermatology, areas where peers like Estée Lauder and Procter & Gamble are also competing for premium consumers. Entry into nutricosmetics through Vichy and the P2 Science partnership extends that push into health focused and lower impact products, which could support brand relevance and pricing power if executed well.

The emphasis on premium luxury brands, dermatology and wellness supplements supports the narrative that product mix and emerging categories can be important drivers of future growth and margins.

Acquisitions and new product formats add complexity, which could test the company’s ability to keep costs disciplined and protect profitability, a key assumption in the narrative.

City scale reuse pilots and green ingredient investments deepen the sustainability angle, which is not a major focus of the existing narrative but may become more important for long term brand strength.

Knowing what a company is worth starts with understanding its story. Check out one of the top narratives in the Simply Wall St Community for L’Oréal to help decide what it is worth to you.

⚠️ Integration risk from recent acquisitions and new categories, where execution missteps could weigh on margins or dilute focus.

⚠️ Strong competition from global peers like Estée Lauder and Unilever, as well as local and digital native brands, could limit the benefits from luxury, dermatology and nutricosmetics pushes.

🎁 The push into higher value segments such as luxury beauty and dermatological aesthetics, alongside nutricosmetics, gives L’Oréal more ways to address premium and health focused demand.

🎁 Sustainability projects such as the Ottawa reuse initiative and green chemistry partnerships may support long term brand equity with regulators and consumers who are focused on environmental impact.

From here, you may want to watch how quickly Kering Beauté brands and Galderma contribute to reported sales, and whether the nutricosmetics launch leads to a broader portfolio of ingestible products. It is also worth tracking how sustainability pilots like the Reuse City Canada Project move from test phase to wider adoption, and any cost or margin commentary around these efforts in future results. Management’s capital allocation between acquisitions, dividends such as the proposed €7.20 per share, and reinvestment in product development will help indicate how the group balances growth with shareholder returns.

To stay informed on how the latest news impacts the investment narrative for L’Oréal, head to the community page for L’Oréal to keep up to date with the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OR.PA.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com