What Planet Fitness stock’s recent slide may be telling investors

Planet Fitness (PLNT) has seen its share price fall about 10% over the past month and about 14% over the past 3 months, prompting investors to revisit what the current valuation reflects.

See our latest analysis for Planet Fitness.

That recent 1 month share price return of about 10% decline and 3 month share price return of about 14% decline leaves Planet Fitness trading at US$90.70, while the 1 year total shareholder return of about 10% decline contrasts with a 3 year total shareholder return of about 17% and 5 year total shareholder return of about 16%. This suggests shorter term momentum has faded compared with the longer term record.

If this gym stock’s pullback has you thinking about where growth could come from next, it might be worth scanning 23 top founder-led companies as another way to find potential long term compounders.

So with Planet Fitness now trading at US$90.70, recent share price weakness, double digit annual revenue and net income growth, and a modest intrinsic value discount, is this a buying window, or is the market already pricing in future growth?

Most Popular Narrative: 30.5% Undervalued

Against the last close at $90.70, the most followed narrative pegs Planet Fitness’ fair value at about $130, implying a sizable valuation gap.

Rising Black Card penetration, combined with proven ability to implement price increases with minimal impact on churn, signals future near-term potential for further price hikes at this higher margin tier, directly benefitting average revenue per member and overall earnings.

Want to see what kind of revenue climb and margin uplift would need to hold for that valuation to stack up? The narrative leans on a multi year earnings build, richer membership mix, and a premium earnings multiple that assumes the model keeps scaling efficiently. The exact mix of growth and profitability might surprise you.

Result: Fair Value of $130.41 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, this depends on churn remaining contained and franchise expansion staying healthy, since sustained attrition or weaker unit growth could quickly challenge that upbeat earnings path.

Find out about the key risks to this Planet Fitness narrative.

Another angle on valuation

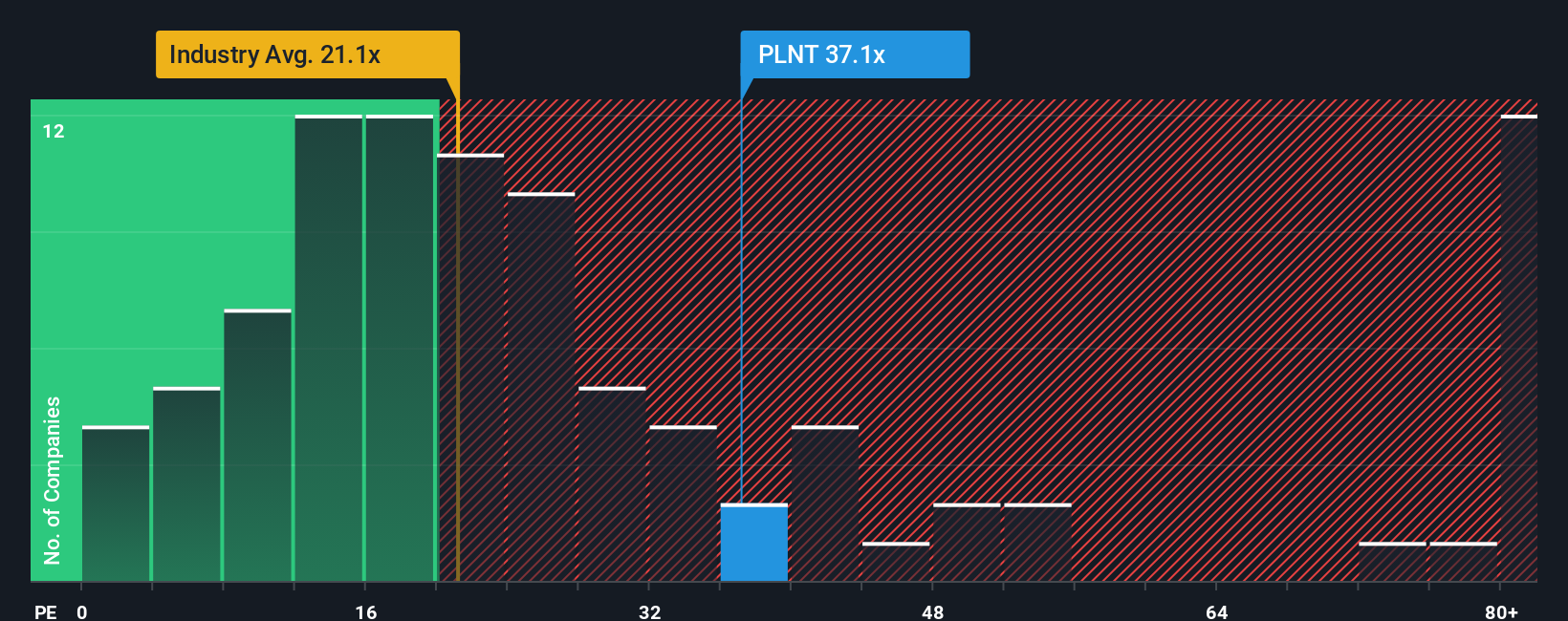

That US$130 fair value from the narrative leans on future earnings and a premium P/E. If you keep things simpler and just compare today’s P/E of 36.6x, Planet Fitness screens as expensive versus the US Hospitality average at 21.1x, peer average at 16.5x, and a fair ratio of 23.8x. The key question is whether the projected growth is powerful enough to justify paying this kind of premium, or whether it builds in extra valuation risk if expectations cool.

See what the numbers say about this price — find out in our valuation breakdown.

NYSE:PLNT P/E Ratio as at Feb 2026 Build Your Own Planet Fitness Narrative

NYSE:PLNT P/E Ratio as at Feb 2026 Build Your Own Planet Fitness Narrative

If you look at the numbers and come to a different conclusion, or simply want to test your own view against the data, you can shape a custom story for Planet Fitness in just a few minutes with Do it your way.

A great starting point for your Planet Fitness research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop at one stock, you could miss some of the most interesting setups the screener is surfacing right now, so keep your watchlist working harder.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com