In February 2026, e.l.f. Beauty, Inc. appointed veteran consumer-products executive and former Church & Dwight CEO Matthew Farrell to its Board of Directors as a Class I director, while also completing a US$100.53 million share repurchase program covering 1,587,303 shares announced in August 2024. This combination of adding an experienced operator with deep finance and consumer-brand expertise and returning capital through buybacks could influence how investors assess e.l.f.’s governance quality and capital allocation discipline. Now we’ll examine how Farrell’s board appointment and the completed buyback might reshape e.l.f. Beauty’s investment narrative around growth and risk.

Find 53 companies with promising cash flow potential yet trading below their fair value.

e.l.f. Beauty Investment Narrative Recap

To own e.l.f. Beauty, you need to believe its Gen Z focused brand, multi-brand portfolio, and international expansion can keep driving growth while margins hold up against tariffs and rising costs. Right now, the key near term catalyst is continued sales and profit execution, including Rhode’s performance, while the biggest risk remains margin pressure from tariffs and elevated spending. Farrell’s appointment and the completed US$100.53 million buyback do not materially change those near term drivers.

The Farrell board appointment is most relevant when viewed alongside e.l.f.’s recent “beat and raise” quarter, where management lifted fiscal 2026 net sales guidance to US$1.60–1.61 billion. Strong reported execution and upgraded guidance put more focus on how effectively the board oversees capital allocation, integration of Rhode, and cost discipline. Farrell’s deep consumer and finance background may influence how confidently some shareholders view that oversight if growth or margins become harder to sustain.

Yet behind the recent earnings strength, investors should be aware that tariff and China supply chain exposure could…

Read the full narrative on e.l.f. Beauty (it’s free!)

e.l.f. Beauty’s narrative projects $2.3 billion revenue and $294.5 million earnings by 2028. This requires 19.1% yearly revenue growth and about a $196.7 million earnings increase from $97.8 million today.

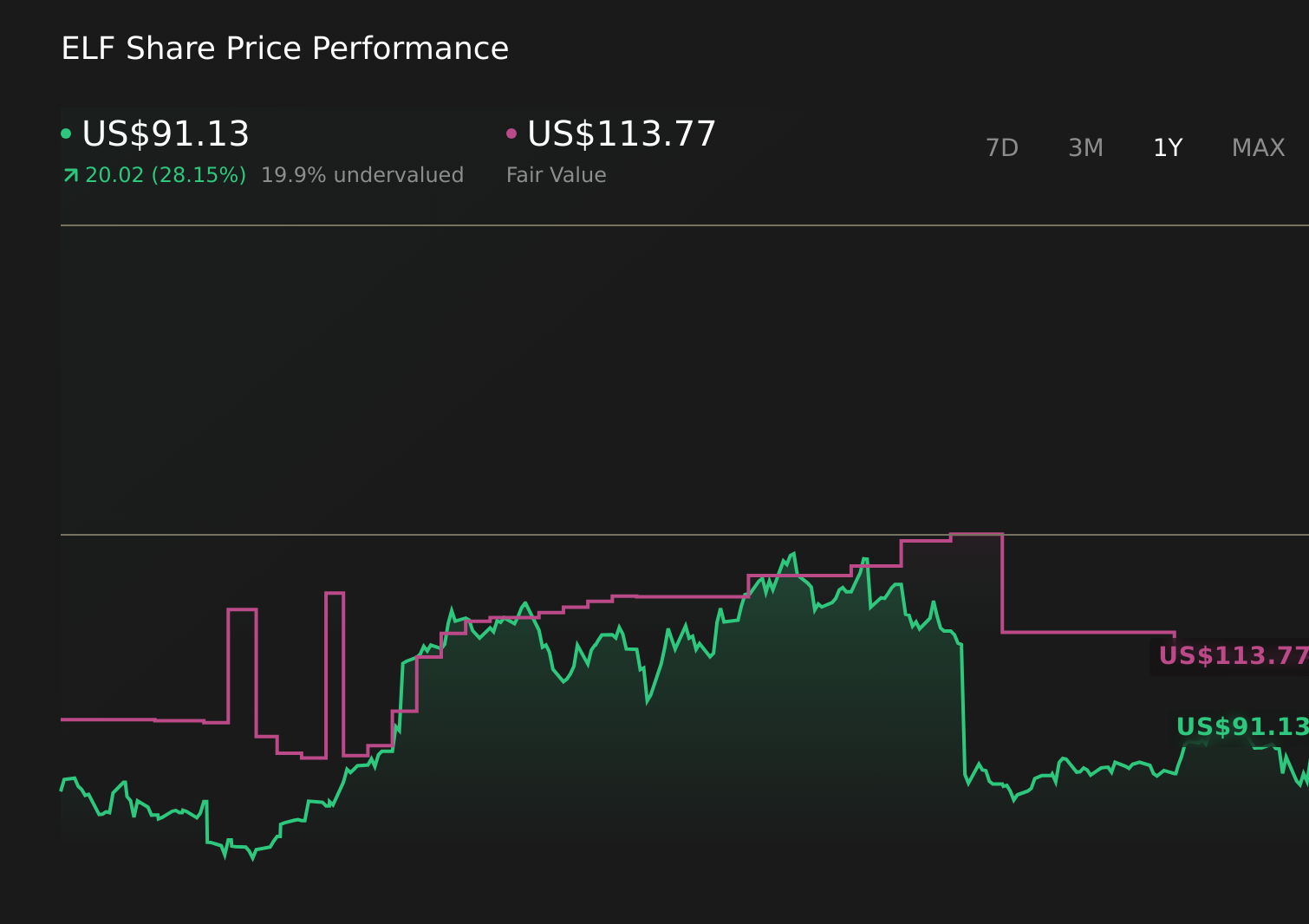

Uncover how e.l.f. Beauty’s forecasts yield a $113.77 fair value, a 29% upside to its current price.

Exploring Other Perspectives ELF 1-Year Stock Price Chart

ELF 1-Year Stock Price Chart

Some of the lowest ranked analysts were already assuming roughly US$2.2 billion of revenue and US$288 million of earnings by 2028, yet still saw downside risk. If you worry, for example, that rising AI driven personalization could pressure e.l.f.’s mass value model, this board appointment and buyback might not fully ease those concerns, and both the upbeat and bearish narratives may need a fresh look after the dust settles.

Explore 13 other fair value estimates on e.l.f. Beauty – why the stock might be worth 43% less than the current price!

The Verdict Is Yours

Don’t just follow the ticker – dig into the data and build a conviction that’s truly your own.

No Opportunity In e.l.f. Beauty?

Our top stock finds are flying under the radar-for now. Get in early:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com